.png)

Injection Molded Plastics Market by Raw Material and Application - Global Industry Analysis and Forecast to 2027

Published On : August 2017 Pages : 145 Category: Plastics, Polymers & Resins Report Code : CM08192

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global injection molded plastics market is anticipated to garner a whopping $195.45 billion by the end of the year 2027, while registering itself at a substantial compound annual growth rate (CAGR) of % during the forecast period. The industry is expected to encounter considerable growth in the coming years due to rising requirements of plastic components beyond numerous industries that include home appliances, medical devices, packaging, automotive and electronics. Injection molding process includes manufacturing of products that are molded by infusing plastic that is molten by making use of heat into a mold and hardening it. Modernized introductions have been made in order to reduce the rate of deficient production and have also improved the implication of injection molded plastics in its massive inventory. Rising cost of construction, specifically in upcoming markets of India, Mexico, Russia, South Africa and China is anticipated to boost the requirement.

This is backed up all the more due to flexible elements of final products that have enhanced resistance to pressure making then efficient for numerous industries. Reduced prices of crude oil and China’s state of economy have had a powerful impact on the industry of petrochemicals. Plastics are extremely useful in packaging applications in comparison with any other material for example wood and glass. An imperative part is played by China in producing and trading derivatives of petrochemicals in a large quantity. Numerous companies have implemented approaches to preserve yearly growth and curtail the impact of reduced prices of oil. Fluctuating prices of prime raw materials that also include propylene, styrene, benzene and ethylene along with excelling environmental concerns in regard with disposals is said to hamper the growth of the market. In order to overcome such hurdles, industries have switched their aim towards creating injection molded plastics by making the use of counterparts that are bio-based.

Raw Material Trend Analysis

Polypropylene came up as the biggest sector of raw material and accounted more than % of the total requirement in the year 2017. Increased requirement of injection molded Polypropylene in applications of packaging, automotive parts and household goods is a huge factor that increases its use. Final products of Polypropylene such as food packaging, electrical contacts, battery housings and protective caps are further anticipated to influence its requirement. Polypropylene as an element is being used on large scale in packaging of food and for electrical contact as it is resistant to corrosion and electrical insulation properties resulting in increased growth over the period of forecast. Acrylonitrile butadiene styrene (ABS) came up as the second leading raw material and accounted more than % of the total demand in the year 2017. It is majorly demanded in consumer appliances, medical devices and electronic housings.

Application Outlook and Trend Analysis

The dominant application of the injection molded plastics industry was packaging with an average requirement of 30,000 kilo tons in the year 2017. The final products that are used in packaging go through several enhancement stages to make the cut of the regulatory guidelines and needs of users. Enhanced performances towards wear and tear, long lasting and increased shelf life of foods are few demands plastics need to meet for the packaging of food. Injection molded plastics have enormous possibilities in the automotive and medical sector. The industry is anticipated to encounter major growth in medical devices and elements section. Optical clarity, biocompatibility and cost efficiency are few factors that are raising its demand in the medical industry. Strict regulations imposed regarding the use of polymer in the healthcare section is expected to influence the growth of the industry over the forecast period in a lucrative manner. Increasing preference of polymers that are bio-degradable among the manufacturers of medical devices develops opportunities for the medical industry. A rapid switch in trends regarding the replacement of steels with plastics in the industry of automotive is also expected to boost the growth of the market.

Regional Outlook and Trend Analysis

The global market of injection molded plastic was led by Asia pacific and accounted more than % of the total market value in the year 2017. Rising cost of infrastructure along with increasing requirement of automobile in countries like China, Indonesia, Malaysia and India are anticipated to spur the market in the given region. Industries with considerable applications like automobiles and electronics are switching their manufacturing given the labor costs are low in Thailand, India and China. Manufactures in these regions are offered incentives in the form of tax benefits. This results in increased demand of manufacturing electrical and automotive parts. Another huge market of the injection molded plastics was held by Europe region with the market predicted to boom in the future. The Non-food and beverage packaging applications of Europe involved household chemicals, cosmetics, pharmaceutical and toiletries. Rising demand of electronic appliances such as smartphones, laptops and tablet, specifically in the United Kingdom, France and Germany is anticipated to spur the growth of the market substantially.

Competitive Insights

The global market of injection molded plastics is widely divided into sectors that are unorganized specifically in Latin America and Asia Pacific. Organizations, mostly prevailing form Asia Pacific have continually been searching for considerable capacity in the past years and accomplish good economic scale. Diversity in branding of the products develop a competitive market in regard with prices and mediums of distribution.

Prime market manufacturers that operate in the global injection molded plastic market are Cascade Engineering, The Dow Chemical, Bemis Manufacturing, ContiTech AG, Great Wall Plastic Industries, Berry Plastics, Lacks Enterprises, SABIC Innovative Plastics, Fabrik Molded Plastics, Magna International, Tupperware Brands, Sonoco, Visteon, BASF and Horizon Plastics International.

Injection Molded Plastics Market is segmented as follows :

Injection molded plastics by raw material

- HDPE

- Polypropylene

- ABS

- Polystyrene

- Others

By Application

- Automotive

- Consumables and electronics

- Building and construction

- Packaging

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- Turkey

- United ArabEmirates

- Other

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2022 to 2027?

- What will be the industry market growth from 2022 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- Injection Molded Plastics Market By Raw Material

- Polypropylene

- Acrylonitrile Butadiene Styrene

- High Density Polyethylene

- Polystyrene

- Others

- Injection Molded Plastics Market, By Application Type

- Packaging

- Consumables & Electronics

- Automotive

- Building & Construction

- Medical

- Others

- Injection Molded Plastics Market, By Region

- North America

- North America Injection Molded Plastics Market, By Country, 2017-2027

- North America Injection Molded Plastics Market, By Raw Material, 2017-2027

- North America Injection Molded Plastics, By Application, 2017-2027

- U.S. Injection Molded Plastics, By Raw Material, 2017-2027

- U.S. Injection Molded Plastics, By Application, 2017-2027

- Canada Injection Molded Plastics, By Raw Material, 2017-2027

- Canada Injection Molded Plastics, By Application, 2017-2027

- Mexico Injection Molded Plastics, By Raw Material, 2017-2027

- Mexico Injection Molded Plastics, By Application, 2017-2027

- Europe

- Europe Injection Molded Plastics Market, By Country, 2017-2027

- Europe Injection Molded Plastics Market, By Raw Material, 2017-2027

- Europe Injection Molded Plastics, By Application, 2017-2027

- Germany Injection Molded Plastics, By Raw Material, 2017-2027

- Germany Injection Molded Plastics, By Application, 2017-2027

- France Injection Molded Plastics, By Raw Material, 2017-2027

- France Injection Molded Plastics, By Application, 2017-2027

- U.K Injection Molded Plastics, By Raw Material, 2017-2027

- U.K Injection Molded Plastics, By Application, 2017-2027

- Italy Injection Molded Plastics, By Raw Material, 2017-2027

- Italy Injection Molded Plastics, By Application, 2017-2027

- Spain Injection Molded Plastics, By Raw Material, 2017-2027

- Spain Injection Molded Plastics, By Application, 2017-2027

- Rest of the Europe Injection Molded Plastics, By Raw Material, 2017-2027

- Rest of the Europe Injection Molded Plastics, By Application, 2017-2027

- Asia-Pacific

- Asia-Pacific Injection Molded Plastics Market, By Country, 2017-2027

- Asia-Pacific Injection Molded Plastics Market, By Raw Material, 2017-2027

- Asia-Pacific Injection Molded Plastics, By Application, 2017-2027

- Japan Injection Molded Plastics, By Raw Material, 2017-2027

- Japan Injection Molded Plastics, By Application, 2017-2027

- China Injection Molded Plastics, By Raw Material, 2017-2027

- China Injection Molded Plastics, By Application, 2017-2027

- Australia Injection Molded Plastics, By Raw Material, 2017-2027

- Australia Injection Molded Plastics, By Application, 2017-2027

- India Injection Molded Plastics, By Raw Material, 2017-2027

- India Injection Molded Plastics, By Application, 2017-2027

- South Korea Injection Molded Plastics, By Raw Material, 2017-2027

- South Korea Injection Molded Plastics, By Application, 2017-2027

- Rest of the Asia-Pacific Injection Molded Plastics, By Raw Material, 2017-2027

- Rest of the Asia-Pacific Injection Molded Plastics, By Application, 2017-2027

- Rest of the World

- Rest of the World Injection Molded Plastics Market, By Country, 2017-2027

- Rest of the World Injection Molded Plastics Market, By Raw Material, 2017-2027

- Rest of the World Injection Molded Plastics, By Application, 2017-2027

- Brazil Injection Molded Plastics, By Raw Material, 2017-2027

- Brazil Injection Molded Plastics, By Application, 2017-2027

- South Africa Injection Molded Plastics, By Raw Material, 2017-2027

- South Africa Injection Molded Plastics, By Application, 2017-2027

- Turkey Injection Molded Plastics, By Raw Material, 2017-2027

- Turkey Injection Molded Plastics, By Application, 2017-2027

- United Arab Emirates Injection Molded Plastics, By Raw Material, 2017-2027

- United Arab Emirates Injection Molded Plastics, By Application, 2017-2027

- Other Injection Molded Plastics, By Raw Material, 2017-2027

- Other Injection Molded Plastics, By Application, 2017-2027

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Share Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Automotive & Transportation Industry to drive the Market

3.3.1.2. Increasing in Construction and Transportation spending

3.3.1.3. Positive outlook on global packaging industry

3.3.2. Restraints

3.3.2.1. Unpredictable raw material price trend

3.3.2.2. Growing environmental concern

3.3.3. Opportunities

3.3.3.1. Growing demand of bio-based polymers

3.3.3.2. Strong growth in packaging industry.

3.4. Industry Trends

4. Injection Molded Plastics Market By Raw Material

4.1. Introduction

4.2. Injection Molded Plastics Market Share By Raw Material, 2017 – 2027

4.3. Polypropylene

4.3.1. Polypropylene Market Estimates and Forecast, 2017 – 2027

4.3.2. Polypropylene Market Estimates and Forecast, By Region, 2017 – 2027

4.4. Acrylonitrile Butadiene Styrene

4.4.1. Acrylonitrile Butadiene Styrene Market Estimates and Forecast, 2017 – 2027

4.4.2. Acrylonitrile Butadiene Styrene Market Estimates and Forecast, By Region, 2017 – 2027

4.5. High Density Polyethylene

4.5.1. High Density Polyethylene Market Estimates and Forecast, 2017 – 2027

4.5.2. High Density Polyethylene Market Estimates and Forecast, By Region, 2017 – 2027

4.6. Polystyrene

4.6.1. Polystyrene Market Estimates and Forecast, 2017 – 2027

4.6.2. Polystyrene Market Estimates and Forecast, By Region, 2017 – 2027

4.7. Others

4.7.1. Others Market Estimates and Forecast, 2017 – 2027

4.7.2. Others Market Estimates and Forecast, By Region, 2017 – 2027

5. Injection Molded Plastics Market, By Application Type

5.1. Introduction

5.2. Injection Molded Plastics Market Share By Application, 2017 – 2027

5.3. Packaging

5.3.1. Packaging Market Estimates and Forecast, 2017 – 2027

5.3.2. Packaging Market Estimates and Forecast, By Region, 2017 – 2027

5.4. Consumables & Electronics

5.4.1. Consumables & Electronics Market Estimates and Forecast, 2017 – 2027

5.4.2. Consumables & Electronics Market Estimates and Forecast, By Region, 2017 – 2027

5.5. Automotive

5.5.1. Automotive Market Estimates and Forecast, 2017 – 2027

5.5.2. Automotive Market Estimates and Forecast, By Region, 2017 – 2027

5.6. Building & Construction

5.6.1. Building & Construction Market Estimates and Forecast, 2017 – 2027

5.6.2. Building & Construction Market Estimates and Forecast, By Region, 2017 – 2027

5.7. Medical

5.7.1. Medical Market Estimates and Forecast, 2017 – 2027

5.7.2. Medical Market Estimates and Forecast, By Region, 2017 – 2027

5.8. Others

5.8.1. Others Market Estimates and Forecast, 2017 – 2027

5.8.2. Others Market Estimates and Forecast, By Region, 2017 – 2027

6. Injection Molded Plastics Market, By Region

6.1. Introduction

6.2. Injection Molded Plastics Market Estimates and Forecast, By Region, 2017-2027

6.3. North America

6.3.1. Market Estimates and Forecast, By Country, 2017-2027

6.3.2. Market Estimates and Forecast, By Raw Material, 2017-2027

6.3.3. Market Estimates and Forecast, By Application, 2017-2027

6.3.3.1. U.S.

6.3.3.1.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.3.3.1.2. Market Estimates and Forecast, By Application, 2017-2027

6.3.3.2. Canada

6.3.3.2.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.3.3.2.2. Market Estimates and Forecast, By Application, 2017-2027

6.3.3.3. Mexico

6.3.3.3.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.3.3.3.2. Market Estimates and Forecast, By Application, 2017-2027

6.4. Europe

6.4.1. Market Estimates and Forecast, By Country, 2017-2027

6.4.2. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3. Market Estimates and Forecast, By Application, 2017-2027

6.4.3.1. Germany

6.4.3.1.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.1.2. Market Estimates and Forecast, By Applications, 2017-2027

6.4.3.2. France

6.4.3.2.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.2.2. Market Estimates and Forecast, By Applications, 2017-2027

6.4.3.3. UK

6.4.3.3.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.3.2. Market Estimates and Forecast, By Applications, 2017-2027

6.4.3.4. Italy

6.4.3.4.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.4.2. Market Estimates and Forecast, By Applications, 2017-2027

6.4.3.5. Russia

6.4.3.5.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.5.2. Market Estimates and Forecast, By Applications, 2017-2027

6.4.3.6. Rest of Europe

6.4.3.6.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.4.3.6.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5. Asia-Pacific

6.5.1. Market Estimates and Forecast, By Country, 2017-2027

6.5.2. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3. Market Estimates and Forecast, By Application, 2017-2027

6.5.3.1. Japan

6.5.3.1.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.1.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5.3.2. China

6.5.3.2.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.2.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5.3.3. India

6.5.3.3.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.3.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5.3.4. South Korea

6.5.3.4.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.4.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5.3.5. Thailand

6.5.3.5.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.5.2. Market Estimates and Forecast, By Applications, 2017-2027

6.5.3.6. Rest of Asia-Pacific

6.5.3.6.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.5.3.6.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6. Rest of the World

6.6.1. Market Estimates and Forecast, By Country, 2017-2027

6.6.2. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3. Market Estimates and Forecast, By Application, 2017-2027

6.6.3.1. Brazil

6.6.3.1.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3.1.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6.3.2. Turkey

6.6.3.2.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3.2.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6.3.3. Saudi Arabia

6.6.3.3.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3.3.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6.3.4. South Africa

6.6.3.4.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3.4.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6.3.4.3.

6.6.3.5. United Arab Emirates

6.6.3.5.1. Market Estimates and Forecast, By Raw Material, 2017-2027

6.6.3.5.2. Market Estimates and Forecast, By Applications, 2017-2027

6.6.3.5.3.

6.6.3.6. Others

6.6.3.6.1. Market Assessment and Forecast, By Raw Material, 2017-2027

6.6.3.6.2. Market Assessment and Forecast, By Applications, 2017-2027

7. Company Profiles

7.1. Exxon Mobil Corp.

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. BASF SE

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. Bostik SA

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. E.I. du Pont de Nemours & Co. (DuPont)

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. Dow Chemical Company

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Key Financials

7.5.4. Strategic Developments

7.6. Huntsman Corporation

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Key Financials

7.6.4. Strategic Developments

7.7. Eastman Chemicals

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

7.8. INEOS Group

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Key Financials

7.8.4. Strategic Developments

7.9. Lyondell Basell

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Key Financials

7.9.4. Strategic Developments

7.10. SABIC

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Key Financials

7.10.4. Strategic Developments

7.11. Magna International Inc.

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Key Financials

7.11.4. Strategic Developments

7.12. IAC Group

7.12.1. Business Overview

7.12.2. Product Portfolio

7.12.3. Key Financials

7.12.4. Strategic Developments

7.13. Berry Plastics

7.13.1. Business Overview

7.13.2. Product Portfolio

7.13.3. Key Financials

7.13.4. Strategic Developments

7.14. Newell Rubbermaid

7.14.1. Business Overview

7.14.2. Product Portfolio

7.14.3. Key Financials

7.14.4. Strategic Developments

7.15. Becton Dickinson

7.15.1. Business Overview

7.15.2. Product Portfolio

7.15.3. Key Financials

7.15.4. Strategic Developments

7.16. Nypro Inc

7.16.1. Business Overview

7.16.2. Product Portfolio

7.16.3. Key Financials

7.16.4. Strategic Developments

7.17. Rutland Plastics

7.17.1. Business Overview

7.17.2. Product Portfolio

7.17.3. Key Financials

7.17.4. Strategic Developments

7.18. AptarGroup, Inc

7.18.1. Business Overview

7.18.2. Product Portfolio

7.18.3. Key Financials

7.18.4. Strategic Developments

7.19. Master Molded Products Corporation

7.19.1. Business Overview

7.19.2. Product Portfolio

7.19.3. Key Financials

7.19.4. Strategic Developments

7.20. HTI Plastics

7.20.1. Business Overview

7.20.2. Product Portfolio

7.20.3. Key Financials

7.20.4. Strategic Developments

List of Tables

Table 1. Injection Molded Plastic - Industry Summary & Key Buying Criteria

Table 2. Injection Molded Plastic market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 3. Injection Molded Plastic market estimates and forecast, 2017-2025, (Kilo Tons)

Table 4. Injection Molded Plastic market estimates and forecast by region, 2017-2025 (USD Million)

Table 5. Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 6. Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (USD Million)

Table 7. Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 8. Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 9. Injection Molded Plastics - Key market driver analysis

Table 10. Basic requirements of automotive materials

Table 11. Injection molded polypropylene market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 12. Injection molded polypropylene market estimates and forecast by region, 2017-2025 (Kilo Tons)

Table 13. Injection molded polypropylene estimates and forecast by region, 2017-2025, (USD Million)

Table 14. Injection molded ABS market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 15. Injection molded ABS market estimates and forecast by region, 2017-2025 (Kilo Tons)

Table 16. Injection molded ABS estimates and forecast by region, 2017-2025, (USD Million)

Table 17. Injection molded HDPE market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 18. Injection molded HDPE market estimates and forecast by region, 2017-2025 (Kilo Tons)

Table 19. Injection molded HDPE estimates and forecast by region, 2017-2025, (USD Million)

Table 20. Injection molded polystyrene market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 21. Injection molded polystyrene market estimates and forecast by region, 2017-2025 (Kilo Tons)

Table 22. Injection molded polystyrene estimates and forecast by region, 2017-2025, (USD Million)

Table 23. Injection molded other polymers market estimates and forecast, 2017-2025, (Kilo Tons) (USD Million)

Table 24. Injection molded other polymers market estimates and forecast by region, 2017-2025 (Kilo Tons)

Table 25. Injection molded other polymers estimates and forecast by region, 2017-2025, (USD Million)

Table 26. Injection Molded Plastic market estimates and forecast in packaging, 2017-2025 (Kilo Tons) (USD Million)

Table 27. Injection Molded Plastic market estimates and forecast in packaging by region, 2017-2025 (Kilo Tons)

Table 28. Injection Molded Plastics estimates and forecast in packaging by region, 2017-2025 (USD Million)

Table 29. Injection Molded Plastic market estimates and forecast in consumables & electronics, 2017-2025 (Kilo Tons) (USD Million)

Table 30. Injection Molded Plastic market estimates and forecast in consumables & electronics by region, 2017-2025 (Kilo Tons)

Table 31. Injection Molded Plastics estimates and forecast in consumables & electronics by region, 2017-2025 (USD Million)

Table 32. Injection Molded Plastic market estimates and forecast in automotive, 2017-2025 (Kilo Tons) (USD Million)

Table 33. Injection Molded Plastic market estimates and forecast in automotive by region, 2017-2025 (Kilo Tons)

Table 34. Injection Molded Plastics estimates and forecast in automotive by region, 2017-2025 (USD Million)

Table 35. Injection Molded Plastic market estimates and forecast in building & construction, 2017-2025 (Kilo Tons) (USD Million)

Table 36. Injection Molded Plastic market estimates and forecast in building & construction by region, 2017-2025 (Kilo Tons)

Table 37. Injection Molded Plastics estimates and forecast in building & construction by region, 2017-2025 (USD Million)

Table 38. Injection Molded Plastic market estimates and forecast in medical, 2017-2025 (Kilo Tons) (USD Million)

Table 39. Injection Molded Plastic market estimates and forecast in medical by region, 2017-2025 (Kilo Tons)

Table 40. Injection Molded Plastics market estimates and forecast in medical by region, 2017-2025 (USD Million)

Table 41. Injection Molded Plastic market estimates and forecast in other applications, 2017-2025 (Kilo Tons) (USD Million)

Table 42. Injection Molded Plastic market estimates and forecast in other applications by region, 2017-2025 (Kilo Tons)

Table 43. Injection Molded Plastics estimates in other applications by region, 2017-2025 (USD Million)

Table 44. Injection Molded Plastics estimates and forecast in other applications by region, 2017-2025 (USD Million)

Table 45. North America Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 46. North America Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 47. North America Injection Molded Plastic market estimates by raw material, 2017-2025 (Kilo Tons)

Table 48. North America Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 49. North America Injection Molded Plastics estimates by raw material, 2017-2025 (USD Million)

Table 50. North America Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 51. North America Injection Molded Plastic market estimates by application, 2017-2025 (Kilo Tons)

Table 52. North America Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 53. North America Injection Molded Plastics estimates by application, 2017-2025 (USD Million)

Table 54. North America Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 55. U.S. Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 56. U.S. Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 57. U.S. Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 58. U.S. Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 59. U.S. Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 60. U.S. Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 61. Canada Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 62. Canada Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 63. Canada Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 64. Canada Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 65. Canada Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 66. Canada Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 67. Mexico Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 68. Mexico Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 69. Mexico Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 70. Mexico Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 71. Mexico Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 72. Mexico Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 73. Europe Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 74. Europe Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 75. Europe Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 76. Europe Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 77. Europe Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 78. Europe Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 79. Germany Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 80. Germany Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 81. Germany Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 82. Germany Injection Molded Plastics market estimates and forecast by raw material, 2017-2025 (USD Million)

Table 83. Germany Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 84. Germany Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 85. France Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 86. France Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 87. France Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 88. France Injection Molded Plastics market estimates and forecast by raw material, 2017-2025 (USD Million)

Table 89. France Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 90. France Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 91. UK Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 92. UK Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 93. UK Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 94. UK Injection Molded Plastics market estimates and forecast by raw material, 2017-2025 (USD Million)

Table 95. UK Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 96. UK Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 97. Italy Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 98. Italy Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 99. Italy Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 100. Italy Injection Molded Plastics market estimates and forecast by raw material, 2017-2025 (USD Million)

Table 101. Italy Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 102. Italy Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 103. Russia Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 104. Russia Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 105. Russia Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 106. Russia Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 107. Russia Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 108. Russia Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 109. Rest of Europe Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 110. Rest of Europe Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 111. Rest of Europe Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 112. Rest of Europe Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 113. Rest of Europe Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 114. Rest of Europe Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 115. Asia Pacific Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 116. Asia Pacific Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 117. Asia Pacific Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 118. Asia Pacific Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 119. Asia Pacific Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 120. Asia Pacific Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 121. Japan Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 122. Japan Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 123. Japan Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 124. Japan Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 125. Japan Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 126. Japan Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 127. China Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 128. China Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 129. China Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 130. China Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 131. China Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 132. China Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 133. India Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 134. India Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 135. India Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 136. India Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 137. India Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 138. India Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 139. South Korea Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 140. South Korea Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 141. South Korea Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 142. South Korea Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 143. South Korea Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 144. South Korea Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 145. Thailand Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 146. Thailand Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 147. Thailand Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 148. Thailand Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 149. Thailand Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 150. Thailand Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 151. Rest of Asia Pacific Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 152. Rest of Asia Pacific Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 153. Rest of Asia Pacific Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 154. Rest of Asia Pacific Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 155. Rest of Asia Pacific Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 156. Rest of Asia Pacific Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 157. Brazil Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 158. Brazil Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 159. Brazil Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 160. Brazil Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 161. Brazil Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 162. Brazil Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 163. Tukey Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 164. Tukey Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 165. Tukey Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 166. Tukey Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 167. Tukey Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 168. Tukey Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 169. Saudi Arabia Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 170. Saudi Arabia Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 171. Saudi Arabia Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 172. Saudi Arabia Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 173. Saudi Arabia Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 174. Saudi Arabia Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 175. South Africa Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 176. South Africa Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 177. South Africa Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 178. South Africa Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 179. South Africa Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 180. South Africa Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

Table 181. United Arab Emirates Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Billion)

Table 182. United Arab Emirates Injection Molded Plastic market estimates and forecast, 2017-2025 (Kilo Tons) (USD Million)

Table 183. United Arab Emirates Injection Molded Plastic market estimates and forecast by raw material, 2017-2025 (Kilo Tons)

Table 184. United Arab Emirates Injection Molded Plastics estimates and forecast by raw material, 2017-2025 (USD Million)

Table 185. United Arab Emirates Injection Molded Plastic market estimates and forecast by application, 2017-2025 (Kilo Tons)

Table 186. United Arab Emirates Injection Molded Plastic market estimates and forecast by application, 2017-2025 (USD Million)

List of Figures

Figure 1. Injection molded plastic market segmentation

Figure 2. Global injection molded plastic market revenue, 2017 - 2025 (Kilo Tons) (USD Million)

Figure 3. Injection molded plastics value chain analysis

Figure 4. Global crude oil prices, 2017 - 2025 (USD/ton)

Figure 5. Global petrochemical derivatives prices, 2017 - 2025 (USD Thousand/ton)

Figure 6. Ethylene market share, by application in 2017

Figure 7. Propylene market share, by application in 2017

Figure 8. Benzene market share, by application in 2017

Figure 9. Tyrene market share, by application in 2017

Figure 10. Injection molded plastics - market dynamics

Figure 11. Global automotive material distribution based on volume, 2017 & 2025

Figure 13. China construction industry estimates and forecast, 2017-2025 (USD Billion)

Figure 14. Asia Pacific construction spending by country, 2017 (USD Billion) & CAGR, 2017 - 2025 (%)

Figure 15. Global packaging market share by material, 2017

Figure 16. Global and China carbon dioxide emissions, 2012-2017 (Billion tons)

Figure 17. Global bio-based polymers production estimates & forecasts, 2012 -2017, (Million Tons) (USD Million)

Figure 18. Key opportunities prioritized

Figure 21. Global injection molded plastic market volume share by raw material, 2017 & 2025

Figure 22. Global injection molded plastic market volume share by application, 2017 & 2025

Figure 23. Global injection molded plastic market volume share by region, 2017 & 2025

Research Methodology

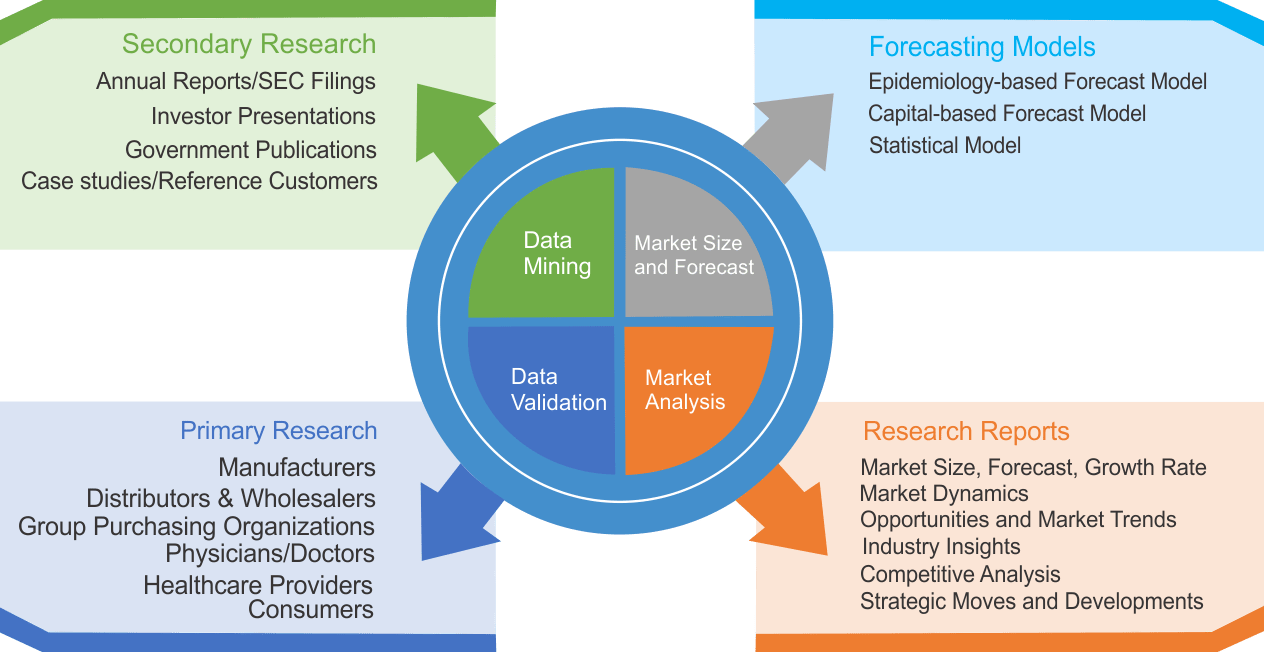

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|