.png)

Compressed Air Treatment Equipment Market by Product, Application and End User - Global Industry Analysis and Forecast to 2022

Published On : October 2017 Pages : 130 Category: Medical Devices Report Code : HC10287

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

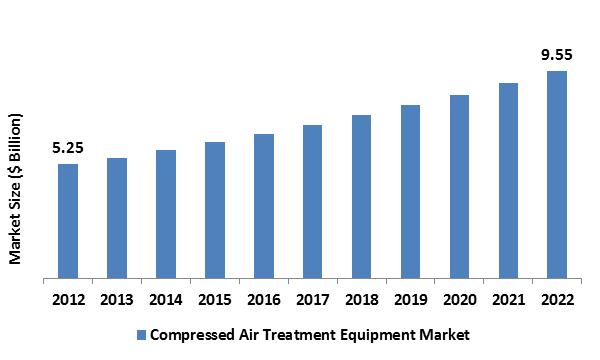

The global Compressed Air Treatment Equipment Market was around USD billion in the year of 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The increasing utilization of compressed air together with the improvement of sophisticated and novel gadgets utilized as a part of manufacturing bases has quickened the requirement for clean air, which is hence anticipated to boost the compressed air treatment equipment market development over the figure time frame. The compressed air leaving a compressor isn't generally of a quality reasonable for the planned use since air in the atmosphere, especially in the mechanical condition, contains dampness, particulate, and hydrocarbons, which may pollute the final product. Moreover, the compressor itself adds to contaminants as wear particles and compressor oil carryover. The previously mentioned factors are relied upon to drive development for the worldwide compacted air treatment equipment market over the estimate time frame. Air treatment equipment maintains the compressed air system fit as a fiddle and disposes of moistness. Proficient cooling and elimination of humidity guarantees low costs of energy, therefore expanding the life of equipment. The air leaving a compressor achieves 100 percent humidity, because of which the compacted air treatment equipment plays a critical part in disposing residual humidity and getting dry air for end use applications. Compacted air treatment is thought to be a brilliant choice while putting resources into a compressor since this treatment equipment not just shield the system from all types of contaminants yet in addition enhance the system productivity and increase system life by decreasing erosion and rust.

Product Outlook and Trend Analysis

Air treatment equipment including dryers and filters developed as the main item classification in 2017 and together represented more than % of the general income share around the same time. Filters are intended for excellent filtration of compressed air utilized as a part of a variety of applications where air quality is of foremost significance. The outline idea for filters which is offered by a few players in the market joins flexibility, safety, ease of use, wellbeing, and high performance. Besides, the accessibility of superior filters that assist to decrease pressure loss by around 40-50 percent is accomplished through an enhanced filter configuration matched with creative filtration innovation, which is anticipated to spur the item requirement extensively in the following years. In the dryer's segment, refrigerated air dryers developed as the leading section representing near USD million in 2017. The mix of enhanced sensor technology in dryers mechanizes producing and the quality checks process and lessens direct expenses. Refrigerated dryers are utilized to dispose water vapor in a many industrial applications, including semiconductor manufacturing, compound, paper, pharmaceutical drugs, and food processing & packaging. Besides, they are likewise utilized as a part of medicinal services gear in surgical and dental gadgets. In the current years, the industrial segment has seen the multiplication of the Industrial Internet of Things (IIoT). The IIoT obscures the lines of uniqueness with regards to a specific segment in a system. In the same way, in refrigerated dryers, IIoT has made it conceivable to see the compressed air treatment system as a solitary unit. In the framework, information gathered from various parts, for example, sensors, refrigerated air dryers, blowers, etc. is investigated to give a more exact comprehension of the system operation. Parker Hannifin is one of the primary producers of such exceptionally coordinated compressed air treatment system.

End Use Outlook and Trend Analysis

The worldwide requirement for compacted air treatment equipment has seen a change in perspective because of rising customer awareness. In 2017 Food & beverage developed as the biggest end-use section and represented more than 25 percent of the aggregate market revenue. The entrance of compacted air treatment hardware and in addition development in the food & beverage segment is relied upon to be high inferable from the developing requirement for clean air in various basic applications, in particular food processing and packaging. A few new players are setting up new food & beverage enterprises, especially in the United States, which will render growth opportunities over the conjecture time frame. Moreover, clean rooms are needed for food processing and pharmaceutical plants for the production of critical products.

Regional Outlook and Trend Analysis

Asia Pacific is anticipated to reflect the most elevated development trailed by North America attributable to the ascent in the quantity of food & beverage and chemical ventures. Dry and clean air stretches out machine life and prompts enhanced item quality, accordingly diminishing the cost of maintenance. In the wake of these variables, there has been a surge in requirement in the previously mentioned sectors and the pattern is anticipated to proceed over the gauge time frame. The existence of water vapor is a part of concern in the food sector as dampness causes quick fungal and microbial development. Thus, high item infiltration in the industry of food packaging alongside an ascent in the quantity of food processing industries in South America, Europe, and North America is anticipated to raise the provincial request over the conjecture time frame. Europe is projected to reflect significant development in the upcoming years. Rising demand in the medical sector renders opportunities for development to this market. There are many controls relating to the compressed air quality utilized as a part of the production procedures, which is additionally anticipated to fuel the request in Europe over the estimate time frame.

Competitive Insights

The market is aggressive attributable to the existence of a few prevailing players, for example, Gardner Denver Inc, Ingersoll-Rand plc, and Parker Hannifin Corp. The contenders flourish with broad R&D and coordinate many enhanced technologies supplementing applications crosswise over various end-utilize areas. A couple of players attempt vertical joining at the levels of planning and production to an extensive degree although most makers concentrate on just a single part of the esteem chain. Besides, organizations concentrate on picking up an upper hand by extending their local and also worldwide reach. The present range of center for a few set up players is to rule the worldwide network of sales.

The global Compressed Air Treatment Equipment market is segmented as follows :

By Product:

- Filters

- Dryers

- Aftercoolers

- Other Products

By Application:

- Instrument Air

- Process Air

- Plant Air/Shop Air

- Breathing Air

By End User:

- Chemical

- Paper

- Healthcare

- Food & Beverage

- Automotive

- Industrial

- Steel

- Aerospace

- Other End Users

By Region:

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- Turkey

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Compressed Air Treatment Equipment Market By Product, Estimates and Forecast, 2012-2022 ($Million)

- Filters

- Dryers

- Aftercoolers

- Other Products

- Compressed Air Treatment Equipment Market By Application, Estimates and Forecast, 2012-2022 ($Million)

- Instrument Air

- Process Air

- Plant Air/Shop Air

- Breathing Air

- Compressed Air Treatment Equipment Market By End User, Estimates and Forecast, 2012-2022 ($Million)

- Chemical

- Paper

- Healthcare

- Food & Beverage

- Automotive

- Industrial

- Steel

- Aerospace

- Other End Users

- Compressed Air Treatment Equipment Market By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Compressed Air Treatment Equipment Market, By Country

- North America Compressed Air Treatment Equipment Market, By Product

- North America Compressed Air Treatment Equipment Market, By Application

- North America Compressed Air Treatment Equipment Market, By End User

- U.S. Compressed Air Treatment Equipment Market, By Product

- U.S. Compressed Air Treatment Equipment Market, By Application

- U.S. Compressed Air Treatment Equipment Market, By End User

- Canada Compressed Air Treatment Equipment Market, By Product

- Canada Compressed Air Treatment Equipment Market, By Application

- Canada Compressed Air Treatment Equipment Market, By End User

- Mexico Compressed Air Treatment Equipment Market, By Product

- Mexico Compressed Air Treatment Equipment Market, By Application

- Mexico Compressed Air Treatment Equipment Market, By End User

-

- Europe

- Europe Compressed Air Treatment Equipment Market, By Country

- Europe Compressed Air Treatment Equipment Market, By Product

- Europe Compressed Air Treatment Equipment Market, By Application

- Europe Compressed Air Treatment Equipment Market, By End User

- Germany Compressed Air Treatment Equipment Market, By Product

- Germany Compressed Air Treatment Equipment Market, By Application

- Germany Compressed Air Treatment Equipment Market, By End User

- France Compressed Air Treatment Equipment Market, By Product

- France Compressed Air Treatment Equipment Market, By Application

- France Compressed Air Treatment Equipment Market, By End User

- UK Compressed Air Treatment Equipment Market, By Product

- UK Compressed Air Treatment Equipment Market, By Application

- UK Compressed Air Treatment Equipment Market, By End User

- Italy Compressed Air Treatment Equipment Market, By Product

- Italy Compressed Air Treatment Equipment Market, By Application

- Italy Compressed Air Treatment Equipment Market, By End User

- Spain Compressed Air Treatment Equipment Market, By Product

- Spain Compressed Air Treatment Equipment Market, By Application

- Spain Compressed Air Treatment Equipment Market, By End User

- Rest of Europe Compressed Air Treatment Equipment Market, By Product

- Rest of Europe Compressed Air Treatment Equipment Market, By Application

- Rest of Europe Compressed Air Treatment Equipment Market, By End User

-

- Asia-Pacific

- Asia-Pacific Compressed Air Treatment Equipment Market, By Country

- Asia-Pacific Compressed Air Treatment Equipment Market, By Product

- Asia-Pacific Compressed Air Treatment Equipment Market, By Application

- Asia-Pacific Compressed Air Treatment Equipment Market, By End User

- Japan Compressed Air Treatment Equipment Market, By Product

- Japan Compressed Air Treatment Equipment Market, By Application

- Japan Compressed Air Treatment Equipment Market, By End User

- China Compressed Air Treatment Equipment Market, By Product

- China Compressed Air Treatment Equipment Market, By Application

- China Compressed Air Treatment Equipment Market, By End User

- Australia Compressed Air Treatment Equipment Market, By Product

- Australia Compressed Air Treatment Equipment Market, By Application

- Australia Compressed Air Treatment Equipment Market, By End User

- India Compressed Air Treatment Equipment Market, By Product

- India Compressed Air Treatment Equipment Market, By Application

- India Compressed Air Treatment Equipment Market, By End User

- South Korea Compressed Air Treatment Equipment Market, By Product

- South Korea Compressed Air Treatment Equipment Market, By Application

- South Korea Compressed Air Treatment Equipment Market, By End User

- Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By Product

- Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By Application

- Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By End User

- Asia-Pacific

-

- Rest of the World

- Rest of the World Compressed Air Treatment Equipment Market, By Country

- Rest of the World Compressed Air Treatment Equipment Market, By Product

- Rest of the World Compressed Air Treatment Equipment Market, By Application

- Rest of the World Compressed Air Treatment Equipment Market, By End User

- Brazil Compressed Air Treatment Equipment Market, By Product

- Brazil Compressed Air Treatment Equipment Market, By Application

- Brazil Compressed Air Treatment Equipment Market, By End User

- South Africa Compressed Air Treatment Equipment Market, By Product

- South Africa Compressed Air Treatment Equipment Market, By Application

- South Africa Compressed Air Treatment Equipment Market, By End User

- Saudi Arabia Compressed Air Treatment Equipment Market, By Product

- Saudi Arabia Compressed Air Treatment Equipment Market, By Application

- Saudi Arabia Compressed Air Treatment Equipment Market, By End User

- Turkey Compressed Air Treatment Equipment Market, By Product

- Turkey Compressed Air Treatment Equipment Market, By Application

- Turkey Compressed Air Treatment Equipment Market, By End User

- United Arab Emirates Compressed Air Treatment Equipment Market, By Product

- United Arab Emirates Compressed Air Treatment Equipment Market, By Application

- United Arab Emirates Compressed Air Treatment Equipment Market, By End User

- Others Compressed Air Treatment Equipment Market, By Product

- Others Compressed Air Treatment Equipment Market, By Application

- Others Compressed Air Treatment Equipment Market, By End User

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Usage of Compressed Air

3.2.1.2. Development of Advanced Devices Used in Manufacturing Facilities

3.2.2. Restraints

3.2.2.1. High Maintenance and Operational Costs

3.2.3. Opportunities

3.2.3.1. Rapid Industrialization in Emerging Countries such as China and India

4. Compressed Air Treatment Equipment Market, By Product

4.1. Introduction

4.2. Compressed Air Treatment Equipment Market Assessment and Forecast, By Product, 2012-2022

4.3. Filters

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Dryers

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Aftercoolers

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Other Products

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Compressed Air Treatment Equipment Market, By Application

5.1. Introduction

5.2. Compressed Air Treatment Equipment Market Assessment and Forecast, By Application, 2012-2022

5.3. Instrument Air

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Process Air

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Plant Air/Shop Air

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.6. Breathing Air

5.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Compressed Air Treatment Equipment Market, By End User

6.1. Introduction

6.2. Compressed Air Treatment Equipment Market Assessment and Forecast, By End User, 2012-2022

6.3. Chemical

6.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.4. Paper

6.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.5. Healthcare

6.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.6. Food & Beverage

6.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.7. Automotive

6.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.8. Industrial

6.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.9. Steel

6.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.10. Aerospace

6.10.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.11. Other End Users

6.11.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7. Compressed Air Treatment Equipment Market, By Region

7.1. Introduction

7.2. Compressed Air Treatment Equipment Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.3.5. U.S.

7.3.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.5.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.3.6. Canada

7.3.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.6.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.3.7. Mexico

7.3.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.7.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.5. Germany

7.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.5.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.6. France

7.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.6.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.7. UK

7.4.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.7.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.8. Italy

7.4.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.8.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.9. Spain

7.4.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.9.2. Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.9.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.4.10. Rest of Europe

7.4.10.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.10.2. Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.10.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5. Asia-Pacific

7.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.5. Japan

7.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.5.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.6. China

7.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.6.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.7. Australia

7.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.7.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.8. India

7.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.8.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.9. South Korea

7.5.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.9.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.5.10. Rest of Asia-Pacific

7.5.10.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.10.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.10.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6. Rest of the World

7.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.5. Brazil

7.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.5.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.6. Turkey

7.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.6.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.7. Saudi Arabia

7.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.7.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.8. South Africa

7.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.8.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.9. United Arab Emirates

7.6.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.9.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

7.6.10. Others

7.6.10.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.10.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.10.3. Market Assessment and Forecast, By End User, 2012-2022 ($Million)

8. Company Profiles

8.1. Chicago Pneumatic

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Key Financials

8.1.4. Strategic Developments

8.2. Airfilter Engineering

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Strategic Developments

8.3. Aircel Corporation

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Key Financials

8.3.4. Strategic Developments

8.4. Atlas Copco

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Key Financials

8.4.4. Strategic Developments

8.5. Alpha-Pure Corporation

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Key Financials

8.5.4. Strategic Developments

8.6. Omega Air

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Key Financials

8.6.4. Strategic Developments

8.7. Aerzener Maschinenfabrik GmbH

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Key Financials

8.7.4. Strategic Developments

8.8. Great Lakes (Great Lakes Air Products, Inc.)

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Strategic Developments

8.9. MTA S.p.A

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Key Financials

8.9.4. Strategic Developments

8.10. Beko Technologies Corp

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Key Financials

8.10.4. Strategic Developments

8.11. Elgi Compressors USA, Inc.

8.11.1. Business Overview

8.11.2. Product Portfolio

8.11.3. Key Financials

8.11.4. Strategic Developments

8.12. Boge Compressors

8.12.1. Business Overview

8.12.2. Product Portfolio

8.12.3. Key Financials

8.12.4. Strategic Developments

List of Tables

Table 1.Compressed Air Treatment Equipment Market, By Product, 2012-2022, ($Million)

Table 2.Filters Market, By Region, 2012-2022, ($Million)

Table 3.Dryers Market, By Region, 2012-2022, ($Million),

Table 4.Aftercoolers Market, By Region ($Million), 2012-2022

Table 5.Other Products Market, By Region ($Million), 2012-2022

Table 6.Compressed Air Treatment Equipment Market, By Application ($Million), 2012-2022

Table 7.Instrument Air Market, By Application ($Million), 2012-2022

Table 8.Process Air Market, By Region, 2012-2022, ($Million)

Table 9.Plant Air/Shop Air Market, By Region, 2012-2022, ($Million),

Table 10.Breathing Air Market, By Region, 2012-2022, ($Million)

Table 6.Compressed Air Treatment Equipment Market, By End User ($Million), 2012-2022

Table 12.Chemical Market, By Region ($Million), 2012-2022

Table 13.Paper Market, By Region, 2012-2022, ($Million)

Table 14.Healthcare Market, By Region, 2012-2022, ($Million)

Table 14.Food & Beverage Market, By Region, 2012-2022, ($Million)

Table 10.Automotive Market, By Region, 2012-2022, ($Million)

Table 11.Industrial Market, By Region, 2012-2022, ($Million)

Table 12.Steel Market, By Region ($Million), 2012-2022

Table 13.Aerospace Market, By Region, 2012-2022, ($Million)

Table 14.Other End Users Market, By Region, 2012-2022, ($Million)

Table 15.Compressed Air Treatment Equipment Market, By Region, 2012-2022 ($Million)

Table 16.North America Compressed Air Treatment Equipment Market, By Country, 2012-2022 ($Million)

Table 17.North America Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 18.North America Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 19.North America Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 20.U.S. Compressed Air Treatment Equipment market, by Product, 2012-2022 ($Million)

Table 21.U.S. Compressed Air Treatment Equipment market, by Application, 2012-2022 ($Million)

Table 22.U.S. Compressed Air Treatment Equipment market, by End User, 2012-2022 ($Million)

Table 23.Canada Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 24.Canada Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 25.Canada Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 26.Mexico Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 27.Mexico Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 28.Mexico Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 29.Europe Compressed Air Treatment Equipment Market, By Country, 2012-2022 ($Million)

Table 30.Europe Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 31.Europe Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 32.Europe Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 33.Germany Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 34.Germany Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 35.Germany Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 36.France Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 37.France Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 38.France Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 39.UK Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 40.UK Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 41.UK Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 42.Italy Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 43.Italy Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 44.Italy Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 45.Spain Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 46.Spain Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 47.Spain Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 51.Rest of Europe Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 52.Rest of Europe Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 53.Rest of Europe Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 54.Asia-Pacific Compressed Air Treatment Equipment Market, By Country, 2012-2022 ($Million)

Table 55.Asia-Pacific Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 56.Asia-Pacific Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 57.Asia-Pacific Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 58.Japan Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 59.Japan Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 60.Japan Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 61.China Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 62.China Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 63.China Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 64.Australia Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 65.Australia Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 66.Australia Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 67.India Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 68.India Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 69.India Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 70.South Korea Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 71.South Korea Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 72.South Korea Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 76.Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 78.Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 79.Rest of Asia-Pacific Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 80.Rest of the World Compressed Air Treatment Equipment Market, By Country, 2012-2022 ($Million)

Table 81.Rest of the World Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 82.Rest of the World Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 83.Rest of the World Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 84.Brazil Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 85.Brazil Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 86.Brazil Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 87.Turkey Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 88.Turkey Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 89.Turkey Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 90.Saudi Arabia Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 91.Saudi Arabia Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 92.Saudi Arabia Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 93.South Africa Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 94.South Africa Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 95.South Africa Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 96.United Arab Emirates Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 97.United Arab Emirates Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 98.United Arab Emirates Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 99.Others Compressed Air Treatment Equipment Market, By Product, 2012-2022 ($Million)

Table 100.Others Compressed Air Treatment Equipment Market, By Application, 2012-2022 ($Million)

Table 101.Others Compressed Air Treatment Equipment Market, By End User, 2012-2022 ($Million)

Table 102.Chicago Pneumatic: Key Strategic Developments, 2017-2017

Table 103.Airfilter Engineering: Key Strategic Developments, 2017-2017

Table 104.Aircel Corporation: Key Strategic Developments, 2017-2017

Table 105.Atlas Copco: Key Strategic Developments, 2017-2017

Table 106.Alpha-Pure Corporation: Key Strategic Developments, 2017-2017

Table 107.Omega Air: Key Strategic Developments, 2017-2017

Table 108.Aerzener Maschinenfabrik GmbH: Key Strategic Developments, 2017-2017

Table 109.Great Lakes (Great Lakes Air Products, Inc.): Key Strategic Developments, 2017-2017

Table 110.MTA S.p.A: Key Strategic Developments, 2017-2017

Table 112.Beko Technologies Corp: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Compressed Air Treatment Equipment Market Share, By Product, 2012 & 2022

Figure 2.Compressed Air Treatment Equipment Market, By Application, 2012 & 2022, ($Million)

Figure 3.Compressed Air Treatment Equipment Market, By End User, 2012 & 2022, ($Million)

Figure 4.Compressed Air Treatment Equipment Market, By Region, 2012 & 2022, ($Million)

Figure 5.Chicago Pneumatic: Net Revenues, 2017-2017 ($Million)

Figure 6.Chicago Pneumatic: Net Revenue Share, By Segment, 2017

Figure 7.Chicago Pneumatic: Net Revenue Share, By Geography, 2017

Figure 8.Aircel Corporation: Net Revenues, 2017-2017 ($Million)

Figure 9.Aircel Corporation: Net Revenue Share, By Segment, 2017

Figure 10.Aircel Corporation: Net Revenue Share, By Geography, 2017

Figure 11.Atlas Copco: Net Revenues, 2017-2017 ($Million)

Figure 12.Atlas Copco: Net Revenue Share, By Segment, 2017

Figure13.Atlas Copco: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|