.png)

Aerospace Plastics Market by Application and End User- Global Industry Analysis and Forecast to 2027

Published On : September 2017 Pages : 116 Category: Plastics, Polymers & Resins Report Code : CM09199

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global aerospace plastics market was worth USD million in the year 2017, and is expected to garner around USD billion by 2027, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The growing requirement for plastic in various applications of aerospace that includes empennage, cabin interiors, fuselage and airframe is anticipated to boost the market in the consecutive years. The performance and the efficacy of airplanes in directly influence by the reduction of its weight. Additionally, with the contraction of a kilogram in the weight of the airplane is anticipated to revoke costs of operating related to fuel for a commercial airplane. Plastics are extensively utilized in place of aluminum and steel as they are extremely durable and lightweight which leads to increased implementation of plastic. Aerostructure registered a major of the volume in the year of 2017. The growth in utilization of plastic that is reinforced for the manufacturing of door fairings, airframes, wings and fuselage is anticipated to be the major factor that influences the growth of the share of the plastic market in applications of aerospace. In addition, the utilization of plastic in its pure form for the interiors of cabin is said to supplement the growth of the market.

Application Outlook and Trend Analysis

The frames of the aircraft consist of the maximum quantity of carbon fiber reinforced plastic and composites that decrease the weight of the airplane by 20 percent. In addition, the extensive utilization of plastics and composites in a high-tension loaded surrounding of fuselage decreases the contractions by making the use of integral clips and fasteners. Supplies, equipment and systems registered the second largest volume of share for the interiors of the cabin. Aerospace plastics provide excellent resistance to chemicals, are lightweight and anti-corrosive and are an excellent alternative to traditional materials like steel and aluminum. One of the prime benefits offered by polymers is that they can be massed into huge structures by bonding instead of riveting. Aerostructure is the most imperative component of the airplane as it develops the basis for the size and shape of the airplane. The utilization of polymers has been extensive by PEEK and POM in this application due to its excellent heat resistance, corrosion and durability. Along with the rising requirement of general aviation and commercial aviation, the requirement of these polymers is anticipated to rise substantially resulting in excellent growth of the global aerospace plastic market.

End-use Outlook and Trend Analysis

The prime end use segment has been the commercial aircrafts for aerospace plastics due to the advent of numerous service providers in the industry of air transport. The segment of Military aircraft is also gainful owing to increasing concerns related to defense and security. The major areas of application of plastics in the aerospace industry are the freight aircrafts and the large passenger aircrafts. The use of polymers in aircrafts supplements in decreasing the weight s well as the cost of operating that result in reduced issue related to maintenance. This has propelled the manufacturer of aircrafts to implement more plastic parts in freight and commercial aircrafts. The manufacturers of Military aircrafts have been utilizing plastic in order to decrease the overall weight of the airplane and enhance the efficiency of fuel. Aerospace plastics render great freedom for designing of complex parts of the airplane. This has led to a huge amount of utilization of aerospace plastics in the manufacturing of Military and commercial airplanes.

Regional Outlook and Trend Analysis

Due to increased prices of fuel, the aerospace market of North America is anticipated to encounter a rising demand for aircrafts that are fuel-efficient. Growth in the rate of replacement, majorly in regional aircrafts is boosting growth in the North American industry of Aerospace plastics. The desire to replace the aircrafts that are inefficient with the ones that are efficient is expected to spur the growth of the aerospace plastic market significantly. The aerospace plastics market in Europe encountered substantial growth in the year of 2017 and is anticipated to witness considerable growth in consecutive years due to surplus investments witnessed in research and development and the availability of qualified engineers. The existence of manufacturing companies of aircraft in France which also include European groups that share business interests has strengthened the growth of the aerospace plastics market. Consistent amendments in the economies of Asia Pacific have had a considerable impact on the airline industry in the recent years. Nonetheless, upcoming economies in Asia Pacific like Japan, India, and China are significantly boosting the aerospace plastics market.

Competitive Insights

The global aerospace plastics market is extensively competitive and is divided into manufactures that operate in the international market as well as the local market. The market was dominated by Toray industries as it provided products and materials to the leading manufacturers such as Boeing and Airbus. Major companies in the industry are Hyosung Corp, Mitsubishi Heavy Industries, Kaman Corp, Hexcel, Composite Holding Comp, Cytec Industries and HITCO Carbon Composites.

The Aerospace plastics market is segmented as follows-

By Application

- Satellites

- Equipment, systems & support

- Propulsion systems

- Aerostructure

- Construction and insulation components

- Cabin interiors

- Components

By End Users

- General aviation

- Commercial & freighter aircrafts

- Rotary aircrafts

- Military aircrafts

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Aerospace Plastics Market, By Application, Estimates and Forecast, 2017-2027 ($Million)

- Satellites

- Equipment, systems & support

- Propulsion systems

- Aerostructure

- Construction and insulation components

- Cabin interiors

- Components

- Aerospace Plastics Market, By End User, Estimates and Forecast, 2017-2027 ($Million)

- General aviation

- Commercial & freighter aircrafts

- Rotary aircrafts

- Military aircrafts

- Other End User

- Aerospace Plastics Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

- North America

- North America Aerospace Plastics Market, By Country

- North America Aerospace Plastics Market, By Application

- North America Aerospace Plastics Market, By End User

- U.S. Aerospace Plastics Market, By Application

- U.S. Aerospace Plastics Market, By End User

- Canada Aerospace Plastics Market, By Application

- Canada Aerospace Plastics Market, By End User

- Mexico Aerospace Plastics Market, By Application

- Mexico Aerospace Plastics Market, By End User

-

- Europe

- Europe Aerospace Plastics Market, By Country

- Europe Aerospace Plastics Market, By Application

- Europe Aerospace Plastics Market, By End User

- Germany Aerospace Plastics Market, By Application

- Germany Aerospace Plastics Market, By End User

- France Aerospace Plastics Market, By Application

- France Aerospace Plastics Market, By End User

- UK Aerospace Plastics Market, By Application

- UK Aerospace Plastics Market, By End User

- Italy Aerospace Plastics Market, By Application

- Italy Aerospace Plastics Market, By End User

- Spain Aerospace Plastics Market, By Application

- Spain Aerospace Plastics Market, By End User

- Rest of Europe Aerospace Plastics Market, By Application

- Rest of Europe Aerospace Plastics Market, By End User

-

- Asia-Pacific

- Asia-Pacific Aerospace Plastics Market, By Country

- Asia-Pacific Aerospace Plastics Market, By Application

- Asia-Pacific Aerospace Plastics Market, By End User

- Japan Aerospace Plastics Market, By Application

- Japan Aerospace Plastics Market, By End User

- Australia Aerospace Plastics Market, By Application

- Australia Aerospace Plastics Market, By End User

- India Aerospace Plastics Market, By Application

- India Aerospace Plastics Market, By End User

- South Korea Aerospace Plastics Market, By Application

- South Korea Aerospace Plastics Market, By End User

- Rest of Asia-Pacific Aerospace Plastics Market, By Application

- Rest of Asia-Pacific Aerospace Plastics Market, By End User

- Asia-Pacific

-

- Rest of the World

- Rest of the World Aerospace Plastics Market, By Country

- Rest of the World Aerospace Plastics Market, By Application

- Rest of the World Aerospace Plastics Market, By End User

- Brazil Aerospace Plastics Market, By Application

- Brazil Aerospace Plastics Market, By End User

- South Africa Aerospace Plastics Market, By Application

- South Africa Aerospace Plastics Market, By End User

- Saudi Arabia Aerospace Plastics Market, By Application

- Saudi Arabia Aerospace Plastics Market, By End User

- Turkey Aerospace Plastics Market, By Application

- Turkey Aerospace Plastics Market, By End User

- United Arab Emirates Aerospace Plastics Market, By Application

- United Arab Emirates Aerospace Plastics Market, By End User

- Others Aerospace Plastics Market, By Application

- Others Aerospace Plastics Market, By End User

Table of Contents

1.Introduction

1.1.Report Description

1.2.Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2.Executive Summary

2.1.Key Highlights

3.Market Overview

3.1.Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2.Market Share Analysis

3.3.Market Dynamics

3.3.1. Drivers

3.3.1.1.Growing adoption of aerospace plastics in aerospace industry

3.3.1.2.Admirable strength to weight ratio

3.3.1.3.Continuous growth in the aviation industry

3.3.2. Restraints

3.3.2.1.High cost of the raw materials

3.3.3. Opportunities

3.3.3.1.Substantial upsurge in the military budget essentially in many countries have provided enough growth impetus for the market.

3.4.Industry Trends

4.Aerospace Plastics Market, By Application

4.1.Introduction

4.2.Aerospace Plastics Market Assessment and Forecast, By Application, 2017-2027

4.3.Satellites

4.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.Equipment, systems & support

4.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.Propulsion systems

4.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.6.Aerostructure

4.6.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.7.Construction and insulation components

4.7.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.8.Cabin interiors

4.8.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.9.Components

4.9.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.10.Microphones & Microspeakers

4.10.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.Aerospace Plastics Market, By End User

5.1.Introduction

5.2.Aerospace Plastics Market Assessment and Forecast, By End User, 2017-2027

5.3.General aviation

5.3.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.4.Commercial & freighter aircrafts

5.4.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.5.Rotary aircrafts

5.5.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.6.Military aircrafts

5.6.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.7.Others

5.7.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6.Aerospace Plastics Market, By Region

6.1.Introduction

6.2.Aerospace Plastics Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6.3.North America

6.3.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.3.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.3.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.1.U.S.

6.3.3.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.3.3.1.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.1.3.

6.3.3.2.Canada

6.3.3.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.3.3.2.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.3.Mexico

6.3.3.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.3.3.3.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.Europe

6.4.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.4.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.1.Germany

6.4.3.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.1.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.2.France

6.4.3.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.2.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.3.UK

6.4.3.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.3.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.4.Italy

6.4.3.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.4.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.5.Spain

6.4.3.5.1.

6.4.3.5.2.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.5.3.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.6.Russia

6.4.3.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.6.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.7.Rest of Europe

6.4.3.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.4.3.7.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.Asia-Pacific

6.5.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.5.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.1.Japan

6.5.3.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.1.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.2.China

6.5.3.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.2.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.3.Australia

6.5.3.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.3.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.4.India

6.5.3.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.4.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.5.South Korea

6.5.3.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.5.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.6.Taiwan

6.5.3.6.1.

6.5.3.6.2.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.6.3.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.7.Rest of Asia-Pacific

6.5.3.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.5.3.7.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.Rest of the World

6.6.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.6.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.1.Brazil

6.6.3.1.1.

6.6.3.1.2.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.1.3.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.2.Turkey

6.6.3.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.2.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.3.Saudi Arabia

6.6.3.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.3.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.4.South Africa

6.6.3.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.4.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.5.United Arab Emirates

6.6.3.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.5.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.6.Others

6.6.3.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.6.3.6.2.Market Assessment and Forecast, By End User, 2017-2027 ($Million)

7.Company Profiles

7.1.Hyosung Corporation

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2.KAMAN CORPORATION

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3.MITSUBISHI HEAVY INDUSTRIES, LTD.

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4.Premium Aerotec GmbH

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.5.Saudi Arabia Basic Industries Corporation (SABIC)

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Key Financials

7.5.4. Strategic Developments

7.6.SGL Group

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Key Financials

7.6.4. Strategic Developments

7.7.Tech-Tool Plastics Inc.

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

7.8.Toho Tenax Co. Ltd.

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9.Toray Carbon Fibers America Inc.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.10.BASF SE

7.10.1.Business Overview

7.10.2.Product Portfolio

7.10.3.Key Financials

7.10.4.Strategic Developments

7.11.Evonik Industries AG

7.11.1.Business Overview

7.11.2.Product Portfolio

7.11.3.Key Financials

7.11.4.Strategic Developments

7.12.Cytec Industries Inc.

7.12.1.Business Overview

7.12.2.Product Portfolio

7.12.3.Key Financials

7.12.4.Strategic Developments

7.13.Hexcel Corporation

7.13.1.Business Overview

7.13.2.Product Portfolio

7.13.3.Key Financials

7.13.4.Strategic Developments

7.14.Ensinger GmbH

7.14.1.Business Overview

7.14.2.Product Portfolio

7.14.3.Strategic Developments

7.15.Solvay

7.15.1.Business Overview

7.15.2.Product Portfolio

7.15.3.Key Financials

7.15.4.Strategic Developments

List of Tables

Table 1.Aerospace Plastics Market, By Application ($Million), 2017-2025

Table 2.Satellites Market, By Region ($Million), 2017-2025

Table 3.Equipment, systems & support Market, By Region ($Million), 2017-2025

Table 4.Propulsion systems Market, By Region ($Million), 2017-2025

Table 5.Aerostructure Market, By Region ($Million), 2017-2025

Table 6.Construction and insulation components Market, By Region ($Million), 2017-2025

Table 7.Cabin interiors Market, By Region ($Million), 2017-2025

Table 8.Components Market, By Region ($Million), 2017-2025

Table 9.Microphones & Microspeakers Market, By Region ($Million), 2017-2025

Table 10.Aerospace Plastics Market, By End User ($Million), 2017-2025

Table 11.General aviation Market, By Region ($Million), 2017-2025

Table 12.Commercial & freighter aircrafts Market, By Region ($Million), 2017-2025

Table 13.Rotary aircrafts Market, By Region ($Million), 2017-2025

Table 14.Military aircrafts Market, By Region ($Million), 2017-2025

Table 15.Others Market, By Region ($Million), 2017-2025

Table 16.Aerospace Plastics Market, By Region ($Million), 2017-2025

Table 17.North America Aerospace Plastics Market, By Country, 2017-2025 ($Million)

Table 18.North America Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 19.North America Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 20.S. Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 21.U.S. Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 22.Canada Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 23.Canada Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 24.Mexico Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 25.Mexico Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 26.Europe Aerospace Plastics Market, By Country, 2017-2025 ($Million)

Table 27.Europe Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 28.Europe Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 29.Germany Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 30.Germany Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 31.France Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 32.France Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 33.UK Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 34.UK Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 35.Italy Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 36.Italy Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 37.Spain Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 38.Spain Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 39.Russia Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 40.Russia Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 41.Rest of Europe Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 42.Rest of Europe Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 43.Asia-Pacific Aerospace Plastics Market, By Country, 2017-2025 ($Million)

Table 44.Asia-Pacific Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 45.Asia-Pacific Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 46.Japan Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 47.Japan Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 48.China Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 49.China Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 50.Australia Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 51.Australia Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 52.India Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 53.India Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 54.South Korea Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 55.South Korea Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 56.Taiwan Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 57.Taiwan Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 58.Rest of Asia-Pacific Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 59.Rest of Asia-Pacific Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 60.Rest of the World Aerospace Plastics Market, By Country, 2017-2025 ($Million)

Table 61.Rest of the World Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 62.Rest of the World Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 63.Brazil Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 64.Brazil Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 65.Turkey Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 66.Turkey Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 67.Saudi Arabia Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 68.Saudi Arabia Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 69.South Africa Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 70.South Africa Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 71.United Arab Emirates Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 72.United Arab Emirates Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 73.Others Aerospace Plastics Market, By Application, 2017-2025 ($Million)

Table 74.Others Aerospace Plastics Market, By End User, 2017-2025 ($Million)

Table 75.Hyosung Corporation: Key Strategic Developments, 2017-2017

Table 76.KAMAN CORPORATION: Key Strategic Developments, 2017-2017

Table 77.MITSUBISHI HEAVY INDUSTRIES, LTD.: Key Strategic Developments, 2017-2017

Table 78.Premium Aerotec GmbH: Key Strategic Developments, 2017-2017

Table 79.Saudi Arabia Basic Industries Corporation (SABIC): Key Strategic Developments, 2017-2017

Table 80.SGL Group: Key Strategic Developments, 2017-2017

Table 81.BASF SE: Key Strategic Developments, 2017-2017

Table 82.Toho Tenax Co. Ltd.: Key Strategic Developments, 2017-2017

Table 83.Toray Carbon Fibers America Inc.: Key Strategic Developments, 2017-2017

Table 84.BASF SE: Key Strategic Developments, 2017-2017

Table 85.Evonik Industries AG: Key Strategic Developments, 2017-2017

Table 86.Cytec Industries Inc.: Key Strategic Developments, 2017-2017

Table 87.Hexcel Corporation: Key Strategic Developments, 2017-2017

Table 88.Ensinger GmbH: Key Strategic Developments, 2017-2017

Table 89.Solvay: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Aerospace Plastics Market, By Application, 2017 & 2025 ($Million)

Figure 2.Aerospace Plastics Market, By End User, 2017 & 2025 ($Million)

Figure 3.Aerospace Plastics Market, By Region, 2017, ($Million)

Figure 4.Hyosung Corporation: Net Revenues, 2017-2017 ($Million)

Figure 5.Hyosung Corporation: Net Revenue Share, By Segment, 2017

Figure 6.Hyosung Corporation: Net Revenue Share, By Geography, 2017

Figure 7.KAMAN CORPORATION: Net Revenues, 2017-2017 ($Million)

Figure 8.KAMAN CORPORATION: Net Revenue Share, By Segment, 2017

Figure 9.KAMAN CORPORATION: Net Revenue Share, By Geography, 2017

Figure 10.MITSUBISHI HEAVY INDUSTRIES, LTD.: Net Revenues, 2017-2017 ($Million)

Figure 11.MITSUBISHI HEAVY INDUSTRIES, LTD.: Net Revenue Share, By Segment, 2017

Figure 12.MITSUBISHI HEAVY INDUSTRIES, LTD.: Net Revenue Share, By Geography, 2017

Figure 13.Saudi Arabia Basic Industries Corporation (SABIC): Net Revenues, 2017-2017 ($Million)

Figure 14.Saudi Arabia Basic Industries Corporation (SABIC): Net Revenue Share, By Segment, 2017

Figure 15.Saudi Arabia Basic Industries Corporation (SABIC): Net Revenue Share, By Geography, 2017

Figure 16.SGL Group: Net Revenues, 2017-2017 ($Million)

Figure 17.SGL Group: Net Revenue Share, By Segment, 2017

Figure 18.SGL Group: Net Revenue Share, By Geography, 2017

Figure 19.BASF SE: Net Revenues, 2017-2017 ($Million)

Figure 20.BASF SE: Net Revenue Share, By Segment, 2017

Figure 21.BASF SE: Net Revenue Share, By Geography, 2017

Figure 22.Evonik Industries AG: Net Revenues, 2017-2017 ($Million)

Figure 23.Evonik Industries AG: Net Revenue Share, By Segment, 2017

Figure 24.Evonik Industries AG: Net Revenue Share, By Geography, 2017

Figure 25.Cytec Industries Inc.: Net Revenues, 2017-2017 ($Million)

Figure 26.Cytec Industries Inc.: Net Revenue Share, By Segment, 2017

Figure 27.Cytec Industries Inc.: Net Revenue Share, By Geography, 2017

Figure 28.Hexcel Corporation: Net Revenues, 2017-2017 ($Million)

Figure 29.Hexcel Corporation: Net Revenue Share, By Segment, 2017

Figure 30.Hexcel Corporation: Net Revenue Share, By Geography, 2017

Figure 31.Solvay: Net Revenues, 2017-2017 ($Million)

Figure 32.Solvay: Net Revenue Share, By Segment, 2017

Figure 33.Solvay: Net Revenue Share, By Geography, 2017

Research Methodology

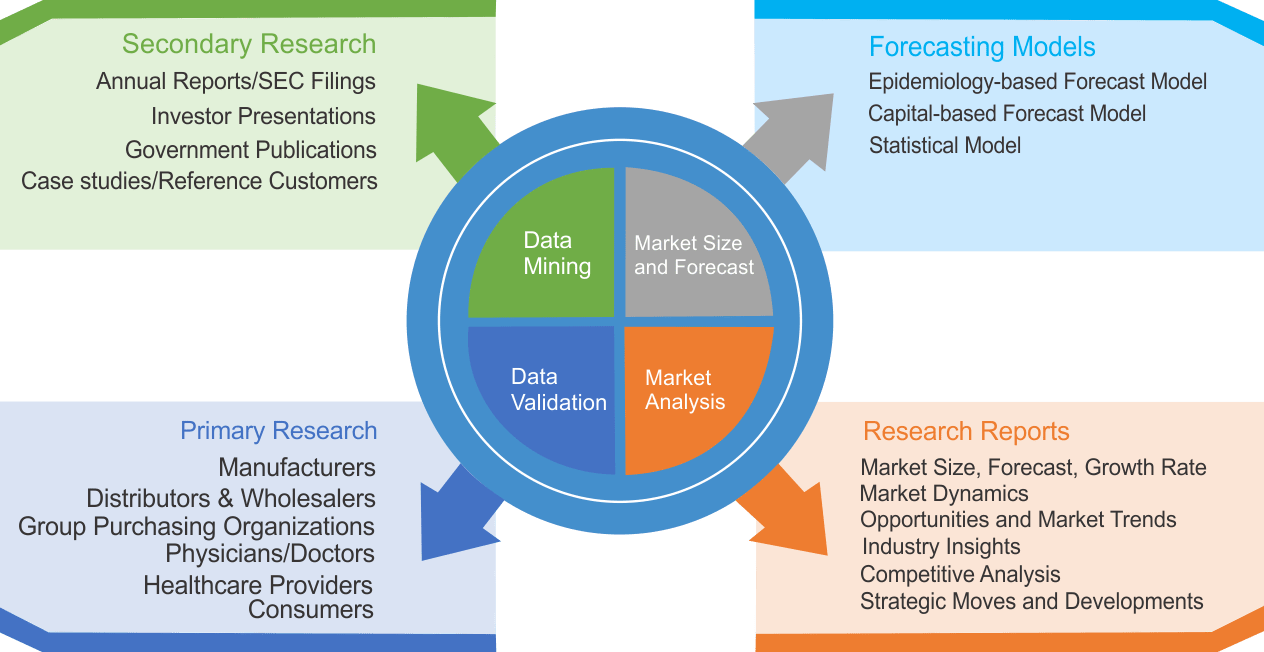

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|