.png)

Dental Compressors Market by Product, Technology and End User - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 112 Category: Medical Devices Report Code : HC11313

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

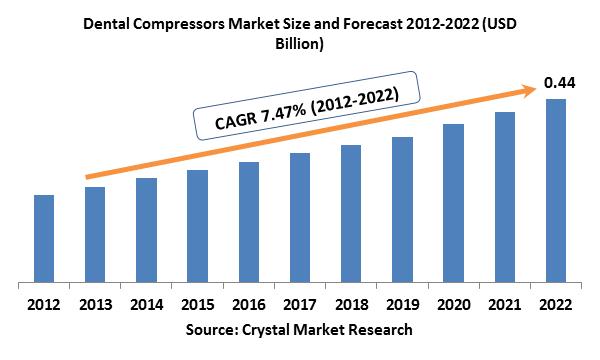

The global Dental Compressors market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Rising requirement for dental methodology, for example, dentures, bonding, crowns & caps, braces, bridges and implants, and filling and repairs is one of the significant drivers for the worldwide dental compressors market. The United States populace is "graying" at a fast rate. As indicated by the American Association of Retired Persons, by the year 2021, roughly % of the populace base would be over 60 years old. With the expansion in regular dentition maintenance, a greater amount of aged populace is found in dental offices to keep up their oral health. Expanding pervasiveness of dental issue and the nearness of neighborly government changes relating to the dental gear and consumables advertise are relied upon to fuel market development.

Product Outlook and Trend Analysis

Lubricated and oil free compressors are two key item fragments examined in the extent of the investigation. In 2017 Dental greased up compressors ruled the general market on the basis of share. Generally high durability and low maintenance related with these gadgets are some central point crediting to its extensive share. Likewise, high utilization rates of these gadgets in the rising and immature markets are relied upon to drive development amid the gauge time frame. Dental oil free compressors are relied upon to pick up profit share amid the estimate time frame. Sans oil compressors are light weight and less expensive. Leading business sector players are engaged with persistent R&D keeping in mind the end goal to dispatch new items with productive innovation. For example, Air Techniques has propelled membrane innovation based AirStar 12 and AirStar 40, that are for all intents and purposes support free and gives clean ultra-dry dental compacted air. Oil free dental compressors are currently most generally utilized as a part of the field of healthcare. Expanding interest for dental compressors with decreased commotion and vibration and smaller shape to spare space anticipated that would drive portion development amid the estimate time frame.

Technology Outlook and Trend Analysis

In terms of technology, the dental compressors market is sectioned into membrane based compressors and desiccant based compressors.in 2017 Desiccant based compressors commanded the general market as far as offer. Desiccant dryers additionally alluded to as regenerative desiccant dryers are comprised of two chambers. Compressed air flows through the chamber loaded with desiccant which is in charge of adsorbing the dampness, in this manner, lessening the air dew focuses. The desiccant dryers have caught awesome piece of the pie because of its capacity of diminishing the workload as it were. Likewise, characteristics, for example, desiccant dryers give low dew focuses without its potential stop up and direct cost of operation related with these items are relied upon to drive section development throughout the following years. Nonetheless, film based compressors, are anticipated to pick up profit share amid the gauge time frame. Membrane dryers expel dampness from the packed air by going it through a film material. Because of their sizes, membrane dryers are favorable as they can be introduced nearer to the point of utilization.

Application outlook and Trend Analysis

Dental air compressors locate its utility in different application regions including dental chair valves, handpieces, scalers and other dental care gadgets. In 2017, Dental handpieces were the most income producing application segment representing most of the dental air compressors market. High utilization rates and rising pervasiveness of dental issue are among key components ascribing to its extensive share. However, dental chair valves are relied upon to develop at a lucrative rate over the conjecture time frame. Dental seats are a standout amongst the most essential gear in any dental care office as it enables the dental practitioner to persistently change position keeping in mind the end goal to show signs of improvement evaluate to the patients mouth. Dental chairs are backed with valves which are worked through air compressor making it flexible. An expanding number of dental practitioners combined with rising commonness of dental issue are among key variables ascribing for its development rate.

Regional Outlook and Trend Analysis

In 2017 the market was commanded by North America on the basis of revenue with a share of more than 30 percent attributable to the existence of advanced healthcare infrastructure, high levels of awareness among patients combined with generally higher medicinal services spending levels in the developed nations. Asia Pacific dental air compressors market is anticipated to develop at a lucrative pace over the assessed time of years. The existence of undiscovered opportunities, enhancing healthcare infrastructure, purchasing power of consumers, and patient awareness levels are a few variables representing this quick development.

Competitive Insights

The leading players in the market are Tech West Inc, Midmark, Air Techniques, Gnatus, Kaeser Dental, Dürr Dental, Foshan Core Deep Medical Apparatus Co Ltd, DentalEZ Group, Aixin Medical Equipment Co Ltd, Slovadent, s.r.o, Metasys Software Pvt Ltd, Fedesa and DIPLOMAT-DENTAL Ltd. market players are focused on new product launches and enhancing the portfolio of the current products to maintain market position.

The global Dental Compressors Market is segmented as follows-

By Product

- Dental oil-free compressors

- Dental lubricated compressors

By Technology

- Membrane based compressors

- Desiccant based compressors

By Application

- Chair Valves

- Handpieces

- Scalers

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Dental Compressors Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Dental lubricated compressors

- Dental oil-free compressors

- Dental Compressors Market, By Technology, Estimates and Forecast, 2012-2022 ($Million)

- Desiccant based compressors

- Membrane based compressors

- Dental Compressors Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Handpieces

- Scalers

- Chair Valves

- Other Application

- Dental Compressors Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Dental Compressors Market, By Country

- North America Dental Compressors Market, By Product

- North America Dental Compressors Market, By Technology

- North America Dental Compressors Market, By Application

- U.S. Dental Compressors Market, By Product

- U.S. Dental Compressors Market, By Technology

- U.S. Dental Compressors Market, By Application

- Canada Dental Compressors Market, By Product

- Canada Dental Compressors Market, By Technology

- Canada Dental Compressors Market, By Application

- Mexico Dental Compressors Market, By Product

- Mexico Dental Compressors Market, By Technology

- Mexico Dental Compressors Market, By Application

-

- Europe

- Europe Dental Compressors Market, By Country

- Europe Dental Compressors Market, By Product

- Europe Dental Compressors Market, By Technology

- Europe Dental Compressors Market, By Application

- Germany Dental Compressors Market, By Product

- Germany Dental Compressors Market, By Technology

- Germany Dental Compressors Market, By Application

- France Dental Compressors Market, By Product

- France Dental Compressors Market, By Technology

- France Dental Compressors Market, By Application

- UK Dental Compressors Market, By Product

- UK Dental Compressors Market, By Technology

- UK Dental Compressors Market, By Application

- Italy Dental Compressors Market, By Product

- Italy Dental Compressors Market, By Technology

- Italy Dental Compressors Market, By Application

- Spain Dental Compressors Market, By Product

- Spain Dental Compressors Market, By Technology

- Spain Dental Compressors Market, By Application

- Rest of Europe Dental Compressors Market, By Product

- Rest of Europe Dental Compressors Market, By Technology

- Rest of Europe Dental Compressors Market, By Application

-

- Asia-Pacific

- Asia-Pacific Dental Compressors Market, By Country

- Asia-Pacific Dental Compressors Market, By Product

- Asia-Pacific Dental Compressors Market, By Technology

- Asia-Pacific Dental Compressors Market, By Application

- Japan Dental Compressors Market, By Product

- Japan Dental Compressors Market, By Technology

- Japan Dental Compressors Market, By Application

- China Dental Compressors Market, By Product

- China Dental Compressors Market, By Technology

- China Dental Compressors Market, By Application

- Australia Dental Compressors Market, By Product

- Australia Dental Compressors Market, By Technology

- Australia Dental Compressors Market, By Application

- India Dental Compressors Market, By Product

- India Dental Compressors Market, By Technology

- India Dental Compressors Market, By Application

- South Korea Dental Compressors Market, By Product

- South Korea Dental Compressors Market, By Technology

- South Korea Dental Compressors Market, By Application

- Rest of Asia-Pacific Dental Compressors Market, By Product

- Rest of Asia-Pacific Dental Compressors Market, By Technology

- Rest of Asia-Pacific Dental Compressors Market, By Application

-

- Rest of the World

- Rest of the World Dental Compressors Market, By Country

- Rest of the World Dental Compressors Market, By Product

- Rest of the World Dental Compressors Market, By Technology

- Rest of the World Dental Compressors Market, By Application

- Brazil Dental Compressors Market, By Product

- Brazil Dental Compressors Market, By Technology

- Brazil Dental Compressors Market, By Application

- South Africa Dental Compressors Market, By Product

- South Africa Dental Compressors Market, By Technology

- South Africa Dental Compressors Market, By Application

- Saudi Arabia Dental Compressors Market, By Product

- Saudi Arabia Dental Compressors Market, By Technology

- Saudi Arabia Dental Compressors Market, By Application

- Turkey Dental Compressors Market, By Product

- Turkey Dental Compressors Market, By Technology

- Turkey Dental Compressors Market, By Application

- United Arab Emirates Dental Compressors Market, By Product

- United Arab Emirates Dental Compressors Market, By Technology

- United Arab Emirates Dental Compressors Market, By Application

- Others Dental Compressors Market, By Product

- Others Dental Compressors Market, By Technology

- Others Dental Compressors Market, By Application

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rising in number of dental procedures

3.2.1.2. Growing prevalence of oral diseases

3.2.2. Restraints

3.2.2.1. High operational price of dental compressors

3.2.3. Opportunities

3.2.3.1. Growing Adoption of dental compressor to protect from oral diseases

4. Dental Compressors Market, By Product

4.1. Introduction

4.2. Dental Compressors Market Assessment and Forecast, By Product, 2012-2022

4.3. Dental lubricated compressors

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Dental oil-free compressors

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Dental Compressors Market, By Technology

5.1. Introduction

5.2. Dental Compressors Market Assessment and Forecast, By Technology, 2012-2022

5.3. Desiccant based compressors

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Membrane based compressors

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Dental Compressors Market, By Application

6.1. Introduction

6.2. Dental Compressors Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.3. Handpieces

6.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.4. Scalers

6.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.5. Chair Valves

6.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.6. Other Applications

6.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7. Dental Compressors Market, By Region

7.1. Introduction

7.2. Dental Compressors Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.3.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.1. U.S.

7.3.4.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.3.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.2. Canada

7.3.4.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.3.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.3. Mexico

7.3.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.3.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.1. Germany

7.4.4.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.2. France

7.4.4.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.3. UK

7.4.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.4. Italy

7.4.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.5. Spain

7.4.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.6. Rest of Europe

7.4.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.4.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5. Asia-Pacific

7.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.1. Japan

7.5.4.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.2. China

7.5.4.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.3. Australia

7.5.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.4. India

7.5.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.5. South Korea

7.5.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.6. Rest of Asia-Pacific

7.5.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.5.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6. Rest of the World

7.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.1. Brazil

7.6.4.1.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.2. Turkey

7.6.4.2.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.2.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.3. Saudi Arabia

7.6.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.4. South Africa

7.6.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.5. United Arab Emirates

7.6.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.6. Others

7.6.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7.6.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

8. Company Profiles

8.1. Metasys

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Key Financials

8.1.4. Strategic Developments

8.2. Tech West Inc.

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Key Financials

8.2.4. Strategic Developments

8.3. Dürr Dental

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Key Financials

8.3.4. Strategic Developments

8.4. Kaeser Dental

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Key Financials

8.4.4. Strategic Developments

8.5. Midmark

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Key Financials

8.5.4. Strategic Developments

8.6. Aixin Medical Equipment Co., Ltd

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Strategic Developments

8.7. Best Dent Equipment Co., Limited

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Key Financials

8.7.4. Strategic Developments

8.8. Gnatus

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Strategic Developments

8.9. Slovadent

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Key Financials

8.9.4. Strategic Developments

8.10. Dental EZ Group

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Key Financials

8.10.4. Strategic Developments

8.11. Fedesa

8.11.1. Business Overview

8.11.2. Product Portfolio

8.11.3. Strategic Developments

8.12. Diplomat Dental Solutions

8.12.1. Business Overview

8.12.2. Product Portfolio

8.12.3. Strategic Developments

List of Tables

Table 1.Dental Compressors Market, By Product ($Million), 2012-2022

Table 2.Dental lubricated compressors Market, By Region ($Million), 2012-2022

Table 3.Dental oil-free compressors Market, By Region ($Million), 2012-2022

Table 7.Dental Compressors Market, By Technology ($Million), 2012-2022

Table 8.Desiccant based compressors Market, By Region ($Million), 2012-2022

Table 9.Membrane based compressors Market, By Region ($Million), 2012-2022

Table 15.Dental Compressors Market, By Application ($Million), 2012-2022

Table 16.Handpieces Market, By Region ($Million), 2012-2022

Table 17.Scalers Market, By Region ($Million), 2012-2022

Table 18.Chair Valves Market, By Region ($Million), 2012-2022

Table 22.Other Applications Market, By Region ($Million), 2012-2022

Table 23.Dental Compressors Market, By Region ($Million), 2012-2022

Table 24.North America Dental Compressors Market, By Country, 2012-2022 ($Million)

Table 25.North America Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 26.North America Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 27.North America Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 28.U.S. Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 29.U.S. Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 30.U.S. Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 31.Canada Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 32.Canada Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 33.Canada Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 34.Mexico Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 35.Mexico Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 36.Mexico Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 37.Europe Dental Compressors Market, By Country, 2012-2022 ($Million)

Table 38.Europe Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 39.Europe Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 40.Europe Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 41.Germany Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 42.Germany Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 43.Germany Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 44.France Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 45.France Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 46.France Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 47.UK Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 48.UK Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 49.UK Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 50.Italy Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 51.Italy Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 52.Italy Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 53.Spain Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 54.Spain Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 55.Spain Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 56.Rest of Europe Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 57.Rest of Europe Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 58.Rest of Europe Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 59.Asia-Pacific Dental Compressors Market, By Country, 2012-2022 ($Million)

Table 60.Asia-Pacific Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 61.Asia-Pacific Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 62.Asia-Pacific Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 63.Japan Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 64.Japan Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 65.Japan Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 66.China Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 67.China Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 68.China Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 69.Australia Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 70.Australia Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 71.Australia Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 72.India Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 73.India Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 74.India Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 75.South Korea Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 76.South Korea Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 77.South Korea Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 78.Rest of Asia-Pacific Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 790.Rest of Asia-Pacific Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 80.Rest of Asia-Pacific Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 81.Rest of the World Dental Compressors Market, By Country, 2012-2022 ($Million)

Table 82.Rest of the World Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 83.Rest of the World Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 84.Rest of the World Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 85.Brazil Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 86.Brazil Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 87.Brazil Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 88.Turkey Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 89.Turkey Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 90.Turkey Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 91.Saudi Arabia Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 92.Saudi Arabia Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 93.Saudi Arabia Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 94.South Africa Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 95.South Africa Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 96.South Africa Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 97.United Arab Emirates Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 98.United Arab Emirates Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 99.United Arab Emirates Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 100.Others Dental Compressors Market, By Product, 2012-2022 ($Million)

Table 101.Others Dental Compressors Market, By Technology, 2012-2022 ($Million)

Table 102.Others Dental Compressors Market, By Application, 2012-2022 ($Million)

Table 103.Metasys: Key Strategic Developments, 2017-2017

Table 104.Tech West Inc.: Key Strategic Developments, 2017-2017

Table 105.Dürr Dental: Key Strategic Developments, 2017-2017

Table 106.Kaeser Dental: Key Strategic Developments, 2017-2017

Table 107.Midmark: Key Strategic Developments, 2017-2017

Table 108.Aixin Medical Equipment Co., Ltd: Key Strategic Developments, 2017-2017

Table 109.Best Dent Equipment Co., Limited: Key Strategic Developments, 2017-2017

Table 110.Gnatus: Key Strategic Developments, 2017-2017

Table 111.Slovadent, LLC: Key Strategic Developments, 2017-2017

Table 112.Dental EZ Group: Key Strategic Developments, 2017-2017

Table 113.Fedesa: Key Strategic Developments, 2017-2017

Table 114.Diplomat Dental Solutions: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Dental Compressors Market Share, By Product, 2012 & 2022 ($Million)

Figure 2.Dental Compressors Market, By Technology, 2012 & 2022 ($Million)

Figure 3.Dental Compressors Market, By Application, 2012 & 2022 ($Million)

Figure 4.Dental Compressors Market, By Region, 2017, ($Million)

Figure 5.Metasys: Net Revenues, 2017-2017 ($Million)

Figure 6.Metasys: Net Revenue Share, By Segment, 2017

Figure 7.Metasys: Net Revenue Share, By Geography, 2017

Figure 8.Tech West Inc.: Net Revenues, 2017-2017 ($Million)

Figure 9.Tech West Inc.: Net Revenue Share, By Segment, 2017

Figure 10.Tech West Inc.: Net Revenue Share, By Geography, 2017

Figure 11.Midmark: Net Revenues, 2017-2017 ($Million)

Figure 12.Midmark: Net Revenue Share, By Segment, 2017

Figure 13.Midmark: Net Revenue Share, By Geography, 2017

Figure 14.Dental EZ Group: Net Revenues, 2017-2017 ($Million)

Figure 15.Dental EZ Group: Net Revenue Share, By Segment, 2017

Figure 16.Dental EZ Group: Net Revenue Share, By Geography, 2017

Research Methodology

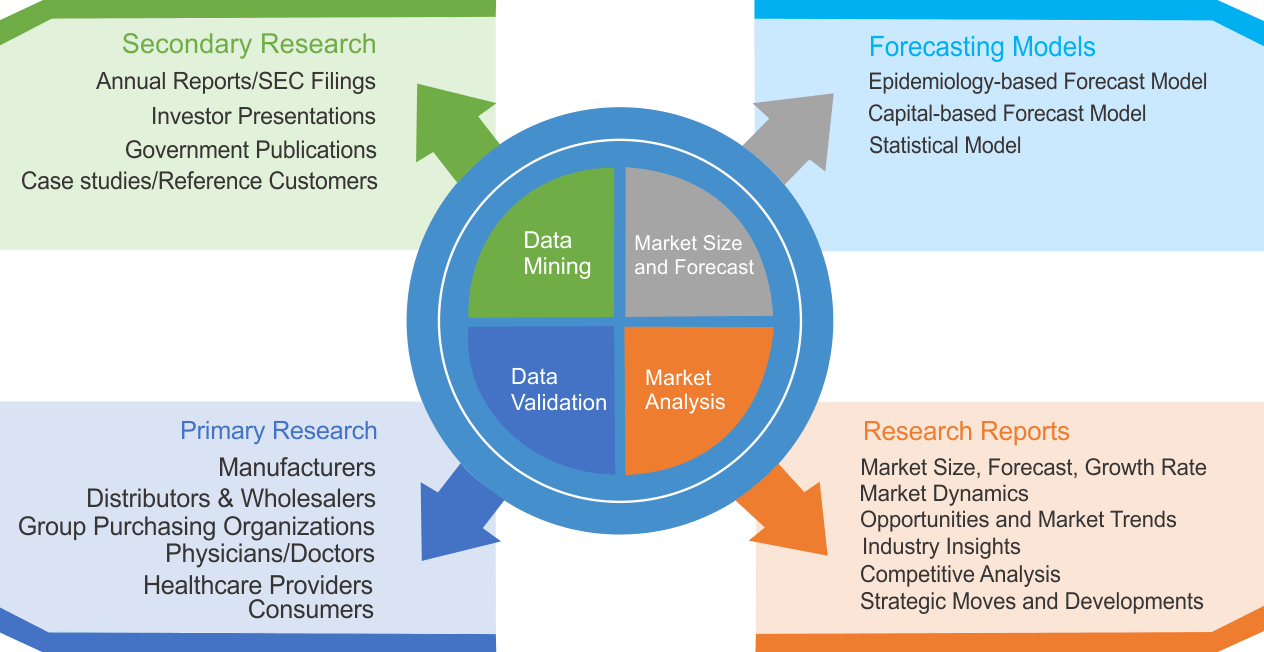

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|