.png)

Aerospace Maintenance Chemicals Market by Products, Aircraft and Nature- Global Industry Analysis and Forecast to 2023

Published On : November 2017 Pages : 112 Category: Bulk Chemicals Report Code : CM11383

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

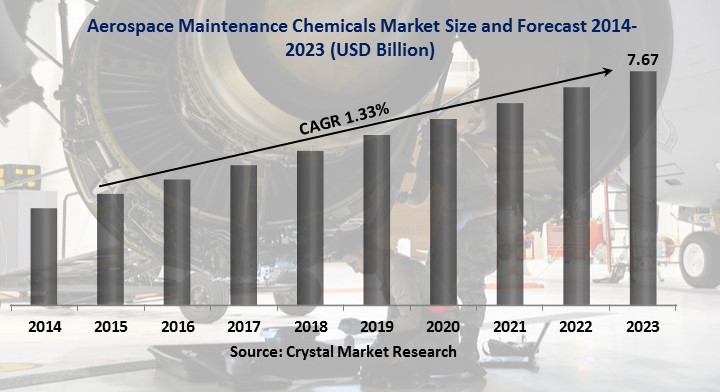

The Aerospace Maintenance Chemicals Market was worth USD billion in 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Development in aircraft fleet, flight recurrence, and strict controls with respect to the safety of aircraft and passenger security that prompt successive support will boost the business demand. The business encountered almost 6.2 percent yearly development in passenger travel from 2017 to 2017. Low air toll, enhancing expectations for everyday comforts of working class particularly in developing markets, uplifting standpoint for tourism industry are boosting air travel. This prompts improved number of flights and support prerequisite for the aircrafts. Aircraft organizations have heightened focus on their administration offerings. For example, in June 2022, Boeing declared its new significant specialty unit Boeing Global Services (BGS) for serving commercial & defense segments. Regional administrative bodies, for example, Registration, Evaluation, Authorization & Restriction of Chemicals (REACH), and European Aviation Safety Agency (EASA) in Europe and United States Federal Government Aviation Administration (FAA), are altering the needs related with the utilization of chemicals in maintenance process. Stock administration of these chemicals is troublesome for the merchants because of the existence of numerous brands in the commercial center. Perilous properties of the chemicals pose confinements on the capacity of specific chemicals for a more drawn out term, limiting the development of aerospace maintenance chemical market in the upcoming years.

Product Outlook and Trend Analysis

In 2017 Aerospace maintenance chemicals market from aircraft cleaning chemicals was over 300 kilo tons. The product is useful as a part of the two exterior and interiors of the planes. Raw material properties are a critical rule while choosing a synthetic. Aircraft cleaning service suppliers are extending their business while the difficulties encountered by them incorporate weather conditions, reducing service time, adhering to ground time schedule, and creating customized specialty services. Huge development in number of air travelers is impelling carriers to expand their aircraft fleet. Improved flight frequencies are raising the demand for air ship cleaning chemicals all around. On the basis of generation of revenue, aviation paint removers will show most noteworthy development in the upcoming years. Laser ablation mobile robot for cutting edge paint expulsion is a developing technology in the market. Many factors, for example, advancements in robotics, high-performing lasers, lower cost, private investment, greater emphasis on the sustainability, and medical advantages of the procedures have met to make the operations less demanding. Commercialization of technologies as such is assessed to animate aviation support chemical market share over the estimate course of events.

Aircraft Outlook and Trend Analysis

In 2017, business airplane represented over 40 percent share in aerospace maintenance chemicals market. Expanding business air fleet attributable to development in travel and tourism will enlarge the interest for maintenance chemicals from business airplanes for various applications, for example, paint removing, cleaning, and degreasing. Business airplanes will reflect huge development rate amid the conjecture time frame. These planes make the use of top of the line leather materials in the inside parts and seats, boosting the interest for calfskin cleaners to guarantee improved life of the product. Continuous cleaning of helicopters enhances its service life, keeping it from erosion and other rust. Cleaning the grease and dirt will offer predominant execution. The need for Constant maintenance of helicopters is foreseen to boost aerospace maintenance chemicals market in the upcoming years.

Nature Outlook and Trend Analysis

Organic maintenance chemicals are anticipated to represent significant development in the upcoming years. Speedier operations combined with work security will drive the demand of the product over the figure time span. Reasonable consistency of the chemical is exceedingly favored as it influences the support to process work inviting. Rising requirement for dangerous free chemicals and a strict regulatory system is evaluated to drive the aerospace maintenance chemicals market. Industry players are investing intensely in the research exercises to make enhanced products that will agree to these directions.

Regional Outlook and Trend Analysis

In 2017, North America aerospace maintenance chemicals market represented 31 percent volume offer of the market, reflecting significant development in the upcoming years. The region is ruled by the United States due to the tremendous development of the aerospace industry combined with rising interests in military and defense area. Alongside the developing air fleet, maintenance operations are anticipated to impel in the locale. The demand in Europe will raise due to key countries, for example, United Kingdom, France, and Germany adding to Europe aeronautics industry development. Enhancing execution of the product with cost-competitiveness are the key variables for aerospace maintenance chemicals market development. Expanding number of private planes and business airplane in the Middle East will impact the aerospace maintenance chemicals market over the anticipated time frame.

Competitive Insights

Aerospace maintenance chemicals market comprises of a few entrenched players. The leading players in the market are Aircraft Spruce and Specialty Co, Arrow Solutions, Nexeo Solutions, LLC, Dow Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Aviation Chemical Solutions Inc, 3M, Florida Chemical, Aerochemicals and Henkel AG & Co. KGaA. Companies are investing vigorously in research exercises to build up their maintenance methods and diminish general maintenance cost. The significant makers of aerospace maintenance chemicals market create association with clients for keep up the demand & supply of the business. Existence of engineered materials in the item should be agreeable with the stringent government controls are making weight on the makers to alter their products accordingly. Strict directions will offer enhanced control over the harmful products that have high requirement.

The Aerospace Maintenance Chemicals Market is segmented as follows-

By Product:

- Aircraft leather cleaners

- Aviation paint strippers

- Aircraft cleaning chemicals

- Aviation paint strippers

- Degreasers

- Aircraft wash and polish

- Specialty solvents

By Aircraft:

- Helicopter

- Single engine piston

- Commercial aircraft

- Military aircraft

- Business aircraft

- Space aircraft

- Other Aircrafts

By Nature:

- Organic

- Inorganic

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- Aerospace Maintenance Chemicals MarketBy Product, Estimates and Forecast, 2014-2023 ($Million)

- Aircraft leather cleaners

- Aviation paint strippers

- Aircraft cleaning chemicals

- Aviation paint strippers

- Degreasers

- Aircraft wash and polish

- Specialty solvents

- Aerospace Maintenance Chemicals MarketBy Aircraft, Estimates and Forecast, 2014-2023 ($Million)

- Helicopter

- Single engine piston

- Commercial aircraft

- Military aircraft

- Business aircraft

- Space aircraft

- Other Aircrafts

- Aerospace Maintenance Chemicals MarketBy Nature, Estimates and Forecast, 2014-2023 ($Million)

- Organic

- Inorganic

- Aerospace Maintenance Chemicals MarketBy Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Aerospace Maintenance Chemicals Market, By Country

- North America Aerospace Maintenance Chemicals Market, By Product

- North America Aerospace Maintenance Chemicals Market, By Aircraft

- North America Aerospace Maintenance Chemicals Market, By Nature

- U.S. Aerospace Maintenance Chemicals Market, By Product

- U.S. Aerospace Maintenance Chemicals Market, By Aircraft

- U.S. Aerospace Maintenance Chemicals Market, By Nature

- Canada Aerospace Maintenance Chemicals Market, By Product

- Canada Aerospace Maintenance Chemicals Market, By Aircraft

- Canada Aerospace Maintenance Chemicals Market, By Nature

- Mexico Aerospace Maintenance Chemicals Market, By Product

- Mexico Aerospace Maintenance Chemicals Market, By Aircraft

- Mexico Aerospace Maintenance Chemicals Market, By Nature

-

- Europe

- Europe Aerospace Maintenance Chemicals Market, By Country

- Europe Aerospace Maintenance Chemicals Market, By Product

- Europe Aerospace Maintenance Chemicals Market, By Aircraft

- Europe Aerospace Maintenance Chemicals Market, By Nature

- Germany Aerospace Maintenance Chemicals Market, By Product

- Germany Aerospace Maintenance Chemicals Market, By Aircraft

- Germany Aerospace Maintenance Chemicals Market, By Nature

- France Aerospace Maintenance Chemicals Market, By Product

- France Aerospace Maintenance Chemicals Market, By Aircraft

- France Aerospace Maintenance Chemicals Market, By Nature

- UK Aerospace Maintenance Chemicals Market, By Product

- UK Aerospace Maintenance Chemicals Market, By Aircraft

- UK Aerospace Maintenance Chemicals Market, By Nature

- Italy Aerospace Maintenance Chemicals Market, By Product

- Italy Aerospace Maintenance Chemicals Market, By Aircraft

- Italy Aerospace Maintenance Chemicals Market, By Nature

- Spain Aerospace Maintenance Chemicals Market, By Product

- Spain Aerospace Maintenance Chemicals Market, By Aircraft

- Spain Aerospace Maintenance Chemicals Market, By Nature

- Rest of Europe Aerospace Maintenance Chemicals Market, By Product

- Rest of Europe Aerospace Maintenance Chemicals Market, By Aircraft

- Rest of Europe Aerospace Maintenance Chemicals Market, By Nature

-

- Asia-Pacific

- Asia-Pacific Aerospace Maintenance Chemicals Market, By Country

- Asia-Pacific Aerospace Maintenance Chemicals Market, By Product

- Asia-Pacific Aerospace Maintenance Chemicals Market, By Aircraft

- Asia-Pacific Aerospace Maintenance Chemicals Market, By Nature

- Japan Aerospace Maintenance Chemicals Market, By Product

- Japan Aerospace Maintenance Chemicals Market, By Aircraft

- Japan Aerospace Maintenance Chemicals Market, By Nature

- China Aerospace Maintenance Chemicals Market, By Product

- China Aerospace Maintenance Chemicals Market, By Aircraft

- China Aerospace Maintenance Chemicals Market, By Nature

- Australia Aerospace Maintenance Chemicals Market, By Product

- Australia Aerospace Maintenance Chemicals Market, By Aircraft

- Australia Aerospace Maintenance Chemicals Market, By Nature

- India Aerospace Maintenance Chemicals Market, By Product

- India Aerospace Maintenance Chemicals Market, By Aircraft

- India Aerospace Maintenance Chemicals Market, By Nature

- South Korea Aerospace Maintenance Chemicals Market, By Product

- South Korea Aerospace Maintenance Chemicals Market, By Aircraft

- South Korea Aerospace Maintenance Chemicals Market, By Nature

- Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Product

- Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Aircraft

- Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Nature

- Asia-Pacific

-

- Rest of the World

- Rest of the World Aerospace Maintenance Chemicals Market, By Country

- Rest of the World Aerospace Maintenance Chemicals Market, By Product

- Rest of the World Aerospace Maintenance Chemicals Market, By Aircraft

- Rest of the World Aerospace Maintenance Chemicals Market, By Nature

- Brazil Aerospace Maintenance Chemicals Market, By Product

- Brazil Aerospace Maintenance Chemicals Market, By Aircraft

- Brazil Aerospace Maintenance Chemicals Market, By Nature

- South Africa Aerospace Maintenance Chemicals Market, By Product

- South Africa Aerospace Maintenance Chemicals Market, By Aircraft

- South Africa Aerospace Maintenance Chemicals Market, By Nature

- Saudi Arabia Aerospace Maintenance Chemicals Market, By Product

- Saudi Arabia Aerospace Maintenance Chemicals Market, By Aircraft

- Saudi Arabia Aerospace Maintenance Chemicals Market, By Nature

- Turkey Aerospace Maintenance Chemicals Market, By Product

- Turkey Aerospace Maintenance Chemicals Market, By Aircraft

- Turkey Aerospace Maintenance Chemicals Market, By Nature

- United Arab Emirates Aerospace Maintenance Chemicals Market, By Product

- United Arab Emirates Aerospace Maintenance Chemicals Market, By Aircraft

- United Arab Emirates Aerospace Maintenance Chemicals Market, By Nature

- Others Aerospace Maintenance Chemicals Market, By Product

- Others Aerospace Maintenance Chemicals Market, By Aircraft

- Others Aerospace Maintenance Chemicals Market, By Nature

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

4. Aerospace Maintenance Chemicals Market, By Product

4.1. Introduction

4.2. Aerospace Maintenance Chemicals Market Assessment and Forecast, By Product, 2017-2023

4.3. Aircraft leather cleaners

4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4. Aviation paint strippers

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Aircraft cleaning chemicals

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Aviation paint strippers

4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.7. Degreasers

4.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.8. Aircraft wash and polish

4.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.9. Specialty solvents

4.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Aerospace Maintenance Chemicals Market, By Aircraft

5.1. Introduction

5.2. Aerospace Maintenance Chemicals Market Assessment and Forecast, By Aircraft, 2017-2023

5.3. Helicopter

5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.4. Single engine piston

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Commercial aircraft

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Military aircraft

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Business aircraft

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Space aircraft

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.9. Other Aircrafts

5.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Aerospace Maintenance Chemicals Market, By Nature

6.1. Introduction

6.2. Aerospace Maintenance Chemicals Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

6.3. Organic

6.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.4. Inorganic

6.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7. Aerospace Maintenance Chemicals Market, By Region

7.1. Introduction

7.2. Aerospace Maintenance Chemicals Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

7.3.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.3.3. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.3.4. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.3.4.1. U.S.

7.3.4.1.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.3.4.1.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.3.4.1.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.3.4.2. Canada

7.3.4.2.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.3.4.2.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.3.4.2.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.3.4.3. Mexico

7.3.4.3.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.3.4.3.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.3.4.3.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

7.4.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.3. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.1. Germany

7.4.4.1.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.1.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4.1.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.2. France

7.4.4.2.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.2.2. Market Assessment and Forecast, By Aircrafts, 2017-2023 ($Million)

7.4.4.2.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.3. UK

7.4.4.3.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.3.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4.3.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.4. Italy

7.4.4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.4.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4.4.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.5. Spain

7.4.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.5.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4.5.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.4.4.6. Rest of Europe

7.4.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.4.4.6.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.4.4.6.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5. Asia-Pacific

7.5.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

7.5.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.3. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.1. Japan

7.5.4.1.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.1.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.1.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.2. China

7.5.4.2.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.2.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.2.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.3. Australia

7.5.4.3.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.3.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.3.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.4. India

7.5.4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.4.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.4.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.5. South Korea

7.5.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.5.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.5.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.5.4.6. Rest of Asia-Pacific

7.5.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.5.4.6.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.5.4.6.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6. Rest of the World

7.6.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

7.6.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.3. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.1. Brazil

7.6.4.1.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.1.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.1.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.2. Turkey

7.6.4.2.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.2.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.2.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.3. Saudi Arabia

7.6.4.3.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.3.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.3.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.4. South Africa

7.6.4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.4.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.4.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.5. United Arab Emirates

7.6.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.5.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.5.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

7.6.4.6. Others

7.6.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

7.6.4.6.2. Market Assessment and Forecast, By Aircraft, 2017-2023 ($Million)

7.6.4.6.3. Market Assessment and Forecast, By Nature, 2017-2023 ($Million)

8. Company Profiles

8.1. Arrow Solutions

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Strategic Developments

8.2. 3M

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Key Financial

8.2.4. Strategic Developments

8.3. Aerochemicals

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Strategic Developments

8.4. Aircraft Spruce and Specialty Co.

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Strategic Developments

8.5. Aviation Chemical Solutions, Inc.

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Strategic Developments

8.6. The Dow Chemical Company (Dow)

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Strategic Developments

8.7. Eastman Chemical Company

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Strategic Developments

8.8. Henkel AG & Co. KGaA

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Strategic Developments

8.9. Exxon Mobil Corporation

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Key Financial

8.9.4. Strategic Developments

8.10. Nexeo Solutions, LLC

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Strategic Developments

8.11. Florida Chemical

8.11.1. Business Overview

8.11.2. Product Portfolio

Strategic Developments

List of Tables

Table 1.Aerospace Maintenance Chemicals Market, By Product ($Million), 2017-2023

Table 2.Aircraft leather cleaners Market, By Region ($Million), 2017-2023

Table 3.Aviation paint strippers Market, By Region ($Million), 2017-2023

Table 4.Aircraft cleaning chemicals Market, By Region ($Million), 2017-2023

Table 5.Aviation paint strippers Market, By Region ($Million), 2017-2023

Table 6.Degreasers Market, By Region ($Million), 2017-2023

Table 7.Aircraft wash and polish Market, By Region ($Million), 2017-2023

Table 8.Specialty solvents Market, By Region ($Million), 2017-2023

Table 9.Aerospace Maintenance Chemicals Market, By Aircraft ($Million), 2017-2023

Table 10.Helicopter Market, By Region ($Million), 2017-2023

Table 11.Single engine piston Market, By Region ($Million), 2017-2023

Table 12.Commercial aircraft Market, By Region ($Million), 2017-2023

Table 13.Military aircraft Market, By Region ($Million), 2017-2023

Table 14.Business aircraft Market, By Region ($Million), 2017-2023

Table 15.Space aircraft Market, By Region ($Million), 2017-2023

Table 16.Other Aircrafts Market, By Region ($Million), 2017-2023

Table 17.Aerospace Maintenance Chemicals Market, By Nature ($Million), 2017-2023

Table 18.Organic Market, By Region ($Million), 2017-2023

Table 19.Inorganic Market, By Region ($Million), 2017-2023

Table 20.Aerospace Maintenance Chemicals Market, By Region ($Million), 2017-2023

Table 21.North America Aerospace Maintenance Chemicals Market, By Country, 2017-2023 ($Million)

Table 22.North America Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 23.North America Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 24.North America Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 25.U.S. Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 26.U.S. Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 27.U.S. Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 28.Canada Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 29.Canada Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 30.Canada Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 31.Mexico Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 32.Mexico Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 33.Mexico Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 34.Europe Aerospace Maintenance Chemicals Market, By Country, 2017-2023 ($Million)

Table 35.Europe Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 36.Europe Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 37.Europe Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 38.Germany Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 39.Germany Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 40.Germany Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 41.France Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 42.France Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 43.France Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 44.UK Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 45.UK Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 46.UK Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 47.Italy Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 48.Italy Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 49.Italy Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 50.Spain Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 51.Spain Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 52.Spain Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 53.Rest of Europe Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 54.Rest of Europe Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 55.Rest of Europe Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 56.Asia-Pacific Aerospace Maintenance Chemicals Market, By Country, 2017-2023 ($Million)

Table 57.Asia-Pacific Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 58.Asia-Pacific Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 59.Asia-Pacific Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 60.Japan Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 61.Japan Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 62.Japan Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 63.China Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 64.China Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 65.China Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 66.Australia Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 67.Australia Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 68.Australia Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 69.India Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 70.India Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 71.India Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 72.South Korea Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 73.South Korea Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 74.South Korea Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 75.Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 76.Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 77.Rest of Asia-Pacific Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 78.Rest of the World Aerospace Maintenance Chemicals Market, By Country, 2017-2023 ($Million)

Table 79.Rest of the World Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 80.Rest of the World Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 81.Rest of the World Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 82.Brazil Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 83.Brazil Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 84.Brazil Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 85.Turkey Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 86.Turkey Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 87.Turkey Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 88.Saudi Arabia Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 89.Saudi Arabia Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 90.Saudi Arabia Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 91.South Africa Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 92.South Africa Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 93.South Africa Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 94.United Arab Emirates Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 95.United Arab Emirates Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 96.United Arab Emirates Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 97.Others Aerospace Maintenance Chemicals Market, By Product, 2017-2023 ($Million)

Table 98.Others Aerospace Maintenance Chemicals Market, By Aircraft, 2017-2023 ($Million)

Table 99.Others Aerospace Maintenance Chemicals Market, By Nature, 2017-2023 ($Million)

Table 100.Arrow Solutions: Key Strategic Developments, 2017-2017

Table 101.3M: Key Strategic Developments, 2017-2017

Table 102.ASEA Brown Boveri (ABB) Group: Key Strategic Developments, 2017-2017

Table 103.Aerochemicals: Key Strategic Developments, 2017-2017

Table 104.Aircraft Spruce and Specialty Co.: Key Strategic Developments, 2017-2017

Table 105.Aviation Chemical Solutions, Inc.: Key Strategic Developments, 2017-2017

Table 106.The Dow Chemical Company (Dow): Key Strategic Developments, 2017-2017

Table 107.Eastman Chemical Company: Key Strategic Developments, 2017-2017

Table 108.Henkel AG & Co. KGaA: Key Strategic Developments, 2017-2017

Table 109.Exxon Mobil Corporation: Key Strategic Developments, 2017-2017

Table 110.Nexeo Solutions, LLC: Key Strategic Developments, 2017-2017

Table 111.Florida Chemical: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Aerospace Maintenance Chemicals Market Share, By Product, 2017 & 2023 ($Million)

Figure 2.Aerospace Maintenance Chemicals Market, By Aircraft, 2017 & 2023 ($Million)

Figure 3.Aerospace Maintenance Chemicals Market, By Nature, 2017 & 2023 ($Million)

Figure 5.Aerospace Maintenance Chemicals Market, By Region, 2017, ($Million)

Figure 6.3M: Net Revenues, 2017-2017 ($Million)

Figure 7.3M: Net Revenue Share, By Segment, 2017

Figure 8.3M: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|