.png)

Head Up Display (HUD) Market by Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 100 Category: Next Generation Technology Report Code : IC11335

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

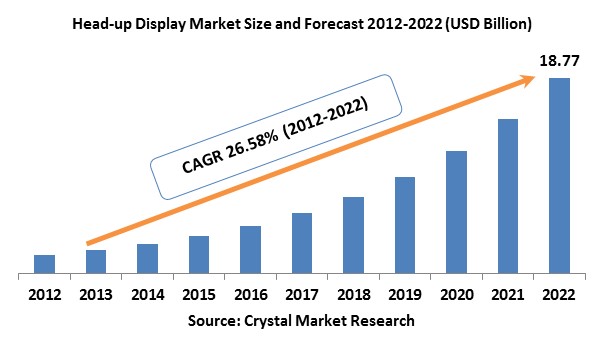

The Head up Display (HUD) Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The development of HUD market is fundamentally determined because of the inexpensive product and simple combination with smartphones, which improves the security of drivers by decreasing diversions. Inventive solution offerings, for example, worldwide positioning system and increased reality that can be coordinated with the head-up display framework additionally drives the interest for head-up display market. HUD is a transparent display that presents data in the driver's viewable pathway without the need to turn away from the street. HUDs were at first created for military and aviation applications; nonetheless, they are progressively being used as a part of commercial aircraft, automobiles, and different wearables. The expansion in purchasing power of people because of development in discretionary income is anticipated to fuel the development of the head-up display market. The modern-age populace is winding up more well informed and satisfactory towards products that are technologically advanced that provide more secure driving practices. Moreover, expanding awareness with respect to security is a key factor boosting the development of the head-up display market. The enhanced way of life of the worldwide populace has brought about expanded moderateness for premium autos, which thus has supported the use of head-up display for navigation purposes. Despite the fact that few car makers are presently offering head-up display systems as an extra component in cars, it might in the long run wind up noticeably essential for each car producer to execute them for enhanced security and improved experiences of consumers.

Application Outlook and Trend Analysis

On the basis of applications, the worldwide display market has been sectioned into wearables, automotive, aviation, and others. The automotive application portion is anticipated to represent a critical share of the overall industry over the conjecture time frame. The aviation section takes after next attributable to larger part of business air ship executing head-up display systems for ideal landing and departure. The expanding number of flight simulators likewise essentially drives the development of head-up display market. Furthermore, the designing of transparent display turns out to be a noteworthy challenge for sellers as the presentations are required to give improved visibility in sunlight similarly that they would around night time. The automotive fragment has additionally been sub-divided into sports cars, basic & mid-segment cars, and premium/luxury cars. The premium/luxury cars sub-fragment is anticipated to represent a noteworthy share of the overall industry in the car portion over the gauge period. The reconciliation of head-up displays with driver assistance systems, which are progressively implemented by a many automobile makers, is anticipated to drive the market development of these displays. The wearable application fragment is anticipated to represent a nominal share of the market over the figure time frame as merchants are investing vigorously in R&D to offer an improved driving background. Expanding requirement for products that are technologically advanced, which offer improved precision, is the key driving variable for the development of head-up displays market in the wearable application.

Regional Outlook and Trend Analysis

The existence of expansive technology organizations and tremendous investments made in the R&D of head-up displays are the central point driving the development of the market in the North American district. Presently, North America possesses a noteworthy share of the overall industry in the general worldwide market, which is trailed by Europe because of the expanding awareness among people about the advantages offered by head-up displays. Recent advancements in technologies as for the automotive business, for example, augmented reality and adaptive cruise control, are the real patterns which would prompt a huge ascent in the interest for the general United States head-up display market. Moreover, the area being one of the biggest auto markets worldwide is likewise anticipated that would altogether support the market income. The Asia Pacific regional market is expected to represent a similarly higher CAGR, attributable to the expanding awareness among clients with respect to the advantages offered by the innovation. Development in the way of life and discretionary income are the driving elements for the development of the market in this area.

Competitive Insights

The major players in the market are Continental AG, ROBERT BOSCH LLC, Elbit Systems, Yazaki, Visteon, BAE Systems and Denso. Head-up display systems have discovered a developing use in the automotive business by virtue of many security highlights which help in the diminishment of collision occurrence.

The global Head up Display Market is segmented as follows-

By Application:

- Aviation

- Automotive

- Basic & Mid-segment Cars

- Premium/Luxury Cars

- Sports Cars

- Wearables

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Head Up Display (HUD) Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Automotive

- Premium/Luxury Cars

- Sports Cars

- Basic & Mid-segment Cars

- Aviation

- Wearables

- Other Applications

- Head Up Display (HUD) Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Head Up Display (HUD) Market, By Country

- North America Head Up Display (HUD) Market, By Application

- U.S. Head Up Display (HUD) Market, By Application

- Canada Head Up Display (HUD) Market, By Application

- Mexico Head Up Display (HUD) Market, By Application

-

- Europe

- Europe Head Up Display (HUD) Market, By Country

- Europe Head Up Display (HUD) Market, By Application

- Germany Head Up Display (HUD) Market, By Application

- France Head Up Display (HUD) Market, By Application

- UK Head Up Display (HUD) Market, By Application

- Italy Head Up Display (HUD) Market, By Application

- Spain Head Up Display (HUD) Market, By Application

- Rest of Europe Head Up Display (HUD) Market, By Application

-

- Asia-Pacific

- Asia-Pacific Head Up Display (HUD) Market, By Country

- Asia-Pacific Head Up Display (HUD) Market, By Application

- Japan Head Up Display (HUD) Market, By Application

- Australia Head Up Display (HUD) Market, By Application

- India Head Up Display (HUD) Market, By Application

- South Korea Head Up Display (HUD) Market, By Application

- Rest of Asia-Pacific Head Up Display (HUD) Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Head Up Display (HUD) Market, By Country

- Rest of the World Head Up Display (HUD) Market, By Application

- Brazil Head Up Display (HUD) Market, By Application

- South Africa Head Up Display (HUD) Market, By Application

- Saudi Arabia Head Up Display (HUD) Market, By Application

- Turkey Head Up Display (HUD) Market, By Application

- United Arab Emirates Head Up Display (HUD) Market, By Application

- Others Head Up Display (HUD) Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rising Demand of HUD for Its Technologically Advanced Features

3.2.1.2. Convenience Offered By the Combination of Satellite Navigation Technology and HUD System in One Unit

3.2.1.3. Ability of Connecting Smartphones With Head-Up Display in Cars

3.2.2. Restraints

3.2.2.1. Potentially Fatal Errors in HUD Display Symbology

3.2.2.2. High Requirement of Luminance, Power, and Brightness is the Major Drawback for the Head-Up Display Market

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Head Up Display (HUD) Market, By Application

4.1. Introduction

4.2. Head Up Display (HUD) Market Assessment and Forecast, By Application, 2012-2022

4.3. Automotive

4.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3. Premium/Luxury Cars

4.3.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4. Sports Cars

4.3.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5. Basic & Mid-segment Cars

4.3.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Aviation

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Wearables

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Other Applications

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Head Up Display (HUD) Market, By Region

5.1. Introduction

5.2. Head Up Display (HUD) Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.3.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6. Company Profiles

6.1. BAE Systems

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. Continental AG

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. DENSO Corporation

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4. Elbit Systems

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5. Visteon Corporation

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.6. YAZAKI Corporation

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7. Robert Bosch LLC

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.8. Rockwell Collins

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9. Thales Group

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Key Financials

6.9.4. Strategic Developments

List of Tables

List of Tables

Table 1.Head Up Display (HUD) Market, By Application ($Million), 2012-2022

Table 2.Automotive Market, By Type ($Million), 2012-2022

Table 3.Automotive Market, By Region ($Million), 2012-2022

Table 4.Premium/Luxury Cars Market, By Region ($Million), 2012-2022

Table 5.Sports Cars Market, By Region ($Million), 2012-2022

Table 6.Basic & Mid-segment Cars Market, By Region ($Million), 2012-2022

Table 7.Aviation Market, By Region ($Million), 2012-2022

Table 8.Wearables Market, By Region ($Million), 2012-2022

Table 9.Other Applications Market, By Region ($Million), 2012-2022

Table 10.North America Head Up Display (HUD) Market, By Country, 2012-2022 ($Million)

Table 11.North America Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 12.U.S.Head Up Display (HUD) Market, by Application, 2012-2022 ($Million)

Table 13Canada Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 14.Mexico Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 15.Europe Head Up Display (HUD) Market, By Country, 2012-2022 ($Million)

Table 16.Europe Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 17.Germany Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 18.France Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 19.UK Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 20.Italy Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 21.Spain Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 22.Rest of Europe Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 23.Asia-Pacific Head Up Display (HUD) Market, By Country, 2012-2022 ($Million)

Table 24.Asia-Pacific Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 25.Japan Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 26.China Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 27.Australia Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 28.India Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 29.South Korea Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 30.Rest of Asia-Pacific Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 31.Rest of the World Head Up Display (HUD) Market, By Country, 2012-2022 ($Million)

Table 32.Rest of the World Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 33.Brazil Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 34.Turkey Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 35.Saudi Arabia Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 36.South Africa Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 37.United Arab Emirates Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 38.Others Head Up Display (HUD) Market, By Application, 2012-2022 ($Million)

Table 39.BAE Systems: Key Strategic Developments, 2017-2017

Table 40.Continental AG: Key Strategic Developments, 2017-2017

Table 41.DENSO Corporation: Key Strategic Developments, 2017-2017

Table 42.Elbit Systems: Key Strategic Developments, 2017-2017

Table 43.Visteon Corporation: Key Strategic Developments, 2017-2017

Table 44.YAZAKI Corporation: Key Strategic Developments, 2017-2017

Table 45.Robert Bosch LLC: Key Strategic Developments, 2017-2017

Table 46.Rockwell Collins: Key Strategic Developments, 2017-2017

Table 47.Thales Group: Key Strategic Developments, 2017-2017

List of Figures

List of Figures

Figure 1.Head Up Display (HUD) Market Share, By Application, 2012 & 2022

Figure 2Head Up Display (HUD) Market, By Region, 2012 & 2022 ($Million)

Figure 3.BAE Systems: Net Revenues, 2017-2017 ($Million)

Figure 4.BAE Systems: Net Revenue Share, By Segment, 2017

Figure 5.BAE Systems: Net Revenue Share, By Geography, 2017

Figure 6.Continental AG: Net Revenues, 2017-2017 ($Million)

Figure7.Continental AG: Net Revenue Share, By Segment, 2017

Figure8.Continental AG: Net Revenue Share, By Geography, 2017

Figure9.DENSO Corporation: Net Revenues, 2017-2017 ($Million)

Figure10.DENSO Corporation: Net Revenue Share, By Segment, 2017

Figure 11.DENSO Corporation: Net Revenue Share, By Geography, 2017

Figure 12.Elbit Systems: Net Revenues, 2017-2017 ($Million)

Figure 13.Elbit Systems: Net Revenue Share, By Segment, 2017

Figure 14.Elbit Systems: Net Revenue Share, By Geography, 2017

Figure 15.Thales Group: Net Revenues, 2017-2017 ($Million)

Figure 16.Thales Group: Net Revenue Share, By Segment, 2017

Figure 17.Thales Group: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|