.png)

Breast Pump Market By Product, Technology and Application- Global Industry Analysis and Forecast to 2022

Published On : October 2017 Pages : 80 Category: Medical Devices Report Code : HC10277

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

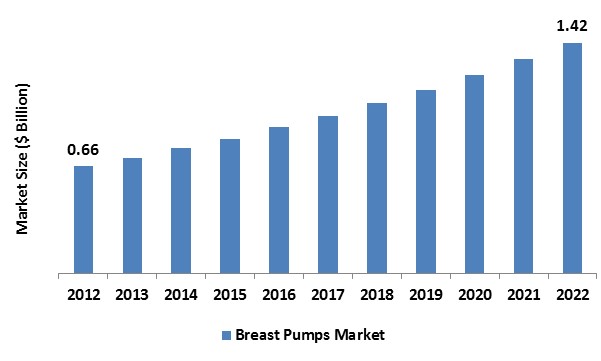

The global Breast Pumps Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. According to information published by UNICEF, there were almost 830 million women working in various industries in 2017. These women face constant pressure to resume work after giving birth and search for items which would assist them in balancing their priorities of work life. The market opportunity for breast feeding pumps incorporates the working ladies in both organized and chaotic segments, and furthermore ladies who remain at home. A portion of the drivers distinguished for Breast Pump Market incorporate the constant suggestion by the healthcare fraternity that children should be breastfed for a period of six months to one year. Additionally, the quick rise in the population of working women, lacking maternity leave period and surging requirement to fulfill nutritional levels are certain factors that are anticipated to boost the development of this market. The rates of breast feeding have been enhancing over the period if past ten years due to rising awareness and support campaigns from international organizations, healthcare providers, non-profit groups and governments. In 2017, as indicated by the information distributed by the United States CDC, out of % babies who were breastfed, about % of the newborn children were breastfed at a half year and the rest % were breastfed at 1 years old year. The states in the United States with high rates of breast feeding incorporate Colorado California, Idaho, and Oregon. The Affordable Care Act has an arrangement which commands the insurance agencies to take care of expenses of visits to lactation advisors and expenses of leasing or buying breast pumps. This advantage can be profited by all mothers who are lactating, and are required to fundamentally support utilization rates over the estimate time frame.

Product Outlook and Trend Analysis

In terms of type of product, In light of the kind of item, the market is classified as and closed system and open system pumps. The market was dominated by closed system breast pumps in 2017 with a share of 82 percent. Major factors for such a high share incorporates greatest removal of contaminations, enhanced safety of the child’s health and convenient cleaning of these devices. Moreover, these pumps have a hindrance between an accumulation kit and the pumping unit or motor to keep the milk form getting contaminated and from entering the pump tubing or motor. These advantages are key components ascribing for the portions major share.

Technology Outlook and Trend Analysis

In terms of technology, the market is divided into electric pumps, manual pumps and battery controlled pumps. The battery controlled pumps represented most of the profit share of 55.4 percent in 2017. Key reasons ascribed for the major share are expanding disposable cash levels, rising requirement for these items by working ladies and the general advantages of the item. Nonetheless, because of mechanical progressions and better productivity, the electric pumps are anticipated to be the quickest developing item fragment in terms of technology.

Application Outlook and Trend Analysis

In terms of application the market is segmented into personal use and hospital grade. Personal use pumps are smaller and normally designed for a single user or mother. Some personal use pumps such as EnJoye electric pumps by Hygeia and pump and the Medical Nurture III by Bailey have been approved by the Food and Drug administration as safe for several users. However, the market was dominated by the electric breast pumps for hospital use in 2017 with a share of 90 percent owing to high rates of utilization.

Regional Outlook and Trend Analysis

In 2017, North America represented the biggest share of 63 percent. Key components ascribing to its major share are vast number of working women and rising awareness about breast feeding. Additionally, in the United States, initiatives made by the government to give repayment to buying breast pumps and for visiting lactation advisors are relied upon to fundamentally spur utilization rates over the estimate time frame. However, Asia Pacific is anticipated to be the quickest developing area over the gauge time frame, because of high financial improvement, expanding in expendable salaries, rising population of working women, absence of sufficient maternity leave and expanding awareness about the use of breast pumps.

Competitive Insights

Some of the major players in the market are Linco Baby Merchandise Work's Co.Ltd, Philips AVENT, Ameda Breastfeeding Solutions, Büttner-Frank GmbH, Lansinoh Laboratories, Guangzhou Happy Baby Products Ltd, Bailey Medical Engineering, Whittlestone Inc, Bailey Medical Engineering, MEDELA LLC and Hygeia II Medical Group, Inc.

The global Breast pumps market is segmented as follows-

By Product

- Closed System

- Open System

By Technology

- Electric

- Manual

- Battery Powered

By Application

- Hospital Grade

- Personal Use

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Breast Pump Market, By Product, Estimates and Forecast, 2012-2022 ($Billion)

- Closed System

- Open System

- Breast Pump Market, By Technology, Estimates and Forecast, 2012-2022 ($Billion)

- Electric

- Manual

- Battery Powered

- Breast Pump Market, By Application, Estimates and Forecast, 2012-2022 ($Billion)

- Hospital Grade

- Personal Use

- Breast Pump Market, By Region, Estimates and Forecast, 2012-2022 ($Billion)

- North America

- North America Breast Pump Market, By Country

- North America Breast Pump Market, By Product

- North America Breast Pump Market, By Technology

- North America Breast Pump Market, By Application

- U.S. Breast Pump Market, By Product

- U.S. Breast Pump Market, By Technology

- U.S. Breast Pump Market, By Application

- Canada Breast Pump Market, By Product

- Canada Breast Pump Market, By Technology

- Canada Breast Pump Market, By Application

- Mexico Breast Pump Market, By Product

- Mexico Breast Pump Market, By Technology

- Mexico Breast Pump Market, By Application

-

- Europe

- Europe Breast Pump Market, By Country

- Europe Breast Pump Market, By Product

- Europe Breast Pump Market, By Technology

- Europe Breast Pump Market, By Application

- Germany Breast Pump Market, By Product

- Germany Breast Pump Market, By Technology

- Germany Breast Pump Market, By Application

- France Breast Pump Market, By Product

- France Breast Pump Market, By Technology

- France Breast Pump Market, By Application

- UK Breast Pump Market, By Product

- UK Breast Pump Market, By Technology

- UK Breast Pump Market, By Application

- Italy Breast Pump Market, By Product

- Italy Breast Pump Market, By Technology

- Italy Breast Pump Market, By Application

- Spain Breast Pump Market, By Product

- Spain Breast Pump Market, By Technology

- Spain Breast Pump Market, By Application

- Rest of Europe Breast Pump Market, By Product

- Rest of Europe Breast Pump Market, By Technology

- Rest of Europe Breast Pump Market, By Application

- Europe

-

- Asia-Pacific

- Asia-Pacific Breast Pump Market, By Country

- Asia-Pacific Breast Pump Market, By Product

- Asia-Pacific Breast Pump Market, By Technology

- Asia-Pacific Breast Pump Market, By Application

- Japan Breast Pump Market, By Product

- Japan Breast Pump Market, By Technology

- Japan Breast Pump Market, By Application

- Australia Breast Pump Market, By Product

- Australia Breast Pump Market, By Technology

- Australia Breast Pump Market, By Application

- India Breast Pump Market, By Product

- India Breast Pump Market, By Technology

- India Breast Pump Market, By Application

- South Korea Breast Pump Market, By Product

- South Korea Breast Pump Market, By Technology

- South Korea Breast Pump Market, By Application

- Rest of Asia-Pacific Breast Pump Market, By Product

- Rest of Asia-Pacific Breast Pump Market, By Technology

- Rest of Asia-Pacific Breast Pump Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Breast Pump Market, By Country

- Rest of the World Breast Pump Market, By Product

- Rest of the World Breast Pump Market, By Technology

- Rest of the World Breast Pump Market, By Application

- Brazil Breast Pump Market, By Product

- Brazil Breast Pump Market, By Technology

- Brazil Breast Pump Market, By Application

- South Africa Breast Pump Market, By Product

- South Africa Breast Pump Market, By Technology

- South Africa Breast Pump Market, By Application

- Saudi Arabia Breast Pump Market, By Product

- Saudi Arabia Breast Pump Market, By Technology

- Saudi Arabia Breast Pump Market, By Application

- Turkey Breast Pump Market, By Product

- Turkey Breast Pump Market, By Technology

- Turkey Breast Pump Market, By Application

- United Arab Emirates Breast Pump Market, By Product

- United Arab Emirates Breast Pump Market, By Technology

- United Arab Emirates Breast Pump Market, By Application

- Others Breast Pump Market, By Product

- Others Breast Pump Market, By Technology

- Others Breast Pump Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Rate of Women Employment

3.2.1.2. Rising Government Initiatives

3.2.1.3. Development of Healthcare Infrastructure in Emerging Countries

3.2.2. Restraints

3.2.2.1. High Cost of breast Pumps

3.2.3. Opportunities

3.2.3.1. Emerging Countries to Offer Lucrative Growth Opportunities

4. Breast Pumps Market, By Product

4.1. Introduction

4.2. Breast Pumps Market Assessment and Forecast, By Product, 2012-2022

4.3. Closed Systems

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

4.4. Open Systems

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5. Breast Pumps Market, By Technology

5.1. Introduction

5.2. Breast Pumps Market Assessment and Forecast, By Technology, 2012-2022

5.3. Electric

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.4. Manual

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.5. Battery Powered

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6. Breast Pumps Market, By Application

6.1. Introduction

6.2. Breast Pumps Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

6.3. Hospital Grade

6.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6.4. Personal Use

6.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

7. Breast Pumps Market, By Region

7.1. Introduction

7.2. Breast Pumps Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

7.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.3.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5. U.S.

7.3.5.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.3.5.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5.2. Canada

7.3.5.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.3.5.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5.3. Mexico

7.3.5.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.3.5.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

7.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.5. Germany

7.4.5.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.5.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.6. France

7.4.6.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.6.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.7. UK

7.4.7.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.7.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.8. Italy

7.4.8.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.8.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.9. Spain

7.4.9.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.9.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.9.2. Rest of Europe

7.4.9.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

7.4.9.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.9.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8. Asia-Pacific

8.1.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

8.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.4.1. Japan

8.1.4.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.4.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.5. China

8.1.5.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.5.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.6. Australia

8.1.6.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.6.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.7. India

8.1.7.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.7.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.8. South Korea

8.1.8.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.8.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.9. Rest of Asia-Pacific

8.1.9.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

8.1.9.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9. Rest of the World

9.1.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

9.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.5. Brazil

9.1.5.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.5.1.2. Market Assessment and Forecast, By Technology , 2012-2022 ($Billion)

9.1.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.6. Turkey

9.1.6.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.6.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.7. Saudi Arabia

9.1.7.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.7.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.8. South Africa

9.1.8.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.8.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.9. United Arab Emirates

9.1.9.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.9.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.10. Others

9.1.10.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Billion)

9.1.10.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.10.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

10. Company Profiles

10.1. Ameda AG

10.1.1. Business Overview

10.1.2. Product Portfolio

10.1.3. Strategic Developments

10.2. Bailey Medical

10.2.1. Business Overview

10.2.2. Product Portfolio

10.2.3. Strategic Developments

10.3. Hygeia Medical Group

10.3.1. Business Overview

10.3.2. Product Portfolio

10.3.3. Strategic Developments

10.4. Medela AG

10.4.1. Business Overview

10.4.2. Product Portfolio

10.4.3. Key Financials

10.4.4. Strategic Developments

10.5. Philips

10.5.1. Business Overview

10.5.2. Product Portfolio

10.5.3. Key Financials

10.5.4. Strategic Developments

10.6. Linco Baby Merchandise Work's Co., Ltd

10.6.1. Business Overview

10.6.2. Product Portfolio

10.6.3. Strategic Developments

10.7. Buettner-Frank GmbH

10.7.1. Business Overview

10.7.2. Product Portfolio

10.7.3. Strategic Developments

10.8. Lansinoh Laboratories

10.8.1. Business Overview

10.8.2. Product Portfolio

10.8.3. Strategic Developments

10.9. Albert Manufacturing USA

10.9.1. Business Overview

10.9.2. Product Portfolio

10.9.3. Strategic Developments

10.10. Whittlestone, Inc.

10.10.1. Business Overview

10.10.2. Product Portfolio

10.10.3. Strategic Developments

List of Tables

Table 1.Breast Pumps Market, By Product ($Billion), 2012-2022

Table 2.Closed System Market, By Region ($Billion), 2012-2022

Table 3.Open System Market, By Region ($Billion), 2012-2022

Table 4.Breast Pumps Market, By Technology ($Billion), 2012-2022

Table 5.Electric Breast Pump Market, By Region ($Billion), 2012-2022

Table 6.Manual Breast Pump Market, By Region ($Billion), 2012-2022

Table 7.Battery Powered Breast Pump Market, By Region ($Billion), 2012-2022

Table 8.Breast Pumps Market, By Application ($Billion), 2012-2022

Table 9.Hospital Grade Market, By Region ($Billion), 2012-2022

Table 10.Personal Use Market, By Region ($Billion), 2012-2022

Table 11.Breast Pumps Market, By Region ($Billion), 2012-2022

Table 12.North America Breast Pumps Market, By Country, 2012-2022 ($Billion)

Table 13.North America Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 14.North America Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 15.North America Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 16.U.S. Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 17.U.S. Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 18.U.S. Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 19.Canada Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 20.Canada Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 21.Canada Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 22.Mexico Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 23.Mexico Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 24.Mexico Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 25.Europe Breast Pumps Market, By Country, 2012-2022 ($Billion)

Table 26.Europe Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 27.Europe Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 28.Europe Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 29.Germany Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 30.Germany Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 31.Germany Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 32.France Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 33.France Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 34.France Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 35.UK Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 36.UK Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 37.UK Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 38.Italy Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 39.Italy Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 40.Italy Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 41.Spain Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 42.Spain Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 43.Spain Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 44.Rest of Europe Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 45.Rest of Europe Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 46.Rest of Europe Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 47.Asia-Pacific Breast Pumps Market, By Country, 2012-2022 ($Billion)

Table 48.Asia-Pacific Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 49.Asia-Pacific Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 50.Asia-Pacific Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 51.Japan Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 52.Japan Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 53.Japan Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 54.China Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 55.China Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 56.China Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 57.Australia Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 58.Australia Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 59.Australia Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 60.India Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 61.India Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 62.India Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 63.South Korea Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 64.South Korea Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 65.South Korea Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 66.Rest of Asia-Pacific Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 67.Rest of Asia-Pacific Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 68.Rest of Asia-Pacific Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 69.Rest of the World Breast Pumps Market, By Country, 2012-2022 ($Billion)

Table 70.Rest of the World Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 71.Rest of the World Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 72.Rest of the World Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 73.Brazil Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 74.Brazil Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 75.Brazil Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 76.Turkey Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 77.Turkey Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 78.Turkey Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 79.Saudi Arabia Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 80.Saudi Arabia Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 81.Saudi Arabia Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 82.South Africa Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 83.South Africa Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 84.South Africa Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 85.United Arab Emirates Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 86.United Arab Emirates Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 87.United Arab Emirates Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 88.Others Breast Pumps Market, By Product, 2012-2022 ($Billion)

Table 89.Others Breast Pumps Market, By Technology, 2012-2022 ($Billion)

Table 90.Others Breast Pumps Market, By Application, 2012-2022 ($Billion)

Table 91.Ameda AG: Key Strategic Developments, 2017-2017

Table 92.Bailey Medical: Key Strategic Developments, 2017-2017

Table 93.Hygeia Medical Group: Key Strategic Developments, 2017-2017

Table 94.Medela AG: Key Strategic Developments, 2017-2017

Table 95.Philips: Key Strategic Developments, 2017-2017

Table 96.Linco Baby Merchandise Work's Co. Ltd: Key Strategic Developments, 2017-2017

Table 97.Buettner-Frank GmbH: Key Strategic Developments, 2017-2017

Table 98.Lansinoh Laboratories: Key Strategic Developments, 2017-2017

Table 99.Albert Manufacturing USA: Key Strategic Developments, 2017-2017

Table 100.Whittlestone, Inc.: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Breast Pumps Market Share, By Product, 2017 & 2025 ($Billion)

Figure 2.Breast Pumps Market, By Technology, 2017 & 2025 ($Billion)

Figure 3.Breast Pumps Market, By Application, 2017 & 2025 ($Billion)

Figure 4.Breast Pumps Market, By Region, 2017, ($Billion)

Figure 5 Philips: Net Revenues, 2017-2017 ($Billion)

Figure 6.Philips: Net Revenue Share, By Segment, 2017

Figure 7.Philips: Net Revenue Share, By Geography, 2017

Figure 8.Medela AG: Net Revenues, 2017-2017 ($Billion)

Figure 9.Medela AG: Net Revenue Share, By Segment, 2017

Figure 10.Medela AG: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|