.png)

High Temperature Insulation Market by Product and Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 100 Category: Construction & Building Materials Report Code : HI11319

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

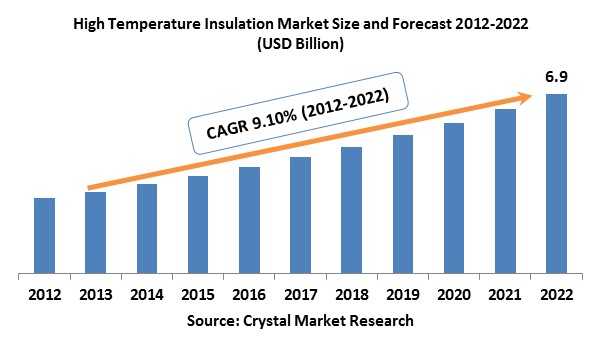

The global High Temperature Insulation market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. High temperature insulation items are materials utilized as a part of utilizations requiring high temperatures crosswise over different end-use enterprises. New developing utilizations of high temperature protection incorporate fire protection and aerospace. Developing need to preserve energy crosswise over different businesses is relied upon to be a key driver for the market. Furthermore, stringent controls forced on oil & gas, metal and cement makers to decrease nursery outflows has likewise significantly affected creating market demand. Also, these items can be made accessible as castables, insulating bricks, blankets, and boards, which can be adjusted for use in kilns, furnaces, and kiln cars. This adaptable nature of HTI items is required to positively affect item acknowledgment throughout the following years. Nonetheless, the carcinogenic content in high temperature insulation materials is anticipated to be a major challenge for the market players. Insulation materials have inorganic compounds like silica and alumina that are carcinogenic in nature and supposedly cause respiratory and skin problems. Additionally, thermal properties of HTI items erode with time, with constant exposure to heat that leads to shrinkage and leakage of heat. Due to this the life expectancy of the products is affected and may become up to two or three years. Replacements that are frequent and that increase the price are said to be a major issue for the market in the following years. To decrease the dependence on synthetic insulation materials, industries have moved their aim towards creating substitutes that are bio-based for high temperature materials.

Product Outlook and Trend Analysis

The major product sections in the market are calcium silicate, ceramic fiber, insulating firebricks and others. The most utilized material for high temperature insulation is ceramic fiber that accounted for 62 percent of share of the overall market in 2017. Some of the outstanding features that have made ceramic fiber prominent for a number application are high tensile strength, high resistance to temperature and enhanced flexibility. Ceramic blankets and boards are majorly utilized for ship building for general heat containment as lagging as well as to stop the fire from spreading. Insulating firebricks (IFBs) are light-weight and soft materials that are composed of ferric oxide (%), alumina (%) and silica (%). They have less thermal conductivity and are particularly constructed for applications of heat containment in the manufacturing of aluminum and ceramic. In 2017 the overall demand for insulating firebricks was valued 119.8 kilo tons and is anticipated to witness significant growth in the upcoming years. Insulating firebricks also render protection from electrical shock and help in reduction of cost through furnace linings that are thinner in contrast to other insulation materials.

Application Outlook and Trend Analysis

Major application sections for high temperature insulation include metallurgy, ceramics, steel, cement, petrochemicals, and refractory, glass and aluminum industries. The largest application segment was the petrochemical industry that accounted for 33.8 percent of the total market in 2017. In 2017 the worldwide petrochemical industry was valued more than USD trillion. Ceramic material production needs heat treatment in kilns; where temperatures can go up to 12000 C. Major HTI items utilized as a part of the business incorporate ceramic fibers for low-mass kiln and refractory or ceramic kilns car applications, where they limit any probability of warmth misfortune through furnace dividers and guarantee the security of operation. Worldwide HTI market profits from the ceramic business were evaluated to be USD million in 2017. On an average, 5 to 6 kilos of HTI items are required for the generation of 1 metric ton of powder metallurgy items including aerospace and automotive wear parts, engine parts, cutting tools, gears, magnets, filters, bearings and pump parts. HTI empowers proficient temperature control while guaranteeing insignificant pollutions; HTI item demand for powder metallurgy applications is anticipated to increase significantly in the upcoming years.

Regional Outlook and Trend Analysis

The biggest consumer of high temperature insulation items was Asia Pacific that registered for more than 48 percent of the total volume in 2017. Nonetheless, on the basis of revenue, the area represented just % of the worldwide market, attributable to the huge value distinction with the European and United States markets. Asia Pacific HTI material expenses are relied upon to stay low because of generally low vitality cost and cost of crude materials, for example, calcium, silica, alumina and magnesium. In 2017 the Asia Pacific ceramic market was valued USD million and is anticipated to witness significant growth in the following years. Ceramics and Petrochemicals production were the most leading application portions in the Asia Pacific HTI market, representing 46 percent of aggregate regional HTI volume in 2017. North America and Europe offer huge open doors for HTI market members, by virtue of positive administrative situation and motivators offered for vitality protection and manageability. European requirement for HTI items is relied upon to grow on a tremendous pace in the upcoming years. Despite the fact that there are more than 100 organizations obliging the European market, a significant part of the territorial request is still met by Chinese providers because of focused costs offered by them. North America HTI market profit was evaluated to be USD million in 2017, with United States being the prevailing regional market, representing more than 80 percent of the aggregate demand.

Competitive Insights

Some of the major players operating in the market are Isolite Systems, Murugappa Morgan Thermal Ceramics Limited, Skamol A/S, Zircar, Unifrax and Promat International. The worldwide high temperature insulation market is genuinely focused, with the best four market members representing % of the worldwide demand in 2017.There are various regional members over the business, particularly in China, which has brought about extreme price affectability. Organizations are taking a gander at long haul understandings and joint efforts to counter this danger and support share of the market.

The global high temperature insulation market is segmented as follows-

By Product

- Calcium Silicate

- Ceramic Fiber

- Insulating Firebrick

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- High Temperature Insulation Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Ceramic Fiber

- Insulating Firebrick

- Calcium Silicate

- Other Products

- High Temperature Insulation Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Petrochemicals

- Ceramics

- Glass

- Cement

- Iron and Steel

- Refractory

- Powder Metallurgy

- Aluminum

- Other Applications

- High Temperature Insulation Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America High Temperature Insulation Market, By Country

- North America High Temperature Insulation Market, By Product

- North America High Temperature Insulation Market, By Application

- U.S. High Temperature Insulation Market, By Product

- U.S. High Temperature Insulation Market, By Application

- Canada High Temperature Insulation Market, By Product

- Canada High Temperature Insulation Market, By Application

- Mexico High Temperature Insulation Market, By Product

- Mexico High Temperature Insulation Market, By Application

-

- Europe

- Europe High Temperature Insulation Market, By Country

- Europe High Temperature Insulation Market, By Product

- Europe High Temperature Insulation Market, By Application

- Germany High Temperature Insulation Market, By Product

- Germany High Temperature Insulation Market, By Application

- France High Temperature Insulation Market, By Product

- France High Temperature Insulation Market, By Application

- UK High Temperature Insulation Market, By Product

- UK High Temperature Insulation Market, By Application

- Italy High Temperature Insulation Market, By Product

- Italy High Temperature Insulation Market, By Application

- Spain High Temperature Insulation Market, By Product

- Spain High Temperature Insulation Market, By Application

- Rest of Europe High Temperature Insulation Market, By Product

- Rest of Europe High Temperature Insulation Market, By Application

-

- Asia-Pacific

- Asia-Pacific High Temperature Insulation Market, By Country

- Asia-Pacific High Temperature Insulation Market, By Product

- Asia-Pacific High Temperature Insulation Market, By Application

- Japan High Temperature Insulation Market, By Product

- Japan High Temperature Insulation Market, By Application

- Australia High Temperature Insulation Market, By Product

- Australia High Temperature Insulation Market, By Application

- India High Temperature Insulation Market, By Product

- India High Temperature Insulation Market, By Application

- South Korea High Temperature Insulation Market, By Product

- South Korea High Temperature Insulation Market, By Application

- Rest of Asia-Pacific High Temperature Insulation Market, By Product

- Rest of Asia-Pacific High Temperature Insulation Market, By Application

-

- Rest of the World

- Rest of the World High Temperature Insulation Market, By Country

- Rest of the World High Temperature Insulation Market, By Product

- Rest of the World High Temperature Insulation Market, By Application

- Brazil High Temperature Insulation Market, By Product

- Brazil High Temperature Insulation Market, By Application

- South Africa High Temperature Insulation Market, By Product

- South Africa High Temperature Insulation Market, By Application

- Saudi Arabia High Temperature Insulation Market, By Product

- Saudi Arabia High Temperature Insulation Market, By Application

- Turkey High Temperature Insulation Market, By Product

- Turkey High Temperature Insulation Market, By Application

- United Arab Emirates High Temperature Insulation Market, By Product

- United Arab Emirates High Temperature Insulation Market, By Application

- Others High Temperature Insulation Market, By Product

- Others High Temperature Insulation Market, By Application

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Need for Energy Savings

3.2.1.2. Rapid Industrialization in Emerging Economies of Asia-Pacific

3.2.1.3. Rising Emission Control Regulations

3.2.2. Restraints

3.2.2.1. Harmful Side Effects of Using Ceramic Fibers

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. High Temperature Insulation Market, By Product

4.1. Introduction

4.2. High Temperature Insulation Market Assessment and Forecast, By Product, 2012-2022

4.3. Ceramic Fiber

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Insulating Firebrick

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Calcium Silicate

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Other Products

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. High Temperature Insulation Market, By Application

5.1. Introduction

5.2. The High Temperature Insulation Market Assessment and Forecast, By Application, 2012-2022

5.3. Petrochemicals

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Ceramics

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Glass

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.6. Cement

5.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.7. Iron & Steel

5.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.8. Refractory

5.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.9. Powder metallurgy

5.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.10. Aluminum

5.10.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.11. Other Applications

5.11.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. High Temperature Insulation Market, By Region

6.1. Introduction

6.2. High Temperature Insulation Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3. High Temperature Insulation Market Assessment and Forecast, By Application , 2012-2022 ($Million)

6.4. North America

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.4. U.S.

6.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.5. Canada

6.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.6. Mexico

6.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5. Europe

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.4. Germany

6.5.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.5. France

6.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.6. UK

6.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.7. Italy

6.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.8. Spain

6.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.9. Rest of Europe

6.5.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6. Asia-Pacific

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.4. Japan

6.6.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.5. China

6.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.6. Australia

6.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.7. India

6.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.8. South Korea

6.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.9. Rest of Asia-Pacific

6.6.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7. Rest of the World

6.7.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.7.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.4. Brazil

6.7.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.5. Turkey

6.7.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.6. Saudi Arabia

6.7.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.7. South Africa

6.7.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.8. United Arab Emirates

6.7.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.9. Others

6.7.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7. Company Profiles

7.1. 3M Company

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. ADL Insulflex Inc

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. Almatic GmbH

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Cellaris Ltd

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. Dyson Group

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. Hi-Temp Insulation Inc.

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. Insulcon Group

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.8. Isolite Insulating Products Company Ltd.

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9. Pacor Inc.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.10. Promat International NV

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Key Financials

7.10.4. Strategic Developments

7.11. Pyrotek

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

List of Tables

Table 1.Global High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 2.Ceramic Fibre Market, By Region, 2012-2022 ($Million)

Table 3.Insulating Firebrick Market, By Region, 2012-2022 ($Million)

Table 4.Calcium Silicate Market, By Region, 2012-2022 ($Million)

Table 5.Other Products Market, By Region, 2012-2022 ($Million)

Table 6.Global High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 7.Petrochemicals Market, By Region, 2012-2022 ($Million)

Table 8.Ceramics Market, By Region, 2012-2022 ($Million)

Table 9.Glass Market, By Region, 2012-2022 ($Million)

Table 10.Cement Market, By Region, 2012-2022 ($Million)

Table 11.Iron & Steel Market, By Region, 2012-2022 ($Million)

Table 12.Refractory Market, By Region, 2012-2022 ($Million)

Table 13.Powder Metallurgy Market, By Region, 2012-2022 ($Million)

Table 14.Aluminum Market, By Region, 2012-2022 ($Million)

Table 15.Other Applications Market, By Region, 2012-2022 ($Million)

Table 16.North America High Temperature Insulation Market, By Country, 2012-2022 ($Million)

Table 17.North America High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 18.North America High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 19.U.S. High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 20.U.S. High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 21.Canada High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 22.Canada High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 23.Mexico High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 24.Mexico High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 25.Europe High Temperature Insulation Market, By Country, 2012-2022 ($Million)

Table 26.Europe High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 27.Europe High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 28.Germany High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 29.Germany High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 30.France High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 31.France High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 32.UK High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 33.UK High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 34.Italy High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 35.Italy High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 36.Spain High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 37.Spain High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 38.Rest of Europe High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 39.Rest of Europe High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 40.Asia-Pacific High Temperature Insulation Market, By Country, 2012-2022 ($Million)

Table 41.Asia-Pacific High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 42.Asia-Pacific High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 43.Japan High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 44.Japan High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 45.China High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 46.China High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 47.Australia High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 48.Australia High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 49.India High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 50.India High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 51.South Korea High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 52.South Korea High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 53.Rest of Asia-Pacific High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 54.Rest of Asia-Pacific High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 55.Rest of the World High Temperature Insulation Market, By Country, 2012-2022 ($Million)

Table 56.Rest of the World High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 57.Rest of the World High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 58.Brazil High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 59.Brazil High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 60.Turkey High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 61.Turkey High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 62.Saudi Arabia High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 63.Saudi Arabia High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 64.South Africa High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 65.South Africa High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 66.United Arab Emirates High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 67.United Arab Emirates High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 68.Others High Temperature Insulation Market, By Product, 2012-2022 ($Million)

Table 69.Others High Temperature Insulation Market, By Application, 2012-2022 ($Million)

Table 70.3M Company: Key Strategic Developments, 2017-2017

Table 71.ADL Insulflex Inc: Key Strategic Developments, 2017-2017

Table 72.Almatic GmbH: Key Strategic Developments, 2017-2017

Table 73.Cellaris Ltd: Key Strategic Developments, 2017-2017

Table 74.Dyson Group: Key Strategic Developments, 2017-2017

Table 75.Hi-Temp Insulation Inc.: Key Strategic Developments, 2017-2017

Table 76.Insulcon Group: Key Strategic Developments, 2017-2017

Table 77.Isolite Insulating Products Company Ltd.: Key Strategic Developments, 2017-2017

Table 78.Pacor Inc.: Key Strategic Developments, 2017-2017

Table 79.Promat International NV: Key Strategic Developments, 2017-2017

Table 80.Pyrotek: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global High Temperature Insulation Market Share, By Product, 2017 & 2025

Figure 2.Global High Temperature Insulation Market, By Application, 2017, ($Million)

Figure 3.Global High Temperature Insulation Market, By Region, 2017, ($Million)

Figure 4.3M Company: Net Revenues, 2017-2017 ($Million)

Figure 5.3M Company: Net Revenue Share, By Segment, 2017

Figure 6.3M Company: Net Revenue Share, By Geography, 2017

Figure 7.ADL Insulflex Inc: Net Revenues, 2017-2017 ($Million)

Figure 8.ADL Insulflex Inc: Net Revenue Share, By Segment, 2017

Figure 9.ADL Insulflex Inc: Net Revenue Share, By Geography, 2017

Figure 10.Almatic GmbH: Net Revenues, 2017-2017 ($Million)

Figure 11.Almatic GmbH: Net Revenue Share, By Segment, 2017

Figure 12.Almatic GmbH: Net Revenue Share, By Geography, 2017

Figure 13.Cellaris Ltd: Net Revenues, 2017-2017 ($Million)

Figure 14.Cellaris Ltd: Net Revenue Share, By Segment, 2017

Figure 15.Cellaris Ltd: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|