.png)

Hydraulic Fracturing Market By Technology, Material and Application- Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 100 Category: Conventional Energy Report Code : CM11328

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

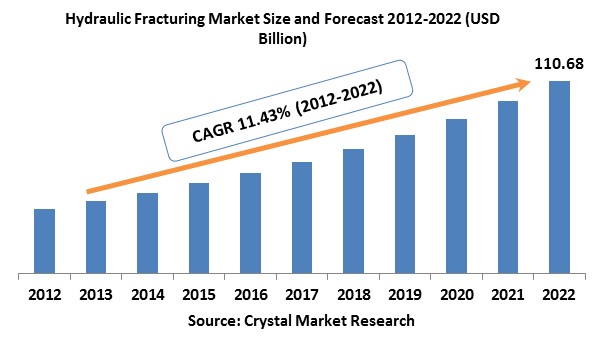

The global Hydraulic Fracturing market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Expanding E&P in oil and gas reserves that are unconventional particularly in the shale basins are relied upon to remain a key factor driving business sector development. Heightening demand for essential vitality in power generation, transportation, and household exercises has prompted expanded utilization of oil and gas in real economies over the globe. Significant oil and gas makers around the globe have been encountering a decrease in manufacturing levels inferable from draining customary reserves. Declining petroleum generation levels is relied upon to extend the demand-supply gap. Hydrocarbon extraction from the unusual stores has expanded manifolds utilizing horizontal drilling in blend with hydraulic fracturing procedures. Moving patterns towards creating flighty stores including tight oil, coal bed methane (CBM), tight gas, and shale is foreseen to drive pressure driven breaking market development over next couple of years. Utilization of such propelled extraction procedures has likewise helped E&P organizations to build the yield in low productive locales, for example, profound and ultra-remote oceans and the Arctic districts. Most of the future fracking requirement is relied upon to originate from developing economies including Russia, China, Mexico, Algeria, Brazil, and Argentina attributable to expanding horizontal drilling undertakings in flighty hydrocarbon fields. As indicated by the Energy Information Agency (EIA), E&P exercises in capricious resources, for example, tight oil and shale gas are relied upon to pick up force throughout the following couple of years. This is expected to expand consumption of traditional reserves facilitate by an additional couple of years because of the switch towards investigating substitute hydrocarbon holds. Previously mentioned factors are relied upon to decidedly affect hydraulic fracturing business sector development over the estimate time frame. Stringent directions and security commands by different national governments and administrative bodies, for example, Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) inferable from the potential natural hazard is relied upon to frustrate the business development. Bans and Moratoriums from a few regional organizations of Tunisia, Bulgaria, France and Romania against hydraulic fracturing are additionally anticipated that would remain a noteworthy test for industry members.

Technology Outlook and Trend Analysis

In 2017 Plug and perforation represented more than 70 percent of the worldwide water powered cracking share of the market. These advances are broadly utilized for cased hole wells. Its simplicity of accessibility for fracking in level wells make it great innovation than others choices. Industry income created from sliding sleeves is set to witness direct development in the upcoming years attributable to its applications in open hole wells. This procedure can be utilized to shut spill out of at least one supply zones that is delivering or utilizing excess of water. It requires less investment of time when contrasted with plug and perf amid fracking which comes about lower cost. These advances utilize less or no water and are relied upon to enable administrators and oilfield to benefit organizations to address ecological enactments forced by different governments. Technological progressions to relieve the related environment dangers and debasement are foreseen to give key hydraulic fracturing market members lucrative chances for investments in the future.

Material Outlook and Trend Analysis

Proppants were the key materials portion utilized for hydrofracking. In 2017 the portion created income surpassing USD billion. Proppants are additionally categorized as resin, ceramic and resin covered sand. Resin covered sand is generally used to enhance pressing and holds the proppant to its place without streaming back to the wellbore. Raw sand is the most broadly utilized proppant sort by virtue of its low cost and easy availability. Raw sand is utilized normally in more of raw conditions in a wellbore, yet it is hard to use in wellbores with high conclusion pressures. Resin covered sand are relied upon to build their share of the overall industry inferable from their cost benefits over ceramics and enhanced execution over utilization of raw sand. Different materials utilized for hydraulic fracturing alongside proppants incorporate sodium chloride, ethylene glycol, magnesium peroxide, methanol, tetramethyl ammonium chloride and hydrochloric acid.

Application Outlook and Trend Analysis

Atypical hydrocarbon reserves including CBM, shale, and tight oil & gas ruled the worldwide hydraulic fracturing industry representing more than 75 percent of the aggregate income in 2017. With the introduction of the shale blast in the United States, the segment rose as the biggest application section. Shale gas is anticipated to develop at a significant rate in the upcoming years. As per IEA estimates, generation of natural gas is relied upon to develop over next couple of years and shale gas is required to be a noteworthy supporter of this development. Tight oil, otherwise called shale oil, is likewise expected to be a central wellspring of substantial raw petroleum in the following couple of years. Water powered breaking industry is expected to witness stable development in tight gas and coal bed methane (CBM) bowls throughout the following couple of years. Expanding E&P in CBM bowls especially in Indonesia, Russia, Australia, China and United States is required to be a noteworthy supporter of water driven breaking market development over the gauge time frame.

Regional Outlook and Trend Analysis

In 2017 North America overwhelmed the worldwide request and represented more than 85 percent of aggregate profit. The United States and Canada together represented the major share in the worldwide hydraulic fracturing industry. Accessibility of major resources including government help, technology and skilled manpower combined with expanding E&P exercises in capricious reserves might be credited to high market infiltration in these locales. Asia Pacific holds massive potential for the business development throughout the following couple of years. Accessibility of vast in fact recoverable shale and CMB saves in Australia, China, and Indonesia alongside extensive ventures through FDI directs in the hydrocarbon segment in these countries is relied upon to make lucrative chances for the business members to investigate the undiscovered potential in the atypical hydrocarbon saves in these local markets. Hydraulic fracturing industry is relied upon to witness significant development in nations including Algeria, Russia, Poland, and Argentina over the conjecture time frame because of rising examinations for building up the extensive accessible atypical hydrocarbon reserves.

Competitive Insights

The worldwide water driven breaking market is respectably united attributable to the existence of substantial number key industry members over the industry. Leading organizations working in the business contains multinational combinations including microseismic companies, proppants, E&P companies, oilfield service corporations and individual equipment. The worldwide market is commanded by oilfield specialist co-op organizations including FTS INTERNATIONAL SERVICES, LLC, Halliburton, BJ Services and Schlumberger. Other prominent players in the market are Trican Well Service Ltd, United Oilfield Services, Calfrac Well Services, Weatherford International, Superior Well Services and Cudd Energy Services.

The global Hydraulic Fracturing Market is segmented as follows-

By Technology

- Sliding Sleeve

- Plug and Perf

By Material

- Resin-coated sand

- Proppant

- Ceramic

- Sand

- Others

By Application

- Tight oil

- Shale gas

- CBM

- Tight gas

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- Hydraulic Fracturing Market, By Technology, Estimates and Forecast, 2012-2022 ($Billion)

- Plug and Perf

- Sliding Sleeve

- Hydraulic Fracturing Market, By Material, Estimates and Forecast, 2012-2022 ($Billion)

- Proppant

- Sand

- Ceramic

- Resin-Coated Sand

- Other Materials

- Hydraulic Fracturing Market, By Application, Estimates and Forecast, 2012-2022 ($Billion)

- Shale gas

- Tight gas

- Tight oil

- CBM

- Other Applications

- Hydraulic Fracturing Market, By Region, Estimates and Forecast, 2012-2022 ($Billion)

- North America

- North America Hydraulic Fracturing Market, By Country

- North America Hydraulic Fracturing Market, By Technology

- North America Hydraulic Fracturing Market, By Material

- North America Hydraulic Fracturing Market, By Application

- U.S. Hydraulic Fracturing Market, By Technology

- U.S. Hydraulic Fracturing Market, By Material

- U.S. Hydraulic Fracturing Market, By Application

- Canada Hydraulic Fracturing Market, By Technology

- Canada Hydraulic Fracturing Market, By Material

- Canada Hydraulic Fracturing Market, By Application

- Mexico Hydraulic Fracturing Market, By Technology

- Mexico Hydraulic Fracturing Market, By Material

- Mexico Hydraulic Fracturing Market, By Applicatio

- Europe

- Europe Hydraulic Fracturing Market, By Country

- Europe Hydraulic Fracturing Market, By Technology

- Europe Hydraulic Fracturing Market, By Material

- Europe Hydraulic Fracturing Market, By Application

- Germany Hydraulic Fracturing Market, By Technology

- Germany Hydraulic Fracturing Market, By Material

- Germany Hydraulic Fracturing Market, By Application

- France Hydraulic Fracturing Market, By Technology

- France Hydraulic Fracturing Market, By Material

- France Hydraulic Fracturing Market, By Application

- UK Hydraulic Fracturing Market, By Technology

- UK Hydraulic Fracturing Market, By Material

- UK Hydraulic Fracturing Market, By Application

- Italy Hydraulic Fracturing Market, By Technology

- Italy Hydraulic Fracturing Market, By Material

- Italy Hydraulic Fracturing Market, By Application

- Spain Hydraulic Fracturing Market, By Technology

- Spain Hydraulic Fracturing Market, By Material

- Spain Hydraulic Fracturing Market, By Application

- Rest of Europe Hydraulic Fracturing Market, By Technology

- Rest of Europe Hydraulic Fracturing Market, By Material

- Rest of Europe Hydraulic Fracturing Market, By Application

-

- Asia-Pacific

- Asia-Pacific Hydraulic Fracturing Market, By Country

- Asia-Pacific Hydraulic Fracturing Market, By Technology

- Asia-Pacific Hydraulic Fracturing Market, By Material

- Asia-Pacific Hydraulic Fracturing Market, By Application

- Japan Hydraulic Fracturing Market, By Technology

- Japan Hydraulic Fracturing Market, By Material

- Japan Hydraulic Fracturing Market, By Application

- Australia Hydraulic Fracturing Market, By Technology

- Australia Hydraulic Fracturing Market, By Material

- Australia Hydraulic Fracturing Market, By Application

- India Hydraulic Fracturing Market, By Technology

- India Hydraulic Fracturing Market, By Material

- India Hydraulic Fracturing Market, By Application

- South Korea Hydraulic Fracturing Market, By Technology

- South Korea Hydraulic Fracturing Market, By Material

- South Korea Hydraulic Fracturing Market, By Application

- Rest of Asia-Pacific Hydraulic Fracturing Market, By Technology

- Rest of Asia-Pacific Hydraulic Fracturing Market, By Material

- Rest of Asia-Pacific Hydraulic Fracturing Market, By Application

-

- Rest of the World

- Rest of the World Hydraulic Fracturing Market, By Country

- Rest of the World Hydraulic Fracturing Market, By Technology

- Rest of the World Hydraulic Fracturing Market, By Material

- Rest of the World Hydraulic Fracturing Market, By Application

- Brazil Hydraulic Fracturing Market, By Technology

- Brazil Hydraulic Fracturing Market, By Material

- Brazil Hydraulic Fracturing Market, By Application

- South Africa Hydraulic Fracturing Market, By Technology

- South Africa Hydraulic Fracturing Market, By Material

- South Africa Hydraulic Fracturing Market, By Application

- Saudi Arabia Hydraulic Fracturing Market, By Technology

- Saudi Arabia Hydraulic Fracturing Market, By Material

- Saudi Arabia Hydraulic Fracturing Market, By Application

- Turkey Hydraulic Fracturing Market, By Technology

- Turkey Hydraulic Fracturing Market, By Material

- Turkey Hydraulic Fracturing Market, By Application

- United Arab Emirates Hydraulic Fracturing Market, By Technology

- United Arab Emirates Hydraulic Fracturing Market, By Material

- United Arab Emirates Hydraulic Fracturing Market, By Application

- Others Hydraulic Fracturing Market, By Technology

- Others Hydraulic Fracturing Market, By Material

- Others Hydraulic Fracturing Market, By Application

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Shift in Trend Towards Developing Unconventional Resources

3.2.1.2. Increasing Energy Demand

3.2.2. Restraints

3.2.2.1. Stringent environmental regulations

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Hydraulic Fracturing Market, By Technology

4.1. Introduction

4.2. Hydraulic Fracturing Market Assessment and Forecast, By Technology, 2012-2022

4.3. Plug and Perf

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

4.4. Sliding Sleeve

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5. Hydraulic Fracturing Market, By Material

5.1. Introduction

5.2. Hydraulic Fracturing Market Assessment and Forecast, By Material, 2012-2022

5.3. Proppant

5.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Billion)

5.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.3.3. Sand

5.3.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.3.4. Ceramic

5.3.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.3.5. Resin-Coated Sand

5.3.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

5.4. Other Materials

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6. Hydraulic Fracturing Market, By Application

6.1. Introduction

6.2. Hydraulic Fracturing Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

6.3. Shale Gas

6.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6.4. Tight Gas

6.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6.5. Tight Oil

6.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6.6. CBM

6.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

6.7. Other Application

6.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

7. Hydraulic Fracturing Market, By Region

7.1. Introduction

7.2. Hydraulic Fracturing Market Assessment and Forecast, By Region, 2012-2022 ($Billion)

7.3. North America

7.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

7.3.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.3. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.3.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5. U.S.

7.3.5.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.3.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5.2. Canada

7.3.5.2.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.2.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.3.5.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.3.5.3. Mexico

7.3.5.3.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.3.5.3.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.3.5.3.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4. Europe

7.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

7.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.3. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.5. Germany

7.4.5.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.5.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.6. France

7.4.6.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.6.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.7. UK

7.4.7.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.7.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.8. Italy

7.4.8.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.8.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.9. Spain

7.4.9.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.9.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.10. Russia

7.4.10.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.10.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.10.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

7.4.10.2. Rest of Europe

7.4.10.2.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

7.4.10.2.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

7.4.10.2.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8. Asia-Pacific

8.1.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

8.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.3. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.4.1. Japan

8.1.4.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.4.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.4.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.5. China

8.1.5.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.5.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.6. Australia

8.1.6.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.6.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.7. India

8.1.7.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.7.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.8. South Korea

8.1.8.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.8.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.9. Taiwan

8.1.9.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.9.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

8.1.10. Rest of Asia-Pacific

8.1.10.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

8.1.10.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

8.1.10.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9. Rest of the World

9.1.1. Market Assessment and Forecast, By Country, 2012-2022 ($Billion)

9.1.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.3. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.4. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.5. Brazil

9.1.5.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.5.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.5.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.6. Turkey

9.1.6.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.6.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.6.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.7. Saudi Arabia

9.1.7.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.7.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.7.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.8. South Africa

9.1.8.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.8.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.8.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.9. United Arab Emirates

9.1.9.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.9.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.9.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

9.1.10. Others

9.1.10.1.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Billion)

9.1.10.1.2. Market Assessment and Forecast, By Material, 2012-2022 ($Billion)

9.1.10.1.3. Market Assessment and Forecast, By Application, 2012-2022 ($Billion)

10. Company Profiles

10.1. Baker Hughes Inc.

10.1.1. Business Overview

10.1.2. Product Portfolio

10.1.3. Key Financials

10.1.4. Strategic Developments

10.2. Calfrac Well Services Ltd.

10.2.1. Business Overview

10.2.2. Product Portfolio

10.2.3. Key Financials

10.2.4. Strategic Developments

10.3. Cudd Energy Services

10.3.1. Business Overview

10.3.2. Product Portfolio

10.3.3. Key Financials

10.3.4. Strategic Developments

10.4. FTS International

10.4.1. Business Overview

10.4.2. Product Portfolio

10.4.3. Key Financials

10.4.4. Strategic Developments

10.5. Halliburton

10.5.1. Business Overview

10.5.2. Product Portfolio

10.5.3. Strategic Developments

10.6. Schlumberger

10.6.1. Business Overview

10.6.2. Product Portfolio

10.6.3. Strategic Developments

10.7. Tacrom Services S.R.L.

10.7.1. Business Overview

10.7.2. Product Portfolio

10.7.3. Strategic Developments

10.8. Superior Well Services Inc.

10.8.1. Business Overview

10.8.2. Product Portfolio

10.8.3. Strategic Developments

10.9. Trican Well Service Ltd.

10.9.1. Business Overview

10.9.2. Product Portfolio

10.9.3. Strategic Developments

10.10. United Oilfield Services

10.10.1. Business Overview

10.10.2. Product Portfolio

10.10.3. Strategic Developments

10.11. Weatherford International Inc.

10.11.1. Business Overview

10.11.2. Product Portfolio

10.11.3. Strategic Developments

List of Tables

Table 1.Hydraulic Fracturing Market, By Technology ($Billion), 2012-2022

Table 2.Plug and Perf Market, By Region ($Billion), 2012-2022

Table 3.Sliding Sleeve Market, By Region ($Billion), 2012-2022

Table 4.Hydraulic Fracturing Market, By Material ($Billion), 2012-2022

Table 5.Proppant Market, By Type ($Billion), 2012-2022

Table 6.Proppant Market, By Region ($Billion), 2012-2022

Table 7.Sand Market, By Region ($Billion), 2012-2022

Table 8.Ceramic Market, By Region ($Billion), 2012-2022

Table 9.Resin-Coated Sand Market, By Region ($Billion), 2012-2022

Table 10.Other Materials Market, By Region ($Billion), 2012-2022

Table 11.Hydraulic Fracturing Market, By Application ($Billion), 2012-2022

Table 12.Shale gas Market, By Region ($Billion), 2012-2022

Table 13.Tight gas Market, By Region ($Billion), 2012-2022

Table 14.Tight oil Market, By Region ($Billion), 2012-2022

Table 15.CBM Market, By Region ($Billion), 2012-2022

Table 16.Other Applications Market, By Region ($Billion), 2012-2022

Table 17.North America Hydraulic Fracturing Market, By Country, 2012-2022 ($Billion)

Table 18.North America Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 19.North America Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 20.North America Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 21.U.S. Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 22.U.S. Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 23.U.S. Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 24.Canada Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 25.Canada Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 26.Canada Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 27.Mexico Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 28.Mexico Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 29.Mexico Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 30.Europe Hydraulic Fracturing Market, By Country, 2012-2022 ($Billion)

Table 31.Europe Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 32.Europe Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 33.Europe Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 34.Germany Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 35.Germany Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 36.Germany Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 37.France Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 38.France Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 39.France Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 40.UK Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 41.UK Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 42.UK Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 43.Italy Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 44.Italy Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 45.Italy Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 46.Spain Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 47.Spain Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 48.Spain Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 49.Russia Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 50.Russia Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 51.Russia Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 53.Rest of Europe Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 54.Rest of Europe Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 55.Rest of Europe Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 56.Asia-Pacific Hydraulic Fracturing Market, By Country, 2012-2022 ($Billion)

Table 57.Asia-Pacific Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 58.Asia-Pacific Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 59.Asia-Pacific Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 60.Japan Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 61.Japan Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 62.Japan Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 63.China Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 64.China Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 65.China Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 66.Australia Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 67.Australia Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 68.Australia Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 69.India Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 70.India Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 71.India Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 72.South Korea Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 73.South Korea Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 74.South Korea Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 75.Taiwan Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 76.Taiwan Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 77.Taiwan Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 78.Rest of Asia-Pacific Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 79.Rest of Asia-Pacific Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 80.Rest of Asia-Pacific Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 81.Rest of the World Hydraulic Fracturing Market, By Country, 2012-2022 ($Billion)

Table 82.Rest of the World Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 83.Rest of the World Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 84.Rest of the World Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 85.Brazil Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 86.Brazil Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 87.Brazil Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 88.Turkey Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 89.Turkey Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 90.Turkey Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 91.Saudi Arabia Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 92.Saudi Arabia Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 93.Saudi Arabia Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 94.South Africa Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 95.South Africa Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 96.South Africa Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 97.United Arab Emirates Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 98.United Arab Emirates Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 99.United Arab Emirates Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 100.Others Hydraulic Fracturing Market, By Technology, 2012-2022 ($Billion)

Table 101Others Hydraulic Fracturing Market, By Material, 2012-2022 ($Billion)

Table 102.Others Hydraulic Fracturing Market, By Application, 2012-2022 ($Billion)

Table 103.Baker Hughes Inc.: Key Strategic Developments, 2017-2017

Table 104.Calfrac Well Services Ltd.: Key Strategic Developments, 2017-2017

Table 105.Cudd Energy Services: Key Strategic Developments, 2017-2017

Table 106.FTS International: Key Strategic Developments, 2017-2017

Table 107.Halliburton: Key Strategic Developments, 2017-2017

Table 108.Schlumberger: Key Strategic Developments, 2017-2017

Table 109.Tacrom Services S.R.L.: Key Strategic Developments, 2017-2017

Table 110.Superior Well Services Inc.: Key Strategic Developments, 2017-2017

Table 111.Trican Well Service Ltd.: Key Strategic Developments, 2017-2017

Table 112.United Oilfield Services: Key Strategic Developments, 2017-2017

Table 113.Weatherford International Inc.: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Hydraulic Fracturing Market Share, By Technology, 2017 & 2025 ($Billion)

Figure 2.Hydraulic Fracturing Market, By Material, 2017 & 2025 ($Billion)

Figure 3.Hydraulic Fracturing Market, By Application, 2017 & 2025 ($Billion)

Figure 4.Hydraulic Fracturing Market, By Region, 2017, ($Billion)

Figure 5.Baker Hughes Inc.: Net Revenues, 2017-2017 ($Billion)

Figure 6.Baker Hughes Inc.: Net Revenue Share, By Segment, 2017

Figure 7.Baker Hughes Inc.: Net Revenue Share, By Geography, 2017

Figure 8.Calfrac Well Services Ltd.: Net Revenues, 2017-2017 ($Billion)

Figure 9.Calfrac Well Services Ltd.: Net Revenue Share, By Segment, 2017

Figure 10.Calfrac Well Services Ltd.: Net Revenue Share, By Geography, 2017

Figure 11.Cudd Energy Services: Net Revenues, 2017-2017 ($Billion)

Figure 12.Cudd Energy Services: Net Revenue Share, By Segment, 2017

Figure 13.Cudd Energy Services: Net Revenue Share, By Geography, 2017

Figure 14.FTS International: Net Revenues, 2017-2017 ($Billion)

Figure 15.FTS International: Net Revenue Share, By Segment, 2017

Figure 16.FTS International: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|