.png)

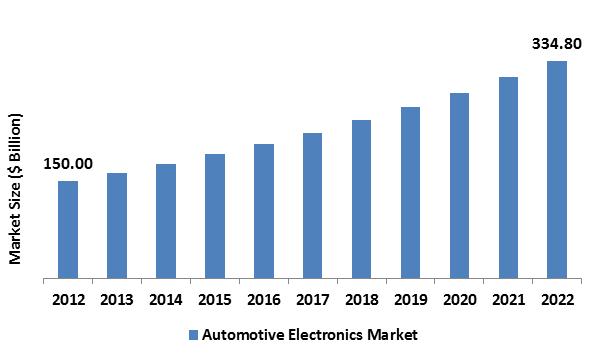

Automotive Electronics Market by Application - Global Industry Analysis and Forecast to 2022

Published On : October 2017 Pages : 98 Category: Automotive & Transportations Report Code : AT10284

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

The Automotive Electronics Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The progress towards cutting edge safety frameworks is relied upon to drive the global automotive electronics market throughout the following years. Alcohol ignition interlocks, emergency call systems, and accident data recorder systems are an example of developments where future request is relied upon to stimulate market development. The European Union is anticipated to command various applications within the following couple of years. Driver’s assistance systems and Low-speed collision avoidance systems are expected to be among the prevalent innovations. Coordination of map-enabled systems likewise gives various application alternatives prompting points of interest, for example, intelligent front lighting systems, lane departure systems and driver assistance systems empowered by united versatile front lighting. Security advances additionally incorporate speed alert, map-supported adaptive front lighting, usage data transmission and collision warning. Absence of awareness about the general comprehension of the interplay of subsystems and trouble of OEMs in keeping up and dealing with the procedure with implanted controllers that are produced by tier-1 providers is anticipated to challenge market development.

Application Outlook and Trend Analysis

Major application sections incorporate powertrain, body electronics, safety, infotainment and ADAS. With a specific end goal to control the amount of fatalities coming about because of street mischances, administrative boards of many nations have made strides for consolidating security gadgets in vehicles. A portion of the fundamental gadgets used to guarantee the security of travelers incorporate on/off switches for air packs, backup sensing system, airbags, heads-up display, electrochromatic mirror/auto dimming mirrors, passenger sensing system, head restrictions, padded knee bolster, and energy-absorbing steering system. Providers, for example, Continental AG alongside OEMs are centered on giving cost-effective ADAS to the medium-sized and compact auto sections. The organization presented inexpensive ADAS systems, for example, lane departure warning system, traffic sign recognition and driver monitoring systems. New Car Assessment Program (NCAP) in districts, for example, China and Europe has been ordering Automatic Emergency Braking (AEB) and Lane Departure Warning (LDW) systems for huge scale implementation of dynamic security systems.

Regional Outlook and Trend Analysis

Asia Pacific is relied upon to keep representing most of the worldwide market throughout the following years. The administration in China has advanced C-NCAP's safety evaluations urging purchasers to see a five-star rating as a manual for vehicle's quality. The Department of Transportation in the United States has commanded equipment for safety, for example, a backup camera in every new vehicle, expanding vehicle costs by USD for the new base models. The Department of Transportation additionally keeps up Federal Motor Vehicle Safety Standards and Regulations (FMVSS), which recommend crash-avoidance segments consequently lessening environmental contamination and gas utilization. Developing interest for more intuitive systems, for example, embedded vision systems able to do continuous picture tracking on real-time basis has picked up noticeable quality. There has been an expansion in implementation of green technologies attributable to stringent government controls prompting diminish in modular stages.

Competitive Insights

Proceeded with invasion of electronics into the greater part of the primary systems in vehicles is relied upon to drive market development. Automakers are anticipated to increase the implementation of savvy electronics which makes their vehicles environment-friendly and safe to drive. Major players in the market are TRW Automotive, Continental AG, Denso, Johnson Controls, Robert Bosch GmbH and Delphi Automotive. The aggressive nature of the business has offered ascend to an accentuation on setting up vital organizations together with channel accomplices. Telematics highlights give chances to tie-ins with insurers including discount offers for clients who drive securely. OEMs, for example, Mercedes are concentrating on gathering vehicle and customer information, which is a bundle of client administrations covering financing, servicing, and vehicle obtaining alongside short-term rentals accessible on various advanced stages.

The global automotive electronics market is segmented as follows:

By Application:

- Infotainment

- Safety Systems

- ADAS

- Powertrain

- Body Electronics

By Region:

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Automotive ECU Market, By Type, Estimates and Forecast, 2012-2022 ($Million)

- Infotainment

- Safety Systems

- ADAS

- Powertrain

- Body Electronics

- Automotive ECU Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Automotive ECU Market, By Country

- North America Automotive ECU Market, By Application

- U.S. Automotive ECU Market, By Application

- Canada Automotive ECU Market, By Application

- Mexico Automotive ECU Market, By Application

-

- Europe

- Europe Automotive ECU Market, By Country

- Europe Automotive ECU Market, By Application

- Germany Automotive ECU Market, By Application

- France Automotive ECU Market, By Application

- UK Automotive ECU Market, By Application

- Italy Automotive ECU Market, By Application

- Spain Automotive ECU Market, By Application

- Rest of Europe Automotive ECU Market, By Application

-

- Asia-Pacific

- Asia-Pacific Automotive ECU Market, By Country

- Asia-Pacific Automotive ECU Market, By Application

- Japan Automotive ECU Market, By Application

- China Automotive ECU Market, By Application

- Australia Automotive ECU Market, By Application

- India Automotive ECU Market, By Application

- South Korea Automotive ECU Market, By Application

- Rest of Asia-Pacific Automotive ECU Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Automotive ECU Market, By Country

- Rest of the World Automotive ECU Market, By Application

- Brazil Automotive ECU Market, By Application

- South Africa Automotive ECU Market, By Application

- Saudi Arabia Automotive ECU Market, By Application

- Turkey Automotive ECU Market, By Application

- United Arab Emirates Automotive ECU Market, By Application

- Others Automotive ECU Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rising Demand Of Automotive

3.2.1.2. Growing Demand Of Advanced Features In Vehicles

3.2.2. Restraints

3.2.2.1. Increasing number of Complexity in Electronics fields

3.2.3. Opportunities

3.2.3.1. Technological Advancement in Automotive Electronics

4. Automotive Electronics Market, By Application

4.1. Introduction

4.2. Automotive Electronics Market Assessment and Forecast, By Application, 2012-2022

4.3. Infotainment

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Safety Systems

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. ADAS

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Powertrain

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.7. Body Electronics

4.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Automotive Electronics Market, By Region

5.1. Introduction

5.2. Automotive Electronics Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.3.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Applications, 2012-2022 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6. Company Profiles

6.1. Altera

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. Audiovox Corp.

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. Bosch Group

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4. Avago Technologies

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5. Atmel Corporation

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Key Financials

6.5.4. Strategic Developments

6.6. Continental AG

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7. Denso Corp.

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Key Financials

6.7.4. Strategic Developments

6.8. Delphi Automotive

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9. Infineon Technologies

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Key Financials

6.9.4. Strategic Developments

6.10. Hitachi Automotive

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Key Financials

6.10.4. Strategic Developments

6.11. Dow Corning

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Key Financials

6.11.4. Strategic Developments

6.12. Texas Instruments

6.12.1. Business Overview

6.12.2. Product Portfolio

6.12.3. Strategic Developments

6.13. TRW Automotive

6.13.1. Business Overview

6.13.2. Product Portfolio

6.13.3. Key Financials

6.13.4. Strategic Developments

List of Tables

Table 1.Automotive Electronics Market, By Application ($Million), 2012-2022

Table 2.Safety & Security Systems Market, By Region ($Million), 2012-2022

Table 3.Entertainment Systems Market, By Region ($Million), 2012-2022

Table 4.Powertrain Electronics Market, By Region ($Million), 2012-2022

Table 5.Communication & Navigation Systems Market, By Region ($Million), 2012-2022

Table 6.Chassis Electronics Market, By Region ($Million), 2012-2022

Table 7.Automotive Electronics Market, By Region ($Million), 2012-2022

Table 8.North America Automotive Electronics Market, By Country, 2012-2022 ($Million)

Table 9.North America Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 10.U.S. Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 11.Canada Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 12.Mexico Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 13.Europe Automotive Electronics Market, By Country, 2012-2022 ($Million)

Table 14.Europe Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 15.Germany Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 16.France Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 17.UK Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 18.Italy Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 19.Spain Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 20.Rest of Europe Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 21.Asia-Pacific Automotive Electronics Market, By Country, 2012-2022 ($Million)

Table 22.Asia-Pacific Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 23.Japan Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 24.China Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 25.Australia Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 26.India Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 27.South Korea Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 28.Rest of Asia-Pacific Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 29.Rest of the World Automotive Electronics Market, By Country, 2012-2022 ($Million)

Table 30.Rest of the World Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 31.Brazil Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 32.Turkey Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 33.Saudi Arabia Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 34.South Africa Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 35.United Arab Emirates Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 36.Others Automotive Electronics Market, By Application, 2012-2022 ($Million)

Table 37.Altera: Key Strategic Developments, 2017-2017

Table 38.Audiovox Corp.: Key Strategic Developments, 2017-2017

Table 39.Bosch Group: Key Strategic Developments, 2017-2017

Table 40.Avago Technologies: Key Strategic Developments, 2017-2017

Table 41.Atmel Corporation: Key Strategic Developments, 2017-2017

Table 42.Continental AG: Key Strategic Developments, 2017-2017

Table 43.Denso Corp.: Key Strategic Developments, 2017-2017

Table 44.Delphi Automotive: Key Strategic Developments, 2017-2017

Table 45.Infineon Technologies: Key Strategic Developments, 2017-2017

Table 46.Hitachi Automotive: Key Strategic Developments, 2017-2017

Table 47.Dow Corning: Key Strategic Developments, 2017-2017

Table 48.Texas Instruments: Key Strategic Developments, 2017-2017

Table 49.TRW Automotive: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Automotive Electronics Market, By Application, 2012 & 2022 ($Million)

Figure 2.Automotive Electronics Market, By Region, 2017, ($Million)

Figure 3.Altera: Net Revenues, 2017-2017 ($Million)

Figure 4.Altera: Net Revenue Share, By Segment, 2017

Figure 5.Altera: Net Revenue Share, By Geography, 2017

Figure 6.Audiovox Corp.: Net Revenues, 2017-2017 ($Million)

Figure 7.Audiovox Corp.: Net Revenue Share, By Segment, 2017

Figure 8.Audiovox Corp.: Net Revenue Share, By Geography, 2017

Figure 9.Bosch Group: Net Revenues, 2017-2017 ($Million)

Figure 10.Bosch Group: Net Revenue Share, By Segment, 2017

Figure 11.Bosch Group: Net Revenue Share, By Geography, 2017

Figure 12.Continental AG: Net Revenues, 2017-2017 ($Million)

Figure 13.Continental AG: Net Revenue Share, By Segment, 2017

Figure 14.Continental AG: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|