.png)

Angina Pectoris Drugs Market By Therapeutic Class - Global Industry Analysis and Forecast To 2023

Published On : November 2017 Pages : 85 Category: Pharmaceuticals Report Code : CM11388

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

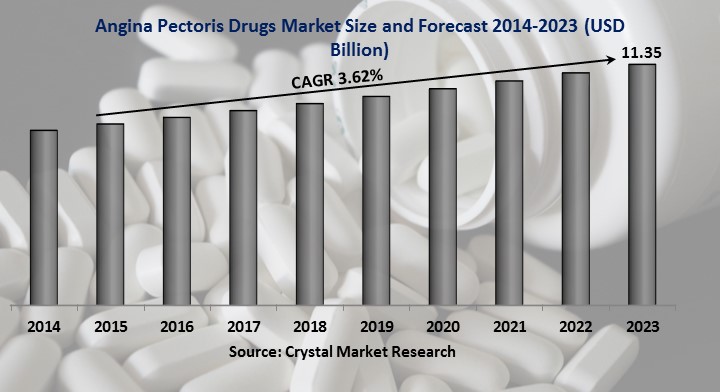

The Angina Pectoris Drugs Market was worth USD billion in the year of 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The United States commanded angina pectoris drugs market among the seven noteworthy nations. The worldwide angina pectoris market is relied upon to be all things considered driven by interest for malady changing and focused on medicines, expanded consumption on human services and accessibility of powerful treatment strategies over the developing markets. Angina pectoris is a clinical sign identified by precordial heaviness or distress because of transient myocardial ischemia without infarction, evoked by physical effort or mental anxiety. Angina pectoris is classified as - microvascular, stable, unstable and Prinzmetal/variation. Angina pectoris is an underlying introduction of coronary heart disease (CHD) and applies a noteworthy effect on personal satisfaction (QOL). Chronic stable angina pectoris has a predominance of 2.0 - 4.0 percent in the seven noteworthy markets United Kingdom, Italy, Spain, Germany, United States, France, and Japan. Stroke and Heart Disease Statistics from American Heart Association gauges demonstrate that more than nine million adults in the United States have unending angina pectoris. The commonness of angina rises pointedly with age in the two sexual orientations, going from 2.0-5.0 percent in men matured 45-54 to 10.0-20.0 percent in men matured 65-74 and from 0.1-1.0 percent in women aged 45-54 to 10.0-15.0 percent in women aged 65-74.

Therapeutic Class Outlook and Trend Analysis

The angina pectoris drug market is monetarily significant; however marked deals are declining as generics rule a bigger segment of medicines. Despite the fact that the market is divided, key players, for example, Pfizer, AstraZeneca, Sanofi and Gilead hold critical market positions. Rising aged populace in domains, for example, China will impact the interest for angina pectoris drugs in the coming years. The drug portion can be segmented into different therapeutic classes, for example, Anticoagulants, Beta Blockers, Calcium Antagonists, Anti-Platelets, Ranolazine and Nitrates. The Beta Blocker market is predominately nonexclusive with key patent lapses affecting GlaxoSmithKline's Coreg and AstraZeneca's Toprol. Post Pfizer's Norvasc patent being resolved invalid in 2007, the Calcium Antagonist market is overwhelmingly generic too.

Pipeline Outlook and Trend Analysis

Novel targets and treatments that are gaining prominence incorporate gene therapy, Factor Xa Inhibitors and monoclonal antibodies. Some conspicuous players canvassed in the section incorporate LegoChem Biosciences, Amgen, TaxusCardium Pharmaceuticals, Milestone Pharmaceuticals, ViroMed, Kuhnil Pharmaceutical, Juventas Therapeutics, and Lee’s Pharmaceutical Holdings. Changing administrative situation in the United States also, EU is expected to affect clinical trials of Advanced Therapy Medicinal Products. Various gene therapy products in Phase II/III trials are developing as a novel approach towards tending to the requirement for non-surgical cardiovascular medicines. TaxusCardium'sadenovector (serotype 5) that is a DNA-based gene therapy is experiencing late stage clinical trials and could introduce promising development open doors for the market in the following couple of years.

Regional Outlook and Trend Analysis

In 2017 The United States ruled the section by representing over 33 percent of the piece of the overall industry. Entrenched healthcare foundation, expanded implementation of therapeutics and existence of key makers in the United States are in charge of its huge share. Besides, expanding frequency of cardiovascular issue because of inactive way of life and supportive administrative activities are filling the market development. China offers solid opportunity for the extension of the market because of expulsion of value tops on all medication classifications, the progressing Healthy China 2021 social insurance change, and strong twelfth Five-Year Plan measures which target biotechnology as key advancement division. Besides, existence of an extensive target populace and solid neglected clinical requirements are a portion of the components that are anticipated to drive the development of this area.

Competitive Insights

The major players in the market are AstraZeneca, GlaxoSmithKline, Sanofi, Pfizer, Gilead Sciences, Eli Lilly and Company and Amgen. The organizations are concentrating on business extension in developing markets or developing locales, for example, China by embracing procedures including mergers and acquisitions for improvement of new products. Biosimilar improvement is developing as a promising business sector opportunity in angina therapeutics. Numerous enoxaparin sodium and abciximabbiosimilars have picked up endorsements in the Indian, United States, European and markets.

The Angina Pectoris Drugs Market is segmented as follows-

By Therapeutic Class:

- Calcium Antagonists

- Anti-Platelets

- Beta Blockers

- Anticoagulants

- Others

- ACE inhibitors

- Nitrates

- Anti-anginal (Ranolazine)

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Angina Pectoris Drugs Market, By Therapeutic Class, Estimates and Forecast, 2014-2023 ($Million)

- Beta Blockers

- Calcium Antagonists

- Anticoagulants

- Anti-Platelets

- Other Therapeutic Class (Nitrates, Anti-Anginal, ACE inhibitors)

- Angina Pectoris Drugs Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Angina Pectoris Drugs Market, By Country

- North America Angina Pectoris Drugs Market, By Therapeutic Class

- U.S. Angina Pectoris Drugs Market, By Therapeutic Class

- Canada Angina Pectoris Drugs Market, By Therapeutic Class

- Mexico Angina Pectoris Drugs Market, By Therapeutic Class

-

- Europe

- Europe Angina Pectoris Drugs Market, By Country

- Europe Angina Pectoris Drugs Market, By Therapeutic Class

- Germany Angina Pectoris Drugs Market, By Therapeutic Class

- France Angina Pectoris Drugs Market, By Therapeutic Class

- UK Angina Pectoris Drugs Market, By Therapeutic Class

- Italy Angina Pectoris Drugs Market, By Therapeutic Class

- Spain Angina Pectoris Drugs Market, By Therapeutic Class

- Rest of Europe Angina Pectoris Drugs Market, By Therapeutic Class

-

- Asia-Pacific

- Asia-Pacific Angina Pectoris Drugs Market, By Country

- Asia-Pacific Angina Pectoris Drugs Market, By Therapeutic Class

- Japan Angina Pectoris Drugs Market, By Therapeutic Class

- Australia Angina Pectoris Drugs Market, By Therapeutic Class

- India Angina Pectoris Drugs Market, By Therapeutic Class

- South Korea Angina Pectoris Drugs Market, By Therapeutic Class

- Rest of Asia-Pacific Angina Pectoris Drugs Market, By Therapeutic Class

- Asia-Pacific

-

- Rest of the World

- Rest of the World Angina Pectoris Drugs Market, By Country

- Rest of the World Angina Pectoris Drugs Market, By Therapeutic Class

- Brazil Angina Pectoris Drugs Market, By Therapeutic Class

- South Africa Angina Pectoris Drugs Market, By Therapeutic Class

- Saudi Arabia Angina Pectoris Drugs Market, By Therapeutic Class

- Turkey Angina Pectoris Drugs Market, By Therapeutic Class

- United Arab Emirates Angina Pectoris Drugs Market, By Therapeutic Class

- Others Angina Pectoris Drugs Market, By Therapeutic Class

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.3. Opportunities

4. Angina Pectoris Drugs Market, By Therapeutic Class

4.1. Introduction

4.2. Angina Pectoris Drugs Market Assessment and Forecast, By Therapeutic Class, 2017-2023

4.3. Beta Blockers

4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4. Calcium Antagonists

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Anticoagulants

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Anti-Platelets

4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.7. Other Therapeutic Class (Nitrates, Anti-Anginal, ACE inhibitors)

4.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Angina Pectoris Drugs Market, By Region

5.1. Introduction

5.2. Angina Pectoris Drugs Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.3.2. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.4.2. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.5.2. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.6.2. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Therapeutic Class, 2017-2023 ($Million)

6. Company Profiles

6.1. Gilead Sciences

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. AstraZeneca

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. Sanofi

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4. Amgen

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Strategic Developments

6.5. Eli Lilly

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.6. Amgen

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7. GlaxoSmithKline

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.8. Pfizer

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

List of Tables

Table 1.Global Angina Pectoris Drugs Market, By Therapeutic Class ($Million), 2017-2023

Table 2.Beta BlockersMarket, By Region ($Million), 2017-2023

Table 3.Calcium Antagonists Market, By Region ($Million), 2017-2023

Table 4.Anticoagulants Market, By Region ($Million), 2017-2023

Table 5.Anti-Platelets Market, By Region ($Million), 2017-2023

Table 6.Other Therapeutic Class (Nitrates, Anti-Anginal, ACE inhibitors) Market, By Region ($Million), 2017-2023

Table 7.Angina Pectoris Drugs Market, By Region ($Million), 2017-2023

Table 8.North America Angina Pectoris Drugs Market, By Country, 2017-2023 ($Million)

Table 9.North America Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 10.U.S. Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 11.Canada Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 12.Mexico Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 13.Europe Angina Pectoris Drugs Market, By Country, 2017-2023 ($Million)

Table 14.Europe Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 15.Germany Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 16.France Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 17.UK Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 18.Italy Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 19.Spain Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 20.Rest of Europe Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 21.Asia-Pacific Angina Pectoris Drugs Market, By Country, 2017-2023 ($Million)

Table 22.Asia-Pacific Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 23.Japan Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 24.China Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 25.Australia Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 26.India Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 27.South Korea Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 28.Rest of Asia-Pacific Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 29.Rest of the World Angina Pectoris Drugs Market, By Country, 2017-2023 ($Million)

Table 30.Rest of the World Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 31.Brazil Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 32.Turkey Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 33.Saudi Arabia Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 34.South Africa Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 35.United Arab Emirates Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 36.Others Angina Pectoris Drugs Market, By Therapeutic Class, 2017-2023 ($Million)

Table 37.Gilead Sciences: Key Strategic Developments, 2017-2017

Table 38.AstraZeneca: Key Strategic Developments, 2017-2017

Table 39.Sanofi: Key Strategic Developments, 2017-2017

Table 40.Amgen: Key Strategic Developments, 2017-2017

Table 41.Eli Lilly: Key Strategic Developments, 2017-2017

Table 42.Amgen: Key Strategic Developments, 2017-2017

Table 43.GlaxoSmithKline: Key Strategic Developments, 2017-2017

Table 44.Pfizer: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Angina Pectoris Drugs Market Share, By Therapeutic Class, 2017 & 2023

Figure 3.Angina Pectoris Drugs Market, By Region, 2017, ($Million)

Figure 4.Eli Lilly: Net Revenues, 2017-2017 ($Million)

Figure 5.Eli Lilly: Net Revenue Share, By Segment, 2017

Figure 6.Eli Lilly: Net Revenue Share, By Geography, 2017

Figure 7.Pfizer: Net Revenues, 2017-2017 ($Million)

Figure 8.Pfizer: Net Revenue Share, By Segment, 2017

Figure 9.Pfizer: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|