.png)

Liquidity Asset Liability Management Solutions Market by Type and Application - Global Industry Analysis & Forecast to 2027

Published On : February 2020 Pages : 180 Category: Financial Services & Investment Intelligence Report Code : OI029009

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Liquidity Asset Liability Management Solutions Market by Type (Hardware, Solution, Services) Application (Banks, Broker Dealers, Specialty Finance, Wealth Advisors) - Global Industry Analysis & Forecast to 2027

Industry Outlook and Trend Analysis

The Liquidity Asset Liability Management Solutions Market has encountered significant development over the recent years and is anticipated to grow tremendously over the forecast period.

Drivers and Restraints

Top-down and bottom-up approaches are used to validate the global Liquidity Asset Liability Management Solutions Market size market and estimate the market size for company, regions segments, type segments and applications (end users). In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and sub segments listed in this report. Extensive qualitative and further quantitative analysis is also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Regional Insights

The data for 2021 is an estimate, based on the history data and the integrated view of industry experts, manufacturers, distributors and end users etc.

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Columbia

- Rest of South America

- Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- Nigeria

- South Africa

- Rest of MEA

Competitive Analysis

The major players in the market are profiled in detail in view of qualities, for example, company portfolio, business strategies, financial overview, recent developments, and share of the overall industry.

- Finastra

- Fiserv, Inc

- Infosys Limited

- International Business Machines Corporation

- Moody's Corporation

- Oracle Corporation

- Polaris Financial Technology Limited

- SAP SE

- Wolters Kluwer N.V.

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2021 to 2027?

- What will be the industry market growth from 2017 to 2027?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

· Liquidity Asset Liability Management Solutions Market, By Type, Estimates and Forecast, 2017-2027 ($Million)

o Hardware

o Solution

o Services

· Liquidity Asset Liability Management Solutions Market, By Application, Estimates and Forecast, 2017-2027 ($Million)

o Banks

o Broker Dealers

o Specialty Finance

o Wealth Advisors

· Liquidity Asset Liability Management Solutions Market, By Key Players, Estimates and Forecast, 2017-2027 ($Million)

o Finastra

o Fiserv, Inc

o Infosys Limited

o International Business Machines Corporation

o Moody's Corporation

o Oracle Corporation

o Polaris Financial Technology Limited

o SAP SE

o Wolters Kluwer N.V

· Liquidity Asset Liability Management Solutions Market, By Region, Estimates and Forecast, 2017-2027 ($Million)

o North America

§ North America Submarine Cables Market, By Country

o U.S. Submarine Cables Market

o Canada Submarine Cables Market

o Mexico Submarine Cables Market

o Europe

§ Europe Submarine Cables Market, By Country

o Germany Submarine Cables Market

o UK Submarine Cables Market

o France Submarine Cables Market

o Russia Submarine Cables Market

o Italy Submarine Cables Market

o Rest of Europe Submarine Cables Market

o Asia-Pacific

§ Asia-Pacific Submarine Cables Market, By Country

o China Submarine Cables Market

o Japan Submarine Cables Market

o South Korea Submarine Cables Market

o India Submarine Cables Market

o Southeast Asia Submarine Cables Market

o Rest of Asia-Pacific Submarine Cables Market

o South America

§ South America Submarine Cables Market

o Brazil Submarine Cables Market

o Argentina Submarine Cables Market

o Columbia Submarine Cables Market

o Rest of South America Submarine Cables Market

o Middle East and Africa

§ Middle East and Africa Submarine Cables Market

o Saudi Arabia Submarine Cables Market

o UAE Submarine Cables Market

o Egypt Submarine Cables Market

o Nigeria Submarine Cables Market

o South Africa Submarine Cables Market

o Rest of MEA Submarine Cables Market

Table of Contents:

1. Introduction

1.1. Report Description

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

4. Market Analysis by Regions

4.1. North America (United States, Canada and Mexico)

4.1.1. United States Market Status and Outlook (2017-2027)

4.1.2. Canada Market Status and Outlook (2017-2027)

4.1.3. Mexico Market Status and Outlook (2017-2027)

4.2. Europe (Germany, France, UK, Russia, Italy and Rest of Europe)

4.2.1. Germany Market Status and Outlook (2017-2027)

4.2.2. France Market Status and Outlook (2017-2027)

4.2.3. UK Market Status and Outlook (2017-2027)

4.2.4. Russia Market Status and Outlook (2017-2027)

4.2.5. Italy Market Status and Outlook (2017-2027)

4.2.6. Rest of Europe Market Status and Outlook (2017-2027)

4.3. Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Rest of Asia-Pacific)

4.3.1. China Market Status and Outlook (2017-2027)

4.3.2. Japan Market Status and Outlook (2017-2027)

4.3.3. Korea Market Status and Outlook (2017-2027)

4.3.4. India Market Status and Outlook (2017-2027)

4.3.5. Southeast Asia Market Status and Outlook (2017-2027)

4.3.6. Rest of Asia-Pacific Market Status and Outlook (2017-2027)

4.4. South America (Brazil, Argentina, Columbia and Rest of South America)

4.4.1. Brazil Market Status and Outlook (2017-2027)

4.4.2. Argentina Market Status and Outlook (2017-2027)

4.4.3. Columbia Market Status and Outlook (2017-2027)

4.4.4. Rest of South America Market Status and Outlook (2017-2027)

4.5. Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa and Rest of MEA)

4.5.1. Saudi Arabia Market Status and Outlook (2017-2027)

4.5.2. United Arab Emirates Market Status and Outlook (2017-2027)

4.5.3. Egypt Market Status and Outlook (2017-2027)

4.5.4. Nigeria Market Status and Outlook (2017-2027)

4.5.5. South Africa Market Status and Outlook (2017-2027)

4.5.6. Turkey Market Status and Outlook (2017-2027)

4.5.7. Rest of Middle East and Africa Market Status and Outlook (2017-2027)

5. Liquidity Asset Liability Management Solutions Market, By Type

5.1. Introduction

5.2. Global Liquidity Asset Liability Management Solutions Revenue and Market Share by Type (2017-2021)

5.2.1. Global Liquidity Asset Liability Management Solutions Revenue and Revenue Share by Type (2017-2021)

5.3. Hardware

5.3.1. Global Hardware Revenue and Growth Rate (2017-2021)

5.4. Solution

5.4.1. Global Solution Revenue and Growth Rate (2017-2021)

5.5. Services

5.5.1. Global Services Revenue and Growth Rate (2017-2021)

6. Liquidity Asset Liability Management Solutions Market, By Applications

6.1. Introduction

6.2. Global Liquidity Asset Liability Management Solutions Revenue and Market Share by Applications (2017-2021)

6.2.1. Global Liquidity Asset Liability Management Solutions Revenue and Revenue Share by Applications (2017-2021)

6.3. Banks

6.3.1. Global Banks Revenue and Growth Rate (2017-2021)

6.4. Broker Dealers

6.4.1. Global Broker Dealers Revenue and Growth Rate (2017-2021)

6.5. Specialty Finance

6.5.1. Global Specialty Finance Revenue and Growth Rate (2017-2021)

6.6. Wealth Advisors

6.6.1. Global Wealth Advisors Revenue and Growth Rate (2017-2021)

7. Liquidity Asset Liability Management Solutions Market, By Region

7.1. Introduction

7.2. Global Liquidity Asset Liability Management Solutions Revenue and Market Share by Regions

7.2.1. Global Liquidity Asset Liability Management Solutions Revenue by Regions (2017-2021)

7.3. North America Liquidity Asset Liability Management Solutions by Countries

7.3.1. North America Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2021)

7.3.2. North America Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2021)

7.3.3. United States

7.3.3.1. United States Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.3.4. Canada

7.3.4.1. Canada Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.3.5. Mexico

7.3.5.1. Mexico Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4. Europe Liquidity Asset Liability Management Solutions by Countries

7.4.1. Europe Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2021)

7.4.2. Europe Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2021)

7.4.3. Germany

7.4.3.1. Germany Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4.4. France

7.4.4.1. France Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4.5. UK

7.4.5.1. UK Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4.6. Russia

7.4.6.1. Russia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4.7. Italy

7.4.7.1. Italy Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.4.8. Rest of Europe

7.4.8.1. Rest of Europe Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5. Asia-Pacific Liquidity Asset Liability Management Solutions by Countries

7.5.1. Asia-Pacific Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2021)

7.5.2. Asia-Pacific Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2021)

7.5.3. China

7.5.3.1. China Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5.4. Japan

7.5.4.1. Japan Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5.5. Korea

7.5.5.1. Korea Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5.6. India

7.5.6.1. India Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5.7. Southeast Asia

7.5.7.1. Southeast Asia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.5.8. Rest of Asia-Pacific

7.5.8.1. Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.6. South America Liquidity Asset Liability Management Solutions by Countries

7.6.1. South America Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2021)

7.6.2. South America Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2021)

7.6.3. Brazil

7.6.3.1. Brazil Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.6.4. Argentina

7.6.4.1. Argentina Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.6.5. Columbia

7.6.5.1. Columbia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.6.6. Rest of South America

7.6.6.1. Rest of South America Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7. Middle East and Africa Liquidity Asset Liability Management Solutions by Countries

7.7.1. Middle East and Africa Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2021)

7.7.2. Middle East and Africa Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2021)

7.7.3. Saudi Arabia

7.7.3.1. Saudi Arabia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.4. United Arab Emirates

7.7.4.1. United Arab Emirates Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.5. Egypt

7.7.5.1. Egypt Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.6. Nigeria

7.7.6.1. Nigeria Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.7. South Africa

7.7.7.1. South Africa Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.8. Turkey

7.7.8.1. Turkey Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

7.7.9. Rest of Middle East and Africa

7.7.9.1. Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2021)

8. Company Profiles

8.1. Finastra

8.1.1. Business Overview

8.1.2. Service Portfolio

8.1.3. Strategic Developments

8.1.4. Financial Overview

8.2. Fiserv, Inc

8.2.1. Business Overview

8.2.2. Service Portfolio

8.2.3. Strategic Developments

8.2.4. Financial Overview

8.3. Infosys Limited

8.3.1. Business Overview

8.3.2. Service Portfolio

8.3.3. Strategic Developments

8.3.4. Financial Overview

8.4. International Business Machines Corporation

8.4.1. Business Overview

8.4.2. Service Portfolio

8.4.3. Strategic Developments

8.4.4. Financial Overview

8.5. Moody's Corporation

8.5.1. Business Overview

8.5.2. Service Portfolio

8.5.3. Strategic Developments

8.5.4. Financial Overview

8.6. Oracle Corporation

8.6.1. Business Overview

8.6.2. Service Portfolio

8.6.3. Strategic Developments

8.6.4. Financial Overview

8.7. Polaris Financial Technology Limited

8.7.1. Business Overview

8.7.2. Service Portfolio

8.7.3. Strategic Developments

8.7.4. Financial Overview

8.8. SAP SE

8.8.1. Business Overview

8.8.2. Service Portfolio

8.8.3. Strategic Developments

8.8.4. Financial Overview

9. Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.1. Global Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2022-2027)

9.2. Liquidity Asset Liability Management Solutions Market Forecast by Regions (2022-2027)

9.2.1. North America Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.1.1. United States Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.1.2. Canada Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.1.3. Mexico Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2. Europe Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.1. Germany Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.2. France Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.3. UK Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.4. Russia Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.5. Italy Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.2.6. Rest of Europe Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3. Asia-Pacific Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.1. China Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.2. Japan Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.3. Korea Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.4. India Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.5. Southeast Asia Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.3.6. Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.4. South America Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.4.1. Brazil Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.4.2. Argentina Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.4.3. Columbia Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.4.4. Rest of South America Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5. Middle East and Africa Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.1. Saudi Arabia Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.2. United Arab Emirates Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.3. Egypt Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.4. Nigeria Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.5. South Africa Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.6. Turkey Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.2.5.7. Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Market Forecast (2022-2027)

9.3. Liquidity Asset Liability Management Solutions Market Forecast by Type (2022-2027)

9.3.1. Liquidity Asset Liability Management Solutions Forecast by Type (2022-2027)

9.3.2. Liquidity Asset Liability Management Solutions Market Share Forecast by Type (2022-2027)

9.4. Liquidity Asset Liability Management Solutions Market Forecast by Applications (2022-2027)

9.4.1. Liquidity Asset Liability Management Solutions Forecast by Applications (2022-2027)

9.4.2. Liquidity Asset Liability Management Solutions Market Share Forecast by Applications (2022-2027)

List of Tables

List of Tables and Figures:

Figure United States Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Canada Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Mexico Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Germany Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure France Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure UK Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Russia Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Italy Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Rest of Europe Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure China Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Japan Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Korea Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure India Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Southeast Asia Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Brazil Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Argentina Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Columbia Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Rest of South America Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Saudi Arabia Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure United Arab Emirates Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Egypt Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Nigeria Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure South Africa Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Turkey Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Figure Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Revenue (Million USD) and Growth Rate (2017-2027)

Table Global Liquidity Asset Liability Management Solutions Revenue and Revenue Share by Type (2017-2019)

Figure Global Hardware Revenue and Growth Rate (2017-2019)

Figure Global Solution Revenue and Growth Rate (2017-2019)

Figure Global Services Revenue and Growth Rate (2017-2019)

Table Global Liquidity Asset Liability Management Solutions Revenue and Revenue Share by Applications (2017-2019)

Figure Global Banks Revenue and Growth Rate (2017-2019)

Figure Global Broker Dealers Revenue and Growth Rate (2017-2019)

Figure Global Specialty Finance Revenue and Growth Rate (2017-2019)

Figure Global Wealth Advisors Revenue and Growth Rate (2017-2019)

Table Global Liquidity Asset Liability Management Solutions Revenue by Regions (2017-2019)

Figure North America Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure North America Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2019)

Figure North America Liquidity Asset Liability Management Solutions by Countries (2017-2019)

Figure North America Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2019)

Figure United States Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure United States Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Canada Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Canada Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Mexico Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Mexico Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Europe Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Europe Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2019)

Figure Europe Liquidity Asset Liability Management Solutions by Countries (2017-2019)

Figure Europe Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2019)

Figure Germany Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Germany Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure France Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure France Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure UK Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure UK Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Russia Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Russia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Italy Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Italy Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Rest of Europe Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Rest of Europe Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Asia-Pacific Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Asia-Pacific Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2019)

Figure Asia-Pacific Liquidity Asset Liability Management Solutions by Countries (2017-2019)

Figure Asia-Pacific Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2019)

Figure China Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure China Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Japan Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Japan Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Korea Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Korea Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure India Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure India Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Southeast Asia Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Southeast Asia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure South America Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure South America Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2019)

Figure South America Liquidity Asset Liability Management Solutions by Countries (2017-2019)

Figure South America Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2019)

Figure Brazil Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Brazil Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Argentina Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Argentina Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Columbia Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Columbia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Rest of South America Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Rest of South America Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Middle East and Africa Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Middle East and Africa Liquidity Asset Liability Management Solutions Revenue and Growth Rate (2017-2019)

Figure Middle East and Africa Liquidity Asset Liability Management Solutions by Countries (2017-2019)

Figure Middle East and Africa Liquidity Asset Liability Management Solutions Revenue (Million USD) by Countries (2017-2019)

Figure Saudi Arabia Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Saudi Arabia Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure United Arab Emirates Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure United Arab Emirates Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Egypt Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Egypt Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Nigeria Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Nigeria Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure South Africa Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure South Africa Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Turkey Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Turkey Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Figure Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Growth Rate (2017-2019)

Figure Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2017-2019)

Table Finastra Liquidity Asset Liability Management Solutions Financial Overview

Table Fiserv, Inc Liquidity Asset Liability Management Solutions Financial Overview

Table Infosys Limited Liquidity Asset Liability Management Solutions Financial Overview

Table International Business Machines Corporation Liquidity Asset Liability Management Solutions Financial Overview

Table Moody's Corporation Liquidity Asset Liability Management Solutions Financial Overview

Table Oracle Corporation Liquidity Asset Liability Management Solutions Financial Overview

Table Polaris Financial Technology Limited Liquidity Asset Liability Management Solutions Financial Overview

Table SAP SE Liquidity Asset Liability Management Solutions Financial Overview

Figure Global Liquidity Asset Liability Management Solutions Revenue (Millions USD) and Growth Rate (2019-2027)

Table Liquidity Asset Liability Management Solutions Market Forecast by Regions (2019-2027)

Figure North America Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure United States Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Canada Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Mexico Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Europe Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Germany Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure France Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure UK Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Russia Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Italy Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Rest of Europe Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Asia-Pacific Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure China Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Japan Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Korea Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure India Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Southeast Asia Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Rest of Asia-Pacific Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure South America Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Brazil Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Argentina Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Columbia Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Rest of South America Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Middle East and Africa Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Saudi Arabia Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure United Arab Emirates Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Egypt Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Nigeria Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure South Africa Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Turkey Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Rest of Middle East and Africa Liquidity Asset Liability Management Solutions Market Forecast (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Forecast by Type (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Market Share Forecast by Type (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Forecast by Type (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Forecast by Applications (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Market Share Forecast by Applications (2019-2027)

Figure Global Liquidity Asset Liability Management Solutions Forecast by Applications (2019-2027)

Please Note: Data related to the Companies are subject to Availability.

Research Methodology

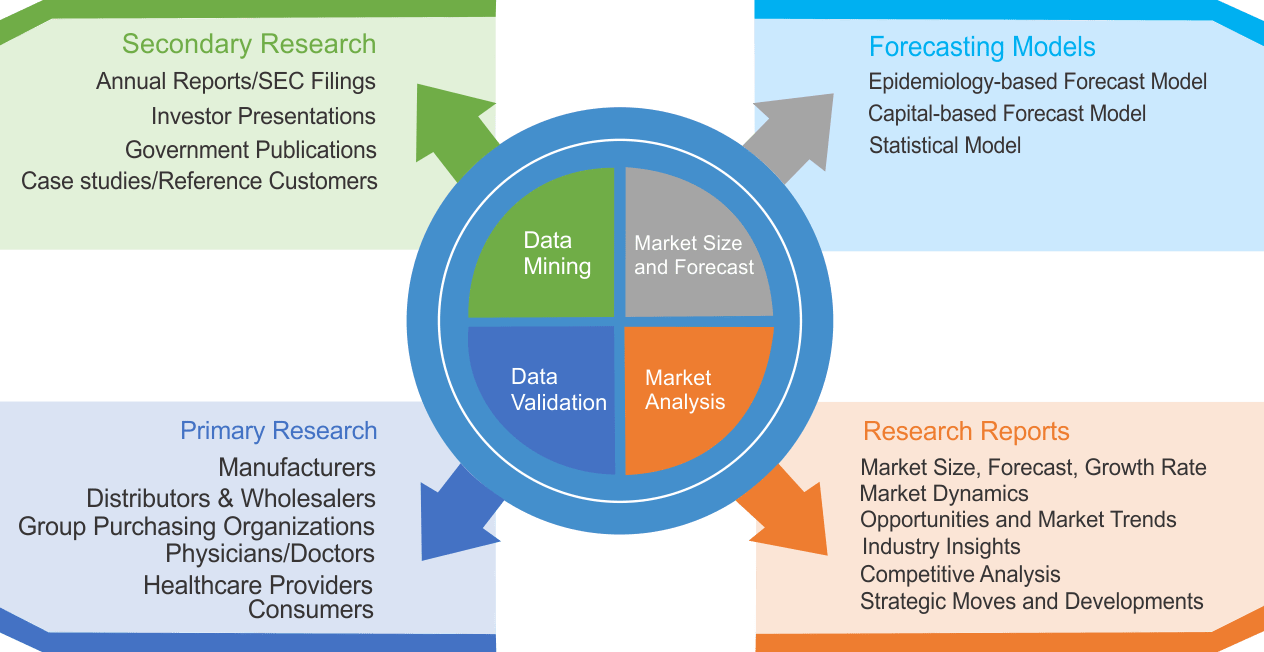

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|