.png)

ENT and Bronchoscopy Devices Market by Product and End User - Global Industry Analysis and Forecast To 2027

Published On : August 2017 Pages : 107 Category: Medical Devices Report Code : HC08188

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global ENT and bronchoscopy devices market is expected to be around $30 billion by 2027. This can be primarily attributed to number of factors such growing incidences of ENT disorders, rapidly increasing geriatric population, and growing awareness related to availability of treatment devices. Disorders related to the ear such as hearing loss constitute a considerable share of ENT disorders. According to the National Institute of Deafness and Other Communication Disorders (NIDCD), 2 to 3 among every 1,000 children in the U.S. are born with detectable level of hearing impairment in one or both ears. Hearing aids and hearing implants are used to treat the hearing impaired patients. While hearing aids amplify the incoming sound, implants transform sound into electrical signals that stimulate the patient’s auditory nerve.

Product Type Outlook and Trend Analysis

On the basis of product type, the hearing care devices market accounted for the largest share of the global ENT and bronchoscopy in 2017 and is expected to lead the market throughout the forecast period. This is primarily attributed to the growing prevalence of hearing disorders and development of innovative hearing devices.

End User Outlook and Trend Analysis

Hospitals and clinics segment dominated the global market for ENT and bronchoscopy devices in 2017 due to large number of ENT related surgeries performed in the hospitals. This segment accounted for almost half of the overall market in 2017 and will continue to lead the market during the forecast period.

Regional Outlook and Trend Analysis

North America accounted for a majority share of the global ENT and bronchoscopy devices market in 2017 owing to presence of advanced healthcare infrastructure along with favorable reimbursement policies for ENT surgeries in the region. The Asia-Pacific ENT and bronchoscopy devices market is projected to exhibit significant growth during the forecast period due to increasing healthcare expenditure in countries such as China and India along with increased awareness related to the advantages of ENT devices.

Competitive Insights

Development of technologically advanced ENT devices is the key strategy adopted by these players. For instance, in September 2017, Med-El obtained FDA approval for its SYNCHRONY EAS (Electrical Acoustic Stimulation) hearing implant system. This system is a combination of two technologies viz. the Synchrony cochlear implant technology, which is used to stimulate the auditory nerve in high frequency hearing loss, and the SONNET EAS audio processor, which has built-in acoustic amplification used for low frequency hearing loss.

Some of the key players in this market are, Starkey Hearing Technologies, Smith & Nephew PLC, Olympus Corporation, Karl Storz Gmbh & Co. Kg, Hoya Corporation (Pentax Medical), Sivantos Pte. Ltd., Medtronic PLC, Oticon Medical, Endoservice, Maxer Endoscopy, Sopro-Comeg (Acteon Group), William Demant Holding A/S, Entellus Medical, Inc., Johnson & Johnson (Acclarent, Inc.), Sonova Holding AG, MED-EL, OPTOMIC ESPANA S.A., IntriCon Corporation, GN Store Nord A/S, and Cochlear Limited.

Market Opportunities

Technological advancements in ENT diagnostic and surgical devices will offer lucrative growth opportunities for the manufacturers. Latest developments in minimally invasive Trans-Oral Robotic Surgeries (TORS) are highly effective as recovery time for patients undergoing such surgeries is considerably reduced. In these surgeries, surgeons use computer enhanced, sophisticated systems to remove oral cancers assisted by an enhanced view of the existing cancer and the surrounding tissue.

ENT and Bronchoscopy Devices Market Segmentation:

By Product:

- Endoscopes

- Flexible Endoscopes

- Nasopharyngoscopes

- Pharyngoscopes

- Rhinoscopes

- Laryngoscopes

- Rigid Endoscopes

- Sinuscopes

- Otoscopes

- Bronchoscopes

- Hearing Screening Devices

- Surgical ENT & Bronchoscopy Devices

- Radiofrequency Devices

- Powered Surgical Instruments

- Handheld Instruments

- Otology Instruments

- Rhinology Instruments

- Head & Neck Surgical Instruments

- Laryngeal Instruments

- Other Handheld Instruments

- Image-Guided Surgery Systems

- Balloon Sinus Dilation Devices

- ENT Lasers

- Nasal Stents

- Bronchial/Tracheal Stents

- Ear Tubes

- Hearing Care Devices

- Hearing Implants

- Middle Ear Implants

- Bone-Anchored Hearing Systems (BAHS)

- Cochlear Implants

- Auditory Brainstem Implants

- Hearing Aids

- Canal Hearing Aids

- Behind-the-Ear (BTE) Aids

- Receiver-in-the-Ear (RITE)

- In-the-Ear Aids

By End User:

- Ambulatory Surgical Centers (ASCs)

- Home Use

- Hospitals & Clinics

By Region:

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- ENT and Bronchoscopy Devices Market, By Product, Estimates and Forecast, 2017-2027 ($Million)

- Endoscopes

- Flexible Endoscopes

- Nasopharyngoscopes

- Pharyngoscopes

- Rhinoscopes

- Laryngoscopes

- Rigid Endoscopes

- Sinuscopes

- Otoscopes

- Bronchoscopes

- Hearing Screening Devices

- Surgical ENT & Bronchoscopy Devices

- Radiofrequency Devices

- Powered Surgical Instruments

- Handheld Instruments

- Otology Instruments

- Rhinology Instruments

- Head & Neck Surgical Instruments

- Laryngeal Instruments

- Other Handheld Instruments

- Image-Guided Surgery Systems

- Balloon Sinus Dilation Devices

- ENT Lasers

- Nasal Stents

- Bronchial/Tracheal Stents

- Ear Tubes

- Hearing Care Devices

- Hearing Implants

- Middle Ear Implants

- Bone-Anchored Hearing Systems (BAHS)

- Cochlear Implants

- Auditory Brainstem Implants

- Hearing Aids

- Canal Hearing Aids

- Behind-the-Ear (BTE) Aids

- Receiver-in-the-Ear (RITE)

- In-the-Ear Aids

- ENT and Bronchoscopy Devices Market, By End User, Estimates and Forecast, 2017-2027 ($Million)

- Ambulatory Surgical Centers (ASCs)

- Home Use

- Hospitals & Clinics

- ENT and Bronchoscopy Devices Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

- North America

- North America ENT and Bronchoscopy Devices Market, By Country

- North America ENT and Bronchoscopy Devices Market, By Product

- North America ENT and Bronchoscopy Devices Market ,By End User

- U.S. ENT and Bronchoscopy Devices Market, By Product

- U.S. ENT and Bronchoscopy Devices Market, By End User

- Canada ENT and Bronchoscopy Devices Market, By Product

- Canada ENT and Bronchoscopy Devices Market, By End User

- Mexico ENT and Bronchoscopy Devices Market, By Product

- Mexico ENT and Bronchoscopy Devices Market, By End User

-

- Europe

- Europe ENT and Bronchoscopy Devices Market, By Country

- Europe ENT and Bronchoscopy Devices Market, By Product

- Europe ENT and Bronchoscopy Devices Market, By End User

- Germany ENT and Bronchoscopy Devices Market, By Product

- Germany ENT and Bronchoscopy Devices Market, By End User

- France ENT and Bronchoscopy Devices Market, By Product

- France ENT and Bronchoscopy Devices Market, By End User

- UK ENT and Bronchoscopy Devices Market, By Product

- UK ENT and Bronchoscopy Devices Market, By End User

- Italy ENT and Bronchoscopy Devices Market, By Product

- Italy ENT and Bronchoscopy Devices Market, By End User

- Spain ENT and Bronchoscopy Devices Market, By Product

- Spain ENT and Bronchoscopy Devices Market, By End User

- Rest of Europe ENT and Bronchoscopy Devices Market, By Product

- Rest of Europe ENT and Bronchoscopy Devices Market, By End User

- Europe

-

- Asia-Pacific

- Asia-Pacific ENT and Bronchoscopy Devices Market, By Country

- Asia-Pacific ENT and Bronchoscopy Devices Market, By Product

- Asia-Pacific 3D ENT and Bronchoscopy Devices Market, By End User

- Japan ENT and Bronchoscopy Devices Market, By Product

- Japan ENT and Bronchoscopy Devices Market, By End User

- China ENT and Bronchoscopy Devices Market, By Product

- China ENT and Bronchoscopy Devices Market, By End User

- Australia ENT and Bronchoscopy Devices Market, By Product

- Australia ENT and Bronchoscopy Devices Market, By End User

- India ENT and Bronchoscopy Devices Market, By Product

- India ENT and Bronchoscopy Devices Market, By End User

- South Korea ENT and Bronchoscopy Devices Market, By Product

- South Korea ENT and Bronchoscopy Devices Market, By End User

- Rest of Asia-Pacific ENT and Bronchoscopy Devices Market, By Product

- Rest of Asia-Pacific ENT and Bronchoscopy Devices Market, By End User

- Asia-Pacific

-

- Rest of the World

- Rest of the World ENT and Bronchoscopy Devices Market, By Country

- Rest of the World ENT and Bronchoscopy Devices Market, By Product

- Rest of the World ENT and Bronchoscopy Devices Market ,By End User

- Brazil ENT and Bronchoscopy Devices Market, By Product

- Brazil ENT and Bronchoscopy Devices Market, By End User

- South Africa ENT and Bronchoscopy Devices Market, By Product

- South Africa ENT and Bronchoscopy Devices Market, By End User

- Saudi Arabia ENT and Bronchoscopy Devices Market, By Product

- Saudi Arabia ENT and Bronchoscopy Devices Market, By End User

- Turkey ENT and Bronchoscopy Devices Market, By Product

- Turkey ENT and Bronchoscopy Devices Market, By End User

- United Arab Emirates ENT and Bronchoscopy Devices Market, By Product

- United Arab Emirates ENT and Bronchoscopy Devices Market, By End User

- Other ENT and Bronchoscopy Devices Market, By Product

- Other ENT and Bronchoscopy Devices Market, By End User

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growing Incidences of ENT Disorders

3.2.1.2. Rapidly Increasing Geriatric Population

3.2.1.3. Growing Awareness related to Availability of Treatment Devices

3.2.2. Restraints

3.2.2.1. Unfavorable Reimbursement Policies for Hearing Aids

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. ENT and Bronchoscopy Devices Market, By Product

4.1. Introduction

4.2. ENT and Bronchoscopy Devices Market Assessment and Forecast, By Product, 2017-2027

4.3. Endoscopes

4.3.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3. Flexible Endoscopes

4.3.3.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.3.3.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3.2.1. Nasopharyngoscopes

4.3.3.2.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3.2.2. Pharyngoscopes

4.3.3.2.2.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3.2.3. Rhinoscopes

4.3.3.2.3.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.3.2.4. Laryngoscopes

4.3.3.2.4.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.4. Rigid Endoscopes

4.3.4.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.3.4.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.4.2.1. Sinuscopes

4.3.4.2.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.4.2.2. Otoscopes

4.3.4.2.2.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.5. Bronchoscopes

4.3.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.3.6. Hearing Screening Devices

4.3.6.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4. Surgical ENT & Bronchoscopy Devices

4.4.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.3. Radiofrequency Devices

4.4.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.4. Powered Surgical Instruments

4.4.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5. Handheld Instruments

4.4.5.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.4.5.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5.2.1. Otology Instruments

4.4.5.2.1.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5.2.2. Rhinology Instruments

4.4.5.2.2.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5.2.3. Head & Neck Surgical Instruments

4.4.5.2.3.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5.2.4. Laryngeal Instruments

4.4.5.2.4.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.5.2.5. Other Handheld Instruments

4.4.5.2.5.1.Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.6. Image-Guided Surgery Systems

4.4.6.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.7. Balloon Sinus Dilation Devices

4.4.7.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.8. ENT Lasers

4.4.8.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.9. Nasal Stents

4.4.9.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.10. Bronchial/Tracheal Stents

4.4.10.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.4.11. Ear Tubes

4.4.11.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5. Hearing Care Devices

4.5.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.5.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3. Hearing Implants

4.5.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3.2. Middle Ear Implants

4.5.3.2.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3.3. Bone-Anchored Hearing Systems (BAHS)

4.5.3.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3.4. Cochlear Implants

4.5.3.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.3.5. Auditory Brainstem Implants

4.5.3.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.4. Hearing Aids

4.5.4.1. Market Assessment and Forecast, By Type, 2017-2027 ($Million)

4.5.4.2. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.4.3. Canal Hearing Aids

4.5.4.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.4.4. Behind-the-Ear (BTE) Aids

4.5.4.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.4.5. Receiver-in-the-Ear (RITE)

4.5.4.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

4.5.4.6. In-the-Ear Aids

4.5.4.6.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5. ENT and Bronchoscopy Devices Market, By End User

5.1. Introduction

5.2. ENT and Bronchoscopy Devices Market Assessment and Forecast, By End User, 2017-2027

5.3. Ambulatory Surgical Centers (ASCs)

5.3.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.4. Home Use

5.4.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

5.5. Hospitals & Clinics

5.5.1. Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6. ENT and Bronchoscopy Devices Market, By Region

6.1. Introduction

6.2. ENT and Bronchoscopy Devices Market Assessment and Forecast, By Region, 2017-2027 ($Million)

6.3. North America

6.3.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.3.2. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.3.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.1. U.S.

6.3.3.1.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.3.3.1.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.2. Canada

6.3.3.2.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.3.3.2.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.3.3.3. Mexico

6.3.3.3.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.3.3.3.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4. Europe

6.4.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.4.2. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.1. Germany

6.4.3.1.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.1.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.2. France

6.4.3.2.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.2.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.3. UK

6.4.3.3.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.3.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.4. Italy

6.4.3.4.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.4.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.5. Spain

6.4.3.5.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.5.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.6. Russia

6.4.3.6.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.6.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.4.3.7. Rest of Europe

6.4.3.7.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.4.3.7.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5. Asia-Pacific

6.5.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.5.2. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.1. Japan

6.5.3.1.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.1.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.2. China

6.5.3.2.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.2.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.3. Australia

6.5.3.3.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.3.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.4. India

6.5.3.4.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.4.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.5. South Korea

6.5.3.5.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.5.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.6. Taiwan

6.5.3.6.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.6.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.5.3.7. Rest of Asia-Pacific

6.5.3.7.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.5.3.7.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6. Rest of the World

6.6.1. Market Assessment and Forecast, By Country, 2017-2027 ($Million)

6.6.2. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.1. Brazil

6.6.3.1.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.1.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.2. Turkey

6.6.3.2.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.2.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.3. Saudi Arabia

6.6.3.3.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.3.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.4. South Africa

6.6.3.4.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.4.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.5. United Arab Emirates

6.6.3.5.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.5.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

6.6.3.6. Others

6.6.3.6.1. Market Assessment and Forecast, By Product, 2017-2027 ($Million)

6.6.3.6.2. Market Assessment and Forecast, By End User, 2017-2027 ($Million)

7. Company Profiles

7.1. Starkey Hearing Technologies

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.2. Smith & Nephew plc

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.3. Olympus Corporation

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.4. Karl Storz Gmbh & Co. Kg

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Strategic Developments

7.5. Hoya Corporation (Pentax Medical)

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.6. Sivantos Pte. Ltd.

1.1.4. Business Overview

1.1.5. Product Portfolio

1.1.6. Strategic Developments

7.7. William Demant Holding A/S

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.8. Entellus Medical, Inc.

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.9. Johnson & Johnson (Acclarent, Inc.)

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.10. Sonova Holding AG

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.11. MED-EL

1.1.7. Business Overview

1.1.8. Product Portfolio

1.1.9. Strategic Developments

7.12. OPTOMIC ESPANA S.A.

1.1.10. Business Overview

1.1.11. Product Portfolio

1.1.12. Strategic Developments

7.13. IntriCon Corporation

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.14. GN Store Nord A/S

1.1.1. Business Overview

1.1.2. Product Portfolio

1.1.3. Key Financials

1.1.4. Strategic Developments

7.15. Cochlear Limited

1.1.13. Business Overview

1.1.14. Product Portfolio

1.1.15. Key Financials

1.1.16. Strategic Developments

7.16. Medtronic PLC

1.1.17. Business Overview

1.1.18. Product Portfolio

1.1.19. Key Financials

1.1.20. Strategic Developments

7.17. Oticon Medical

1.1.21. Business Overview

1.1.22. Product Portfolio

1.1.23. Key Financials

1.1.24. Strategic Developments

7.18. Endoservice

1.1.25. Business Overview

1.1.26. Product Portfolio

1.1.27. Key Financials

1.1.28. Strategic Developments

7.19. Maxer Endoscopy

1.1.29. Business Overview

1.1.30. Product Portfolio

1.1.31. Key Financials

1.1.32. Strategic Developments

7.20. Sopro Conmeg (Acteon Group)

1.1.33. Business Overview

1.1.34. Product Portfolio

1.1.35. Key Financials

1.1.36. Strategic Developments

List of Tables

Table 1.ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 1.Endoscopes Market, By Type, 2017-2025 ($Million)

Table 1.Flexible Endoscopes Market, By Type, 2017-2025 ($Million)

Table 1.Nasopharyngoscopes Market, By Region, 2017-2025 ($Million)

Table 2.Pharyngoscopes Market, By Region, 2017-2025 ($Million)

Table 3.Rhinoscopes Market, By Region, 2017-2025 ($Million)

Table 4.Laryngoscopes Market, By Region, 2017-2025 ($Million)

Table 5.Endoscopes Market, By Region, 2017-2025 ($Million)

Table 6.Rigid Endoscopes Market, By Type, 2017-2025 ($Million)

Table 7.Sinuscopes Market, By Region, 2017-2025 ($Million)

Table 8.Otoscopes Market, By Region, 2017-2025 ($Million)

Table 9.Rigid Endoscopes Market, By Region, 2017-2025 ($Million)

Table 10.Bronchoscopes Market, By Region, 2017-2025 ($Million)

Table 11.Hearing Screening Devices Market, By Region, 2017-2025 ($Million)

Table 12.Surgical ENT & Bronchoscopy Devices Market, By Type, 2017-2025 ($Million)

Table 13.Radiofrequency Devices Market, By Region, 2017-2025 ($Million)

Table 14.Powered Surgical Instruments Market, By Region, 2017-2025 ($Million)

Table 15.Handheld Instruments Market, By Region, 2017-2025 ($Million)

Table 16.Image-Guided Surgery Systems Market, By Region, 2017-2025 ($Million)

Table 17.Balloon Sinus Dilation Devices Market, By Region, 2017-2025 ($Million)

Table 18.ENT Lasers Market, By Region, 2017-2025 ($Million)

Table 19.Nasal Stents Market, By Region, 2017-2025 ($Million)

Table 20.Bronchial/Tracheal Stents Market, By Region, 2017-2025 ($Million)

Table 21.Ear Tubes Market, By Region, 2017-2025 ($Million)

Table 22.Surgical ENT & Bronchoscopy Devices Market, By Region, 2017-2025 ($Million)

Table 23.Hearing Care Devices Market, By Type, 2017-2025 ($Million)

Table 24.Hearing Implants Market, By Type, 2017-2025 ($Million)

Table 25.Middle Ear Implants Market, By Region, 2017-2025 ($Million)

Table 26.Bone-Anchored Hearing Systems (BAHS) Market, By Region, 2017-2025 ($Million)

Table 27.Cochlear Implants Market, By Region, 2017-2025 ($Million)

Table 28.Auditory Brainstem Implants Market, By Region, 2017-2025 ($Million)

Table 29.Hearing Implants Market, By Region, 2017-2025 ($Million)

Table 30.Hearing Care Devices Market, By Region, 2017-2025 ($Million)

Table 31.Hearing Aids Market, By Type, 2017-2025 ($Million)

Table 32.Canal Hearing Aids Market, By Region, 2017-2025 ($Million)

Table 33.Behind-the-Ear (BTE) Aids Market, By Region, 2017-2025 ($Million)

Table 34.Receiver-in-the-Ear (RITE) Market, By Region, 2017-2025 ($Million)

Table 35.In-the-Ear Aids Market, By Region, 2017-2025 ($Million)

Table 36.Hearing Aids Market, By Region, 2017-2025 ($Million)

Table 37.ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 38.ENT and Bronchoscopy Devices for ASCs Market, By Region, 2017-2025 ($Million)

Table 39.ENT and Bronchoscopy Devices for Home Use Market, By Region, 2017-2025 ($Million)

Table 40.ENT and Bronchoscopy Devices for Hospitals & Clinics Market, By Region, 2017-2025 ($Million)

Table 41.ENT and Bronchoscopy Devices Market, By Region, 2017-2025 ($Million)

Table 42.NorthAmerica ENT and Bronchoscopy Devices Market, By Country, 2017-2025 ($Million)

Table 43.North America ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 44.North America ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 45.U.S. ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 46.U.S. ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 47.Canada ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 48.Canada ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 49.Mexico ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 50.Mexico ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 51.Europe ENT and Bronchoscopy Devices Market, By Country, 2017-2025 ($Million)

Table 52.Europe ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 53.Europe ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 54.Germany ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 55.Germany ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 56.France ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 57.France ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 58.UK ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 59.UK ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 60.Italy ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 61.Italy ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 62.Spain ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 63.Spain ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 64.Russia ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 65.Russia ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 66.Rest of Europe ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 67.Rest of Europe ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 68.Asia-Pacific Diabetes Devices Market, By Country, 2017-2025 ($Million)

Table 69.Asia-Pacific ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 70.Asia-Pacific ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 71.Japan ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 72.Japan ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 73.China ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 74.China ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 75.Australia ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 76.Australia ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 77.India ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 78.India ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 79.South Korea ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 80.South Korea ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 81.Rest of Asia-Pacific ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 82.Rest of Asia-Pacific ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 83.Rest of the World ENT and Bronchoscopy Devices Market, By Country, 2017-2025 ($Million)

Table 84.Rest of the World ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 85.Rest of the World ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 86.Brazil ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 87.Brazil ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 88.Turkey ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 89.Turkey ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 90.Saudi Arabia ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 91.Saudi Arabia ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 92.South Africa ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 93.South Africa ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 94.United Arab Emirates ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 95.United Arab Emirates ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 96.Other ENT and Bronchoscopy Devices Market, By Product, 2017-2025 ($Million)

Table 97.Other ENT and Bronchoscopy Devices Market, By End User, 2017-2025 ($Million)

Table 98.Starkey Hearing Technologies: Key Strategic Developments, 2017-2017

Table 99.Smith & Nephew plc: Key Strategic Developments, 2017-2017

Table 100.Olympus Corporation: Key Strategic Developments, 2017-2017

Table 101.Karl Storz Gmbh & Co. Kg: Key Strategic Developments, 2017-2017

Table 103.Hoya Corporation: Key Strategic Developments, 2017-2017

Table 104.Sivantos Pte. Ltd.: Key Strategic Developments, 2017-2017

Table 105.William Demant Holding A/S: Key Strategic Developments, 2017-2017

Table 106.Entellus Medical, Inc.: Key Strategic Developments, 2017-2017

Table 107.Johnson & Johnson: Key Strategic Developments, 2017-2017

Table 108.Sonova Holding AG: Key Strategic Developments, 2017-2017

Table 109.MED-EL: Key Strategic Developments, 2017-2017

Table 110.OPTOMIC ESPANA S.A.: Key Strategic Developments, 2017-2017

Table 111.IntriCon Corporation: Key Strategic Developments, 2017-2017

Table 112.GN Store Nord A/S: Key Strategic Developments, 2017-2017

Table 113.Cochlear Limited: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.ENT and Bronchoscopy Devices Market, By Product, 2017 & 2025 ($Million)

Figure 2.ENT and Bronchoscopy Devices Market, By End User, 2017 & 2025 ($Million)

Figure 3.ENT and Bronchoscopy Devices Market, By Region, 2017 & 2025 ($Million)

Figure 4.Starkey Hearing Technologies: Net Revenues, 2017-2017 ($Million)

Figure 5.Starkey Hearing Technologies: Net Revenue Share, By Segment, 2017

Figure 6.Starkey Hearing Technologies: Net Revenue Share, By Geography, 2017

Figure 7.Smith & Nephew plc: Net Revenues, 2017-2017 ($Million)

Figure 8.Smith & Nephew plc: Net Revenue Share, By Segment, 2017

Figure 9.Smith & Nephew plc: Net Revenue Share, By Geography, 2017

Figure 10.Olympus Corporation: Net Revenues, 2017-2017 ($Million)

Figure 11.Olympus Corporation: Net Revenue Share, By Segment, 2017

Figure 12.Olympus Corporation: Net Revenue Share, By Geography, 2017

Figure 13.Hoya Corporation: Net Revenues, 2017-2017 ($Million)

Figure 14.Hoya Corporation: Net Revenue Share, By Segment, 2017

Figure 15.Hoya Corporation: Net Revenue Share, By Geography, 2017

Figure 16.William Demant Holding A/S: Net Revenues, 2017-2017 ($Million)

Figure 17.William Demant Holding A/S: Net Revenue Share, By Segment, 2017

Figure 18.William Demant Holding A/S: Net Revenue Share, By Geography, 2017

Figure 19.Entellus Medical, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 20.Entellus Medical, Inc.: Net Revenue Share, By Segment, 2017

Figure 21.Entellus Medical, Inc.: Net Revenue Share, By Geography, 2017

Figure 22.Johnson & Johnson: Net Revenues, 2017-2017 ($Million)

Figure 23.Johnson & Johnson: Net Revenue Share, By Segment, 2017

Figure 24.Johnson & Johnson: Net Revenue Share, By Geography, 2017

Figure 25.Sonova Holding AG: Net Revenues, 2017-2017 ($Million)

Figure 26.Sonova Holding AG: Net Revenue Share, By Segment, 2017

Figure 27.Sonova Holding AG: Net Revenue Share, By Geography, 2017

Figure 28.IntriCon Corporation: Net Revenues, 2017-2017 ($Million)

Figure 29.IntriCon Corporation: Net Revenue Share, By Segment, 2017

Figure 30.IntriCon Corporation: Net Revenue Share, By Geography, 2017

Figure 31.GN Store Nord A/S: Net Revenues, 2017-2017 ($Million)

Figure 32.GN Store Nord A/S: Net Revenue Share, By Segment, 2017

Figure 33.GN Store Nord A/S: Net Revenue Share, By Geography, 2017

Figure 34.Cochlear Limited: Net Revenues, 2017-2017 ($Million)

Figure 35.Cochlear Limited: Net Revenue Share, By Segment, 2017

Figure 36.Cochlear Limited: Net Revenue Share, By Geography, 2017

Research Methodology

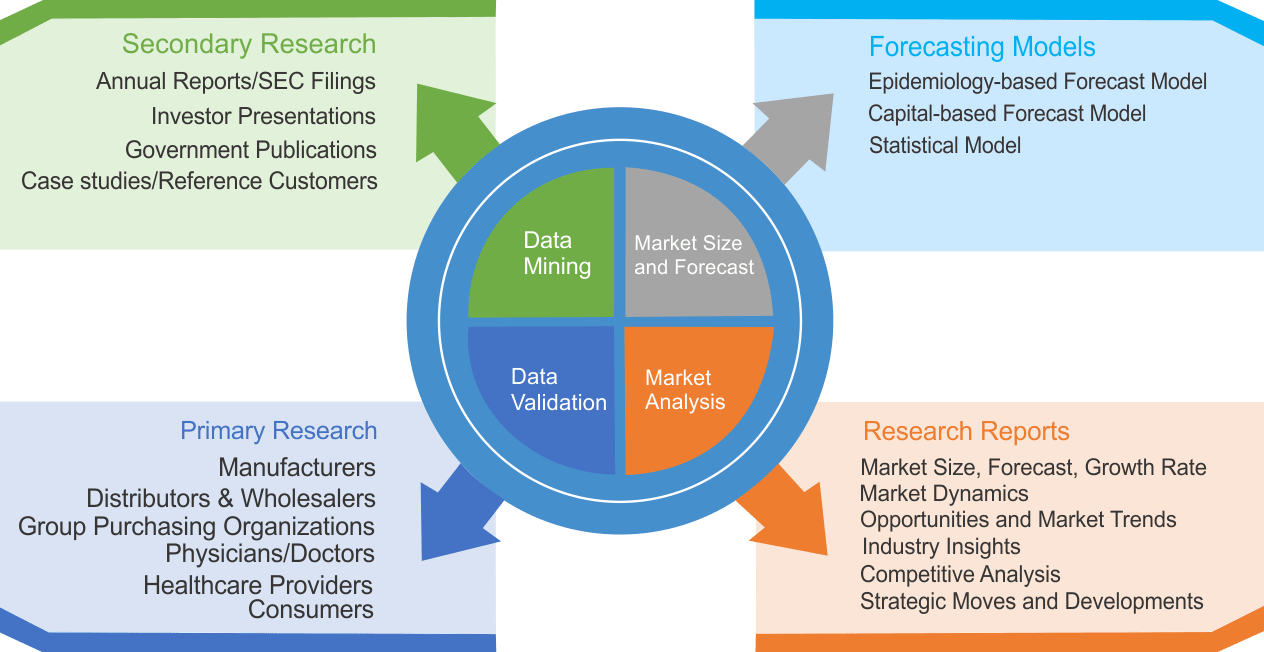

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|