.png)

Electronic Adhesives Market By Application, Type and Form- Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 100 Category: Advanced Materials Report Code : CM02559

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

The global Electronic Adhesives Market was worth USD billion in 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Electronic adhesives are a section of the electronic segments that are used as a part of the production of electronic circuits and products. They are mostly used as a part of wire tacking, restricting the surface-mount segments, and exemplifying segments. Raw materials used as a part of the generation of electronic adhesives incorporate polysulfides, silicones, polyurethanes, epoxies, and cyanoacrylates

Form Outlook and Trend Analysis

Liquid form adhesives are the biggest section of the electronic adhesives market. Due to its solid adhesion quality the liquid adhesives are useful in several applications where solid adhesion flow is required and the surfaces to be bonded are huge. The electronics sectors makes use of liquid adhesives for mounting the semiconductor colors, as conformal coatings on printed circuits boards (PCBs) and preparing. These cement frames are accessible in different organizations, for example, acrylics, silicones, and epoxies.

Type Outlook and Trend Analysis

Electrically Conductive Adhesives, abbreviated ECA, is the biggest fragment of the electronic adhesives type market. They are used as substitute for conventional tin-lead solders. Attributable to their high electrical conductivity, and capacity to permit the entry of current while starting electrical association between two bonded surfaces, electronic cements are broadly used as a part of microelectronic industry for packaging applications.

Application Outlook and Trend Analysis

The Printed Circuit Board (PCB) application is the leading applications for electronic adhesives due to the rising demand from applications, for example, wire tacking adhesives, chip bonding, potting, and conformal coatings in several regions. The ability to guard the electronic & circuit assembly parts from dust, corrosion, shock & vibration, physical and environmental damage makes electronic adhesives the most preferred adhesives in the PCB industry.

Regional Outlook and Trend Analysis

The Asia-Pacific region is the biggest market for electronic glues all around. This is predominantly ascribed to the high monetary development rate, developing manufacturing businesses, inexpensive labour, and expanding electronic adhesives based application patents. Likewise, involvement of government associations for the commercialization and improvement of electronic adhesives are few components prompting the development of market.

Competitive Insights

The leading players in the market are Henkel, Alent, KgaA, LG Chemical Limited, H.B. Fuller, Mitsui Chemicals, Indium Corporation and 3M. The major players in the market are profiled in detail in view of qualities, for example, company portfolio, business strategies, financial overview, recent developments, and share of the overall industry.

The Electronic Adhesives Market is segmented as follows-

By Type:

- Electrically conductive

- UV curing

- Thermally conductive

- Others

By Form:

- Liquid

- Paste

- Solid

By Application:

- Semiconductor & IC

- Printed Circuit Board (PCB)

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Electronic Adhesives Market, By Application, Estimates and Forecast, 2014-2023($Billion)

- Printed Circuit Board

- Semiconductor & Ic

- Electronic Adhesives Market, By Type, Estimates and Forecast, 2014-2023($Billion)

- Electrically Conductive

- Thermally Conductive

- UV Curing

- Other Types

- Electronic Adhesives Market, By Form, Estimates and Forecast, 2014-2023($Billion)

- Liquid Form

- Paste Form

- Solid Form

- Electronic Adhesives Market, By Region, Estimates and Forecast, 2014-2023($Billion)

- North America

- North America Electronic Adhesives Market, By Country

- North America Electronic Adhesives Market, By Application

- North America Electronic Adhesives Market, By Type

- North America Electronic Adhesives Market, By Form

- U.S. Electronic Adhesives Market, By Application

- U.S. Electronic Adhesives Market, By Type

- U.S. Electronic Adhesives Market, By Form

- Canada Electronic Adhesives Market, By Application

- Canada Electronic Adhesives Market, By Type

- Canada Electronic Adhesives Market, By Form

- Mexico Electronic Adhesives Market, By Application

- Mexico Electronic Adhesives Market, By Type

- Mexico Electronic Adhesives Market, By Form

-

- Europe

- Europe Electronic Adhesives Market, By Country

- Europe Electronic Adhesives Market, By Application

- Europe Electronic Adhesives Market, By Type

- Europe Electronic Adhesives Market, By Form

- Germany Electronic Adhesives Market, By Application

- Germany Electronic Adhesives Market, By Type

- Germany Electronic Adhesives Market, By Form

- France Electronic Adhesives Market, By Application

- France Electronic Adhesives Market, By Type

- France Electronic Adhesives Market, By Form

- UK Electronic Adhesives Market, By Application

- UK Electronic Adhesives Market, By Type

- UK Electronic Adhesives Market, By Form

- Italy Electronic Adhesives Market, By Application

- Italy Electronic Adhesives Market, By Type

- Italy Electronic Adhesives Market, By Form

- Spain Electronic Adhesives Market, By Application

- Spain Electronic Adhesives Market, By Type

- Spain Electronic Adhesives Market, By Form

- Rest of Europe Electronic Adhesives Market, By Application

- Rest of Europe Electronic Adhesives Market, By Type

- Rest of Europe Electronic Adhesives Market, By Form

- Europe

-

- Asia-Pacific

- Asia-Pacific Electronic Adhesives Market, By Country

- Asia-Pacific Electronic Adhesives Market, By Application

- Asia-Pacific Electronic Adhesives Market, By Type

- Asia-Pacific Electronic Adhesives Market, By Form

- Japan Electronic Adhesives Market, By Application

- Japan Electronic Adhesives Market, By Type

- Japan Electronic Adhesives Market, By Form

- Australia Electronic Adhesives Market, By Application

- Australia Electronic Adhesives Market, By Type

- Australia Electronic Adhesives Market, By Form

- India Electronic Adhesives Market, By Application

- India Electronic Adhesives Market, By Type

- India Electronic Adhesives Market, By Form

- South Korea Electronic Adhesives Market, By Application

- South Korea Electronic Adhesives Market, By Type

- South Korea Electronic Adhesives Market, By Form

- Rest of Asia-Pacific Electronic Adhesives Market, By Application

- Rest of Asia-Pacific Electronic Adhesives Market, By Type

- Rest of Asia-Pacific Electronic Adhesives Market, By Form

- Asia-Pacific

-

- Rest of the World

- Rest of the World Electronic Adhesives Market, By Country

- Rest of the World Electronic Adhesives Market, By Application

- Rest of the World Electronic Adhesives Market, By Type

- Rest of the World Electronic Adhesives Market, By Form

- Brazil Electronic Adhesives Market, By Application

- Brazil Electronic Adhesives Market, By Type

- Brazil Electronic Adhesives Market, By Form

- South Africa Electronic Adhesives Market, By Application

- South Africa Electronic Adhesives Market, By Type

- South Africa Electronic Adhesives Market, By Form

- Saudi Arabia Electronic Adhesives Market, By Application

- Saudi Arabia Electronic Adhesives Market, By Type

- Saudi Arabia Electronic Adhesives Market, By Form

- Turkey Electronic Adhesives Market, By Application

- Turkey Electronic Adhesives Market, By Type

- Turkey Electronic Adhesives Market, By Form

- United Arab Emirates Electronic Adhesives Market, By Application

- United Arab Emirates Electronic Adhesives Market, By Type

- United Arab Emirates Electronic Adhesives Market, By Form

- Others Electronic Adhesives Market, By Application

- Others Electronic Adhesives Market, By Type

- Others Electronic Adhesives Market, By Form

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Application Sector

3.2.2. Restraints

3.2.2.1. Established Electronics Market in the Developed Countries

3.2.2.2. Volatility in Feedstocks

3.2.3. Opportunities

3.2.3.1. Emerging Countries to Offer Lucrative Growth Opportunities

4. Electronic Adhesives Market, By Application

4.1. Introduction

4.2. Global Electronic Adhesives Sales, Revenue and Market Share by Application (2017-2017)

4.2.1. Global Electronic Adhesives Sales and Sales Share by Application (2017-2017)

4.2.2. Global Electronic Adhesives Revenue and Revenue Share by Application (2017-2017)

4.3. Electronic Adhesives Market Assessment and Forecast, By Application, 2017-2023

4.4. Printed Circuit Board

4.4.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

4.5. Semiconductor & Ic

4.5.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

5. Electronic Adhesives Market, By Type

5.1. Introduction

5.2. Global Electronic Adhesives Sales, Revenue and Market Share by Type (2017-2017)

5.2.1. Global Electronic Adhesives Sales and Sales Share by Type (2017-2017)

5.2.2. Global Electronic Adhesives Revenue and Revenue Share by Type (2017-2017)

5.3. Electronic Adhesives Market Assessment and Forecast, By Type, 2017-2023

5.4. Electrically Conductive

5.4.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

5.5. Thermally Conductive

5.5.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

5.6. UV Curing

5.6.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

5.7. Other Types

5.7.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

6. Electronic Adhesives Market, By Form

6.1. Introduction

6.2. Global Electronic Adhesives Sales, Revenue and Market Share by Form (2017-2017)

6.2.1. Global Electronic Adhesives Sales and Sales Share by Form (2017-2017)

6.2.2. Global Electronic Adhesives Revenue and Revenue Share by Form (2017-2017)

6.3. Electronic Adhesives Market Assessment and Forecast, By Form, 2017-2023($Billion)

6.4. Liquid Form

6.4.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

6.5. Paste Form

6.5.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

6.6. Solid Form

6.6.1. Market Assessment and Forecast, By Region, 2017-2023($Billion)

7. Electronic Adhesives Market, By Region

7.1. Introduction

7.2. Electronic Adhesives Market Assessment and Forecast, By Region, 2017-2023($Billion)

7.3. Global Electronic Adhesives Sales, Revenue and Market Share by Regions

7.3.1. Global Electronic Adhesives Sales by Regions (2017-2017)

7.3.2. Global Electronic Adhesives Revenue by Regions (2017-2017)

7.4. North America

7.4.1. North America Electronic Adhesives Sales and Growth Rate (2017-2017)

7.4.2. Market Assessment and Forecast, By Country, 2017-2023($Billion)

7.4.3. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.4.4. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.4.5. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.4.6. U.S.

7.4.6.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.4.6.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.4.6.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.4.7. Canada

7.4.7.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.4.7.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.4.7.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.4.8. Mexico

7.4.8.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.4.8.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.4.8.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5. Europe

7.5.1. Europe Electronic Adhesives Sales and Growth Rate (2017-2017)

7.5.2. Market Assessment and Forecast, By Country, 2017-2023($Billion)

7.5.3. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.4. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.5. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.6. Germany

7.5.6.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.6.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.6.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.7. France

7.5.7.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.7.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.7.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.8. UK

7.5.8.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.8.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.8.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.9. Italy

7.5.9.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.9.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.9.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.10. Spain

7.5.10.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.10.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.10.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

7.5.11. Rest of Europe

7.5.11.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

7.5.11.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

7.5.11.3. Market Assessment and Forecast, By Form, 2017-2023($Billion)

8. Asia-Pacific

8.1.1. Asia-Pacific Electronic Adhesives Sales and Growth Rate (2017-2017)

8.1.2. Market Assessment and Forecast, By Country, 2017-2023($Billion)

8.1.3. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.4. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.5. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.5.1. Japan

8.1.5.2. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.5.3. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.5.4. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.6. China

8.1.6.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.6.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.6.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.7. Australia

8.1.7.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.7.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.7.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.8. India

8.1.8.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.8.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.8.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.9. South Korea

8.1.9.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.9.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.9.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

8.1.10. Rest of Asia-Pacific

8.1.10.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

8.1.10.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

8.1.10.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9. Rest of the World

9.1.1. Rest of the World Electronic Adhesives Sales and Growth Rate (2017-2017)

9.1.2. Market Assessment and Forecast, By Country, 2017-2023($Billion)

9.1.3. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.4. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.5. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.6. Brazil

9.1.6.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.6.2. Market Assessment and Forecast, By Application , 2017-2023($Billion)

9.1.6.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.7. Turkey

9.1.7.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.7.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

9.1.7.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.8. Saudi Arabia

9.1.8.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.8.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

9.1.8.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.9. South Africa

9.1.9.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.9.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

9.1.9.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.10. United Arab Emirates

9.1.10.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.10.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

9.1.10.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

9.1.11. Others

9.1.11.1. Market Assessment and Forecast, By Type, 2017-2023($Billion)

9.1.11.2. Market Assessment and Forecast, By Application, 2017-2023($Billion)

9.1.11.3. Market Assessment and Forecast, By Form,2017-2023($Billion)

10. Company Profiles

10.1. Alent PLC

10.1.1. Business Overview

10.1.2. Product Portfolio

10.1.3. Strategic Developments

10.1.4. Electronic Adhesives Sales, Revenue and Market Share

10.2. BASF SE

10.2.1. Business Overview

10.2.2. Product Portfolio

10.2.3. Strategic Developments

10.2.4. Electronic Adhesives Sales, Revenue and Market Share

10.3. The Dow Chemical Co.

10.3.1. Business Overview

10.3.2. Product Portfolio

10.3.3. Strategic Developments

10.3.4. Electronic Adhesives Sales, Revenue and Market Share

10.4. H.B. Fuller

10.4.1. Business Overview

10.4.2. Product Portfolio

10.4.3. Strategic Developments

10.4.4. Electronic Adhesives Sales, Revenue and Market Share

10.5. Henkel AG & Co. KGAA

10.5.1. Business Overview

10.5.2. Product Portfolio

10.5.3. Strategic Developments

10.5.4. Electronic Adhesives Sales, Revenue and Market Share

10.6. Indium Corporation

10.6.1. Business Overview

10.6.2. Product Portfolio

10.6.3. Strategic Developments

10.6.4. Electronic Adhesives Sales, Revenue and Market Share

10.7. Kyocera Chemical Corporation

10.7.1. Business Overview

10.7.2. Product Portfolio

10.7.3. Strategic Developments

10.7.4. Electronic Adhesives Sales, Revenue and Market Share

10.8. LG Chemical Limited

10.8.1. Business Overview

10.8.2. Product Portfolio

10.8.3. Strategic Developments

10.8.4. Electronic Adhesives Sales, Revenue and Market Share

10.9. Mitsui Chemicals, Inc.

10.9.1. Business Overview

10.9.2. Product Portfolio

10.9.3. Strategic Developments

10.9.4. Electronic Adhesives Sales, Revenue and Market Share

10.10.The 3M Company

10.10.1. Business Overview

10.10.2. Product Portfolio

10.10.3. Strategic Developments

10.10.4. Electronic Adhesives Sales, Revenue and Market Share

11. Global Electronic Adhesives Market Competition, by Manufacturer

11.1. Global Electronic Adhesives Sales and Market Share by Manufacturer (2017-2017)

11.2. Global Electronic Adhesives Revenue and Market Share by Manufacturer (2017-2017)

11.3. Top 5 Electronic Adhesives Manufacturer Market Share

11.4. Market Competition Trend

List of Tables

You can glance through the list of Tables and Figures when you view the sample copy of Electronic Adhesives Market.

Research Methodology

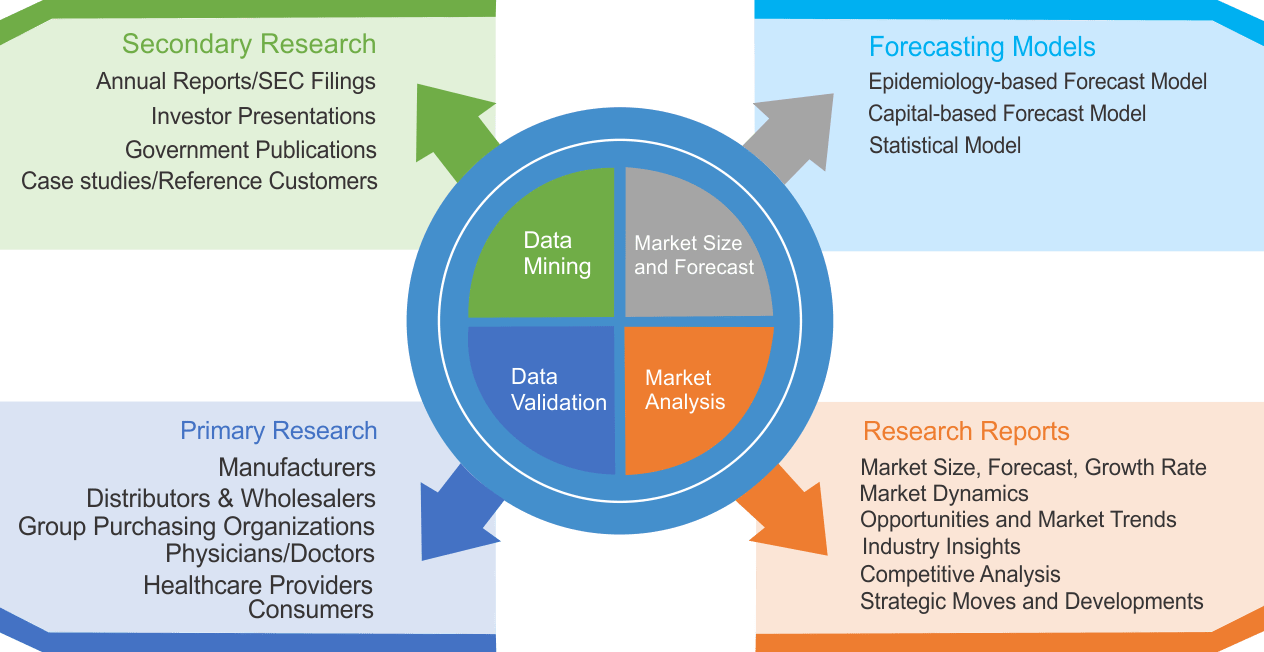

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|