.png)

BRIC Telemedicine Market by Component, Application, and Delivery mode - Global Industry Analysis and Forecast to 2027

Published On : May 2022 Pages : 95 Category: Medical Devices Report Code : HC0638

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trends Analysis

The BRIC telemedicine market is expected to be around $2.7 billion by 2027. Rapid advancements in telecommunication technologies need for accessible healthcare in rural areas, and increasing predominance of chronic disorders in the BRIC nations are the key factors contributing to the market growth. Conversely, dearth of skilled resources, poor response time, high infrastructure costs, poor response by patients and doctors in rural areas, and associated privacy and security concerns related to telecommunication mediums can hamper the growth of BRIC telemedicine market during the forecast period.

Product Outlook and Trend Analysis

Services segment accounted for the largest share of the BRIC telemedicine market in 2017, due to increase in adoption of remote monitoring solutions. Technological advancements in telecommunication technologies will further assist better delivery of telemedicine services to the patients over the forecast period.

Application Outlook and Trend Analysis

Teleconsultation segment accounted for the largest market share in 2017, due to the associated benefit of eliminating the physical distance between the patient and the doctor through the telecommunication platform. Moreover, rising global geriatric population and increasing adoption of mobile monitoring solutions will further contribute to the growth of teleconsultation market.

Delivery mode Outlook and Trend Analysis

Web-based segment had the largest share of the BRIC telemedicine market in 2017, due to the presence of huge customer base and remote data accessibility. With increasing penetration of internet in emerging nations, the web-based market will experience favorable growth over the forecast period.

Regional Outlook and Trend Analysis

China held the largest share of the BRIC telemedicine market in 2017, due to increased household incomes and availability of sophisticated telemedicine products at affordable prices. Moreover, China is a lucrative market for suppliers in order to set up their manufacturing plants due to easy availability of cheap labor and favorable taxation policies. Brazil telemedicine market is expected to witness fastest growth during the forecast period as a result of rising healthcare expenditure and increased purchasing power of the people.

Competitive Analysis

Some of the major players in BRIC telemedicine market are Medisoft Telemedicine Pvt. Ltd., Philips Healthcare, Haemonetics Corp., Apollo Hospitals, AMD Global Telemedicine Inc., Cloudvisit Telemedicine, Maestros Telemedicine, GE Healthcare, Reach Health, and SnapMD Telemedicine Technology.

Market Opportunities

The future growth for BRIC telemedine market lies in technological advancements in order to design and develop enhanced telemedicine solutions to the patients. With increasing penetration of internet and telecommunication networks in these countries, the market will witness favorable growth over the forecast period.

BRIC Telemedicine Market Segmentation

By Component:

- Services

- Store-and-Forward

- Real-Time Analysis

- Remote Monitoring

- Software

- Standalone

- Integrated

- Hardware

- Telemedicine Kits

- Monitors

By Application:

- Telecardiology

- Teleradiology

- Teleconsultation

- Teledermatology

- Telepathology

- Others

By Delivery Mode:

- Web-based

- On-premise

- Cloud-based

By Region:

- Brazil

- Russia

- India

- China

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- BRIC Telemedicine Market, By Component, Estimates and Forecast, 2017-2027 ($Million)

- Services Market, By Type

- Real-Time Analysis

- Remote Monitoring

- Store-and-Forward

- Software Market, By Type

- Standalone

- Integrated

- Hardware Market, By Type

- Monitors

- Telemedicine Kits

- BRIC Telemedicine Market, By Component, Estimates and Forecast, 2017-2027 ($Million)

- Teleconsultation

- Telecardiology

- Teleradiology

- Telepathology

- Teledermatology

- Others

- BRIC Telemedicine Market, By Delivery Mode, Estimates and Forecast, 2017-2027 ($Million)

- Web-based

- Cloud-based

- On-premise

- BRIC Telemedicine Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

- Russia BRIC Telemedicine Market, By Component

- Russia BRIC Telemedicine Market, By Component

- Russia BRIC Telemedicine Market, By Component

- China BRIC Telemedicine Market, By Component

- China BRIC Telemedicine Market, By Application

- China BRIC Telemedicine Market, By Delivery mode

- India BRIC Telemedicine Market, By Component

- India BRIC Telemedicine Market, By Delivery mode

- India BRIC Telemedicine Market, By Application

- India BRIC Telemedicine Market, By Delivery mode

- Brazil BRIC Telemedicine Market, By Component

- Brazil BRIC Telemedicine Market, By Application

- Brazil BRIC Telemedicine Market, By Delivery mode

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Share Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Increasing Prevalence of Chronic Disorders

3.3.1.2. Rapid Advancements in Telecommunication Technologies

3.3.1.3. Need for Accessible Healthcare in Rural Areas

3.3.2. Restraints

3.3.2.1. Dearth of Skilled Resources

3.3.2.2. Privacy and Security Concerns Related to Telecommunication Mediums

3.3.3. Opportunities

3.3.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

3.4. Industry Trends

4. BRIC Telemedicine Market, By Component

4.1. Introduction

4.2. BRIC Telemedicine Market Assessment and Forecast, By Component, 2017-2027

4.3. Services

4.3.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3. Real-Time Analysis

4.3.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.4. Remote Monitoring

4.3.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.5. Store-and-Forward

4.3.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4. Software

4.4.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.3. Standalone

4.4.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.4. Integrated

4.4.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5. Hardware

4.5.1.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.5.1.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.2. Monitors

4.5.2.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3. Telemedicine Kits

4.5.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5. BRIC Telemedicine Market, By Application

5.1. Introduction

5.2. BRIC Telemedicine Market Assessment and Forecast, By Application, 2017-2027

5.3. Teleconsultation

5.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.4. Telecardiology

5.4.1.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million).

5.5. Teleradiology

5.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.6. Telepathology

5.6.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.7. Teledermatology

5.7.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.8. Others

6. BRIC Telemedicine Market, By Delivery Mode

6.1. Introduction

6.2. BRIC Telemedicine Market Assessment and Forecast, By Delivery Mode, 2017-2027

6.3. Web-based

6.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6.4. Cloud-based

6.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6.5. On-premise

6.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

7. BRIC Telemedicine Market, By Region

7.1. Introduction

7.2. 3D Printing Medical Device Assessment and Forecast, By Region, 2017-2027 ($Million)

7.3. Russia

7.3.1. Market Assessment and Forecast, By Component, 2017-2027 ($Million)

7.3.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

7.3.3. Market Assessment and Forecast, By Delivery Mode, 2017-2027 ($Million)

7.4. China

7.4.1. Market Assessment and Forecast, By Component, 2017-2027 ($Million)

7.4.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

7.4.3. Market Assessment and Forecast, By Delivery Mode, 2017-2027 ($Million)

7.5. India

7.5.1. Market Assessment and Forecast, By Component, 2017-2027 ($Million)

7.5.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

7.5.3. Market Assessment and Forecast, By Delivery Mode, 2017-2027 ($Million)

7.6. Brazil

7.6.1. Market Assessment and Forecast, By Component, 2017-2027 ($Million)

7.6.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

7.6.3. Market Assessment and Forecast, By Delivery Mode, 2017-2027 ($Million)

8. Company Profiles

8.1. Philips Healthcare

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Key Financials

8.1.4. Strategic Developments

8.2. Haemonetics Corp.

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Key Financials

8.2.4. Strategic Developments

8.3. Apollo Hospitals

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Key Financials

8.3.4. Strategic Developments

8.4. Maestros Telemedicine

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Key Financials

8.4.4. Strategic Developments

8.5. Amd Global Telemedicine Inc.

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Key Financials

8.5.4. Strategic Developments

8.6. Medisoft Telemedicine Pvt. Ltd.

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Key Financials

8.6.4. Strategic Developments

8.7. Cloudvisit Telemedicine

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Key Financials

8.7.4. Strategic Developments

8.8. GE Healthcare

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Key Financials

8.8.4. Strategic Developments

8.9. Reach Health

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Key Financials

8.9.4. Strategic Developments

8.10. SnapMD Telemedicine Technology

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Key Financials

8.10.4. Strategic Developments

List of Tables

Table 1.BRIC Telemedicine Market, By Component, 2017-2025 ($Million)

Table 2.Services Market, By Type, 2017-2025 ($Million)

Table 3.Services Market, By Region ($Million), 2017-2025 ($Million)

Table 4.Real-Time Analysis Market, By Region, 2017-2025 ($Million)

Table 5.Remote Monitoring Market, By Region, 2017-2025 ($Million)

Table 6.Store-and-Forward Market, By Region, 2017-2025 ($Million)

Table 7.Software Market, By Type, 2017-2025 ($Million)

Table 8.Software Market, By Region, 2017-2025 ($Million)

Table 9.Standalone Market, By Region, 2017-2025 ($Million)

Table 10.Integrated Market, By Region, 2017-2025 ($Million)

Table 11.Hardware Market, By Type, 2017-2025 ($Million)

Table 12.Hardware Market, By Region, 2017-2025 ($Million)

Table 13.Monitors Market, By Region, 2017-2025 ($Million)

Table 14.Telemedicine Kits Market, By Region, 2017-2025 ($Million)

Table 15.BRIC Telemedicine Market, By Application, 2017-2025 ($Million)

Table 16.Teleconsultation Market, By Region, 2017-2025 ($Million)

Table 17.Telecardiology Market, By Region, 2017-2025 ($Million)

Table 18.Teleradiology Market, By Region, 2017-2025 ($Million)

Table 19.Telepathology Market, By Region, 2017-2025 ($Million)

Table 20.Teledermatology Market, By Region, 2017-2025 ($Million)

Table 21.Others, By Region, 2017-2025 ($Million)

Table 22.BRIC Telemedicine Market, By Delivery Mode, 2017-2025 ($Million)

Table 23.Web-based Market, By Region, 2017-2025 ($Million)

Table 24.Cloud-based Market, By Region, 2017-2025 ($Million)

Table 25.On-premise Market, By Region, 2017-2025 ($Million)

Table 26.BRIC Telemedicine Market, By Region, 2017-2025 ($Million)

Table 27.China BRIC Telemedicine Market, By Component, 2017-2025 ($Million)

Table 28.China BRIC Telemedicine Market, By Application, 2017-2025 ($Million)

Table 29.China BRIC Telemedicine Market, By Delivery Mode, 2017-2025 ($Million)

Table 30.India BRIC Telemedicine Market, By Component, 2017-2025 ($Million)

Table 31.India BRIC Telemedicine Market, By Application, 2017-2025 ($Million)

Table 32.India BRIC Telemedicine Market, By Delivery Mode, 2017-2025 ($Million)

Table 33.Brazil BRIC Telemedicine Market, By Component, 2017-2025 ($Million)

Table 34.Brazil BRIC Telemedicine Market, By Application, 2017-2025 ($Million)

Table 35.Brazil BRIC Telemedicine Market, By Delivery Mode, 2017-2025 ($Million)

Table 36.Philips Healthcare: Key Strategic Developments, 2017-2017

Table 37.Haemonetics Corp.: Key Strategic Developments, 2017-2017

Table 38.Apollo Hospitals: Key Strategic Developments, 2017-2017

Table 39.Maestros Telemedicine: Key Strategic Developments, 2017-2017

Table 40.Amd Global Telemedicine Inc.: Key Strategic Developments, 2017-2017

Table 41.Medisoft Telemedicine Pvt. Ltd.: Key Strategic Developments, 2017-2017

Table 42.Cloudvisit Telemedicine: Key Strategic Developments, 2017-2017

Table 43.GE Healthcare: Key Strategic Developments, 2017-2017

Table 44.Reach Health: Key Strategic Developments, 2017-2017

Table 45.SnapMD Telemedicine Technology: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.BRIC Telemedicine Market Share, By Component, 2017 & 2025

Figure 2.BRIC Telemedicine Market, By Application, 2017, ($Million)

Figure 3.BRIC Telemedicine Market, By Delivery Mode, 2017, ($Million)

Figure 4.BRIC Telemedicine Market, By Region, 2017, ($Million)

Figure 5.Philips Healthcare: Net Revenues, 2017-2017 ($Million)

Figure 6.Philips Healthcare: Net Revenue Share, By Segment, 2017

Figure 7.Philips Healthcare: Net Revenue Share, By Geography, 2017

Figure 8.Haemonetics Corp: Net Revenues, 2017-2017 ($Million)

Figure 9.Haemonetics Corp: Net Revenue Share, By Segment, 2017

Figure 10.Haemonetics Corp: Net Revenue Share, By Geography, 2017

Figure 12.Apollo Hospitals: Net Revenues, 2017-2017 ($Million)

Figure 13.Apollo Hospitals: Net Revenue Share, By Segment, 2017

Figure 14.Apollo Hospitals: Net Revenue Share, By Geography, 2017

Figure 15.Maestros Telemedicine: Net Revenues, 2017-2017 ($Million)

Figure 16.Maestros Telemedicine: Net Revenue Share, By Segment, 2017

Figure 17.Maestros Telemedicine: Net Revenue Share, By Geography, 2017

Figure 18.Amd Global Telemedicine Inc.: Net Revenues, 2017-2017 ($Million)

Figure 19.Amd Global Telemedicine Inc.: Net Revenue Share, By Segment, 2017

Figure 20.Amd Global Telemedicine Inc.: Net Revenue Share, By Geography, 2017

Figure 21.Medisoft Telemedicine Pvt. Ltd.: Net Revenues, 2017-2017 ($Million)

Figure 22.Medisoft Telemedicine Pvt. Ltd.: Net Revenue Share, By Segment, 2017

Figure 23.Medisoft Telemedicine Pvt. Ltd.: Net Revenue Share, By Geography, 2017

Figure 24.Cloudvisit Telemedicine: Net Revenues, 2017-2017 ($Million)

Figure 25.Cloudvisit Telemedicine: Net Revenue Share, By Segment, 2017

Figure 26.Cloudvisit Telemedicine: Net Revenue Share, By Geography, 2017

Figure 27.GE Healthcare: Net Revenues, 2017-2017 ($Million)

Figure 28.GE Healthcare: Net Revenue Share, By Segment, 2017

Figure 29.GE Healthcare: Net Revenue Share, By Geography, 2017

Figure 30.Reach Health: Net Revenues, 2017-2017 ($Million)

Figure 31.Reach Health: Net Revenue Share, By Segment, 2017

Figure 32.Reach Health: Net Revenue Share, By Geography, 2017

Figure 33.SnapMD Telemedicine Technology: Net Revenues, 2017-2017 ($Million)

Figure 34.SnapMD Telemedicine Technology: Net Revenue Share, By Segment, 2017

Figure 35.SnapMD Telemedicine Technology: Net Revenue Share, By Geography, 2017

Research Methodology

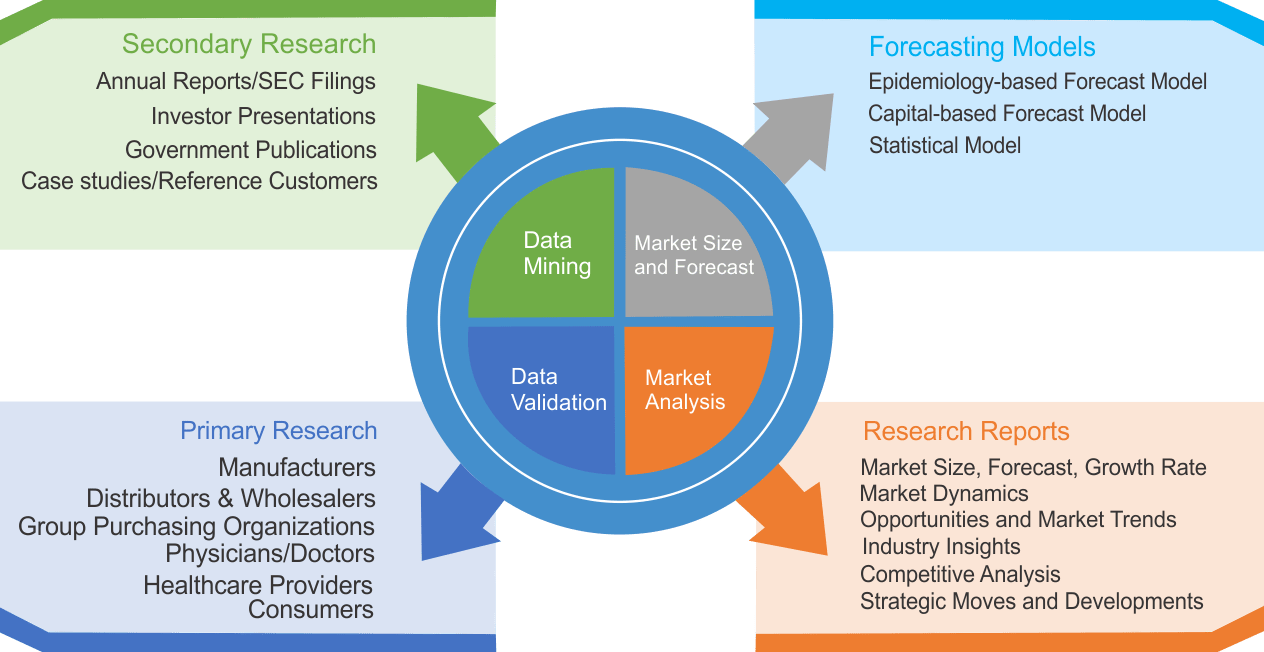

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|