.png)

Bio-based PET Market by Application - Global Industry Analysis and Forecast to 2027

Published On : September 2017 Pages : 90 Category: Renewable Chemicals Report Code : CM09207

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

In 2017 the global bio-based polyethylene terephthalate (PET) market size was approximated at nearly USD billion and is anticipated to reach approximately USD billion by 2027 at a compound annual growth rate (CAGR) of % during forecast period. The rising requirement for bio based polyethylene terephthalate for manufacturing different packaging solutions such as bottles is anticipated to spur the growth of this market. Bio-based polyethylene terephthalate is a polyester resin that is naturally derived and is utilized for production of various products like construction goods, automotive interiors, electronics, bottles and packaged goods. The development of these sectors along with regulations in support, is anticipated to boost the growth of the market. One of the biggest consumers of bio-based polyethylene terephthalate has been the United States where the material is widely utilized for the manufacturing of technical and consumer goods and bottles. Factors such as increasing requirement of food and beverages packaging materials that are eco-friendly are anticipated to have a significant impact on the growth of this market. Increasing concerns related to greenhouse gasses along with bioplastics being utilized as a substitute in the automotive and packaging industry are anticipated to play a vital role in the growth of this market. Additionally, riding importance for durable packaging is anticipated to spur the growth of this market in the upcoming years. However, the introduction of alternatives such as polyethylenefuranoate (PEF) may inhibit the growth of this market. In 2017, an agreement was made by the Coca-Cola Company with Avantium for the enhancement of polyethylenefuranoate which contains higher stability and glass transition temperature as compared to bio-based polyethylene terephthalate which may result in increased utilization of polyethylenefuranoate by major companies, thus hindering the growth of this market.

Application Outlook and Trend Analysis

Bio-based polyethylene terephthalate was extensively utilized in bottles that registered 86.4 percent of the market volume in the year 2017. These containers are extremely useful for packing carbonated drinks and alcoholic beverages like spirits, beer and wine. Increasing importance of long lasting packaging in carbonated soft drinks manufacturers including companies like Coca-Cola and PepsiCo is anticipated to boost the growth of the market significantly. Further, increasing consumption of carbonated soft drinks is said to increase the demand of the bio-based polyethylene terephthalate. Bottles are expected to be the most swiftly growing segment. The application of the bio-based polyethylene terephthalate in the technical sector registered 10.4 percent of the global volume in the year 2017. Increasing awareness regarding reduction of greenhouse emissions in the sector of manufacturing is anticipated to fuel the market.

Regional Outlook and Trend Analysis

The largest market in 2017 was the Asia Pacific which was worth USD million. The rising awareness regarding significance of bioplastics in emerging economies like South Korea and Japan as a result of regulations with the aim of reducing dependence of synthetic polymer products is one of the major factors to boost the growth of this market. In order to encourage investments in the industry of domestic biopolymers, Japan is expected to be the largest destinations for the manufacturing of bio-based polyethylene terephthalate. In 2017, companies such as Toyota Tsusho, Toray Industries and Teijin Limited were the largest manufacturers of biopolymers in Japan. Factors such as increasing concerns related to greenhouse emissions or increasing requirement of sustainable packaging coupled with technical advancements are anticipated to boost the growth of the bio-based polyethylene terephthalate significantly in North America. The Montreal protocol has been implanted by the government of Canada and the United States with the aim of decreasing greenhouse gas emissions and forbidding the utilization of products that cause global warming.

Competitive insights

The major companies in the global Bio-based polyethylene terephthalate market are The Coca-Cola Company, Gruppo Mossi Ghisolfi chemicals, Toray Industries, Toyota Tsusho and Teijin Chemicals Company. The Coca-Cola Company distributes its bio-based polyethylene terephthalate under the name of PlantBottle. A few other brands that are available in the market are GLOBIO and Eco Circle Plantfiber. The nature of this industry is extensively competitive due to the existence of a restricted number of companies. These companies get into a partnership with companies that manufacture raw materials to have an uninterrupted supply of purified terephthalic acid (PTA).

The Global Bio-based polyethylene terephthalate market is segmented as follows-

By Application

- Consumer Goods

- Packaging (Bottles)

- Technical (Electronics and Automotive)

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Wearable Sensors Market, By Application, Estimates and Forecast, 2017-2027 ($Million)

- Consumer Goods

- Packaging (Bottles)

- Technical (Electronics and Automotive)

- Other Applications

- Wearable Sensors Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

- North America

- North America Wearable Sensors Market, By Country

- North America Wearable Sensors Market, By Application

- U.S. Wearable Sensors Market, By Application

- Canada Wearable Sensors Market, By Application

- Mexico Wearable Sensors Market, By Type

-

- Europe

- Europe Wearable Sensors Market, By Country

- Europe Wearable Sensors Market, By Application

- Germany Wearable Sensors Market, By Application

- France Wearable Sensors Market, By Application

- UK Wearable Sensors Market, By Application

- Italy Wearable Sensors Market, By Application

- Spain Wearable Sensors Market, By Application

- Rest of Europe Wearable Sensors Market, By Application

-

- Asia-Pacific

- Asia-Pacific Wearable Sensors Market, By Country

- Asia-Pacific Wearable Sensors Market, By Application

- Japan Wearable Sensors Market, By Application

- Australia Wearable Sensors Market, By Application

- India Wearable Sensors Market, By Application

- South Korea Wearable Sensors Market, By Application

- Rest of Asia-Pacific Wearable Sensors Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Wearable Sensors Market, By Country

- Rest of the World Wearable Sensors Market, By Application

- Brazil Wearable Sensors Market, By Application

- South Africa Wearable Sensors Market, By Application

- Saudi Arabia Wearable Sensors Market, By Application

- Turkey Wearable Sensors Market, By Application

- United Arab Emirates Wearable Sensors Market, By Application

- Others Wearable Sensors Market, By Application

- Rest of the World

Table of Contents

1.Introduction

1.1.Report Description

1.2.Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2.Executive Summary

2.1.Key Highlights

3.Market Overview

3.1.Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2.Market Share Analysis

3.3.Market Dynamics

3.3.1. Drivers

3.3.1.1.Encouragement of environmental friendly products

3.3.1.2.Increasing food & beverage consumption in BRICS

3.3.1.3.Norms and Standards for progressing fuel efficiency in vehicles

3.3.2. Restraints

3.3.2.1.Utilization of Polyethylene furanoate (PEF), serves as an alternative to bio PET for its stretchable strength and light weight properties

3.3.3. Opportunities

3.3.3.1.Reduction in greenhouse emissions on a domestic level

3.4.Industry Trends

4.Bio-based PET Market, By Application

4.1.Introduction

4.2.Bio-based PET Market Assessment and Forecast, By Application, 2017-2027

4.3.Consumer Goods

4.3.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.Packaging (Bottles)

4.4.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.Technical (Electronics and Automotive)

4.5.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.6.Other Applications

4.6.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.Bio-based PET Market, By Region

5.1.Introduction

5.2.Bio-based PET Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.3.North America

5.3.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.3.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.1.U.S.

5.3.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.2.Canada

5.3.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.3.Mexico

5.3.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.Europe

5.4.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.4.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.1.Germany

5.4.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.2.France

5.4.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.3.UK

5.4.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.4.Italy

5.4.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.5.Spain

5.4.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.6.Russia

5.4.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.7.Rest of Europe

5.4.2.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.5.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.1.Japan

5.5.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.2.China

5.5.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.3.Australia

5.5.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.4.India

5.5.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.5.South Korea

5.5.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.6.Taiwan

5.5.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.7.Rest of Asia-Pacific

5.5.2.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.6.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.1.Brazil

5.6.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.2.Turkey

5.6.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.3.Saudi Arabia

5.6.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.4.South Africa

5.6.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.5.United Arab Emirates

5.6.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.6.Others

5.6.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.Company Profiles

6.1.Toyota Tsusho Corporation

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. The Coca-Cola Company

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3.PepsiCo Inc.

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4.Toray Industries

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5.TEIJIN LIMITED

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Key Financials

6.5.4. Strategic Developments

6.6.M&G Chemicals

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7.Plastipak Holdings, Inc.

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Key Financials

6.7.4. Strategic Developments

6.8.Anellotech, Inc.

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9.Danone

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Key Financials

6.9.4. Strategic Developments

List of Tables

Table 1.Bio-based PET Market, By Application ($Million), 2017-2025

Table 2.Consumer Goods Market, By Region ($Million), 2017-2025

Table 3.Packaging (Bottles) Market, By Region ($Million), 2017-2025

Table 4.Technical (Electronics and Automotive) Market, By Region ($Million), 2017-2025

Table 5.Other Applications Market, By Region ($Million), 2017-2025

Table 6.Bio-based PET Market, By Region ($Million), 2017-2025

Table 7.North America Bio-based PET Market, By Country, 2017-2025 ($Million)

Table 8.North America Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 9.U.S. Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 10.Canada Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 11.Mexico Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 12.Europe Bio-based PET Market, By Country, 2017-2025 ($Million)

Table 13.Europe Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 14.Germany Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 15.France Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 16.UK Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 17.Italy Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 18.Spain Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 19.Russia Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 20.Rest of Europe Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 21.Asia-Pacific Bio-based PET Market, By Country, 2017-2025 ($Million)

Table 22.Asia-Pacific Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 23.Japan Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 24.China Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 25.Australia Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 26.India Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 27.South Korea Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 28.Taiwan Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 29.Rest of Asia-Pacific Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 30.Rest of the World Bio-based PET Market, By Country, 2017-2025 ($Million)

Table 31.Rest of the World Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 32.Brazil Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 33.Turkey Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 34.Saudi Arabia Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 35.South Africa Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 36.United Arab Emirates Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 37.Others Bio-based PET Market, By Application, 2017-2025 ($Million)

Table 38.Toyota Tsusho Corporation: Key Strategic Developments, 2017-2017

Table 39.The Coca-Cola Company: Key Strategic Developments, 2017-2017

Table 40.PepsiCo Inc.: Key Strategic Developments, 2017-2017

Table 41.Toray Industries: Key Strategic Developments, 2017-2017

Table 42.TEIJIN LIMITED: Key Strategic Developments, 2017-2017

Table 43.Plastipak Holdings, Inc.: Key Strategic Developments, 2017-2017

Table 44.Plastipak Holdings, Inc.: Key Strategic Developments, 2017-2017

Table 45.Anellotech, Inc.: Key Strategic Developments, 2017-2017

Table 46.Danone: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Bio-based PET Market, By Application, 2017 & 2025 ($Million)

Figure 2.Bio-based PET Market, By Region, 2017, ($Million)

Figure 3.Toyota Tsusho Corporation: Net Revenues, 2017-2017 ($Million)

Figure 4.Toyota Tsusho Corporation: Net Revenue Share, By Segment, 2017

Figure 5.Toyota Tsusho Corporation: Net Revenue Share, By Geography, 2017

Figure 6.The Coca-Cola Company: Net Revenues, 2017-2017 ($Million)

Figure 7.The Coca-Cola Company: Net Revenue Share, By Segment, 2017

Figure 8.The Coca-Cola Company: Net Revenue Share, By Geography, 2017

Figure 9.PepsiCo Inc.: Net Revenues, 2017-2017 ($Million)

Figure 10.PepsiCo Inc.: Net Revenue Share, By Segment, 2017

Figure 11.PepsiCo Inc.: Net Revenue Share, By Geography, 2017

Figure 12.Toray Industries: Net Revenues, 2017-2017 ($Million)

Figure 13.Toray Industries: Net Revenue Share, By Segment, 2017

Figure 14.Toray Industries: Net Revenue Share, By Geography, 2017

Figure 15.TEIJIN LIMITED: Net Revenues, 2017-2017 ($Million)

Figure 16.TEIJIN LIMITED: Net Revenue Share, By Segment, 2017

Figure 17.TEIJIN LIMITED: Net Revenue Share, By Geography, 2017

Figure 18.Plastipak Holdings, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 19.Plastipak Holdings, Inc.: Net Revenue Share, By Segment, 2017

Figure 20.Plastipak Holdings, Inc.: Net Revenue Share, By Geography, 2017

Figure 21.Danone: Net Revenues, 2017-2017 ($Million)

Figure 22.Danone: Net Revenue Share, By Segment, 2017

Figure 23.Danone: Net Revenue Share, By Geography, 2017

Research Methodology

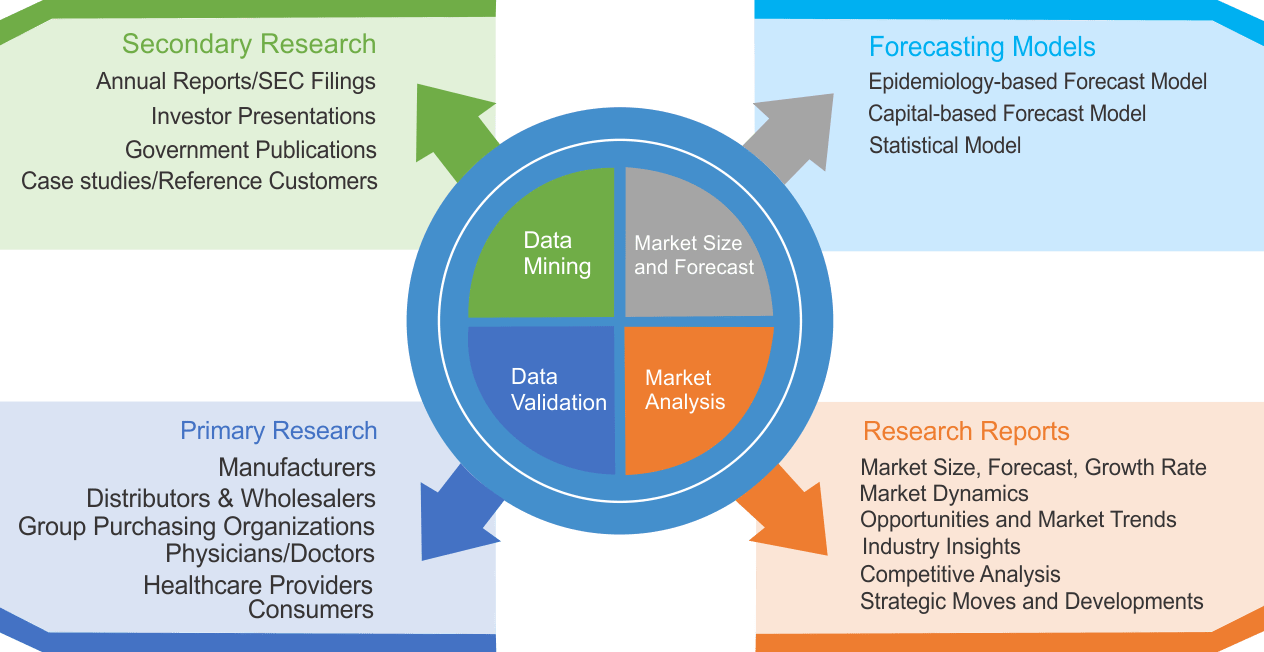

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|