.png)

Next Generation Sequencing (NGS) Market by Application, Technology, Work-flow and End User - Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 192 Category: Biotechnology Report Code : HC02601

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

In 2017, the global next-generation sequencing market was evaluated around USD billion and is expected to reach approximately USD billion by 2023 while registering itself at a compound annual growth rate (CAGR) of % over the forecast period. Expansion of more rapid and efficient genomic sequencing methodologies is projected to fuel the NGS platforms adoption further and consequently regulating industrial expansion. Rising automation within the pre-sequencing protocols is projected to boost progress in the global industry in the approaching years. Use of innovative platforms for the growth of custom-made medicine by clinical analysis at a genetic stage is a major factor that is likely to improve NGS demand during the forecast years. An escalating amount of R&D projects in the areas of transcriptomics, metabolomics, and proteomics are anticipated to fuel the technology demand as well. Genomics and proteomics function with and on a massive array of structural data that demands to be accumulated and classified through subsequent integrated data analysis and sequence determination. The introduction of novel services and products by well-known market giants is anticipated to boost the growth during the forecast years. Additionally, growing inclination of drug developers and scientists for the NGS technology in an attempt to employ the avenues of tailored medicine has established to be a high rise for demanding these platforms with the aim of gaining penetrations into the genetic enterprises of a huge amount of organisms. This augments in demand is expected to boost the NGS industry over the forecast period.

Application Outlook and Trend Analysis

Application-wise NGS technology has profitable approaches in preimplantation and prenatal genetic screening, developmental oncology, HLA typing/immune system monitoring, epidemiology & drug development, metagenomics, agrigenomics & forensics, clinical investigation, and consumer genomics. Oncology is expected to demonstrate profitable growth in the approaching years owing to the speedily developing of sequencing capabilities that facilitate directed sequence determination of an amount of cancer genes that allow oncologists to acquire genetic data exist in few of the less available dense gene clusters concerning cancer tumors and cells.

Technology Outlook and Trend Analysis

Targeted sequencing reported for the leading share due to the existence of numerous benefits linked with a minor dataset and decline in sequencing prices. Moreover, expansion in the amount of protein expression analysis projects is projected to rise due to the existence of DNA-based sequence data sets. Whole genome sequencing (WGS) includes de novo genome, microbial, and genome applications. It is anticipated to observe top year on year growth due to an amplified amount of research programs focused at mapping non-human and human whole genomes joint with decreasing WGS costs.

Work flow Outlook and Trend Analysis

In 2017, sequencing ruled in terms of market revenue share and is anticipated to maintain its supremacy over the projected period. Subsequent to this step, data analysis is projected to experience major growth than rest steps of workflow due to the existence of extensive activities for development and upgradation of novel algorithms in an attempt to render rapid outcome following data analysis.

End User Outlook and Trend Analysis

Usage of these solutions in R&D projects that are executed in the research centers and universities are prenominal for the leading share due to the existence of a huge amount of R&D projects. On-site bioinformatics courses provision which includes the workshops on the actual implementation of data analysis and NGS are also anticipated to fuel revenue produced via academic research in the approaching years. Rising NGS-based smaller scale platforms’ adoption for medical diagnostics is also a major end market projected to fuel demand during the future.

Regional Outlook and Trend Analysis

In 2017, North American regional NGS market reported for the leading share. This huge share can be reported for the existence of an improved technological medical framework, rising adoption of declining in the price of sequencing for each base pair, and elevated R&D funding for proteomic and genomic sequence determination for research of biomarkers. Also, most of the respondents for clinical & academic use are situated in the UK, U.S., and Germany due to the existence of numerous universities that present courses for molecular biology in the region thus affecting the expansion of NGS industry in European and North American regional market. Asia Pacific region is anticipated to grow at the leading rate with a compound annual growth rate of around % over the forecast years due to escalating investment for escalating healthcare awareness levels of the regional population, development of healthcare, and escalating residual and per capita income levels.

Competitive Outlook and Trend Analysis

The major market players in global next-generation sequencing market are Beijing Genomics Institute, Pacific Biosciences, Knome Inc., F Hoffmann-La Roche, Thermo Fisher Scientific, GATC Biotech AG., Oxford Nanopore Technologies Inc., Biomatters Ltd., Agilent Technologies Inc., DNAStar Inc., Helicos BioSciences, CLC Bio (Qiagen), Macrogen Inc., and Illumina Inc. The rivalry between market players seeking to achieve a grip in the rapidly-developing biotech segment is engaging on numerous battlefields. Companies are concentrating on the advent of economical sequencing devices in regular healthcare checkups.

The global next generation sequencing market is segmented as follows –

By Application

- Oncology

- Clinical Investigation

- Idiopathic Diseases

- Inherited Diseases

- Infectious Diseases

- Non-Communicable / Other Diseases

- Reproductive Health

- NIPT

- PGT

- Newborn/Genetic Screening

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

By Technology

- Targeted Sequencing Analysis

- DNA Based Targeted Sequencing Analysis

- RNA Based Targeted Sequencing Analysis

- Whole Genome Sequencing

- Whole Exome Sequencing

By Work flow

- Pre-sequencing

- NGS Library Preparation Kits

- NGS Semi-Automated Library Preparation

- NGS Automated Library Preparation

- Clonal Amplification

- Sequencing

- Data Analysis

- Primary Data Analysis

- Secondary Data Analysis

- Tertiary Data Analysis

By End User

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

· What was the market size in 2017 and forecast from 2017 to 2023?

· What will be the industry market growth from 2017 to 2023?

· What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

· What are the major segments leading the market growth and why?

· Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Next Generation Sequencing (NGS) Market By Application, Estimates and Forecast, 2014-2023 ($Million)

- Oncology

- Clinical Investigation

- Idiopathic Diseases

- Inherited Diseases

- Infectious Diseases

- Non-Communicable / Other Diseases

- Reproductive Health

- NIPT

- PGT

- Newborn/Genetic Screening

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

- Next Generation Sequencing (NGS) Market By Technology, Estimates and Forecast, 2014-2023 ($Million)

- Targeted Sequencing Analysis

- DNA Based Targeted Sequencing Analysis

- RNA Based Targeted Sequencing Analysis

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing Analysis

- Next Generation Sequencing (NGS) Market By Work-flow, Estimates and Forecast, 2014-2023 ($Million)

- Pre-sequencing

- NGS Library Preparation Kits

- NGS Semi-Automated Library Preparation

- NGS Automated Library Preparation

- Clonal Amplification

- Sequencing

- Data Analysis

- Primary Data Analysis

- Secondary Data Analysis

- Tertiary Data Analysis

- Data Analysis

- Pre-sequencing

- Next Generation Sequencing (NGS) Market By End User, Estimates and Forecast, 2014-2023 ($Million)

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

- Next Generation Sequencing (NGS) Market By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Next Generation Sequencing (NGS) Market, By Country

- North America Next Generation Sequencing (NGS) Market, By Application

- North America Next Generation Sequencing (NGS) Market, By Technology

- North America Next Generation Sequencing (NGS) Market, By Work-flow

- North America Next Generation Sequencing (NGS) Market, By End User

- U.S. Next Generation Sequencing (NGS) Market, By Application

- U.S. Next Generation Sequencing (NGS) Market, By Technology

- U.S. Next Generation Sequencing (NGS) Market, By Work-flow

- U.S. Next Generation Sequencing (NGS) Market, By End User

- Canada Next Generation Sequencing (NGS) Market, By Application

- Canada Next Generation Sequencing (NGS) Market, By Technology

- Canada Next Generation Sequencing (NGS) Market, By Work-flow

- Canada Next Generation Sequencing (NGS) Market, By End User

- Mexico Next Generation Sequencing (NGS) Market, By Application

- Mexico Next Generation Sequencing (NGS) Market, By Technology

- Mexico Next Generation Sequencing (NGS) Market, By Work-flow

- Mexico Next Generation Sequencing (NGS) Market, By End User

-

- Europe

- Europe Next Generation Sequencing (NGS) Market, By Country

- Europe Next Generation Sequencing (NGS) Market, By Application

- Europe Next Generation Sequencing (NGS) Market, By Technology

- Europe Next Generation Sequencing (NGS) Market, By Work-flow

- Europe Next Generation Sequencing (NGS) Market, By End User

- Germany Next Generation Sequencing (NGS) Market, By Application

- Germany Next Generation Sequencing (NGS) Market, By Technology

- Germany Next Generation Sequencing (NGS) Market, By Work-flow

- Germany Next Generation Sequencing (NGS) Market, By End User

- France Next Generation Sequencing (NGS) Market, By Application

- France Next Generation Sequencing (NGS) Market, By Technology

- France Next Generation Sequencing (NGS) Market, By Work-flow

- France Next Generation Sequencing (NGS) Market, By End User

- UK Next Generation Sequencing (NGS) Market, By Application

- UK Next Generation Sequencing (NGS) Market, By Technology

- UK Next Generation Sequencing (NGS) Market, By Work-flow

- UK Next Generation Sequencing (NGS) Market, By End User

- Italy Next Generation Sequencing (NGS) Market, By Application

- Italy Next Generation Sequencing (NGS) Market, By Technology

- Italy Next Generation Sequencing (NGS) Market, By Work-flow

- Italy Next Generation Sequencing (NGS) Market, By End User

- Spain Next Generation Sequencing (NGS) Market, By Application

- Spain Next Generation Sequencing (NGS) Market, By Technology

- Spain Next Generation Sequencing (NGS) Market, By Work-flow

- Spain Next Generation Sequencing (NGS) Market, By End User

- Rest of Europe Next Generation Sequencing (NGS) Market, By Application

- Rest of Europe Next Generation Sequencing (NGS) Market, By Technology

- Rest of Europe Next Generation Sequencing (NGS) Market, By Work-flow

- Rest of Europe Next Generation Sequencing (NGS) Market, By End User

-

- Asia-Pacific

- Asia-Pacific Next Generation Sequencing (NGS) Market, By Country

- Asia-Pacific Next Generation Sequencing (NGS) Market, By Application

- Asia-Pacific Next Generation Sequencing (NGS) Market, By Technology

- Asia-Pacific Next Generation Sequencing (NGS) Market, By Work-flow

- Asia-Pacific Next Generation Sequencing (NGS) Market, By End User

- Japan Next Generation Sequencing (NGS) Market, By Application

- Japan Next Generation Sequencing (NGS) Market, By Technology

- Japan Next Generation Sequencing (NGS) Market, By Work-flow

- Japan Next Generation Sequencing (NGS) Market, By End User

- China Next Generation Sequencing (NGS) Market, By Application

- China Next Generation Sequencing (NGS) Market, By Technology

- China Next Generation Sequencing (NGS) Market, By Work-flow

- China Next Generation Sequencing (NGS) Market, By End User

- Australia Next Generation Sequencing (NGS) Market, By Application

- Australia Next Generation Sequencing (NGS) Market, By Technology

- Australia Next Generation Sequencing (NGS) Market, By Work-flow

- Australia Next Generation Sequencing (NGS) Market, By End User

- India Next Generation Sequencing (NGS) Market, By Application

- India Next Generation Sequencing (NGS) Market, By Technology

- India Next Generation Sequencing (NGS) Market, By Work-flow

- India Next Generation Sequencing (NGS) Market, By End User

- South Korea Next Generation Sequencing (NGS) Market, By Application

- South Korea Next Generation Sequencing (NGS) Market, By Technology

- South Korea Next Generation Sequencing (NGS) Market, By Work-flow

- South Korea Next Generation Sequencing (NGS) Market, By End User

- Rest of Asia-Pacific Next Generation Sequencing (NGS) Market, By Application

- Rest of Asia-Pacific Next Generation Sequencing (NGS) Market, By Technology

- Rest of Asia-Pacific Next Generation Sequencing (NGS) Market, By Work-flow

- Rest of Asia-Pacific Next Generation Sequencing (NGS) Market, By End User

- Asia-Pacific

-

- Rest of the World

- Rest of the World Next Generation Sequencing (NGS) Market, By Country

- Rest of the World Next Generation Sequencing (NGS) Market, By Application

- Rest of the World Next Generation Sequencing (NGS) Market, By Technology

- Rest of the World Next Generation Sequencing (NGS) Market, By Work-flow

- Rest of the World Next Generation Sequencing (NGS) Market, By End User

- Brazil Next Generation Sequencing (NGS) Market, By Application

- Brazil Next Generation Sequencing (NGS) Market, By Technology

- Brazil Next Generation Sequencing (NGS) Market, By Work-flow

- Brazil Next Generation Sequencing (NGS) Market, By End User

- South Africa Next Generation Sequencing (NGS) Market, By Application

- South Africa Next Generation Sequencing (NGS) Market, By Technology

- South Africa Next Generation Sequencing (NGS) Market, By Work-flow

- South Africa Next Generation Sequencing (NGS) Market, By End User

- Saudi Arabia Next Generation Sequencing (NGS) Market, By Application

- Saudi Arabia Next Generation Sequencing (NGS) Market, By Technology

- Saudi Arabia Next Generation Sequencing (NGS) Market, By Work-flow

- Saudi Arabia Next Generation Sequencing (NGS) Market, By End User

- Turkey Next Generation Sequencing (NGS) Market, By Application

- Turkey Next Generation Sequencing (NGS) Market, By Technology

- Turkey Next Generation Sequencing (NGS) Market, By Work-flow

- Turkey Next Generation Sequencing (NGS) Market, By End User

- United Arab Emirates Next Generation Sequencing (NGS) Market, By Application

- United Arab Emirates Next Generation Sequencing (NGS) Market, By Technology

- United Arab Emirates Next Generation Sequencing (NGS) Market, By Work-flow

- United Arab Emirates Next Generation Sequencing (NGS) Market, By End User

- Others Next Generation Sequencing (NGS) Market, By Application

- Others Next Generation Sequencing (NGS) Market, By Technology

- Others Next Generation Sequencing (NGS) Market, By Work-flow

- Others Next Generation Sequencing (NGS) Market, By End User

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growth of companion diagnostics and personalized medicine

3.2.1.2. Expansion of technological advancements in cloud computing and data integration

3.2.1.3. Increasing clinical prospect for NGS technology

3.2.2. Restraints

3.2.2.1. Lack of computational efficiency for data management

3.2.3. Opportunities

3.2.3.1. Technological advancement in cancer diagnostic process

4. Next Generation Sequencing (NGS) Market, By Application

4.1. Introduction

4.2. Global Next Generation Sequencing (NGS) Sales, Revenue and Market Share By Application (2017-2017)

4.2.1. Global Next Generation Sequencing (NGS) Sales and Sales Share By Application (2017-2017)

4.2.2. Global Next Generation Sequencing (NGS) Revenue and Revenue Share By Application (2017-2017)

4.3. Next Generation Sequencing (NGS) Market Assessment and Forecast, By Application, 2017-2023

4.4. Oncology

4.4.1.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Clinical Investigation

4.5.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

4.5.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.3. Idiopathic Diseases

4.5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.4. Inherited Diseases

4.5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.5. Infectious Diseases

4.5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.6. Non-Communicable / Other Diseases

4.5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Reproductive Health

4.6.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

4.6.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.3. NIPT

4.6.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.4. PGT

4.6.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.5. Newborn/Genetic Screening

4.6.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.7. HLA Typing/Immune System Monitoring

4.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.8. Metagenomics, Epidemiology & Drug Development

4.8.1. arket Assessment and Forecast, By Region, 2017-2023 ($Million)

4.9. Agrigenomics & Forensics

4.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.10. Consumer Genomics

4.10.1.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Next Generation Sequencing (NGS) Market, By Technology

5.1. Introduction

5.2. Global Next Generation Sequencing (NGS) Sales, Revenue and Market Share By Technology (2017-2017)

5.2.1. Global Next Generation Sequencing (NGS) Sales and Sales Share By Technology (2017-2017)

5.2.2. Global Next Generation Sequencing (NGS) Revenue and Revenue Share By Technology (2017-2017)

5.3. Next Generation Sequencing (NGS) Market Assessment and Forecast, By Technology, 2017-2023

5.4. Targeted Sequencing Analysis

5.4.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

5.4.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.4.3. DNA Based Targeted Sequencing Analysis

5.4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.4.4. RNA Based Targeted Sequencing Analysis

5.4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Whole Genome Sequencing

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Whole Exome Sequencing

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Next Generation Sequencing (NGS) Market, By Work-flow

6.1. Introduction

6.2. Global Next Generation Sequencing (NGS) Sales, Revenue and Market Share By Work-flow (2017-2017)

6.2.1. Global Next Generation Sequencing (NGS) Sales and Sales Share By Work-flow (2017-2017)

6.2.2. Global Next Generation Sequencing (NGS) Revenue and Revenue Share By Work-flow (2017-2017)

6.3. Next Generation Sequencing (NGS) Market Assessment and Forecast, By Work-flow, 2017-2023

6.4. Pre-sequencing

6.4.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

6.4.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.4.3. NGS Library Preparation Kits

6.4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.4.4. NGS Semi-Automated Library Preparation

6.4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.4.5. NGS Automated Library Preparation

6.4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.4.6. Clonal Amplification

6.4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.5. Sequencing

6.5.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

6.5.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.5.3. Data Analysis

6.5.3.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

6.5.3.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.5.3.3. Primary Data Analysis

6.5.3.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.5.3.4. Secondary Data Analysis

6.5.3.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.5.3.5. Tertiary Data Analysis

6.5.3.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7. Next Generation Sequencing (NGS) Market, By End User

7.1. Introduction

7.2. Global Next Generation Sequencing (NGS) Sales, Revenue and Market Share By End User (2017-2017)

7.2.1. Global Next Generation Sequencing (NGS) Sales and Sales Share By End User (2017-2017)

7.2.2. Global Next Generation Sequencing (NGS) Revenue and Revenue Share By End User (2017-2017)

7.3. Next Generation Sequencing (NGS) Market Assessment and Forecast, By End User, 2017-2023

7.4. Academic Research

7.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7.5. Clinical Research

7.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7.6. Hospitals & Clinics

7.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7.7. Pharma & Biotech Entities

7.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

7.8. Other Users

7.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

8. Next Generation Sequencing (NGS) Market, By Region

8.1. Introduction

8.2. Next Generation Sequencing (NGS) Market Assessment and Forecast, By Region, 2017-2023 ($Million)

8.3. Global Next Generation Sequencing (NGS) Sales, Revenue and Market Share by Regions

8.3.1. Global Next Generation Sequencing (NGS) Sales by Regions (2017-2017)

8.3.2. Global Next Generation Sequencing (NGS) Revenue by Regions (2017-2017)

8.4. North America

8.4.1. North America Next Generation Sequencing (NGS) Sales and Growth Rate (2017-2017)

8.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

8.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.4. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.4.5. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.4.6.1. U.S.

8.4.6.1.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.1.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.4.6.1.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.1.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.4.6.2. Canada

8.4.6.2.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.2.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.4.6.2.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.2.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.4.6.3. Mexico

8.4.6.3.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.3.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.4.6.3.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.4.6.3.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5. Europe

8.5.1. Europe Next Generation Sequencing (NGS) Sales and Growth Rate (2017-2017)

8.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

8.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.4. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.5. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.1. Germany

8.5.6.1.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.1.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.1.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.1.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.2. France

8.5.6.2.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.2.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.2.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.2.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.3. UK

8.5.6.3.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.3.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.3.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.3.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.4. Italy

8.5.6.4.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.4.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.4.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.5. Spain

8.5.6.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.5.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.5.3. Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.5.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.6. Russia

8.5.6.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.6.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.6.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.5.6.7. Rest of Europe

8.5.6.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.7.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.5.6.7.3. Assessment and Forecast, By Application, 2017-2023 ($Million)

8.5.6.7.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6. Asia-Pacific

8.6.1. Asia-Pacific Next Generation Sequencing (NGS) Sales and Growth Rate (2017-2017)

8.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

8.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.4. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.5. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.1. Japan

8.6.6.1.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.1.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.1.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.1.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.2. China

8.6.6.2.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.2.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.2.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.2.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.3. Australia

8.6.6.3.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.3.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.3.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.3.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.4. India

8.6.6.4.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.4.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.4.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.5. South Korea

8.6.6.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.5.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.5.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.6. Taiwan

8.6.6.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.6.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.6.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.6.6.7. Rest of Asia-Pacific

8.6.6.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.7.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.6.6.7.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.6.6.7.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7. Rest of the World

8.7.1. Rest of the World Next Generation Sequencing (NGS) Sales and Growth Rate (2017-2017)

8.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

8.7.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.4. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.5. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.1. Brazil

8.7.6.1.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.1.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.1.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.1.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.2. Turkey

8.7.6.2.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.2.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.2.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.2.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.3. Saudi Arabia

8.7.6.3.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.3.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.3.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.3.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.4. South Africa

8.7.6.4.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.4.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.4.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.5. United Arab Emirates

8.7.6.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.5.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.5.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

8.7.6.6. Others

8.7.6.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.6.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

8.7.6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

8.7.6.6.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

9. Company Profiles

9.1. Roche Holding AG

9.1.1. Business Overview

9.1.2. Product Portfolio

9.1.3. Strategic Developments

9.1.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.2. Agilent Technologies

9.2.1. Business Overview

9.2.2. Product Portfolio

9.2.3. Strategic Developments

9.2.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.3. Genomatix Software Gmbh

9.3.1. Business Overview

9.3.2. Product Portfolio

9.3.3. Strategic Developments

9.3.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.4. Illumina, Inc.

9.4.1. Business Overview

9.4.2. Product Portfolio

9.4.3. Strategic Developments

9.4.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.5. Dnastar, Inc.

9.5.1. Business Overview

9.5.2. Product Portfolio

9.5.3. Strategic Developments

9.5.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.6. Oxford Nanopore Technologies, Ltd.

9.6.1. Business Overview

9.6.2. Product Portfolio

9.6.3. Strategic Developments

9.6.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.7. Qiagen N.V.

9.7.1. Business Overview

9.7.2. Product Portfolio

9.7.3. Strategic Developments

9.7.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.8. Genomatix Software Gmbh

9.8.1. Business Overview

9.8.2. Product Portfolio

9.8.3. Strategic Developments

9.8.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.9. Knome, Inc.

9.9.1. Business Overview

9.9.2. Product Portfolio

9.9.3. Strategic Developments

9.9.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.10. Macrogen, Inc.

9.10.1. Business Overview

9.10.2. Product Portfolio

9.10.3. Strategic Developments

9.10.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

9.11. Thermo Fisher Scientific Inc.

9.11.1. Business Overview

9.11.2. Product Portfolio

9.11.3. Strategic Developments

9.11.4. Next Generation Sequencing (NGS) Sales, Revenue and Market Share

10. Global Next Generation Sequencing (NGS) Market Competition, by Manufacturer

10.1. Global Next Generation Sequencing (NGS) Sales and Market Share by Manufacturer (2017-2017)

10.2. Global Next Generation Sequencing (NGS) Revenue and Market Share by Manufacturer (2017-2017)

10.3. Top 5 Next Generation Sequencing (NGS) Manufacturer Market Share

10.4. Market Competition Trend

List of Tables

*You can glance through the list of Tables and Figures when you view the sample copy of Next Generation Sequencing (NGS) Market.

Research Methodology

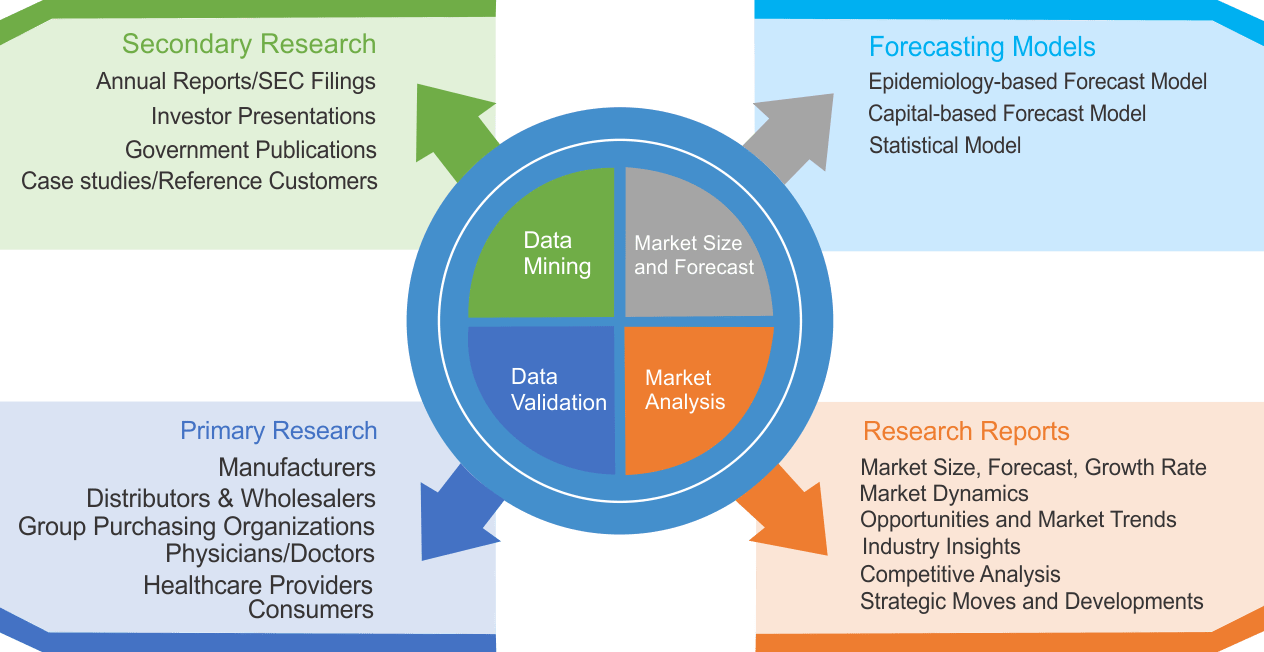

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|