.png)

Automotive Collision Repair Market by Type and Product - Global Industry Analysis and Forecast to 2022

Published On : October 2017 Pages : 102 Category: Automotive & Transportations Report Code : AT10272

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

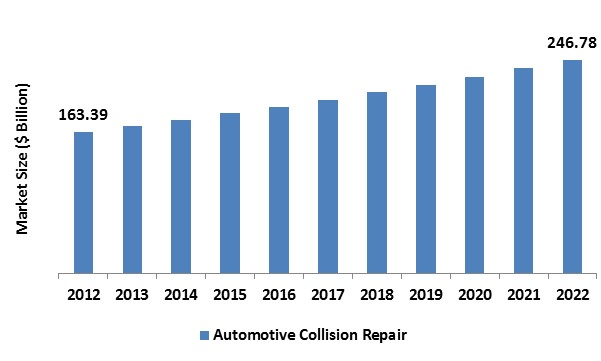

In 2017, the global automotive collision repair market was valued around USD billion and is anticipated to reach approximately USD billion by 2022, while maintaining a compound annual growth rate (CAGR) of % during the forecast period owing to the augmented technological advancements and subscriptions of automobile insurance. The modern age automobiles have superior safety features set up in them that have contributed to reducing losses on roads. Contrarily, accidents & impacts caused vehicular damage is amplified, directly affecting the revenue produced in the automotive collision repair industry worldwide. The market includes numerous sales-valuation models. For example, many retail merchants of automobiles sell DIY (Do-It-Yourself) kits to customers who desire to repair their cars themselves. In several suburban areas in the Asia Pacific and Latin American, this trend is observed. Some retail merchants sell to specialized restoration and auto service centers particularly. OEMs have generated their own many channels to sell their branded components to repairing departments. The automotive industry is experiencing a rise in the hybrid electric and gas cars demand, contributing to a boost in the specific tools and spare parts demand for these exclusive cars. The augment can be assigned to the augmented prices of petrol engine-based automobiles as well as petrol.

Vehicle Type Outlook and Trend Analysis

The global automotive collision repair market has been categorized according to vehicle types as, heavy-duty and light-duty vehicles. The light-duty vehicles section constitutes sedans, hatchbacks, crossover, and SUVs cars; while, multi-axle and commercial vehicles like buses and trucks, are classified under the segment of heavy-duty vehicles. The global market demand for another transportation options and government-directed initiatives to amend the fuel economy as well as the Alternative Fuel Vehicles (AFVs) will boost the light-duty vehicle sales in the approaching years. The industry sales would be mainly motivated by the acceptance of automobiles that operate on alternative fuels completely and automobiles with numerous drivetrain electrification levels.

Product Outlook and Trend Analysis

The global automotive collision repair market studied and accounted in the study involves consumables, spare parts, and paints & coatings. Consumables and paints & coatings comprise scratch resistant coatings, colored paints, engine motor oil, resin materials, and refinishing materials. Spare parts comprise repair materials, tools, restoration materials, supplementary mechanical parts, and crash parts utilized in the vehicle service delivery. The speedily developing technology of paints and coatings in the automobile industry to fulfill the recent protecting automobile materials, as well as aesthetical demands, can be assigned as the major cause for this expansion. The rising requirement for carbon footprint technologies and escalating automobile production has boosted the growth of the global market. Ecological coatings are likely to experience higher acceptance rates in the markets with high volume during the projected period, due to the growing ecological concerns attributed to the utilization of refinishing materials and detrimental synthetic coatings.

Regional Outlook and Trend Analysis

The rising sales vehicle generates massive growth scenario in the global automotive collision repair industry in the Asia Pacific. Due to the deficiency of stringent driving regulations in several areas of the Asia Pacific, vehicular damage owing to accidents has experienced a rise, thus bestowing to the generated revenue in the automobile repairing sector of Asia Pacific. Even though the Asia Pacific regional market has been amorphous awhile, during the past few years, it has been demonstrating signs of consistency. The Asia Pacific region is recognized as a components source for multinationals and local companies which are competing to cater low-priced machine parts to major automobile manufacturers. The European regional market represents most of the market revenue share. The European region is anticipated to experience a sluggish growth rate during the projected period due to the infiltration of automobiles having superior safety features and idled sales. The North America region is also projected to experience a parallel phenomenon like Europe. Moreover, the rising infiltration of hybrid electric and gas automobiles is expected to start the groundwork of précised vehicle repair centers during the forecast years.

Competitive Outlook and Trend Analysis

The major market players presenting special aftermarket automotive products and renders for automotive collision repair service centers are BASF, 3M, Continental AG, DuPont, Bosch, Honeywell International, ZF Friedrichshafen, Federal-Mogul Holdings, and DENSO. Federal-Mogul Holdings hosts a comprehensive technical learning platform named as Garage Gurus which provides on-demand, on-site, and online training as well as support beneficial to numerous shop owners, technicians, and service writers. The market observes several mergers and acquisitions with the aim of enlarging their global approach and consequently achieves an amplified share in the global market. 3M has a extensive range of compounds, tapes, seam sealers, cleaners & removers, coatings, detailing, paint spray equipment, plastic, headlight lens restoration, glazes, welding tools and accessories, composite, polishes, adhesives, body filler, paint booth protection, fiberglass repair, abrasives, and buffing pads, which basically cover all the required aspects regarding collision & reparation.

The global automotive collision repair market is segmented as follows :

By Vehicle Type

- Light-duty

- Heavy-duty

By Product

- Coatings & Paints

- Consumables

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Automotive Collision Repair Market By Type, Estimates and Forecast, 2017-2027 ($Million)

- Light-duty

- Heavy-duty

- Automotive Collision Repair Market By Product, Estimates and Forecast, 2017-2027 ($Million)

- Coatings & Paints

- Consumables

- Automotive Collision Repair Market By Region, Estimates and Forecast, 2017-2027 ($Million)

- North America

- North America Automotive Collision Repair Market, By Country

- North America Automotive Collision Repair Market, By Type

- North America Automotive Collision Repair Market, By Product

- U.S. Automotive Collision Repair Market, By Type

- U.S. Automotive Collision Repair Market, By Product

- Canada Automotive Collision Repair Market, By Type

- Canada Automotive Collision Repair Market, By Product

- Mexico Automotive Collision Repair Market, By Type

- Mexico Automotive Collision Repair Market, By Product

-

- Europe

- Europe Automotive Collision Repair Market, By Country

- Europe Automotive Collision Repair Market, By Type

- Europe Automotive Collision Repair Market, By Product

- Germany Automotive Collision Repair Market, By Type

- Germany Automotive Collision Repair Market, By Product

- France Automotive Collision Repair Market, By Type

- France Automotive Collision Repair Market, By Product

- UK Automotive Collision Repair Market, By Type

- UK Automotive Collision Repair Market, By Product

- Italy Automotive Collision Repair Market, By Type

- Italy Automotive Collision Repair Market, By Product

- Spain Automotive Collision Repair Market, By Type

- Spain Automotive Collision Repair Market, By Product

- Rest of Europe Automotive Collision Repair Market, By Type

- Rest of Europe Automotive Collision Repair Market, By Product

-

- Asia-Pacific

- Asia-Pacific Automotive Collision Repair Market, By Country

- Asia-Pacific Automotive Collision Repair Market, By Type

- Asia-Pacific Automotive Collision Repair Market, By Product

- Japan Automotive Collision Repair Market, By Type

- Japan Automotive Collision Repair Market, By Product

- China Automotive Collision Repair Market, By Type

- China Automotive Collision Repair Market, By Product

- Australia Automotive Collision Repair Market, By Type

- Australia Automotive Collision Repair Market, By Product

- India Automotive Collision Repair Market, By Type

- India Automotive Collision Repair Market, By Product

- South Korea Automotive Collision Repair Market, By Type

- South Korea Automotive Collision Repair Market, By Product

- Rest of Asia-Pacific Automotive Collision Repair Market, By Type

- Rest of Asia-Pacific Automotive Collision Repair Market, By Product

- Asia-Pacific

-

- Rest of the World

- Rest of the World Automotive Collision Repair Market, By Country

- Rest of the World Automotive Collision Repair Market, By Type

- Rest of the World Automotive Collision Repair Market, By Product

- Brazil Automotive Collision Repair Market, By Type

- Brazil Automotive Collision Repair Market, By Product

- South Africa Automotive Collision Repair Market, By Type

- South Africa Automotive Collision Repair Market, By Product

- Saudi Arabia Automotive Collision Repair Market, By Type

- Saudi Arabia Automotive Collision Repair Market, By Product

- Turkey Automotive Collision Repair Market, By Type

- Turkey Automotive Collision Repair Market, By Product

- United Arab Emirates Automotive Collision Repair Market, By Type

- United Arab Emirates Automotive Collision Repair Market, By Product

- Others Automotive Collision Repair Market, By Type

- Others Automotive Collision Repair Market, By Product

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increase in consumer and passenger automobile production

3.2.1.2. Progressive technology practice in auto parts fabrication

3.2.1.3. Digitalization of automotive services

3.2.2. Restraints

3.2.2.1. Environmental concerns

3.2.3. Opportunities

3.2.3.1. Technological Advancement in Automobiles

4. Automotive Collision Repair Market, By Type

4.1. Introduction

4.2. Automotive Collision Repair Market Assessment and Forecast, By Type, 2012-2022

4.3. Light-duty

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Heavy-duty

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Automotive Collision Repair Market, By Product

5.1. Introduction

5.2. Automotive Collision Repair Market Assessment and Forecast, By Product, 2012-2022

5.3. Coatings & Paints

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Consumables

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Automotive Collision Repair Market, By Region

6.1. Introduction

6.2. Automotive Collision Repair Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.3. North America

6.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.3.2. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.3.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.3.1. U.S.

6.3.3.1.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.3.3.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.3.2. Canada

6.3.3.2.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.3.3.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.3.3. Mexico

6.3.3.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.3.3.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4. Europe

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3.1. Germany

6.4.3.1.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3.2. France

6.4.3.2.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.2.2. Market Assessment and Forecast, By Products, 2012-2022 ($Million)

6.4.3.3. UK

6.4.3.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3.4. Italy

6.4.3.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3.5. Spain

6.4.3.5.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3.6. Rest of Europe

6.4.3.6.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.4.3.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5. Asia-Pacific

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.1. Japan

6.5.3.1.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.2. China

6.5.3.2.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.3. Australia

6.5.3.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.4. India

6.5.3.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.5. South Korea

6.5.3.5.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3.6. Rest of Asia-Pacific

6.5.3.6.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.5.3.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6. Rest of the World

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.1. Brazil

6.6.3.1.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.2. Turkey

6.6.3.2.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.3. Saudi Arabia

6.6.3.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.4. South Africa

6.6.3.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.5. United Arab Emirates

6.6.3.5.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3.6. Others

6.6.3.6.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

6.6.3.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7. Company Profiles

7.1. Mann+Hummel Group

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. 3M

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. ATP Automotive

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Continental AG

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. Robert Bosch GmbH

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Key Financials

7.5.4. Strategic Developments

7.6. DENSO Corporation

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Key Financials

7.6.4. Strategic Developments

7.7. Federal-Mogul Holdings Corporation

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

7.8. Faurecia

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Key Financials

7.8.4. Strategic Developments

7.9. Honeywell International Inc.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Key Financials

7.9.4. Strategic Developments

7.10. International Automotive Components Group

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Key Financials

7.10.4. Strategic Developments

7.11. Johnson Controls Inc.

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Key Financials

7.11.4. Strategic Developments

7.12. Magna International Inc.

7.12.1. Business Overview

7.12.2. Product Portfolio

7.12.3. Key Financials

7.12.4. Strategic Developments

7.13. MITSUBA Corporation

7.13.1. Business Overview

7.13.2. Product Portfolio

7.13.3. Key Financials

7.13.4. Strategic Developments

7.14. Huntsman Corporation

7.14.1. Business Overview

7.14.2. Product Portfolio

7.14.3. Key Financials

7.14.4. Strategic Developments

List of Tables

Table 1.Automotive Collision Repair Market, By Type ($Million), 2012-2022

Table 2.Light-duty Market, By Region ($Million), 2012-2022

Table 3.Heavy-duty Market, By Region ($Million), 2012-2022

Table 4.Automotive Collision Repair Market, By Product ($Million), 2012-2022

Table 5.Coatings & Paints Market, By Region ($Million), 2012-2022

Table 6.Consumables Market, By Region ($Million), 2012-2022

Table 7.Automotive Collision Repair Market, By Region ($Million), 2012-2022

Table 8.North America Automotive Collision Repair Market, By Country, 2012-2022 ($Million)

Table 9.North America Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 10.North America Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 11.U.S. Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 12.U.S. Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 13.Canada Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 14.Canada Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 15.Mexico Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 16.Mexico Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 17.Europe Automotive Collision Repair Market, By Country, 2012-2022 ($Million)

Table 18.Europe Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 20.Europe Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 21.Germany Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 22.Germany Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 23.France Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 24.France Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 25.UK Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 26.UK Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 27.Italy Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 8.Italy Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table298.Spain Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 30.Spain Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 31.Rest of Europe Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 32.Rest of Europe Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 33.Asia-Pacific Automotive Collision Repair Market, By Country, 2012-2022 ($Million)

Table 34.Asia-Pacific Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 35.Asia-Pacific Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 36.Japan Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 37.Japan Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 38.China Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 39.China Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 40.Australia Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 41.Australia Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 42.India Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 43.India Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 44.South Korea Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 45.South Korea Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 46.Rest of Asia-Pacific Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 47.Rest of Asia-Pacific Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 48.Rest of the World Automotive Collision Repair Market, By Country, 2012-2022 ($Million)

Table 49.Rest of the World Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 50.Rest of the World Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 51.Brazil Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 52.Brazil Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 53.Turkey Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 54.Turkey Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 55.Saudi Arabia Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 56.Saudi Arabia Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 57.South Africa Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 58.South Africa Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 59.United Arab Emirates Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 60.United Arab Emirates Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 61.Others Automotive Collision Repair Market, By Type, 2012-2022 ($Million)

Table 62.Others Automotive Collision Repair Market, By Product, 2012-2022 ($Million)

Table 63.Mann+Hummel Group: Key Strategic Developments, 2017-2017

Table 64.3M: Key Strategic Developments, 2017-2017

Table 65.ATP Automotive: Key Strategic Developments, 2017-2017

Table 66.Continental AG: Key Strategic Developments, 2017-2017

Table 67.Robert Bosch GmbH: Key Strategic Developments, 2017-2017

Table 68.DENSO Corporation: Key Strategic Developments, 2017-2017

Table 69.Federal-Mogul Holdings Corporation: Key Strategic Developments, 2017-2017

Table 70.Faurecia: Key Strategic Developments, 2017-2017

Table 71.International Automotive Components Group: Key Strategic Developments, 2017-2017

Table 72.Johnson Controls Inc.: Key Strategic Developments, 2017-2017

Table 73.Magna International Inc.: Key Strategic Developments, 2017-2017

Table 74.MITSUBA Corporation: Key Strategic Developments, 2017-2017

Table 78.Huntsman Corporation: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Automotive Collision Repair Market Share, By Type, 2012 & 2022 ($Million)

Figure 2.Automotive Collision Repair Market, By Product, 2012 & 2022 ($Million)

Figure 3.Automotive Collision Repair Market, By Region, 2017, ($Million)

Figure 4.3M: Net Revenues, 2017-2017 ($Million)

Figure 5.3M: Net Revenue Share, By Segment, 2017

Figure 6.3M: Net Revenue Share, By Geography, 2017

Figure 7.ATP Automotive: Net Revenues, 2017-2017 ($Million)

Figure 8.ATP Automotive: Net Revenue Share, By Segment, 2017

Figure 9.ATP Automotive: Net Revenue Share, By Geography, 2017

Figure 10.Continental AG: Net Revenues, 2017-2017 ($Million)

Figure 11.Continental AG: Net Revenue Share, By Segment, 2017

Figure 12.Continental AG: Net Revenue Share, By Geography, 2017

Figure 13.Robert Bosch GmbH: Net Revenues, 2017-2017 ($Million)

Figure 14.Robert Bosch GmbH: Net Revenue Share, By Segment, 2017

Figure 15.Robert Bosch GmbH: Net Revenue Share, By Geography, 2017

Figure 16.Honeywell International Inc.: Net Revenues, 2017-2017 ($Million)

Figure 17.Honeywell International Inc.: Net Revenue Share, By Segment, 2017

Figure 18.Honeywell International Inc.: Net Revenue Share, By Geography, 2017

Figure 19.International Automotive Components Group: Net Revenues, 2017-2017 ($Million)

Figure 20.International Automotive Components Group: Net Revenue Share, By Segment, 2017

Figure 21.International Automotive Components Group: Net Revenue Share, By Geography, 2017

Figure 22.Johnson Controls Inc.: Net Revenues, 2017-2017 ($Million)

Figure 23.Johnson Controls Inc.: Net Revenue Share, By Segment, 2017

Figure 24.Johnson Controls Inc.: Net Revenue Share, By Geography, 2017

Figure 25.Magna International Inc.: Net Revenues, 2017-2017 ($Million)

Figure 26.Magna International Inc.: Net Revenue Share, By Segment, 2017

Figure 27.Magna International Inc.: Net Revenue Share, By Geography, 2017

Figure 28.MITSUBA Corporation: Net Revenues, 2017-2017 ($Million)

Figure 29.MITSUBA Corporation: Net Revenue Share, By Segment, 2017

Figure 30.MITSUBA Corporation: Net Revenue Share, By Geography, 2017

Figure 31.Huntsman Corporation: Net Revenues, 2017-2017 ($Million)

Figure 32.Huntsman Corporation: Net Revenue Share, By Segment, 2017

Figure 33.Huntsman Corporation: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|