.png)

Ceramic Filters Market, By Product and Application - Global Industry Analysis and Forecast to 2027

Published On : October 2017 Pages : 110 Category: Advanced Materials Report Code : CM10281

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

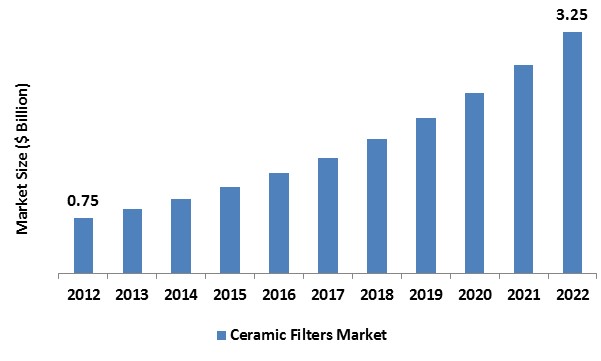

The Ceramic Filters Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Administrative bodies, in coalition with different establishments working towards environmental maintainability, conduct researches and set the rules that are relied upon to catalyze development. Environmental protection Agency (EPA), as a team with National Science Foundation (NSF), has set up directions and models to oversee the drinking water filtration framework, making the use of proficient filters obligatory in all private and business areas. Such factors affect the worldwide ceramic filters market and will help a sound development in the following few years. Rising government activities and standards by administrative bodies including the EPA, REACH, NSF, Energy and Environmental Affairs (EEA), European Environment Agency, and so on, relating to industrial and residential filtration of waste water and air will be the main boosting factor for the development of worldwide ceramic filters market in the gauge time frame. These rules urge item utilization to adhere to the required emanation and sewage standards. Application for sewage water and slurry assist in managing the biological oxygen request (BOD) of the waste water before transfer in natural water bodies. They additionally clear the outflow of any destructive poisons before being released into the environment. Worldwide demand is projected to rise considerably in the upcoming years because of declining climatic conditions and developing awareness regarding the environment. For example, Clean Air Act, ordered by the EPA, lays out the directions to shield people from disclosure to poisonous gasses. Outstanding mechanical and physical features of ceramic filters in correlation with polymer filters will likewise be an imperative driving element for worldwide ceramic filters market in the following years. Ceramic filters, being latent to most chemicals, are impervious to any corrosion caused by lethal chemicals. Polymeric materials witness the issue of natural fouling because of unfavorable responses with specific chemicals including diverse fats, grease, and oils. Higher productivity, inferable from better cleaning ability will require lesser number of channels to clean a similar volume of liquid. Operation costs are accordingly lessened impressively by utilizing ceramic filters. Nonetheless, manufacturing is extremely capital escalated in view of conflicting supply and costs of unpredictable raw materials including aluminum oxide, zirconium oxide, and titanium oxide. This factor may influence the item value patterns and hamper the worldwide ceramic filters market development.

Product Outlook and Trend Analysis

In 2017, the revenue generated by the water filters segment was much less than USD million, whereas ceramic air filters generated more than USD million exclusively in that same year. Numerous guidelines and mandates which are issued by the regulatory authorities for sewage disposal and air and water treatment propel the practice of eco-friendly methods in order to save water and the quality of air. Nevertheless, ceramic air filters market will garner lucrative growth by the end of 2022 owing to ascending carbon emissions and regulatory pressure on commercial and industrial sector to curb toxic emissions, will encourage the product demand in the projected years.

Application Outlook and Trend Analysis

Key applications of this market industry are commercial, residential and industrial. Of which, residential applications have led the market by accounting to more than % if the ceramic filters market on a global level, with several regulatory attempts to render safe and clean drinking water projected to assist the need in the next few years. Increasing demand in African countries owing to economic development of the region might be advantageous to the worldwide market. Industrial ceramic filters market is anticipated to experience fastest growth during the forecast period, along with ascending industrialization in emerging markets. This segment is further classified into fluid, (water or oil) filtration, hot gas filtration, bio filtration and many others. Several research and development initiatives and technological inventions are predicted to lucratively effect the market. Industrial applications in emerging countries like India, China, Brazil and Southeast Asia was considerable in the recent years and is predicted to have a lucrative effect in the particular regional market of ceramic filters.

Regional Outlook and Trend Analysis

North America and Europe are predicted to drop market share to other regions owing to inundated saturation and well-developed economy. Nonetheless, strict regulatory standards will still lucratively impact the regional growth. India and China from the Asia Pacific regions dominated the market and held maximum share with more than the third of the global market of this industry. Shift of industrial developments on a global level towards this region will propel the regional market further. Presence of large scale industries in China and stringent norms pertaining to the environment is expected to back the growth of the market in the coming years. Middle East & Africa (MEA) ceramic filters market is predicted to be highly influenced by the petrochemical industries in the gulf countries along with the development related to the economics and rising awareness regarding hygiene and safe drinking water in many African countries.

Competitive Insights

The competitive landscape of the global ceramic filters market comprises of manufactures like Unifrax, Pall Corporation, 3M, Doulton, Tri-Mer Corporation, Glosfume, Haldor Topsøe, Anguil Environmental Systems and Clear Edge Filtration India Pvt Ltd. Organizations frequently show critical measure of forward and backward reconciliation in the item esteem chain. Glosfume Ltd., for example, have a production base for ceramics and other soluble components to be utilized to fabricate the filters. They, in any case, depend on a successful dissemination channel to supply their final results in the market.

The global ceramic filter market is segmented as follows -

By Product:

- Ceramic Air Filter

- Ceramic Water Filter

By Application:

- Residential

- Commercial

- Industrial

- Bio Filtration

- Oil/Water Separation

- Hot Gas Filtration

- Other Applications

By Region:

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- Turkey

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Ceramic Filters Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Ceramic Air Filters

- Ceramic Water Filters

- Ceramic Filters Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Residential Applications

- Commercial Applications

- Industrial Applications

- Bio Filtration

- Oil/Water Separation

- Hot Gas Filtration

- Other Applications

- Ceramic Filters Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Ceramic Filters Market, By Country

- North America Ceramic Filters Market, By Product

- North America Ceramic Filters Market, By Application

- U.S. Ceramic Filters Market, By Product

- U.S. Ceramic Filters Market, By Application

- Canada Ceramic Filters Market, By Product

- Canada Ceramic Filters Market, By Application

- Mexico Ceramic Filters Market, By Product

- Mexico Ceramic Filters Market, By Application

-

- Europe

- Europe Ceramic Filters Market, By Country

- Europe Ceramic Filters Market, By Product

- Europe Ceramic Filters Market, By Application

- Germany Ceramic Filters Market, By Product

- Germany Ceramic Filters Market, By Application

- France Ceramic Filters Market, By Product

- France Ceramic Filters Market, By Application

- UK Ceramic Filters Market, By Product

- UK Ceramic Filters Market, By Application

- Italy Ceramic Filters Market, By Product

- Italy Ceramic Filters Market, By Application

- Spain Ceramic Filters Market, By Product

- Spain Ceramic Filters Market, By Application

- Rest of Europe Ceramic Filters Market, By Product

- Rest of Europe Ceramic Filters Market, By Application

-

- Asia-Pacific

- Asia-Pacific Ceramic Filters Market, By Country

- Asia-Pacific Ceramic Filters Market, By Product

- Asia-Pacific Ceramic Filters Market, By Application

- Japan Ceramic Filters Market, By Product

- Japan Ceramic Filters Market, By Application

- Australia Ceramic Filters Market, By Product

- Australia Ceramic Filters Market, By Application

- India Ceramic Filters Market, By Product

- India Ceramic Filters Market, By Application

- South Korea Ceramic Filters Market, By Product

- South Korea Ceramic Filters Market, By Application

- Rest of Asia-Pacific Ceramic Filters Market, By Product

- Rest of Asia-Pacific Ceramic Filters Market, By Application

-

- Rest of the World

- Rest of the World Ceramic Filters Market, By Country

- Rest of the World Ceramic Filters Market, By Product

- Rest of the World Ceramic Filters Market, By Application

- Brazil Ceramic Filters Market, By Product

- Brazil Ceramic Filters Market, By Application

- South Africa Ceramic Filters Market, By Product

- South Africa Ceramic Filters Market, By Application

- Saudi Arabia Ceramic Filters Market, By Product

- Saudi Arabia Ceramic Filters Market, By Application

- Turkey Ceramic Filters Market, By Product

- Turkey Ceramic Filters Market, By Application

- United Arab Emirates Ceramic Filters Market, By Product

- United Arab Emirates Ceramic Filters Market, By Application

- Others Ceramic Filters Market, By Product

- Others Ceramic Filters Market, By Application

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Share Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Advanced Properties as Compared to Polymeric Materials

3.3.1.2. Favorable Regulatory Policies

3.3.2. Restraints

3.3.2.1. High Capital Expenditure

3.3.3. Opportunities

4. Ceramic Filters Market, By Product

4.1. Introduction

4.2. Ceramic Filters Market Assessment and Forecast, By Product, 2012-2022

4.3. Fully Ceramic Filters

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Semi-Ceramic Filters

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Ceramic Filters Market, By Application

5.1. Introduction

5.2. The Ceramic Filters Market Assessment and Forecast, By Application, 2012-2022

5.3. Residential Applications

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Commercial Applications

5.4.1.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Industrial Applications

5.5.1.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

5.5.1.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5.1.3. Bio Filtration

5.5.1.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5.1.4. Oil/Water Separation

5.5.1.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5.1.5. Hot Gas Filtration

5.5.1.6. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.6. Other Applications

5.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Ceramic Filters Market, By Region

6.1. Introduction

6.2. Ceramic Filters Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.3. North America

6.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.3.4. U.S.

6.3.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.3.5. Canada

6.3.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.3.6. Mexico

6.3.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4. Europe

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.4. Germany

6.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.5. France

6.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.6. UK

6.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.7. Italy

6.4.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.8. Spain

6.4.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.9. Rest of Europe

6.4.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5. Asia-Pacific

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.4. Japan

6.5.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.5. China

6.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.6. Australia

6.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.7. India

6.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.8. South Korea

6.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.9. Rest of Asia-Pacific

6.5.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6. Rest of the World

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.4. Brazil

6.6.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.5. Turkey

6.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.6. Saudi Arabia

6.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.7. South Africa

6.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.8. United Arab Emirates

6.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.9. Others

6.6.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7. Company Profiles

7.1. Unifrax I LLC

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. Haldor Topsoe A/S

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. Doulton Ceramics

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.4. 3M Company

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. Glosfume Ltd.

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. Aquacera

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. KLT Filtration

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

7.8. Ceramic Filters Company, Inc.

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9. Anguil Environmental Systems Inc.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.10. Global Water Ceramic Filter Manufacture Corporation

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.11. Tri-Mer Corporation

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

7.12. Pall Corporation

7.12.1. Business Overview

7.12.2. Product Portfolio

7.12.3. Strategic Developments

7.13. Corning Inc.

7.13.1. Business Overview

7.13.2. Product Portfolio

7.13.3. Strategic Developments

List of Tables

Table 1.Global Ceramic Filters Market, By Product ($Million), 2012-2022

Table 2.Ceramic Air Filters Market, By Region ($Million), 2012-2022

Table 3.Ceramic Water Filters Market, By Region ($Million), 2012-2022

Table 4.Global Ceramic Filters Market, By Application ($Million), 2012-2022

Table 5.Residential Applications Market, By Region ($Million), 2012-2022

Table 6.Commercial Applications Market, By Region ($Million), 2012-2022

Table 7.Industrial Applications Market, By Type ($Million), 2012-2022

Table 8.Industrial Applications Market, By Region ($Million), 2012-2022

Table 9.Bio Filtration Market, By Region ($Million), 2012-2022

Table 10.Oil/Water Separation Market, By Region ($Million), 2012-2022

Table 11.Hot Gas Filtration Market, By Region ($Million), 2012-2022

Table 12.Other Applications Market, By Region ($Million), 2012-2022

Table 13.Ceramic Filters Market, By Region ($Million), 2012-2022

Table14.North America Ceramic Filters Market, By Country, 2012-2022 ($Million)

Table15.North America Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 16.North America Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 17.U.S. Ceramic Filters Market, by Product, 2012-2022 ($Million)

Table 18.U.S. Ceramic Filters Market, by Application, 2012-2022 ($Million)

Table 19.Canada Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 20.Canada Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 21.Mexico Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 22.Mexico Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 23.Europe Ceramic Filters Market, By Country, 2012-2022 ($Million)

Table 24.Europe Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 25.Europe Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 26.Germany Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 27.Germany Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 28.France Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 29.France Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 30.UK Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 31.UK Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 32.Italy Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 31.Italy Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 32.Spain Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 33.Spain Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 34.Russia Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 35.Russia Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 36.Rest of Europe Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 37.Rest of Europe Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 38.Asia-Pacific Ceramic Filters Market, By Country, 2012-2022 ($Million)

Table 39.Asia-Pacific Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 40.Asia-Pacific Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 41.Japan Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 42.Japan Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 43.China Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 44.China Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 45.Australia Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 46.Australia Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 47.India Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 48.India Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 49.South Korea Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 50.South Korea Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 51.Taiwan Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 52.Taiwan Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 53.Rest of Asia-Pacific Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 54.Rest of Asia-Pacific Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 55.Rest of the World Ceramic Filters Market, By Country, 2012-2022 ($Million)

Table 56.Rest of the World Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 57.Rest of the World Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 58.Brazil Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 59.Brazil Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 60.Turkey Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 61.Turkey Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 62.Saudi Arabia Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 63.Saudi Arabia Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 64.South Africa Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 65.South Africa Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 66.United Arab Emirates Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 67.United Arab Emirates Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 68.Others Ceramic Filters Market, By Product, 2012-2022 ($Million)

Table 71.Others Ceramic Filters Market, By Application, 2012-2022 ($Million)

Table 72.Unifrax I LLC: Key Strategic Developments, 2017-2017

Table 73.Haldor Topsoe A/S: Key Strategic Developments, 2017-2017

Table 74.Doulton Ceramics: Key Strategic Developments, 2017-2017

Table 75.Asahi Kasei Corporation: Key Strategic Developments, 2017-2017

Table 76.Glosfume Ltd.: Key Strategic Developments, 2017-2017

Table 77.Aquacera: Key Strategic Developments, 2017-2017

Table 78.KLT Filtration: Key Strategic Developments, 2017-2017

Table 79.Ceramic Filters Company, Inc.: Key Strategic Developments, 2017-2017

Table 80.Anguil Environmental Systems Inc.: Key Strategic Developments, 2017-2017

Table 81.Global Water Ceramic Filter Manufacture Corporation: Key Strategic Developments, 2017-2017

Table 82.Tri-Mer Corporation: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Ceramic Filters Market Share, By Product, 2012 & 2022

Figure 2.Ceramic Filters Market, By Application, 2012 & 2022, ($Million)

Figure 3.Ceramic Filters Market, By Region, 2012 & 2022, ($Million)

Figure 4.Unifrax I LLC: Net Revenues, 2017-2017 ($Million)

Figure 5.Unifrax I LLC: Net Revenue Share, By Segment, 2017

Figure 6.Unifrax I LLC: Net Revenue Share, By Geography, 2017

Figure 7.Haldor Topsoe A/S: Net Revenues, 2017-2017 ($Million)

Figure 8.Haldor Topsoe A/S: Net Revenue Share, By Segment, 2017

Figure 9.Haldor Topsoe A/S: Net Revenue Share, By Geography, 2017

Figure 10.3M Company: Net Revenues, 2017-2017 ($Million)

Figure 11.3M Company: Net Revenue Share, By Segment, 2017

Figure 12.3M Company: Net Revenue Share, By Geography, 2017

Figure 13.Corning Inc.: Net Revenues, 2017-2017 ($Million)

Figure 14.Corning Inc.: Net Revenue Share, By Segment, 2017

Figure 15.Corning Inc.: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|