.png)

In-Vitro Colorectal Cancer Screening Tests Market by Product - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 95 Category: In-Vitro Diagnostics Report Code : HC11325

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

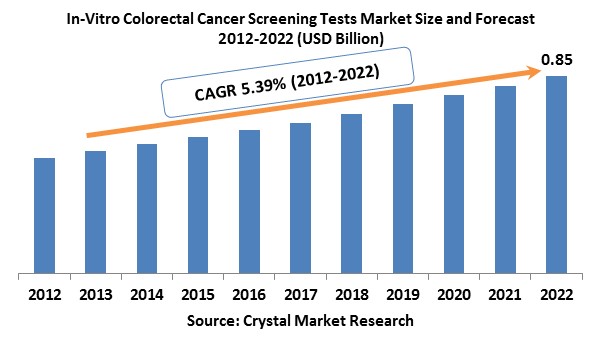

The global In-Vitro Colorectal Cancer Screening Tests market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Developing rates of rectal and colon cancer and the advent of novel screening tests utilizing genetic testing are the key elements that are anticipated to drive the in-vitro colorectal cancer screening tests market over the conjecture time frame. The advent of government controls went for compulsory use of cancer screening tests, increasing requirement for novel minimally invasive tests which screen for colorectal cancer utilizing genetic and DNA biomarkers and the expanding commonness of colorectal disease are foreseen to fuel the development of the market for in-vitro colorectal cancer screening tests. Comprehensively, colorectal cancer (CRC) is the third most common type of cancer. CRC represents right around a tenth of all disease occurrences around the world. This rate has just been expanding in the course of the most recent few years. Moreover, the advent of novel colorectal tests which utilize biomarkers, for example, tumor M2-PK marker or which screen for colorectal disease utilizing methylated genes for screening will witness a development in market demand all through the gauge time frame. The essential factor in charge of this switch in pattern can be ascribed to by the expanded precision of screening which these more up to date genetic tests bring to the table.

Product Outlook and Trend Analysis

The worldwide in-vitro colorectal cancer screening tests market was observed to be ruled by fecal mysterious blood tests attributable to their higher utilization rates and simple relevance to extensive gatherings of the populace on the double for cancer screening. The biggest share of the market for in-vitro colorectal screening tests was observed to be possessed Immuno-FOB ELISA and Immuno-FOB agglutination tests in 2017. Nonetheless, the development and investigation of more up to date more precise techniques for in-vitro colorectal cancer screening have prompted the advancement of biomarker and DNA screening tests. The most recent improvements in the screening tests are the methylated gene testing and transferrin assays. Amid the initial phases of cancer and before the genuine tumors spread over the human body, fixation examination of transferrin can give important data in the screening of precancerous lesions. Transferrin dipstick test has reflected precision reliable qualities with Immuno-FOB stool tests and attributable to their simpler appropriateness is anticipated to gain development all through the figure time frame. Likewise, testing for the existence of extreme gene methylation to decide the level of danger of development of colorectal cancer is additionally anticipated that would pick up share of the market in the upcoming years.

Regional Outlook and Trend Analysis

In 2017 the in-vitro colorectal cancer screening tests market was dominated by North America. Factors, for example, rising aged population, high rates of colorectal cancer has added to the district's market position. Nonetheless, Asia-Pacific is relied upon to witness generous development over the figure time frame attributable to the expanding commonness of cancer in this area. Cancer is a developing concern inferable from rising elderly populace base and changes in way of life in Asian nations. In-vitro colorectal cancer is the third most harmful issue in men and women. The death rates of colorectal cancer are on an ascent in this locale over the previous decade. National rules on colorectal cancer screening are nonexistent in most Asian nations aside from in Taiwan, Singapore, Japan, and Korea.

Competitive Insights

The in-vitro colorectal cancer screening tests market is extremely focused set apart by constant key partnerships, mergers, and acquisitions. Coordinated efforts are essentially utilized as a technique to upgrade item portfolio. The market is anticipated to move towards union throughout the following years. Research and development spending is relied upon to keep on growing, as most market players are associated with the improvement of CRC DNA and biomarker screening tests. Some of the major players in the market are R-Biopharm, Epigenomics AG, Sysmex Corporation, Quest Diagnostics, Merck Millipore, Kyowa Medex, Companion Dx, Abbott Molecular Inc, Immunostics Co, MODE Diagnostics Ltd, Siemens Healthineers and Randox Laboratories.

The In-Vitro Colorectal Cancer Screening Tests Market is segmented as follows-

By Product

- Biomarker Tests

- Transferrin Assays

- Tumor M2-PK Stool Test

- Fecal Occult Blood Tests

- Lateral Flow Immuno-FOB Test

- Guaiac FOB Stool Test

- Immuno-FOB Agglutination Test

- Immuno-FOB ELISA Test

- CRC DNA Screening Tests

- Panel DNA Tests

- Methylated Gene Testing

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- In-Vitro Colorectal Cancer Screening Tests Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Fecal Occult Blood Tests

- Guaiac FOB Stool Test

- Lateral Flow Immuno-FOB Test

- Immuno-FOB Agglutination Test

- Immuno-FOB ELISA Test

- Biomarker Tests

- Transferrin Assays

- Tumor M2-PK Stool Test

- CRC DNA Screening Tests

- Panel DNA Tests

- Methylated Gene Testing

- In-Vitro Colorectal Cancer Screening Tests Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America In-Vitro Colorectal Cancer Screening Tests Market, By Country

- North America In-Vitro Colorectal Cancer Screening Tests Market, By Product

- U.S. In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Canada In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Mexico In-Vitro Colorectal Cancer Screening Tests Market, By Product

-

- Europe

- Europe In-Vitro Colorectal Cancer Screening Tests Market, By Country

- Europe In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Germany In-Vitro Colorectal Cancer Screening Tests Market, By Product

- France In-Vitro Colorectal Cancer Screening Tests Market, By Product

- UK In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Italy In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Spain In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Rest of Europe In-Vitro Colorectal Cancer Screening Tests Market, By Product

-

- Asia-Pacific

- Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Country

- Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Japan In-Vitro Colorectal Cancer Screening Tests Market, By Product

- China In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Australia In-Vitro Colorectal Cancer Screening Tests Market, By Product

- India In-Vitro Colorectal Cancer Screening Tests Market, By Product

- South Korea In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Rest of Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Asia-Pacific

-

- Rest of the World

- Rest of the World In-Vitro Colorectal Cancer Screening Tests Market, By Country

- Rest of the World In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Brazil In-Vitro Colorectal Cancer Screening Tests Market, By Product

- South Africa In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Saudi Arabia In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Turkey In-Vitro Colorectal Cancer Screening Tests Market, By Product

- United Arab Emirates In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Others In-Vitro Colorectal Cancer Screening Tests Market, By Product

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rising Incidence of Rectal and Colon Cancer around the World

3.2.1.2. Enhanced Accuracy of Colorectal Cancer Screening Using Genetic Testing

3.2.1.3. Strong Product Pipeline

3.2.2. Restraints

3.2.2.1. Unfavorable Reimbursement Policies

3.2.2.2. Dearth of Skilled Professionals

3.2.3. Opportunities

3.2.3.1. Emerging Economies to Offer Lucrative Growth Opportunities

4. In-Vitro Colorectal Cancer Screening Tests Market, By Product

4.1. Introduction

4.2. In-Vitro Colorectal Cancer Screening Tests Market Assessment and Forecast, By Product, 2012-2022

4.3. Fecal Occult Blood Tests

4.3.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.3.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.3. Guaiac FOB Stool Test

4.3.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.4. Lateral Flow Immuno-FOB Test

4.3.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.5. Immuno-FOB Agglutination Test

4.3.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.3.6. Immuno-FOB ELISA Test

4.3.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Biomarker Tests

4.4.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.3. Transferrin Assays

4.4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4.4. Tumor M2-PK Stool Test

4.4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. CRC DNA Screening Tests

4.5.1. Market Assessment and Forecast, By Type, 2012-2022 ($Million)

4.5.2. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5.3. Panel DNA Tests

4.5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5.4. Methylated Gene Testing

4.5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. In-Vitro Colorectal Cancer Screening Tests Market, By Region

5.1. Introduction

5.2. In-Vitro Colorectal Cancer Screening Tests Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.3.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6. Company Profiles

6.1. Abbott Molecular Inc

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. Alere Inc.

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. Eiken Chemical

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Strategic Developments

6.4. Beckman Coulter Inc

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5. Epigenomics AG Corporation

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Key Financials

6.5.4. Strategic Developments

6.6. Sysmex Corporation

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Key Financials

6.6.4. Strategic Developments

6.7. Quest Diagnostics Incorporated

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Key Financials

6.7.4. Strategic Developments

6.8. Siemens Healthcare Ltd.

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Key Financials

6.8.4. Strategic Developments

6.9. OncoCyte Corporation-Biotime

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Key Financials

6.9.4. Strategic Developments

6.10. CompanianDx

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Key Financials

6.10.4. Strategic Developments

6.11. GeneNews Ltd.

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Key Financials

6.11.4. Strategic Developments

6.12. R-Biopharm Incorporation

6.12.1. Business Overview

6.12.2. Product Portfolio

6.12.3. Key Financials

6.12.4. Strategic Developments

List of Tables

Table 1.Global In-Vitro Colorectal Cancer Screening Tests Market, By Product ($Million), 2012-2022

Table 2.Fecal Occult Blood Tests Market, By Type ($Million), 2012-2022

Table 3.Fecal Occult Blood Tests Market, By Region ($Million), 2012-2022

Table 4.Guaiac FOB Stool Test Market, By Region ($Million), 2012-2022

Table 5.Lateral Flow Immuno-FOB Test Market, By Region ($Million), 2012-2022

Table 6.Immuno-FOB Agglutination Test Market, By Region ($Million), 2012-2022

Table 7.Immuno-FOB ELISA Test Market, By Region ($Million), 2012-2022

Table 8.Biomarker Tests Market, By Type ($Million), 2012-2022

Table 9.Biomarker Tests Market, By Region ($Million), 2012-2022

Table 10.Transferrin Assays Market, By Region ($Million), 2012-2022

Table 11.Tumor M2-PK Stool Test Market, By Region ($Million), 2012-2022

Table 12.CRC DNA Screening Tests Market, By Type ($Million), 2012-2022

Table 13.CRC DNA Screening Tests Market, By Region ($Million), 2012-2022

Table 14.Panel DNA Tests Market, By Region ($Million), 2012-2022

Table 15.Methylated Gene Testing Market, By Region ($Million), 2012-2022

Table 16.In-Vitro Colorectal Cancer Screening Tests Market, By Region ($Million), 2012-2022

Table 17.North America In-Vitro Colorectal Cancer Screening Tests Market, By Country, 2012-2022 ($Million)

Table 18.North America In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 19.U.S. In-Vitro Colorectal Cancer Screening Tests Market, by Product, 2012-2022 ($Million)

Table 20.Canada In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 21.Mexico In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 22.Europe In-Vitro Colorectal Cancer Screening Tests Market, By Country, 2012-2022 ($Million)

Table 23.Europe In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 24.Germany In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 25.France In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 26.UK In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 27.Italy In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 28.Spain In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 30.Rest of Europe In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 31.Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Country, 2012-2022 ($Million)

Table 32.Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 33.Japan In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 34.China In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 35.Australia In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 36.India In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 37.South Korea In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 39.Rest of Asia-Pacific In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 40.Rest of the World In-Vitro Colorectal Cancer Screening Tests Market, By Country, 2012-2022 ($Million)

Table 41.Rest of the World In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 42.Brazil In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 43.Turkey In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 44.Saudi Arabia In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 45.South Africa In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 46.United Arab Emirates In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 47.Others In-Vitro Colorectal Cancer Screening Tests Market, By Product, 2012-2022 ($Million)

Table 48.Abbott Molecular Inc.: Key Strategic Developments, 2017-2017

Table 49.Alere Inc.: Key Strategic Developments, 2017-2017

Table 50 Eiken Chemical: Key Strategic Developments, 2017-2017

Table 51.Beckman Coulter Inc: Key Strategic Developments, 2017-2017

Table 52 .Epigenomics AG Corporation: Key Strategic Developments, 2017-2017

Table 53.Sysmex Corporation: Key Strategic Developments, 2017-2017

Table 54.Quest Diagnostics Incorporated: Key Strategic Developments, 2017-2017

Table 55.Siemens Healthcare Ltd.: Key Strategic Developments, 2017-2017

Table 56.OncoCyte Corporation-Biotime: Key Strategic Developments, 2017-2017

Table 57.CompanianDx: Key Strategic Developments, 2017-2017

Table 58.GeneNews Ltd.: Key Strategic Developments, 2017-2017

Table 59.R-Biopharm Incorporation: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global In-Vitro Colorectal Cancer Screening Tests Market Share, By Product, 2012 & 2022

Figure 2 In-Vitro Colorectal Cancer Screening Tests Market, By Region, 2012 & 2022, ($Million)

Figure 3.Abbott Molecular Inc.: Net Revenues, 2017-2017 ($Million)

Figure 4.Abbott Molecular Inc.: Net Revenue Share, By Segment, 2017

Figure 5.Abbott Molecular Inc.: Net Revenue Share, By Geography, 2017

Figure 6.Alere Inc..: Net Revenues, 2017-2017 ($Million)

Figure7.Alere Inc..: Net Revenue Share, By Segment, 2017

Figure8.Alere Inc..: Net Revenue Share, By Geography, 2017

Figure9.Beckman Coulter Inc: Net Revenues, 2017-2017 ($Million)

Figure10.Beckman Coulter Inc: Net Revenue Share, By Segment, 2017

Figure 11.Beckman Coulter Inc: Net Revenue Share, By Geography, 2017

Figure12.Epigenomics AG Corporation: Net Revenues, 2017-2017 ($Million)

Figure 13.Epigenomics AG Corporation: Net Revenue Share, By Segment, 2017

Figure 14.Epigenomics AG Corporation: Net Revenue Share, By Geography, 2017

Figure 15.Sysmex Corporation: Net Revenues, 2017-2017 ($Million)

Figure 16.Sysmex Corporation: Net Revenue Share, By Segment, 2017

Figure 17.Sysmex Corporation: Net Revenue Share, By Geography, 2017

Figure 18.Quest Diagnostics Incorporated: Net Revenues, 2017-2017 ($Million)

Figure 19.Quest Diagnostics Incorporated: Net Revenue Share, By Segment, 2017

Figure 21.Quest Diagnostics Incorporated: Net Revenue Share, By Geography, 2017

Figure 22.Siemens Healthcare Ltd.: Net Revenues, 2017-2017 ($Million)

Figure 23.Siemens Healthcare Ltd.: Net Revenue Share, By Segment, 2017

Figure 24.Siemens Healthcare Ltd.: Net Revenue Share, By Geography, 2017

Figure 25.OncoCyte Corporation-Biotime: Net Revenues, 2017-2017 ($Million)

Figure 26.OncoCyte Corporation-Biotime: Net Revenue Share, By Segment, 2017

Figure 27.OncoCyte Corporation-Biotime: Net Revenue Share, By Geography, 2017

Figure 28.CompanianDx: Net Revenues, 2017-2017 ($Million)

Figure 29.CompanianDx: Net Revenue Share, By Segment, 2017

Figure 30.CompanianDx: Net Revenue Share, By Geography, 2017

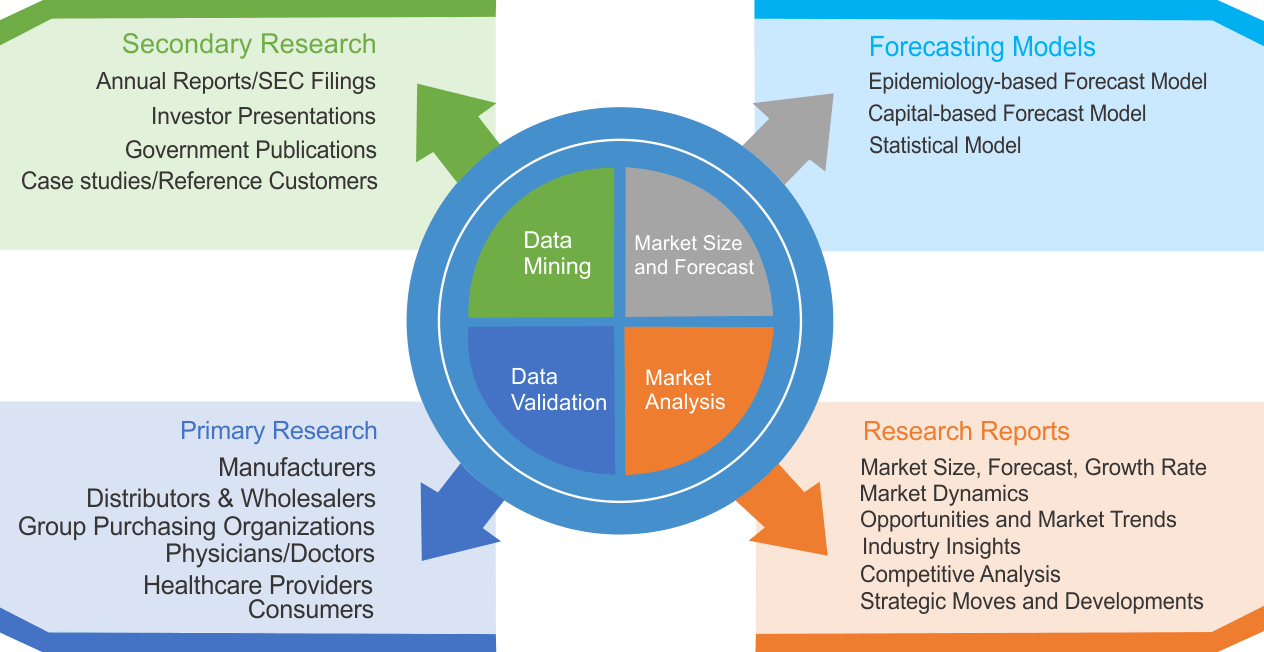

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|