.png)

Hiv Diagnostics Market By Product - Global Industry Analysis And Forecast To 2022

Published On : November 2017 Pages : 130 Category: In-Vitro Diagnostics Report Code : HC11320

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global HIV diagnostics market was evaluated around USD billion in the 2017 and is expected to reach approximately USD billion by the end of 2022 while registering itself at a compound annual growth rate (CAGR) of % over the forecast period. Owing to the technological advancements of disease diagnostic tests, and the expected commercialization and development of innovative, authorities sanctioned POC and faster p24 antigen, EID, and CD4 tests. There is a rising need to establish easily available, proficient and accurate diagnostics tests. Owing to the financial resource-restricted settings in a major market share of the regions that are impacted by disease; it is still not possible to execute the complex, current screening, monitoring and staging tests. This is either owing to the deficiency of adequate testing labs or a need of skilled technicians competent of executing the tests. These restrictions of lab-based testing are an accelerator to the expansion of easy to implement and portable rapid, point of care tests. At present, a very few number of these tests are accessible in the market worldwide. Though, in the current scenario, a number of rapid or POC tests are under scientific progress and analysis. This anticipated augmenting in a number of product benefits to the global market which is estimated to drive the global HIV diagnostics market growth further during the forecast years.

Product Outlook and Trend Analysis

The HIV diagnostics market embraces diagnostic confirmatory and screening tests for HIV-1, 2 and group O occurrence testing. These tests have chief applications to monitor and distinguish between the variety of subtypes and groups of human immunodeficiency virus (HIV). At a wider level, diagnostic products and tests can be segmented into viral identification assays, antibody tests, viral load testing, early infant diagnosis (EID), and CD4 testing. EID is carried out independently than CD4 testing and viral load testing due to the existence of antibodies by maternal blood within infants under the age group of 18 months, outcomes from the abovementioned tests turn out to be incorrect. Hence, DNA PCR molecular test is utilized for infant HIV screening and diagnostics, therefore warranting a different market section reporting for the same. The leading market share for the HIV diagnostics market in 2017 was reported by antibody tests. This major share can be mainly assigned to the existence of a large quantity of antibody tests in this market that can be further again parted into 1 confirmatory, HIV-1 screening, and 2 & Group O tests. These involve modern 4th and 3rd generation POC/NonPOC dried blood spot tests, ELISA tests, western blot, rapid agglutination for HIV-1 screening, radioimmuno-precipitation assay, and indirect immunofluorescent antibody assay, for line immunoassays and disease confirmation for disease. Other test section in the global market involve viral culture and p24 antigen tests for viral identification, CD4 testing, and viral load testing; p24 antigen tests are lesser sensitive as compared to antibody and are utilized in blend with them to render HIV testing functionality and complimentary screening. These tests are necessary for the monitoring and implementation of antiretroviral therapy; once affirmative verification of the contamination is prevailed. In the present market situation, these tests are complicated to use and require laboratories with skilled technicians. The anticipated technological innovations of these testing sections giving augment to the advent of new POC tests is also projected to drive the global HIV diagnostic tests market growth.

Regional Outlook and Trend Analysis

Global HIV diagnostics market can be classified into Europe, North America, Latin America, Asia-Pacific, and Middle East Asia. In 2017, North American regional HIV diagnostics market reported for the major share of global market revenue due to the existence of a technologically innovative medical framework, encouraging compensation policies and comparatively elevated healthcare spending in research and development. This region is anticipated to experience a rise in market demand further over the projected phase with the technological expansion of portable and rapid diagnostic tests. Though, the Asia-Pacific regional HIV diagnostics market, due to the existence of high unfulfilled demand in China and India, is projected to grow at a comparatively rapid rate during the forecast years.

Competitive Outlook and Trend Analysis

Major market players of the HIV diagnostics market are Abbott Healthcare, Abbvie Inc., Alere Inc., Bristol-Myers Squibb, Gilead Sciences, Janssen Therapeutics, Merck & Co. Inc, BD Biosciences, VIIV Healthcare, Partec, Beckman Coulter, bioMerieux, Apogee Flow Systems, Zyomyx Inc., PointCare Technologies Inc., Mylan Unc., Qiagen, Roche Diagnostics, Siemens Healthcare, and Sysmex. These key players in the global market are involved in the research and development of p24 antigen, CD4, and viral load testing methodologies in order to trim down their implementation complications and enhance portability and accessibility.

The global HIV diagnostics market is segmented as follows –

By Product

-

- Antibody Tests

- HIV-1 Screening Tests

- ELISA/EIA

- Home Access Dried Blood Spot

- Rapid Tests (Dot plot, Agglutination Tests)

- HIV-1 Screening Tests

- Antibody Tests

-

-

- HIV-1 Antibody Confirmatory Tests

- Western Blot Test

- Indirect Immunofluorescent Antibody Assay (IFA)

- Line Immunoassay

- RadioImmunoPrecipitation Assay (RIPA)

- HIV-2 & Group O Diagnostic Tests

- Blood Antibody Tests

- Dried Blood Spot (DBS) Test

- Others and (Oral, Urine)

- HIV-1 Antibody Confirmatory Tests

-

-

- Viral Identification Assays

- P24 Antigen Test

- Qualitative PCR Tests

- Viral Culture

- CD4 Testing

- Viral Load Testing

- Early Infant Diagnostics

- Viral Identification Assays

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- HIV Diagnostics Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Antibody Tests

- HIV-1 Screening Tests

- ELISA/EIA

- Home Access Dried Blood Spot

- Rapid Tests (Dot plot, Agglutination Tests)

- HIV-1 Antibody Confirmatory Tests

- Western Blot Test

- Indirect Immunofluorescent Antibody Assay (IFA)

- Line Immunoassay

- RadioImmunoPrecipitation Assay (RIPA)

- HIV-2 & Group O Diagnostic Tests

- Blood Antibody Tests

- Dried Blood Spot (DBS) Test

- Others and (Oral, Urine)

- Viral Identification Assays

- P24 Antigen Test

- Qualitative PCR Tests

- Viral Culture

- CD4 Testing

- Viral Load Testing

- Early Infant Diagnostic

- HIV Diagnostics Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America HIV Diagnostics Market, By Country

- North America HIV Diagnostics Market, By Product

- U.S. HIV Diagnostics Market, By Product

- Canada HIV Diagnostics Market, By Product

- Mexico HIV Diagnostics Market, By Product

-

- Europe

- Europe HIV Diagnostics Market, By Country

- Europe HIV Diagnostics Market, By Product

- Germany HIV Diagnostics Market, By Product

- France HIV Diagnostics Market, By Product

- UK HIV Diagnostics Market, By Product

- Italy HIV Diagnostics Market, By Product

- Spain HIV Diagnostics Market, By Product

- Rest of Europe HIV Diagnostics Market, By Product

-

- Asia-Pacific

- Asia-Pacific HIV Diagnostics Market, By Country

- Asia-Pacific HIV Diagnostics Market, By Product

- Japan HIV Diagnostics Market, By Product

- Australia HIV Diagnostics Market, By Product

- India HIV Diagnostics Market, By Product

- South Korea HIV Diagnostics Market, By Product

- Rest of Asia-Pacific HIV Diagnostics Market, By Product

-

- Rest of the World

- Rest of the World HIV Diagnostics Market, By Country

- Rest of the World HIV Diagnostics Market, By Product

- Brazil HIV Diagnostics Market, By Product

- South Africa HIV Diagnostics Market, By Product

- Saudi Arabia HIV Diagnostics Market, By Product

- Turkey HIV Diagnostics Market, By Product

- United Arab Emirates HIV Diagnostics Market, By Product

- Others HIV Diagnostics Market, By Product

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rising Prevalence of HIV

3.2.1.2. Implementation of Favorable Government Initiatives

3.2.1.3. Introduction of Rapid And Portable Diagnostic Tests

3.2.2. Restraints

3.2.2.1. Lack Of Awareness Regarding Diagnosis

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. HIV Diagnostics Market, By Product

4.1. Introduction

4.2. HIV Diagnostics Market, Assessment and Forecast, By Product, 2012-2022

4.3. Antibody Tests

4.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3. HIV-1 Screening Tests

4.3.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3.3. ELISA/EIA

4.3.3.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3.4. Home Access Dried Blood Spot

4.3.3.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3.5. Rapid Tests (Dot plot, Agglutination Tests)

4.3.3.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4. HIV-1 Antibody Confirmatory Tests

4.3.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.4.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4.3. Western Blot Test

4.3.4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4.4. Indirect Immunofluorescent Antibody Assay (IFA)

4.3.4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4.5. Line Immunoassay

4.3.4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4.6. RadioImmuno Precipitation Assay (RIPA)

4.3.4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5. HIV-2 & Group O Diagnostic Tests

4.3.5.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.5.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5.3. Blood Antibody Tests

4.3.5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5.4. Dried Blood Spot (DBS) Test

4.3.5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5.5. Other Products

4.3.5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Viral Identification Assays

4.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.3. P24 Antigen Test

4.4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.4. Qualitative PCR Tests

4.4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.5. Viral Culture

4.4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. CD4 Testing

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Viral Load Testing

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.7. Early Infant Diagnostics

4.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. HIV Diagnostics Market, By Region

5.1. Introduction

5.2. HIV Diagnostics Market, Assessment and Forecast, By Region, 2012-2022 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6. Company Profiles

6.1. Alere Inc.

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. Beckman Coulter

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. BD Biosciences

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4. VIIV Healthcare

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Strategic Developments

6.5. Merch & Co. Inc.

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.6. Gilead Sciences

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7. Janssen Therapeutics

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.8. Bristol-Myers Squibb

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9. Abbvie Inc.

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Strategic Developments

6.10. Abbott Healthcare

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Key Financials

6.10.4. Strategic Developments

6.11. Partec

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Strategic Developments

List of Tables

Table 1.HIV Diagnostics Market, By Product ($Million), 2012-2022

Table 2.Antibody Tests Market, By Type ($Million), 2012-2022

Table 3.Antibody Tests Market, By Region ($Million), 2012-2022

Table 4.HIV-1 Screening Tests Market, By Type ($Million), 2012-2022

Table 5.HIV-1 Screening Tests Market, By Region ($Million), 2012-2022

Table 6.ELISA/EIA Market, By Region ($Million), 2012-2022

Table 7.Home Access Dried Blood Spot Market, By Region ($Million), 2012-2022

Table 8.Rapid Tests (Dot plot, Agglutination Tests) Market, By Region ($Million), 2012-2022

Table 9.HIV-1 Antibody Confirmatory Tests Market, By Type ($Million), 2012-2022

Table 10.HIV-1 Antibody Confirmatory Tests Market, By Region ($Million), 2012-2022

Table 11.Western Blot Test Market, By Region ($Million), 2012-2022

Table 12.Indirect Immunofluorescent Antibody Assay (IFA) Market, By Region ($Million), 2012-2022

Table 13.Line Immunoassay Market, By Region ($Million), 2012-2022

Table 14 RadioImmuno Precipitation Assay (RIPA) Market, By Region ($Million), 2012-2022

Table 15.HIV-2 & Group O Diagnostic Tests Market, By Type ($Million), 2012-2022

Table 16.HIV-2 & Group O Diagnostic Tests Market, By Region ($Million), 2012-2022

Table 17.Blood Antibody Tests Market, By Region ($Million), 2012-2022

Table 18.Dried Blood Spot (DBS) Test Market, By Region ($Million), 2012-2022

Table 19.Other Products Market, By Region ($Million), 2012-2022

Table 20.Viral Identification Assays Market, By Type ($Million), 2012-2022

Table 21.Viral Identification Assays Market, By Region ($Million), 2012-2022

Table 22.P24 Antigen Test Market, By Region ($Million), 2012-2022

Table 23.Qualitative PCR Tests Market, By Region ($Million), 2012-2022

Table 24.Viral Culture Market, By Region ($Million), 2012-2022

Table 25.CD4 Testing Market, By Region ($Million), 2012-2022

Table 26.Viral Load Testing Market, By Region ($Million), 2012-2022

Table 27.Early Infant Diagnostics Market, By Region ($Million), 2012-2022

Table 28.North America HIV Diagnostics Market, By Country, 2012-2022 ($Million)

Table 29.North America HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 30.U.S.HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 31.Canada HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 32.Mexico HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 33.Europe HIV Diagnostics Market, By Country, 2012-2022 ($Million)

Table 34.Europe HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 35.Germany HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 36.France HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 37.UK HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 38.Italy HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 39.Spain HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 40.Rest of Europe HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 41.Asia-Pacific HIV Diagnostics Market, By Country, 2012-2022 ($Million)

Table 42.Asia-Pacific HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 43.Japan HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 44.China HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 45.Australia HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 46.India HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 47.South Korea HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 48.Rest of Asia-Pacific HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 49.Rest of the World HIV Diagnostics Market, By Country, 2012-2022 ($Million)

Table 50.Rest of the World HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 51.Brazil HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 52.Turkey HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 53.Saudi Arabia HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 54.South Africa HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 55.United Arab Emirates HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 56.Others HIV Diagnostics Market, By Product, 2012-2022 ($Million)

Table 57.Alere Inc.: Key Strategic Developments, 2017-2017

Table 58.Beckman Coulter: Key Strategic Developments, 2017-2017

Table 59.BD Biosciences: Key Strategic Developments, 2017-2017

Table 60.VIIV Healthcare: Key Strategic Developments, 2017-2017

Table 61.Merch & Co. Inc.: Key Strategic Developments, 2017-2017

Table 62.Gilead Sciences: Key Strategic Developments, 2017-2017

Table 63.Janssen Therapeutics: Key Strategic Developments, 2017-2017

Table 64.Bristol-Myers Squibb: Key Strategic Developments, 2017-2017

Table 65.Abbvie Inc.: Key Strategic Developments, 2017-2017

Table 66.Abbott Healthcare: Key Strategic Developments, 2017-2017

Table 67.Partec: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.HIV Diagnostics Market, Share, By Product, 2017 & 2025

Figure 2HIV Diagnostics Market, By Region, 2017, ($Million)

Figure 3.Alere Inc.: Net Revenues, 2017-2017 ($Million)

Figure 4.Alere Inc.: Net Revenue Share, By Segment, 2017

Figure 5.Alere Inc.: Net Revenue Share, By Geography, 2017

Figure 6.Beckman Coulter: Net Revenues, 2017-2017 ($Million)

Figure7.Beckman Coulter: Net Revenue Share, By Segment, 2017

Figure8.Beckman Coulter: Net Revenue Share, By Geography, 2017

Figure9.BD Biosciences: Net Revenues, 2017-2017 ($Million)

Figure10.BD Biosciences: Net Revenue Share, By Segment, 2017

Figure 11.BD Biosciences: Net Revenue Share, By Geography, 2017

Figure 12.Abbott Healthcare: Net Revenues, 2017-2017 ($Million)

Figure 13.Abbott Healthcare: Net Revenue Share, By Segment, 2017

Figure 14.Abbott Healthcare: Net Revenue Share, By Geography, 2017

Research Methodology

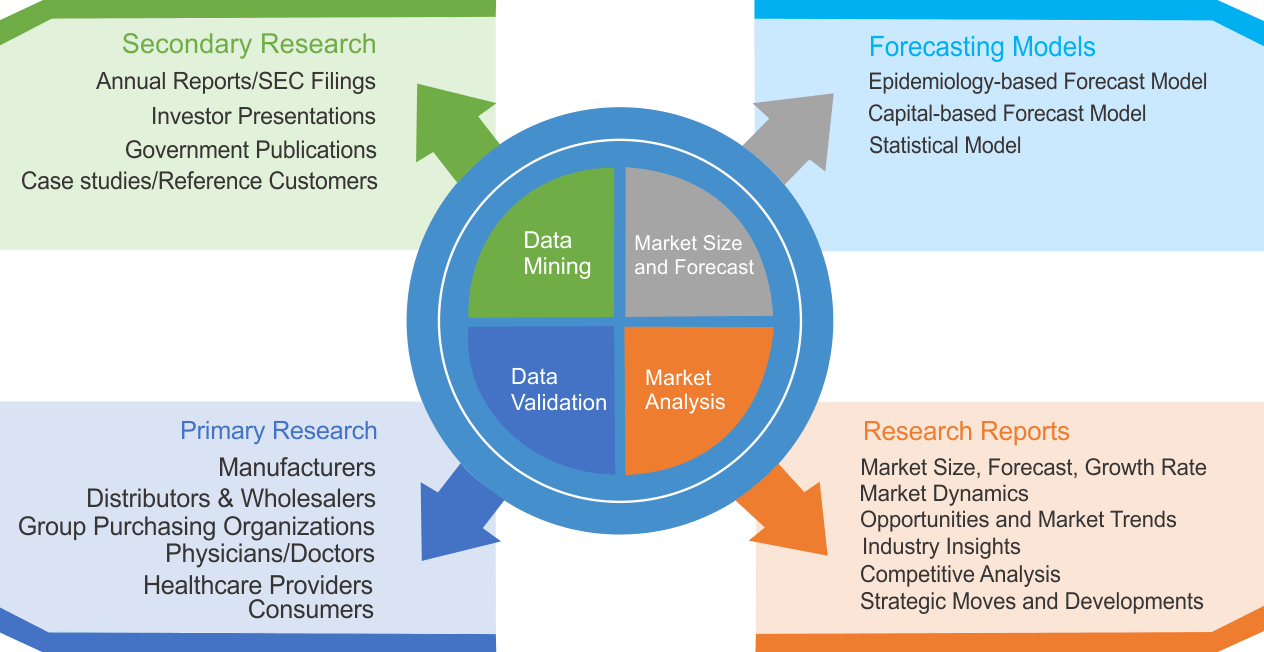

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|