.png)

Geotextiles Market by Material, Product and Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 97 Category: Advanced Materials Report Code : CM11315

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

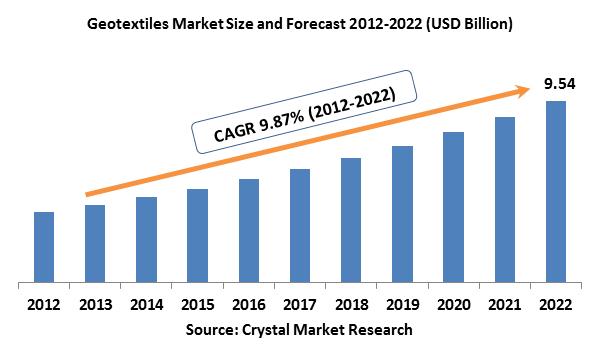

The global Geotextiles market was worth USD billion in the year of 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The market is probably going to watch development over the conjecture time frame attributable to its expanding requirement in anticipating drainage applications and soil erosion. Essential functions performed by the item incorporate protection, separation, reinforcement, filtration, and drainage. Filtration property of geotextiles enables water and different liquids to pass while the texture holds diverse particles. The pore opening, penetrability and structure of geotextiles have an imperative influence in playing out this capacity. Filtration work is generally pertinent to drainage systems. Support utilizing the product gives a synergistic enhancement in the soil system. Reinforcement is utilized to enhance the basic dependability of the soil by virtue of the elasticity of the geotextile fabric. Geotextiles have picked up notoriety in the market because of execution and useful favorable circumstances over different materials. Developing urbanization, rising populace coupled expanding government venture for infrastructure improvement in different locales is anticipated to positively affect the market throughout the following years. Distinctive applications require the item with reasonable life expectancies, for instance, road construction needs geotextiles having a life expectancy of over two or three decades. Conflictingly, the application of soil erosion requires an item which will last more and is bio-degradable. Increasing road construction is Asia Pacific, and Latin America is anticipated to fuel industry development over the figure time frame. Factors responsible for the support of various government bodies incorporate expanding work in the manufacturing segment, application, and enhanced natural conditions. Cost-viability and longer life expectancy in examination with different sorts of materials combined with rising condition concern are anticipated to build item requirement throughout the following years.

Application Outlook and Trend Analysis

The biggest application segment in 2017 was road construction with a share of 40 percent of the market. Geotextiles are progressively utilized as a part of the road construction industry because of the developing attention to the advantages they provide. Geotextiles are utilized as a part of the establishment in laying roads, as they help in fortifying soil by holding it together, therefore bringing about a more drawn out life expectancy of roads. Geotextiles have appeal in creating nations, for example, China, Russia, and India among others, due to the solid infrastructural improvement in these nations. Erosion control represented more than % of the worldwide product market. Erosion caused by natural disasters, for example, floods and tsunamis or because of the infringement of water on riverbanks and extreme rainfall is representing a huge danger all around. Geotextiles assist in holding down the soil and encourage vegetation development. The utilization of geotextile plays a noteworthy part in erosion control and helps alleviate soil erosion. Utilization of the product in applications like drainage is anticipated to develop at a direct pace throughout the following years. Geotextiles utilized for drainages go about as a porous isolating specialist that enables water to go into the drainage. These fabrics likewise assist to eliminate clogging of the drainage system by different materials and soil particles from water. Drainage geotextiles are majorly utilized as a part of created locales of Europe and North America to enhance the effectiveness of waste frameworks and increment their life expectancy. Additionally, product requirement in rising economies is relied upon to foresee significant development by virtue of the infrastructural advancement that incorporates drainage system improvement, which is anticipated to positively affect the business throughout the following years.

Product Outlook and Trend Analysis

In 2017 non-woven geotextiles ruled the market of geotextile with more than % of aggregate market volume attributable to their one of a kind properties, for example, mechanical strength, absorbency, and liquid repellency. Furthermore, the production of non-woven is managed without transformation of fabric into yarn. It spares production, and the greater part of the market players like to keep nonwoven items as a feature of their item portfolio. Woven geotextiles involve more than % of the worldwide offer and are required to witness substantial development throughout the following years. The item is progressively utilized in erosion control applications by virtue of properties including excellent hydro-filtration characteristics and high tensile strength. The capacity of woven geotextiles to filter particles and drain water combined with soil fortification which encourages vegetation development is relied upon to help its demand throughout the following years.

Material Outlook and Trend Analysis

The two sorts of crude materials utilized for geotextile fabricating are synthetic and natural. More than % of the geotextiles made overall utilize engineered strands as a raw material. The change in costs of these crude materials directly affects the cost of the item. Natural fibers are acquired from raw materials, for example, sisal and jute. Synthetic strands are composed of polyamide, polyethylene, polyester, and polypropylene. In 2017 Polypropylene contained more than % of the worldwide volume and is broadly utilized by virtue of their high accessibility. The vast majority of the geotextiles utilized in road construction are made out of polypropylene inferable from their more drawn out life expectancy rather than different materials.

Regional Outlook and Trend Analysis

In 2017 Asia pacific was the largest market as it contributed for more than 40 percent of the market. This pattern is anticipated to continue over the estimate tie frame due to increasing government spending for the enhancement of infrastructure particularly in emerging countries like India and China. New infrastructural improvements in different emerging nations in Latin America including the usage of Growth Acceleration Program (PAC) by Brazilian Government to pull in investments are relied upon to fuel industry development. Thus, around 12,000 infrastructural ventures have been utilitarian in Brazil, which will fuel non-woven geotextile interest for use in soil reinforcement, drainage and filtration solutions. On-going ventures identified with scene reclamation in different developed nations including United States and Japan are relied upon to expand utilization of geotextiles throughout the following years. The item is utilized in ventures in different parts of the world, for example, the change of wastewater impoundment into Qingjing Lake situated in Singapore. These components are relied upon to positively affect the business over the conjecture time frame.

Competitive Insights

Worldwide geotextile market share is divided. A portion of the organizations working in the market incorporate Typar, TENAX, GSE, Fibertex Nonwovens, HUESKER Synthetic GmbH, , and Royal Koninklijke Ten Cate NV which take into account residential and local market. Organizations are centering in business extension crosswise over rising locales alongside setting up new plant for expanding generation limit.

The global geotextile market is segmented as follows-

By Material:

- Synthetic

- Polypropylene

- Polyethylene

- Polyester

- Natural

- Coir

- Jute

By Product:

- Woven

- Non-woven

- Knitted

By Application:

- Drainage

- Railroad

- Agriculture

- Road construction

- Erosion control

- Pavement repair

- Other Applications

By Region:

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- Geotextiles Market, By Material, Estimates and Forecast, 2012-2022 ($Million)

- Synthetic

- Polypropylene

- Polyethylene

- Polyester

- Natural

- Coir

- Jute

- Synthetic

- Geotextiles Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Woven

- Non-woven

- Knitted

- Geotextiles Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Drainage

- Railroad

- Agriculture

- Road construction

- Erosion control

- Pavement repair

- Other Applications

- Geotextiles Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Geotextiles Market, By Country

- North America Geotextiles Market, By Material

- North America Geotextiles Market, By Product

- North America Geotextiles Market, By Application

- U.S. Geotextiles Market, By Material

- U.S. Geotextiles Market, By Product

- U.S. Geotextiles Market, By Application

- Canada Geotextiles Market, By Material

- Canada Geotextiles Market, By Product

- Canada Geotextiles Market, By Application

- Mexico Geotextiles Market, By Material

- Mexico Geotextiles Market, By Product

- Mexico Geotextiles Market, By Application

-

- Europe

- Europe Geotextiles Market, By Country

- Europe Geotextiles Market, By Material

- Europe Geotextiles Market, By Product

- Europe Geotextiles Market, By Application

- Germany Geotextiles Market, By Material

- Germany Geotextiles Market, By Product

- Germany Geotextiles Market, By Application

- France Geotextiles Market, By Material

- France Geotextiles Market, By Product

- France Geotextiles Market, By Application

- UK Geotextiles Market, By Material

- UK Geotextiles Market, By Product

- UK Geotextiles Market, By Application

- Italy Geotextiles Market, By Material

- Italy Geotextiles Market, By Product

- Italy Geotextiles Market, By Application

- Spain Geotextiles Market, By Material

- Spain Geotextiles Market, By Product

- Spain Geotextiles Market, By Application

- Rest of Europe Geotextiles Market, By Material

- Rest of Europe Geotextiles Market, By Product

- Rest of Europe Geotextiles Market, By Application

-

- Asia-Pacific

- Asia-Pacific Geotextiles Market, By Country

- Asia-Pacific Geotextiles Market, By Material

- Asia-Pacific Geotextiles Market, By Product

- Asia-Pacific Geotextiles Market, By Application

- Japan Geotextiles Market, By Material

- Japan Geotextiles Market, By Product

- Japan Geotextiles Market, By Application

- China Geotextiles Market, By Material

- China Geotextiles Market, By Product

- China Geotextiles Market, By Application

- Australia Geotextiles Market, By Material

- Australia Geotextiles Market, By Product

- Australia Geotextiles Market, By Application

- India Geotextiles Market, By Material

- India Geotextiles Market, By Product

- India Geotextiles Market, By Application

- South Korea Geotextiles Market, By Material

- South Korea Geotextiles Market, By Product

- South Korea Geotextiles Market, By Application

- Rest of Asia-Pacific Geotextiles Market, By Material

- Rest of Asia-Pacific Geotextiles Market, By Product

- Rest of Asia-Pacific Geotextiles Market, By Application

-

- Rest of the World

- Rest of the World Geotextiles Market, By Country

- Rest of the World Geotextiles Market, By Material

- Rest of the World Geotextiles Market, By Product

- Rest of the World Geotextiles Market, By Application

- Brazil Geotextiles Market, By Material

- Brazil Geotextiles Market, By Product

- Brazil Geotextiles Market, By Application

- South Africa Geotextiles Market, By Material

- South Africa Geotextiles Market, By Product

- South Africa Geotextiles Market, By Application

- Saudi Arabia Geotextiles Market, By Material

- Saudi Arabia Geotextiles Market, By Product

- Saudi Arabia Geotextiles Market, By Application

- Turkey Geotextiles Market, By Material

- Turkey Geotextiles Market, By Product

- Turkey Geotextiles Market, By Application

- United Arab Emirates Geotextiles Market, By Material

- United Arab Emirates Geotextiles Market, By Product

- United Arab Emirates Geotextiles Market, By Application

- Others Geotextiles Market, By Material

- Others Geotextiles Market, By Product

- Others Geotextiles Market, By Application

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Acceptance of Geotextile Applications

3.2.1.2. Supporting Government Policies and Environmental Norms for Commercial Usage

3.2.2. Restraints

3.2.2.1. Lack of Quality Control Across Developing Nations

3.2.3. Opportunities

3.2.3.1. Technological Advancement in Geotextile Industries

4. Geotextiles Market, By Material

4.1. Introduction

4.2. Geotextiles Market Assessment and Forecast, By Material, 2012-2022

4.3. Synthetic

4.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3. Polypropylene

4.3.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4. Polyethylene

4.3.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5. Polyester

4.3.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Natural

4.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.3. Coir

4.4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.4. Jute

4.4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Geotextiles Market, By Product

5.1. Introduction

5.2. Geotextiles Market Assessment and Forecast, By Product, 2012-2022

5.3. Woven

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Non-woven

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Knitted

5.5.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

6. Geotextiles Market, By Application

6.1. Introduction

6.2. Geotextiles Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.3. Drainage

6.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.4. Railroad

6.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.5. Agriculture

6.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.6. Road construction

6.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.7. Erosion control

6.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.8. Pavement repair

6.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6.9. Other Applications

6.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7. Geotextiles Market, By Region

7.1. Introduction

7.2. Geotextiles Market Assessment and Forecast, By Region, 2012-2022 ($Million)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.3.2. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.3.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.1. U.S.

7.3.4.1.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.3.4.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.2. Canada

7.3.4.2.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.3.4.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.3.4.3. Mexico

7.3.4.3.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.3.4.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.3.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.4.2. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.1. Germany

7.4.4.1.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.2. France

7.4.4.2.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.2.2. Market Assessment and Forecast, By Products, 2012-2022 ($Million)

7.4.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.3. UK

7.4.4.3.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.4. Italy

7.4.4.4.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.5. Spain

7.4.4.5.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.4.4.6. Rest of Europe

7.4.4.6.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.4.4.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.4.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5. Asia-Pacific

7.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.5.2. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.1. Japan

7.5.4.1.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.2. China

7.5.4.2.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.3. Australia

7.5.4.3.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.4. India

7.5.4.4.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.5. South Korea

7.5.4.5.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.5.4.6. Rest of Asia-Pacific

7.5.4.6.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.5.4.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.5.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6. Rest of the World

7.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

7.6.2. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.3. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.1. Brazil

7.6.4.1.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.1.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.2. Turkey

7.6.4.2.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.2.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.3. Saudi Arabia

7.6.4.3.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.4. South Africa

7.6.4.4.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.5. United Arab Emirates

7.6.4.5.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7.6.4.6. Others

7.6.4.6.1. Market Assessment and Forecast, By Material, 2012-2022 ($Million)

7.6.4.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

7.6.4.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

8. Company Profiles

8.1. GSE

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Key Financials

8.1.4. Strategic Developments

8.2. Fibertex

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Key Financials

8.2.4. Strategic Developments

8.3. Royal TenCate

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Key Financials

8.3.4. Strategic Developments

8.4. TENAX

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Key Financials

8.4.4. Strategic Developments

8.5. Global Synthetics Pty Ltd.

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Key Financials

8.5.4. Strategic Developments

8.6. Agru America,Inc

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Strategic Developments

8.7. Huesker

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Key Financials

8.7.4. Strategic Developments

8.8. Terram Geosynthetics Pvt. Ltd.

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Strategic Developments

8.9. Typar

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Key Financials

8.9.4. Strategic Developments

8.10. Hanes Geo Components

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Key Financials

8.10.4. Strategic Developments

8.11. Thrace Plastics Co S.A.

8.11.1. Business Overview

8.11.2. Product Portfolio

8.11.3. Key Financials

8.11.4. Strategic Developments

8.12. Belton Industries, Inc.

8.12.1. Business Overview

8.12.2. Product Portfolio

8.12.3. Strategic Developments

List of Tables

Table 1.Geotextiles Market, By Material ($Million), 2012-2022

Table 2.Synthetic Market, By Region ($Million), 2012-2022

Table 3.Polypropylene Market, By Region ($Million), 2012-2022

Table 4.Polyethylene Market, By Region ($Million), 2012-2022

Table 5.Polyester Market, By Region ($Million), 2012-2022

Table 6.Natural Market, By Region ($Million), 2012-2022

Table 7.Coir Market, By Region ($Million), 2012-2022

Table 8.Jute Market, By Region ($Million), 2012-2022

Table 9.Geotextiles Market, By Product ($Million), 2012-2022

Table 10.Woven Market, By Region ($Million), 2012-2022

Table 11.Non-woven Market, By Region ($Million), 2012-2022

Table 12.Knitted Market, By Region ($Million), 2012-2022

Table 13.Geotextiles Market, By Application ($Million), 2012-2022

Table 14.Drainage Market, By Region ($Million), 2012-2022

Table 15.Railroad Market, By Region ($Million), 2012-2022

Table 16.Agriculture Market, By Region ($Million), 2012-2022

Table 17.Road construction Market, By Region ($Million), 2012-2022

Table 18.Erosion control Market, By Region ($Million), 2012-2022

Table 19.Pavement repair Market, By Region ($Million), 2012-2022

Table 20.Other Applications Market, By Region ($Million), 2012-2022

Table 21.Geotextiles Market, By Region ($Million), 2012-2022

Table 22.North America Geotextiles Market, By Country, 2012-2022 ($Million)

Table 23.North America Geotextiles Market, By Material, 2012-2022 ($Million)

Table 24.North America Geotextiles Market, By Product, 2012-2022 ($Million)

Table 25.North America Geotextiles Market, By Application, 2012-2022 ($Million)

Table 26.U.S. Geotextiles Market, By Material, 2012-2022 ($Million)

Table 27.U.S. Geotextiles Market, By Product, 2012-2022 ($Million)

Table 28.U.S. Geotextiles Market, By Application, 2012-2022 ($Million)

Table 29.Canada Geotextiles Market, By Material, 2012-2022 ($Million)

Table 30.Canada Geotextiles Market, By Product, 2012-2022 ($Million)

Table 31.Canada Geotextiles Market, By Application, 2012-2022 ($Million)

Table 32.Mexico Geotextiles Market, By Material, 2012-2022 ($Million)

Table 33.Mexico Geotextiles Market, By Product, 2012-2022 ($Million)

Table 34.Mexico Geotextiles Market, By Application, 2012-2022 ($Million)

Table 35.Europe Geotextiles Market, By Country, 2012-2022 ($Million)

Table 36.Europe Geotextiles Market, By Material, 2012-2022 ($Million)

Table 37.Europe Geotextiles Market, By Product, 2012-2022 ($Million)

Table 38.Europe Geotextiles Market, By Application, 2012-2022 ($Million)

Table 39.Germany Geotextiles Market, By Material, 2012-2022 ($Million)

Table 40.Germany Geotextiles Market, By Product, 2012-2022 ($Million)

Table 41.Germany Geotextiles Market, By Application, 2012-2022 ($Million)

Table 42.France Geotextiles Market, By Material, 2012-2022 ($Million)

Table 43.France Geotextiles Market, By Product, 2012-2022 ($Million)

Table 44.France Geotextiles Market, By Application, 2012-2022 ($Million)

Table 45.UK Geotextiles Market, By Material, 2012-2022 ($Million)

Table 46.UK Geotextiles Market, By Product, 2012-2022 ($Million)

Table 47.UK Geotextiles Market, By Application, 2012-2022 ($Million)

Table 48.Italy Geotextiles Market, By Material, 2012-2022 ($Million)

Table 49.Italy Geotextiles Market, By Product, 2012-2022 ($Million)

Table 50.Italy Geotextiles Market, By Application, 2012-2022 ($Million)

Table 51.Spain Geotextiles Market, By Material, 2012-2022 ($Million)

Table 52.Spain Geotextiles Market, By Product, 2012-2022 ($Million)

Table 53.Spain Geotextiles Market, By Application, 2012-2022 ($Million)

Table 54.Rest of Europe Geotextiles Market, By Material, 2012-2022 ($Million)

Table 55.Rest of Europe Geotextiles Market, By Product, 2012-2022 ($Million)

Table 56.Rest of Europe Geotextiles Market, By Application, 2012-2022 ($Million)

Table 57.Asia-Pacific Geotextiles Market, By Country, 2012-2022 ($Million)

Table 58.Asia-Pacific Geotextiles Market, By Material, 2012-2022 ($Million)

Table 59.Asia-Pacific Geotextiles Market, By Product, 2012-2022 ($Million)

Table 60.Asia-Pacific Geotextiles Market, By Application, 2012-2022 ($Million)

Table 61.Japan Geotextiles Market, By Material, 2012-2022 ($Million)

Table 62.Japan Geotextiles Market, By Product, 2012-2022 ($Million)

Table 63.Japan Geotextiles Market, By Application, 2012-2022 ($Million)

Table 64.China Geotextiles Market, By Material, 2012-2022 ($Million)

Table 65.China Geotextiles Market, By Product, 2012-2022 ($Million)

Table 66.China Geotextiles Market, By Application, 2012-2022 ($Million)

Table 67.Australia Geotextiles Market, By Material, 2012-2022 ($Million)

Table 68.Australia Geotextiles Market, By Product, 2012-2022 ($Million)

Table 69.Australia Geotextiles Market, By Application, 2012-2022 ($Million)

Table 70.India Geotextiles Market, By Material, 2012-2022 ($Million)

Table 71.India Geotextiles Market, By Product, 2012-2022 ($Million)

Table 72.India Geotextiles Market, By Application, 2012-2022 ($Million)

Table 73.South Korea Geotextiles Market, By Material, 2012-2022 ($Million)

Table 74.South Korea Geotextiles Market, By Product, 2012-2022 ($Million)

Table 75.South Korea Geotextiles Market, By Application, 2012-2022 ($Million)

Table 76.Rest of Asia-Pacific Geotextiles Market, By Material, 2012-2022 ($Million)

Table 77.Rest of Asia-Pacific Geotextiles Market, By Product, 2012-2022 ($Million)

Table 78.Rest of Asia-Pacific Geotextiles Market, By Application, 2012-2022 ($Million)

Table 79.Rest of the World Geotextiles Market, By Country, 2012-2022 ($Million)

Table 80.Rest of the World Geotextiles Market, By Material, 2012-2022 ($Million)

Table 81.Rest of the World Geotextiles Market, By Product, 2012-2022 ($Million)

Table 82.Rest of the World Geotextiles Market, By Application, 2012-2022 ($Million)

Table 83.Brazil Geotextiles Market, By Material, 2012-2022 ($Million)

Table 84.Brazil Geotextiles Market, By Product, 2012-2022 ($Million)

Table 85.Brazil Geotextiles Market, By Application, 2012-2022 ($Million)

Table 86.Turkey Geotextiles Market, By Material, 2012-2022 ($Million)

Table 87.Turkey Geotextiles Market, By Product, 2012-2022 ($Million)

Table 88.Turkey Geotextiles Market, By Application, 2012-2022 ($Million)

Table 89.Saudi Arabia Geotextiles Market, By Material, 2012-2022 ($Million)

Table 90.Saudi Arabia Geotextiles Market, By Product, 2012-2022 ($Million)

Table 91.Saudi Arabia Geotextiles Market, By Application, 2012-2022 ($Million)

Table 92.South Africa Geotextiles Market, By Material, 2012-2022 ($Million)

Table 93.South Africa Geotextiles Market, By Product, 2012-2022 ($Million)

Table 94.South Africa Geotextiles Market, By Application, 2012-2022 ($Million)

Table 95.United Arab Emirates Geotextiles Market, By Material, 2012-2022 ($Million)

Table 96.United Arab Emirates Geotextiles Market, By Product, 2012-2022 ($Million)

Table 97.United Arab Emirates Geotextiles Market, By Application, 2012-2022 ($Million)

Table 98.Others Geotextiles Market, By Material, 2012-2022 ($Million)

Table 99.Others Geotextiles Market, By Product, 2012-2022 ($Million)

Table 100.Others Geotextiles Market, By Application, 2012-2022 ($Million)

Table 101.GSE: Key Strategic Developments, 2017-2017

Table 102.Fibertex: Key Strategic Developments, 2017-2017

Table 103.Royal TenCate: Key Strategic Developments, 2017-2017

Table 104.TENAX: Key Strategic Developments, 2017-2017

Table 105.Global Synthetics Pty Ltd.: Key Strategic Developments, 2017-2017

Table 106.Agru America,Inc: Key Strategic Developments, 2017-2017

Table 107.Huesker: Key Strategic Developments, 2017-2017

Table 108.Terram Geosynthetics Pvt. Ltd.: Key Strategic Developments, 2017-2017

Table 109.Typar: Key Strategic Developments, 2017-2017

Table 110.Hanes Geo Components: Key Strategic Developments, 2017-2017

Table 111.Thrace Plastics Co S.A.: Key Strategic Developments, 2017-2017

Table 112.Belton Industries, Inc.: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Geotextiles Market Share, By Material, 2012 & 2022 ($Million)

Figure 2.Geotextiles Market, By Product, 2012 & 2022 ($Million)

Figure 3.Geotextiles Market, By Application, 2012 & 2022 ($Million)

Figure 4.Geotextiles Market, By Region, 2017, ($Million)

Figure 5.GSE: Net Revenues, 2017-2017 ($Million)

Figure 6.GSE: Net Revenue Share, By Segment, 2017

Figure 7.GSE: Net Revenue Share, By Geography, 2017

Figure 8.TENAX: Net Revenues, 2017-2017 ($Million)

Figure 9.TENAX: Net Revenue Share, By Segment, 2017

Figure 10.TENAX: Net Revenue Share, By Geography, 2017

Figure 11.Huesker: Net Revenues, 2017-2017 ($Million)

Figure 12.Huesker: Net Revenue Share, By Segment, 2017

Figure 13.Huesker: Net Revenue Share, By Geography, 2017

Figure 14.Hanes Geo Components: Net Revenues, 2017-2017 ($Million)

Figure 15.Hanes Geo Components: Net Revenue Share, By Segment, 2017

Figure 16.Hanes Geo Components: Net Revenue Share, By Geography, 2017

Research Methodology

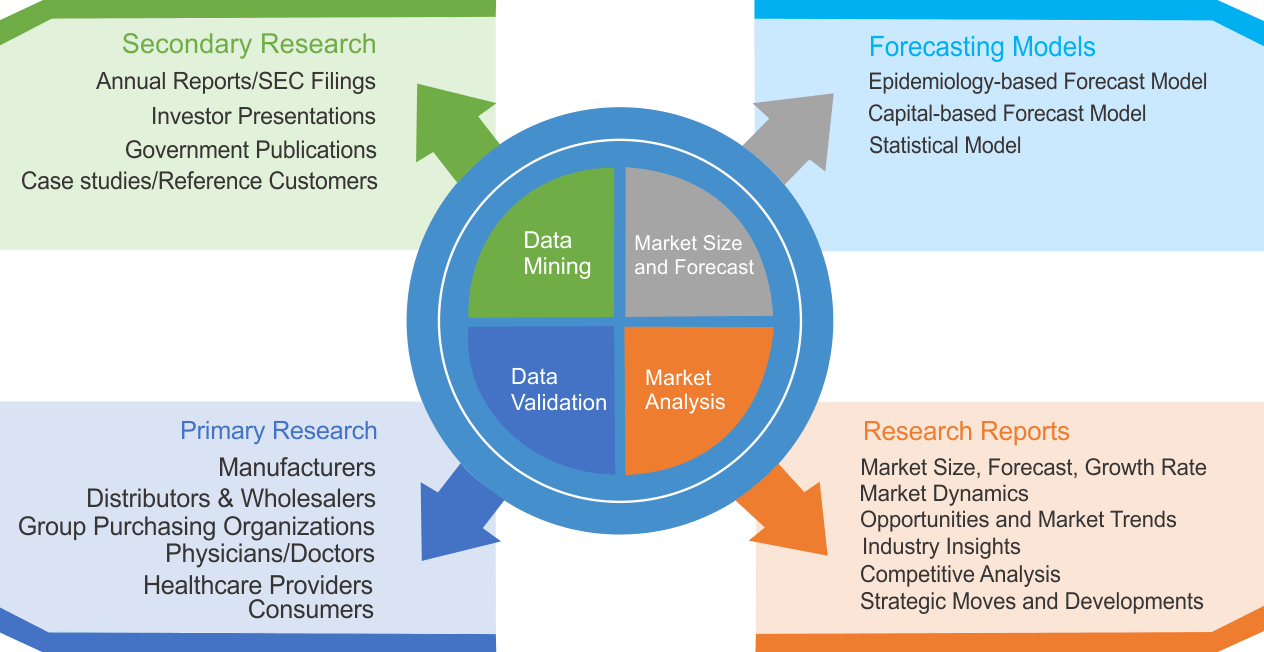

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|