.png)

Molecular Diagnostics Market by Infectious Diseases and Technology - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 110 Category: Medical Devices Report Code : HC11353

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

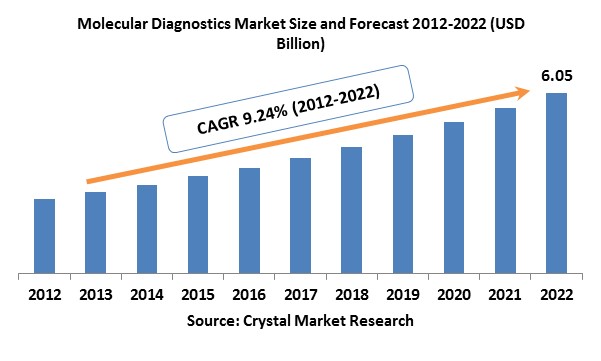

The Molecular Diagnostics Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Molecular diagnostics are exceptionally viable in diagnosing contagious diseases and operating preventive cancer screening in this way assisting healthcare experts with prescribing precise restorative mediations in the beginning periods of sicknesses. Expanding pervasiveness of hospital procured diseases and other transferable contaminations are anticipated to drive the area extension over the conjecture time frame. Molecular diagnostics help in the early conclusion of contagious ailments, cancer, and other hereditary issue. Technological progressions play a crucial part in conveying quick and precise test outcomes. This is assessed to empower more noteworthy infiltration of molecular diagnostics in hospitals and additionally in point of care (PoC) facilities. As genetic varieties frame the base of different target diseases, the relentlessly developing reception of molecular diagnostics is foreseen to upgrade the acknowledgment level of customized molecular medicine over the estimate time frame.

Technology Outlook and Trend Analysis

In 2017, the % of the total industry share was taken by PCR technology. Nevertheless, the revenue share is predicted to decrease owing to rise of several other technologies like in-situ hybridization and genetic sequencing over the forecast period. Developments in genomics and proteomics have attributed to rise of new diagnostic methods. Patient and physician awareness, growth of inventive diagnostic tests, pairing of tests with novel treatment methods and affordability, is anticipated to propel the growth of this market.

Infectious Diseases Outlook and Trend Analysis

The global molecular diagnostics based on different infectious diseases are segmented into Flu, Tuberculosis, Meningitis, RSV Virus, Hepatitis B, Hepatitis C, HPV, STD, HIV, Dengue, Gonorrhea, Chlamydia, TORCH, and H. Pylori. The test location fragment incorporates PoC, central laboratories, and self-test or over-the-counter. In 2017 Central laboratories commanded this fragment with a share of more than 60 percent. The major components adding to the expansive share of this portion are high method volumes, their bigger existence in the nations that are underdeveloped, and the rising consciousness about early detection of diseases. The PoC section is anticipated to indicate lucrative development in the upcoming years. Advent of technologically inventive gadgets and the rising requirement for bedside patient monitoring are the key drivers highlighting the development of this portion. For example, the cobas product array by Roche is a PCR-based PoC framework additionally assessed to furnish this section with an exponential development platform. In 2017, the reagents section held the biggest offer producing income of around USD billion. The reagents segment is determined to develop at a significant pace, along these lines rendering it the quickest developing section. Besides, instruments fragment is relied upon to develop at a critical development rate inferable from the expanding R&D activities for biomarker revelation and improvement. Molecular diagnostics finds wide applications in different fields including diabetes, pharmacogenomics, neurological & cardiovascular diseases, oncology, infectious diseases, and genetic testing. In 2017 infectious diseases held the biggest piece of the pie of more than 45 percent ascribed to the existence of novel multiplex PCR tests to distinguish viral load and infectious organisms. Cancer represents a vast monetary weight in the developing and in addition developed economies. Set up players are implementing R&D attempts to create novel, biomarker-based companion analytic tests. F. Hoffmann-La Roche Ltd, Abbott, and bioMérieux SA got the United States Food and Drug Administration endorsement in 2017 for their companion diagnostics for cancer therapeutics.

Regional Outlook and Trend Analysis

North America held a major share of around 45 percent in 2017 and has turned out to be a standout amongst the most powerful markets in the molecular diagnostics market. Existence of entrenched laboratory accreditation system, positive awareness programs instructing patients about early detection and the growing expenditure of healthcare are the key factors strengthening the predominance of this area. Government administrative activities play a critical part in advancing PoC offices, which is foreseen to affect the segment as a solid driver. For example, in the United States, the advent of Clinical Laboratory Improvement Amendments confirmation has prompted an expanded utilization rate of PoC gadgets over the estimate time frame. In the course of recent years, creating countries including India and China have shown persistent advancement, which is anticipated to offer prospering chances to the molecular diagnostics sector. Developing external funding for clinical investigations in this district is expected to drive the vertical toward lucrative development. Neglected requirements and the rising aged populace are assessed to be key concentration zones of the real players in this vertical. For example, organizations like Insight Kindstar Globalgene Technology, Inc and Genetics are focusing on improvement of cancer care in the People's Republic of China.

Competitive Insights

Some of the leading players in the market are Novartis, Bayer, Becton Dickinson, Danaher Corporation, Roche Holding AG, Qiagen, Abbott Molecular Inc, Sysmex Corporation, Hologic, BioMérieux, Johnson & Johnson and Cepheid Inc.

The global Molecular Diagnostics Market is segmented as follows-

By Product

- Services & Software

- Instruments

- Reagents & Kits

By Technology

- DNA Sequencing and Next-generation Sequencing

- Polymerase Chain Reaction (PCR)

- Hybridization [In Situ Hybridization & Fluorescent In Situ Hybridization (FISH)]

- Microarray

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Other Technologies (Mass Spectrometry, Flow Cytometry, and Electrophoresis)

By Application

- Genetic Tests

- Microbiology

- Infectious Diseases

- Blood Screening

- Oncology

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Molecular Diagnostics Market, By Infectious Disease, Estimates and Forecast, 2012-2022 ($Million)

- Flu

- Tuberculosis

- Meningitis

- RSV Virus

- Hepatitis B

- Hepatitis C

- HPV

- STD

- HIV

- Dengue

- Gonorrhea

- Chlamydia

- TORCH

- H. Pylori

- Molecular Diagnostics Market, By Technology, Estimates and Forecast, 2012-2022 ($Million)

- PCR

- Real-Time PCR

- DNA/RNA Purification

- Molecular Diagnostics Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Molecular Diagnostics Market, By Country

- North America Molecular Diagnostics Market, By Infectious Disease

- North America Molecular Diagnostics Market, By Technology

- U.S. Molecular Diagnostics Market, By Infectious Disease

- U.S. Molecular Diagnostics Market, By Technology

- Canada Molecular Diagnostics Market, By Infectious Disease

- Canada Molecular Diagnostics Market, By Technology

- Mexico Molecular Diagnostics Market, By Infectious Disease

- MexicoMolecular Diagnostics Market, By Technology

-

- Europe

- Europe Molecular Diagnostics Market, By Country

- EuropeMolecular Diagnostics Market, By Infectious Disease

- EuropeMolecular Diagnostics Market, By Technology

- Germany Molecular Diagnostics Market, By Infectious Disease

- Germany Molecular Diagnostics Market, By Technology

- France Molecular Diagnostics Market, By Infectious Disease

- France Molecular Diagnostics Market, By Technology

- UK Molecular Diagnostics Market, By Infectious Disease

- UK Molecular Diagnostics Market, By Technology

- Italy Molecular Diagnostics Market, By Infectious Disease

- Italy Molecular Diagnostics Market, By Technology

- Spain Molecular Diagnostics Market, By Infectious Disease

- Spain Molecular Diagnostics Market, By Technology

- Rest of Europe Molecular Diagnostics Market, By Infectious Disease

- Rest of Europe Molecular Diagnostics Market, By Technology

-

- Asia-Pacific

- Asia-Pacific Molecular Diagnostics Market, By Country

- Asia-Pacific Molecular Diagnostics Market, By Infectious Disease

- Asia-Pacific Molecular Diagnostics Market, By Technology

- Japan Molecular Diagnostics Market, By Infectious Disease

- Japan Molecular Diagnostics Market, By Technology

- Australia Molecular Diagnostics Market, By Infectious Disease

- Australia Molecular Diagnostics Market, By Technology

- India Molecular Diagnostics Market, By Infectious Disease

- India Molecular Diagnostics Market, By Technology

- South Korea Molecular Diagnostics Market, By Infectious Disease

- South Korea Molecular Diagnostics Market, By Technology

- Rest of Asia-Pacific Molecular Diagnostics Market, By Infectious Disease

- Rest of Asia-Pacific Molecular Diagnostics Market, By Technology

- Asia-Pacific

-

- Rest of the World

- Rest of the World Molecular Diagnostics Market, By Country

- Rest of the World Molecular Diagnostics Market, By Infectious Disease

- Rest of the World Molecular Diagnostics Market, By Technology

- Brazil Molecular Diagnostics Market, By Infectious Disease

- Brazil Molecular Diagnostics Market, By Technology

- South Africa Molecular Diagnostics Market, By Infectious Disease

- South Africa Molecular Diagnostics Market, By Technology

- Saudi Arabia Molecular Diagnostics Market, By Infectious Disease

- Saudi Arabia Molecular Diagnostics Market, By Technology

- Turkey Molecular Diagnostics Market, By Infectious Disease

- Turkey Molecular Diagnostics Market, By Technology

- United Arab Emirates Molecular Diagnostics Market, By Infectious Disease

- United Arab Emirates Molecular Diagnostics Market, By Technology

- Others Molecular Diagnostics Market, By Infectious Disease

- Others Molecular Diagnostics Market, By Technology

- Rest of the World

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Technological Advancements

3.2.1.2. Growing prevalence of Target Diseases

3.2.1.3. Increasing Demand for Point of Care Facilities

3.2.2. Restraints

3.2.2.1. Presence of Ambiguous Regulatory Framework

3.2.2.2. Cost Concerns

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Molecular Diagnostics Market, By Infectious Disease

4.1. Introduction

4.2. Molecular Diagnostics MarketAssessment and Forecast, By Infectious Disease, 2012-2022

4.3. Flu

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Tuberculosis

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Meningitis

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. RSV Virus

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.7. Hepatitis B

4.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.8. Hepatitis C

4.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.9. HPV

4.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.10. STD

4.10.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.11. HIV

4.11.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.12. Dengue

4.12.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.13. Gonorrhea

4.13.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.14. Chlamydia

4.14.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.15. TORCH

4.15.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.16. H. Pylori

4.16.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Molecular Diagnostics Market, By Technology

5.1. Introduction

5.2. The Molecular Diagnostics Market Assessment and Forecast, By Technology, 2012-2022

5.3. PCR

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Real-Time PCR

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. DNA/RNA Purification

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Molecular Diagnostics Market, By Region

6.1. Introduction

6.2. Molecular Diagnostics Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.3. Molecular Diagnostics Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4. North America

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.4. U.S.

6.4.4.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.4.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.5. Canada

6.4.5.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.4.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.6. Mexico

6.4.6.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.4.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5. Europe

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.4. Germany

6.5.4.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.5. France

6.5.5.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.6. UK

6.5.6.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.7. Italy

6.5.7.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.7.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.8. Spain

6.5.8.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.8.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.9. Rest of Europe

6.5.9.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.5.9.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6. Asia-Pacific

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.4. Japan

6.6.4.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.5. China

6.6.5.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.6. Australia

6.6.6.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.7. India

6.6.7.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.7.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.8. South Korea

6.6.8.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.8.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.9. Rest of Asia-Pacific

6.6.9.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.6.9.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7. Rest of the World

6.7.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.7.2. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.3. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.4. Brazil

6.7.4.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.5. Turkey

6.7.5.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.6. Saudi Arabia

6.7.6.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.7. South Africa

6.7.7.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.7.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.8. United Arab Emirates

6.7.8.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.8.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.9. Others

6.7.9.1. Market Assessment and Forecast, By Infectious Disease, 2012-2022 ($Million)

6.7.9.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

7. Company Profiles

7.1. Abbott Molecular

7.1.1. Business Overview

7.1.2. ProductPortfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. Alere, Inc.

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. Bayer Healthcare AG

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Becton, Dickinson and Company

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. bioMérieux SA

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. Cepheid

7.6.1. Business Overview

7.6.2. ProductPortfolio

7.6.3. Strategic Developments

7.7. Dako

7.7.1. Business Overview

7.7.2. ProductPortfolio

7.7.3. Strategic Developments

7.8. Danaher Corporation

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9. Johnson & Johnson Services, Inc.

7.9.1. Business Overview

7.9.2. ProductPortfolio

7.9.3. Strategic Developments

7.10. Hologic, Inc. (Gen Probe)

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.11. Bio-Rad Laboratories, Inc.

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Key Financials

7.11.4. Strategic Developments

List of Tables

Table 1.Global Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 2.Flu Market, By Region, 2012-2022 ($Million)

Table 3.TuberculosisMarket, By Region, 2012-2022 ($Million)

Table 4.Meningitis Market, By Region, 2012-2022 ($Million)

Table 5.RSV Virus Market, By Region, 2012-2022 ($Million)

Table 6.Hepatitis BMarket, By Region, 2012-2022 ($Million)

Table 7.Hepatitis CMarket, By Region, 2012-2022 ($Million)

Table 8.HPVMarket, By Region, 2012-2022 ($Million)

Table 9.STDMarket, By Region, 2012-2022 ($Million)

Table 10.HIVMarket, By Region, 2012-2022 ($Million)

Table 11.Dengue Market, By Region, 2012-2022 ($Million)

Table 12.Gonorrhea Market, By Region, 2012-2022 ($Million)

Table 13.Chlamydia Market, By Region, 2012-2022 ($Million)

Table 14.TORCH Market, By Region, 2012-2022 ($Million)

Table 15.H. Pylori Market, By Region, 2012-2022 ($Million)

Table 16.Global Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 17.PCR Market, By Region, 2012-2022 ($Million)

Table 18.Real-Time PCR Market, By Region, 2012-2022 ($Million)

Table 19.DNA/RNA Purification Market, By Region, 2012-2022 ($Million)

Table 20.North America Molecular Diagnostics Market, By Country, 2012-2022 ($Million)

Table 21.North America Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 22.North America Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 23.U.S. Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 24.U.S. Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 25.Canada Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 26.Canada Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 27.Mexico Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 28.Mexico Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 29.Europe Molecular Diagnostics Market, By Country, 2012-2022 ($Million)

Table 30.Europe Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 31.Europe Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 32.Germany Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 33.Germany Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 34.France Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 35.France Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 36.UK Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 37.UK Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 38.Italy Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 39.Italy Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 40.Spain Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 41.Spain Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 42.Rest of Europe Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 43.Rest of Europe Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 44.Asia-Pacific Molecular Diagnostics Market, By Country, 2012-2022 ($Million)

Table 45.Asia-Pacific Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 46.Asia-Pacific Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 47.Japan Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 48.Japan Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 49.China Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 50.China Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 51.Australia Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 52.Australia Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 53.India Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 54.India Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 55.South Korea Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 56.South Korea Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 57.Rest of Asia-Pacific Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 58.Rest of Asia-Pacific Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 59.Rest of the World Molecular Diagnostics Market, By Country, 2012-2022 ($Million)

Table 60.Rest of the World Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 61.Rest of the World Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 62.Brazil Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 63.Brazil Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 64.Turkey Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 65.Turkey Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 66.Saudi Arabia Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 67.Saudi Arabia Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 68.South Africa Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 69.South Africa Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 70.United Arab Emirates Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 71.United Arab Emirates Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 72.Others Molecular Diagnostics Market, By Infectious Disease, 2012-2022 ($Million)

Table 73.Others Molecular Diagnostics Market, By Technology, 2012-2022 ($Million)

Table 74.Abbott Molecular: Key Strategic Developments, 2017-2017

Table 75.Alere, Inc.: Key Strategic Developments, 2017-2017

Table 76.Bayer Healthcare AG: Key Strategic Developments, 2017-2017

Table 77.Becton, Dickinson and Company: Key Strategic Developments, 2017-2017

Table 78.bioMérieux SA: Key Strategic Developments, 2017-2017

Table 79.Cepheid: Key Strategic Developments, 2017-2017

Table 80.Dako: Key Strategic Developments, 2017-2017

Table 81.Danaher Corporation: Key Strategic Developments, 2017-2017

Table 82.Hologic, Inc. (Gen Probe): Key Strategic Developments, 2017-2017

Table 83.Johnson & Johnson Services, Inc.: Key Strategic Developments, 2017-2017

Table 84.Bio-Rad Laboratories, Inc.: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Molecular Diagnostics MarketShare, By Infectious Disease, 2017 & 2025

Figure 2.Global Molecular Diagnostics Market, By Technology, 2017,($Million)

Figure 3.Global Molecular Diagnostics Market, By Region, 2017, ($Million)

Figure 4.Abbott Molecular: Net Revenues, 2017-2017 ($Million)

Figure 5.Abbott Molecular: Net Revenue Share, By Segment, 2017

Figure 6.Abbott Molecular: Net Revenue Share, By Geography, 2017

Figure 7.Alere, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 8.Alere, Inc.: Net Revenue Share, By Segment, 2017

Figure 9.Alere, Inc.: Net Revenue Share, By Geography, 2017

Figure 10.Bayer Healthcare AG: Net Revenues, 2017-2017 ($Million)

Figure 11.Bayer Healthcare AG: Net Revenue Share, By Segment, 2017

Figure 12.Bayer Healthcare AG: Net Revenue Share, By Geography, 2017

Figure 13.Becton, Dickinson and Company: Net Revenues, 2017-2017 ($Million)

Figure 14.Becton, Dickinson and Company: Net Revenue Share, By Segment, 2017

Figure 15.Becton, Dickinson and Company: Net Revenue Share, By Geography, 2017

Figure 16.Bio-Rad Laboratories, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 17.Bio-Rad Laboratories, Inc.: Net Revenue Share, By Segment, 2017

Figure 18.Bio-Rad Laboratories, Inc.: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|