.png)

Butane Market by Product, Technology, and Application - Global Industry Analysis and Forecast to 2027

Published On : September 2017 Pages : 95 Category: Petrochemicals Report Code : CM09209

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global butane market was worth USD billion in the year of 2017 and is projected to touch nearly USD billion by 2027, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The market industry is anticipated to witness substantial growth with decent compound annual growth rate during the forecast period due to increasing use of liquid petroleum gas (LPG) for a variety of applications. It is likely to have a positive prospect over the approaching years. Butane is employed in fuel manufacturing procedures, owing to its characteristics like easily liquefiable and high flammability. The market demand of LPG is growing, as its adoption as household fuel, chiefly in Asia Pacific and Africa, is expected to fuel butane market. In many countries, the government is offering subsidy on LPG rates to encourage its use as domestic fuel. The government is encouraging its utilization in order to trim down coal need and limit carbon footprints. As compared to coal combustion, the CO2 emission with LPG is reduced by almost 33 percent which makes it a proficient alternative for traditional fossil fuels. LPG has extensive range of use over numerous sectors like residential, commercial, agriculture and automobile. Increasing use of autogas due to its cost and functional benefits as compared to oil based fuels. The utilization has been speedily increasing from the previous few years, primarily owing to its ecological benefits and other properties like high energy content and the fact that it burns easily. Governments of nations like Australia and Algeria are encouraging the local public to make use of autogas vehicles. The government of Indonesia had established a program for paraffin-to-LPG conversion to encourage its use, and allotted a stove and 3 kilo refillable cylinder for LPG. In South Africa, knowledge and promotion of the product is not implemented yet, particularly in rural areas, the whole focus is on LPG promotion now. In India, government has taken initiatives such as Rajiv Gandhi Gramin LPG Vitaran program, this facilitates the distribution of LPG at low cost in the rural areas of India.

Application Outlook and Trend Analysis

The LPG section has major share in 2017 and its requirement was 92.12 million tons. Growing applications for LPG in commercial and residential sectors for heating and cooking purposes is anticipated to promote the market growth during the forecast period. Butane as well as its isomers is employed for gasoline mixing in plants to oxygenate and to amend its octane rating. Iso-butane is likely to substitute the conventional hazardous chlorofluorocarbons (CFC) which were earlier used as deodorants, propellants, and refrigerants. The fuel gas use in fuel refineries amends the combustible characteristics of the fuel and is hence projected to drive the development from 2017 to 2027. Petrochemical sector is projected to be the quickest growing market during the forecast period. Rising disposable earnings and increasing standard of living is projected to boost the growth during the forecast period. Increasing incidences of human health risks due to breathing-in butane gas has positioned the market under numerous regulations and supply norms. These standard and regulation acts are likely to regulate negatively during the upcoming years.

Regional Outlook and Trend Analysis

Asia Pacific conquered the regional sector due to the rise in the gas requirement in chemical processing units and refineries in China. Asia Pacific region was estimated around USD billion in 2017. Growth of numerous end-use industries like infrastructure and automotive in Asia Pacific and Latin America is predicted to drive the market. Encouraging government regulations like subsidies and several connections for LPG are the key factors which led to the rise in LPG demand and subsequently butane demand in these regions. Middle East is the key regional manufacturer of butane, as the natural resources of petroleum and oil are present there. North America is also likely to have an optimistic outlook for growth via its petrochemicals and auto fuel industry. Speedy development of sedimentary rock gas in the United States is anticipated to preserve the sustainable supply of natural gas liquids and will ultimately promote the market growth over the coming years.

Competitive Insights

The market is a monopoly and is likely to move towards integration. Key players race against one another based on overall profitability and services. As the market is consisted of many players and is capital concentrated, there are quite high hurdles for entry in this market. Some companies have been implicated R&D for formulating bio-based option in order to produce niche applications. A new market player has to bring any innovation in terms of product improvement or alternate products with extra applications to enroll into this market and carry on the existing competition. Major players operating in this market industry involves ConocoPhillips Inc., British Petroleum (BP), Exxon Mobil Corporation and Chevron Corporation. Few other companies that are having major operations in butane market are; China Petroleum and Chemical Corporation (SINOPEC), Royal Dutch Shell PLC., China National Petroleum Corporation (CNPC), Total S.A., Linde, Air Liquide and Praxair.

The butane market is segmented as follows -

By Application

- Petrochemicals

- Liquefied Petroleum Gas (LPG)

- Chemical/ Petrochemical

- Residential/ Commercial

- Auto fuel

- Industrial

- Refinery

- Others

- Refinery

- Other

By Regions

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Butane Market, By Application, Estimates and Forecast, 2017-2027 ($Million)

- Petrochemicals

- Liquefied Petroleum Gas (LPG)

- Chemical/ Petrochemical

- Residential/ Commercial

- Auto fuel

- Industrial

- Refinery

- Other Liquefied Petroleum Gas (LPG)

- Refinery

- Other Applications

- Butane Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

- North America

- North America Butane Market, By Country

- North America Butane Market, By Application

- U.S. Butane Market, By Application

- Canada Butane Market, By Application

- Mexico Butane Market, By Application

-

- Europe

- Europe Butane Market, By Country

- Europe Butane Market, By Application

- Germany Butane Market, By Application

- France Butane Market, By Application

- UK Butane Market, By Application

- Italy Butane Market, By Application

- Spain Butane Market, By Application

- Rest of Europe Butane Market, By Application

-

- Asia-Pacific

- Asia-Pacific Butane Market, By Country

- Asia-Pacific Butane Market, By Application

- Japan Butane Market, By Application

- Australia Butane Market, By Application

- India Butane Market, By Application

- South Korea Butane Market, By Application

- Rest of Asia-Pacific Butane Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Butane Market, By Country

- Rest of the World Butane Market, By Application

- Brazil Butane Market, By Application

- South Africa Butane Market, By Application

- Saudi Arabia Butane Market, By Application

- Turkey Butane Market, By Application

- United Arab Emirates Butane Market, By Application

- Others Butane Market, By Application

- Rest of the World

Table of Contents

1.Introduction

1.1.Report Description

1.2.Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2.Executive Summary

2.1.Key Highlights

3.Market Overview

3.1.Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2.Market Share Analysis

3.3.Market Dynamics

3.3.1. Drivers

3.3.1.1.Growth of global autogas vehicle industry

3.3.1.2.Increasing penetration of LPG as a domestic fuel in emerging markets

3.3.1.3.Fast petrochemicals volume expansion in the Middle East countries

3.3.2. Restraints

3.3.2.1.Volatility of raw material prices

3.3.2.2.Increasing demand for substitute products for gasoline blending

3.3.3. Opportunities

3.3.3.1.Rapid increment of autogas in automobile industry

3.4.Industry Trends

4.Butane Market, By Application

4.1.Introduction

4.2.Butane Market Assessment and Forecast, By Application, 2017-2027

4.3.Petrochemicals

4.3.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.Liquefied Petroleum Gas (LPG)

4.4.1.1.Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.4.1.2.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.3.Chemical/ Petrochemical

4.4.1.3.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.4.Residential/ Commercial

4.4.1.4.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.5.Auto fuel

4.4.1.5.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.6.Industrial

4.4.1.6.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.7.Refinery

4.4.1.7.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.1.8.Other Liquefied Petroleum Gas (LPG)

4.4.1.8.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.2. Refinery

4.4.2.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.3. Other Application

4.4.3.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.Butane Market, By Region

5.1.Introduction

5.2.Butane Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.3.North America

5.3.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.3.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.1.U.S.

5.3.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.2.Canada

5.3.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.3.2.3.Mexico

5.3.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.Europe

5.4.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.4.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.1.Germany

5.4.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.2.France

5.4.2.2.1.Market Assessment and Forecast, By Type, 2017-2027 ($Million)

5.4.2.3.UK

5.4.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.4.Italy

5.4.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.5.Spain

5.4.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.6.Russia

5.4.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.4.2.7.Rest of Europe

5.4.2.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.5.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.1.Japan

5.5.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.2.China

5.5.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.3.Australia

5.5.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.4.India

5.5.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.5.South Korea

5.5.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.6.Taiwan

5.5.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.5.2.7.Rest of Asia-Pacific

5.5.2.7.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

5.6.2. Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.1.Brazil

5.6.2.1.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.2.Turkey

5.6.2.2.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.3.Saudi Arabia

5.6.2.3.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.4.South Africa

5.6.2.4.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.5.United Arab Emirates

5.6.2.5.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

5.6.2.6.Others

5.6.2.6.1.Market Assessment and Forecast, By Application, 2017-2027 ($Million)

6.Company Profiles

6.1.BP p.l.c.

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2.China National Petroleum Corporation (CNPC)

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3.Chevron Corporation

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4.Valero Marketing and Supply Company

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5.DEVON ENERGY CORPORATION

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Key Financials

6.5.4. Strategic Developments

6.6.ConocoPhillips Company

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Key Financials

6.6.4. Strategic Developments

6.7. Exxon Mobil Corporation

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Key Financials

6.7.4. Strategic Developments

6.8.Perenco

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9.Royal Dutch Shell plc

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Key Financials

6.9.4. Strategic Developments

6.10.Sinopec Group

6.10.1.Business Overview

6.10.2.Product Portfolio

6.10.3.Key Financials

6.10.4.Strategic Developments

6.11.Linde AG

6.11.1.Business Overview

6.11.2.Product Portfolio

6.11.3.Key Financials

6.11.4.Strategic Developments

6.12.Proton Gases India Pvt. Ltd.

6.12.1.Business Overview

6.12.2.Product Portfolio

6.12.3.Strategic Developments

6.13.Total S.A

6.13.1.Business Overview

6.13.2.Product Portfolio

6.13.3.Key Financials

6.13.4.Strategic Developments

6.14.Air Liquide

6.14.1.Business Overview

6.14.2.Product Portfolio

6.14.3.Strategic Developments

6.15.Praxair

6.15.1.Business Overview

6.15.2.Product Portfolio

6.15.3.Key Financials

6.15.4.Strategic Developments

List of Tables

Table 1.Butane Market, By Application ($Million), 2017-2025

Table 2.Petrochemicals Market, By Region ($Million), 2017-2025

Table 3.Liquefied Petroleum Gas (LPG) Market, By Region ($Million), 2017-2025

Table 4.Chemical/ Petrochemical Market, By Region ($Million), 2017-2025

Table 5.Residential/ Commercial Market, By Region ($Million), 2017-2025

Table 6.Auto fuel Market, By Region ($Million), 2017-2025

Table 7.Industrial Market, By Region ($Million), 2017-2025

Table 8.Refinery Market, By Region ($Million), 2017-2025

Table 9.Other Liquefied Petroleum Gas (LPG) Market, By Region ($Million), 2017-2025

Table 10.Refinery Market, By Region ($Million), 2017-2025

Table 11.Other Application Market, By Region ($Million), 2017-2025

Table 12.North America Butane Market, By Application, 2017-2025 ($Million)

Table 13.U.S. Butane Market, By Application, 2017-2025 ($Million)

Table 14.Canada Butane Market, By Application, 2017-2025 ($Million)

Table 15.Mexico Butane Market, By Application, 2017-2025 ($Million)

Table 16.Europe Butane Market, By Country, 2017-2025 ($Million)

Table 17.Europe Butane Market, By Application, 2017-2025 ($Million)

Table 18.Germany Butane Market, By Application, 2017-2025 ($Million)

Table 19.France Butane Market, By Application, 2017-2025 ($Million)

Table 20.UK Butane Market, By Application, 2017-2025 ($Million)

Table 21.Italy Butane Market, By Application, 2017-2025 ($Million)

Table 22.Spain Butane Market, By Application, 2017-2025 ($Million)

Table 23.Russia Butane Market, By Application, 2017-2025 ($Million)

Table 24.Rest of Europe Butane Market, By Application, 2017-2025 ($Million)

Table 25.Asia-Pacific Butane Market, By Country, 2017-2025 ($Million)

Table 26.Asia-Pacific Butane Market, By Application, 2017-2025 ($Million)

Table 27.Japan Butane Market, By Application, 2017-2025 ($Million)

Table 28.China Butane Market, By Application, 2017-2025 ($Million)

Table 29.Australia Butane Market, By Application, 2017-2025 ($Million)

Table 30.India Butane Market, By Application, 2017-2025 ($Million)

Table 31.South Korea Butane Market, By Application, 2017-2025 ($Million)

Table 32.Taiwan Butane Market, By Application, 2017-2025 ($Million)

Table 33.Rest of Asia-Pacific Butane Market, By Application, 2017-2025 ($Million)

Table 34.Rest of the World Butane Market, By Country, 2017-2025 ($Million)

Table 35.Rest of the World Butane Market, By Application, 2017-2025 ($Million)

Table 36.Brazil Butane Market, By Application, 2017-2025 ($Million)

Table 37.Turkey Butane Market, By Application, 2017-2025 ($Million)

Table 38.Saudi Arabia Butane Market, By Application, 2017-2025 ($Million)

Table 39.South Africa Butane Market, By Application, 2017-2025 ($Million)

Table 40.United Arab Emirates Butane Market, By Application, 2017-2025 ($Million)

Table 41.Others Butane Market, By Application, 2017-2025 ($Million)

Table 42.BP p.l.c.: Key Strategic Developments, 2017-2017

Table 43.China National Petroleum Corporation (CNPC): Key Strategic Developments, 2017-2017

Table 44.Chevron Corporation: Key Strategic Developments, 2017-2017

Table 45.Valero Marketing and Supply Company: Key Strategic Developments, 2017-2017

Table 46.DEVON ENERGY CORPORATION: Key Strategic Developments, 2017-2017

Table 47.ConocoPhillips Company: Key Strategic Developments, 2017-2017

Table 48.Exxon Mobil Corporation: Key Strategic Developments, 2017-2017

Table 49.Perenco: Key Strategic Developments, 2017-2017

Table 50.Royal Dutch Shell plc: Key Strategic Developments, 2017-2017

Table 51.Sinopec Group: Key Strategic Developments, 2017-2017

Table 52.Linde AG: Key Strategic Developments, 2017-2017

Table 53.Proton Gases India Pvt. Ltd.: Key Strategic Developments, 2017-2017

Table 54.Total S.A: Key Strategic Developments, 2017-2017

Table 55.Air Liquide: Key Strategic Developments, 2017-2017

Table 56.Praxair: Key Strategic Developments, 2017-2017

List of Figures

Figure 2.Butane Market, By Application, 2017 & 2025 ($Million)

Figure 4.Butane Market, By Region, 2017, ($Million)

Figure 5.BP p.l.c.: Net Revenues, 2017-2017 ($Million)

Figure 6.BP p.l.c.: Net Revenue Share, By Segment, 2017

Figure 7.BP p.l.c.: Net Revenue Share, By Geography, 2017

Figure 8.China National Petroleum Corporation (CNPC): Net Revenues, 2017-2017 ($Million)

Figure 9.China National Petroleum Corporation (CNPC): Net Revenue Share, By Segment, 2017

Figure 10.China National Petroleum Corporation (CNPC): Net Revenue Share, By Geography, 2017

Figure 11.Chevron Corporation: Net Revenues, 2017-2017 ($Million)

Figure 12.Chevron Corporation: Net Revenue Share, By Segment, 2017

Figure 13.Chevron Corporation: Net Revenue Share, By Geography, 2017

Figure 14.Valero Marketing and Supply Company: Net Revenues, 2017-2017 ($Million)

Figure 15.Valero Marketing and Supply Company: Net Revenue Share, By Segment, 2017

Figure 16.Valero Marketing and Supply Company: Net Revenue Share, By Geography, 2017

Figure 17.DEVON ENERGY CORPORATION: Net Revenues, 2017-2017 ($Million)

Figure 18.DEVON ENERGY CORPORATION: Net Revenue Share, By Segment, 2017

Figure 19.DEVON ENERGY CORPORATION: Net Revenue Share, By Geography, 2017

Figure 20.ConocoPhillips Company: Net Revenues, 2017-2017 ($Million)

Figure 21.ConocoPhillips Company: Net Revenue Share, By Segment, 2017

Figure 22.ConocoPhillips Company: Net Revenue Share, By Geography, 2017

Figure 23.Exxon Mobil Corporation: Net Revenues, 2017-2017 ($Million)

Figure 24.Exxon Mobil Corporation: Net Revenue Share, By Segment, 2017

Figure 25.Exxon Mobil Corporation: Net Revenue Share, By Geography, 2017

Figure 26.Perenco: Net Revenues, 2017-2017 ($Million)

Figure 27.Perenco: Net Revenue Share, By Segment, 2017

Figure 28.Perenco: Net Revenue Share, By Geography, 2017

Figure 29.Royal Dutch Shell plc: Net Revenues, 2017-2017 ($Million)

Figure 30.Royal Dutch Shell plc: Net Revenue Share, By Segment, 2017

Figure 31.Royal Dutch Shell plc: Net Revenue Share, By Geography, 2017

Figure 32.Sinopec Group: Net Revenues, 2017-2017 ($Million)

Figure 33.Sinopec Group: Net Revenue Share, By Segment, 2017

Figure 34.Sinopec Group: Net Revenue Share, By Geography, 2017

Figure 35.Linde AG: Net Revenues, 2017-2017 ($Million)

Figure 36.Linde AG: Net Revenue Share, By Segment, 2017

Figure 37.Linde AG: Net Revenue Share, By Geography, 2017

Figure 38.Total S.A: Net Revenues, 2017-2017 ($Million)

Figure 39.Total S.A: Net Revenue Share, By Segment, 2017

Figure 40.Total S.A: Net Revenue Share, By Geography, 2017

Figure 41.Praxair: Net Revenues, 2017-2017 ($Million)

Figure 42.Praxair: Net Revenue Share, By Segment, 2017

Figure 43.Praxair: Net Revenue Share, By Geography, 2017

Research Methodology

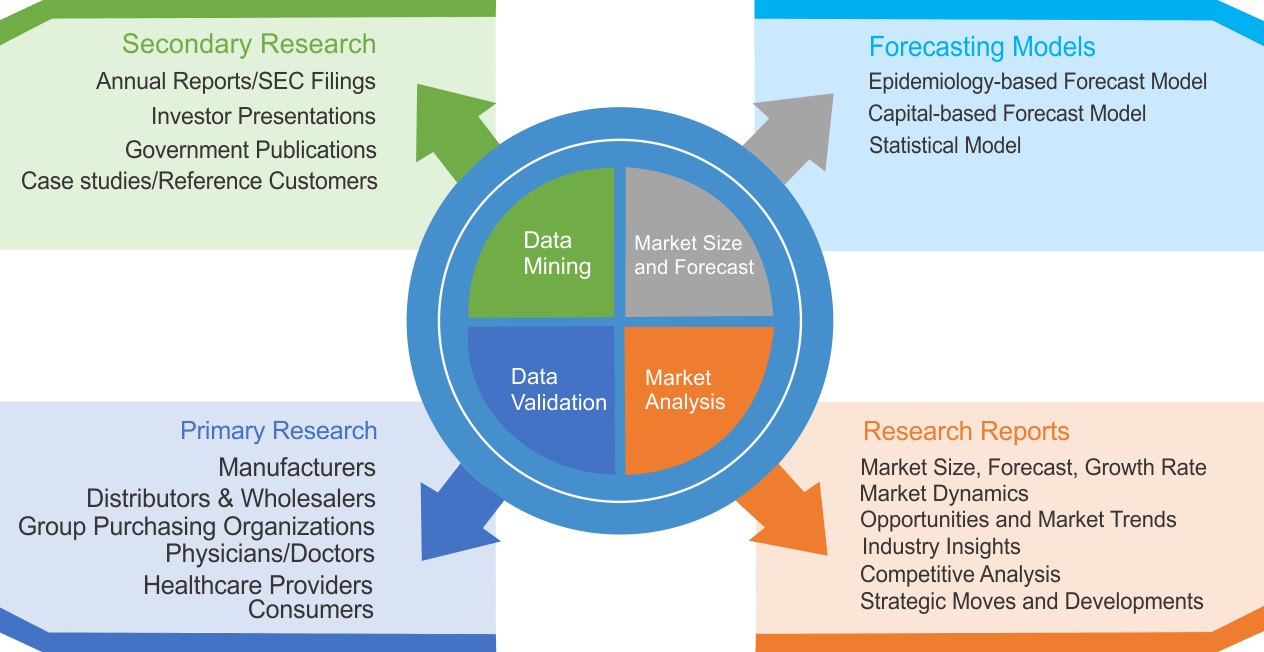

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|