.png)

North America Frozen Bakery Products Market by Target Audience, Product, Distribution Channel and Technology - Global Industry Analysis and Forecast to 2027

Published On : October 2019 Pages : 130 Category: Food and Beverages Report Code : FB106579

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

The North America frozen bakery products market was worth USD XXX billion in 2017 and is prognosticated to be nearly USD XXXX billion by 2027, growing at a compound annual growth rate (CAGR) of % during the forecast period. Rising requirement of processed food and increasing preference of bakery products among consumers is said to boost the demand of bakery products. These products can be stored for longer time in comparison with traditional bakery products. Various benefits provided by these products such as enhanced quality, manufacturing process that is environment friendly, convenient availability and low prices are anticipated to spur the growth of this market. A considerable chunk is contributed by frozen bakery products to the frozen food market owing to the increasing demand of ready to warm and ready to bake products. Quick service is offered by these products along with maintaining freshness as well as quality. Multiple companies have accomplished prosperity in a competitive market by providing these products to places that offer quick services like cafes, gas stations, restaurants, in-store bakeries and coffee chains. The major factors that influence the growth of these products are growing demand among consumers, consistency in taste and enhancement of retail avenues providing these products. On the other hand, shortage of distribution facilities in rural or semi-urban areas and absence of refrigeration facility in some retail stores are factors that can hamper the growth of this market.

Product Outlook and Trend analysis

The NA frozen bakery products market in terms of product is disintegrated into pastries, pizza crusts, rolls, donuts, cakes, breads and others. With regards to revenue a substantial market share was registered by pizza crust of over 30 percent. In several western countries like Germany, France, Spain and Mexico frozen pizza is a part of daily meal. Moreover, this segment was leading the market owing to the pattern of consumption in emerging countries like United States and Italy. Companies providing frozen food are launching new pizzas that contain ingredients that are healthy. On the basis of consumption, frozen bread is said to show significant growth in the upcoming years. In America, bread is known to be as a staple food item. At the time of storage various physical and chemical changes take place that may degrade the freshness and the quality of the bread.

Distribution Channel outlook and Trend Analysis

On the basis of distribution channel the NA frozen bakery products market is disintegrated into quick serving restaurants, artisan bakers, convenience stores, catering & industrial and Hypermarket & supermarket. Catering and industrial sector is anticipated to witness swift growth in the forecast period. The major factors that spur the growth of this market are the availability of several national as well as international brands of bakery products coupled with rising tourism. Many international cuisines include bread and bread products in their food items. The catering sector is the fastest growing in comparison with any other industry. Quick service restaurants are an increasingly emerging channel of distribution for frozen bakery products. This segment is said to witness significant growth owing to factors like enhanced living standards of people coupled with increased disposable income. Moreover, the rising requirement of convenient and on-the-go products is said to boost the quick service restaurants market.

Regional Outlook and Trend analysis

A significant amount of contribution to the global frozen bakery products market is expected from Europe during the forecast period. Emerging tourism and catering industry in the United Kingdom, France and Germany is said to reflect significant growth in the region in the upcoming years. The growth of the regional market of frozen bakery products is attributed to the increasing requirement for ‘thaw and serve’ products that render convenience to retail bakeries, households, quick service restaurants and grocery stores. Moreover, increase in the shelf life of these products render an option of stocking the products and utilizing as and when needed. Latin America was accounted for a revenue of USD billion in 2017 in the frozen bakery market. The region is anticipated to have a booming market due to the rising requirement of processed food and diversity in the lifestyle of the consumers. Additionally, the enhance food culture couples with rising living standards and disposable income is said to spur the growth of the market.

Competitive Insights

The leading manufacturers in the global frozen bakery products market are Kellogg Company, General Mills, Bridgford Foods Corporation, Alpha Baking Company Inc, Pepperidge Farm, Maple Leaf Foods, Conagra Brands, Vandemoortele, Lantmännen Unibake, Cargill, Général Waffle Manufactory SPRL, Cole's Quality Foods and EUROPASTRY S.A.

The global frozen bakery products marketis segmented as follows-

By Target Audience

Food safety agencies

Government and research organizations

Frozen bakery products manufacturers and suppliers

Food safety agencies

Associations and industrial bodies

Regulatory institutions

Traders, distributors, and retailers

Agricultural institutes and universities

By Product

Breads

Rolls

Pizza Crusts

Cakes

Muffins

Pound cakes

Pancakes

Pastries

Donuts

Others Frozen Bakery Products

By Distribution Channel

Catering & Industrial

Artisan Bakers

Retail

Supermarkets & Hypermarkets

In-Store Bakeries

Convenience Stores

By Technology

Ready Baked & Frozen

Raw Products

Ready-to-Bake

By Region

North America

U.S

Canada

Mexico

Some of the key questions answered by the report are:

What was the market size in 2017 and forecast from 2022 to 2027?

What will be the industry market growth from 2022 to 2027?

What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

What are the major segments leading the market growth and why?

Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Table of Contents

1.Introduction

1.1.Report Description

1.2.Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2.Executive Summary

2.1.Key Highlights

3.Market Overview

3.1.Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2.Market Share Analysis

3.3.Market Dynamics

3.3.1. Drivers

3.3.1.1.Adoption rate of processed and preserved goods

3.3.1.2.Benefits of frozen bakery products over traditional bakery items

3.3.1.3.Technological advancement in processed food

3.3.2. Restraints

3.3.2.1.Lack of refrigeration facility in many areas

3.3.3. Opportunities

3.3.3.1.Advancement in food quality with improvise technological aspects

3.4.Industry Trends

4.Frozen Bakery Products Market, By Target Audience

4.1.Introduction

4.2.Frozen Bakery Products Market Assessment and Forecast, By Product, 2013-2023

4.3.Food safety agencies

4.3.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.4.Government and research organizations

4.4.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.5.Frozen bakery products manufacturers and suppliers

4.5.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.6.Food safety agencies

4.6.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.7.Associations and industrial bodies

4.7.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.8.Regulatory institutions

4.8.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.9.Traders, distributors, and retailers

4.9.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

4.10.Agricultural institutes and universities

4.10.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.Frozen Bakery Products Market, By Product

5.1.Introduction

5.2.Frozen Bakery Products Market Assessment and Forecast, By Product, 2013-2023

5.3.Breads

5.3.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.4.Rolls

5.4.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.5.Pizza Crusts

5.6.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.7.Cakes

5.7.1. Market Assessment and Forecast, By Type, 2013-2023 ($Million)

5.7.2. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.7.2.1.Muffins

5.7.2.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.7.2.2.Pound cakes

5.7.2.2.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.7.2.3.Pancakes

5.7.2.3.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.8.Pastries

5.8.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.9.Donuts

5.9.1. Market Assessment and Forecast, By Region, 2013-2023 ($Million)

5.10.Other Frozen Bakery Products

5.10.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.Frozen Bakery Products Market, By Distribution Channel

6.1.Introduction

6.2.Frozen Bakery Products Market Assessment and Forecast, By Distribution Channel, 2013-2023

6.3.Catering & Industrial

6.3.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.4.Artisan Bakers

6.4.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.5.Retail

6.5.1.1.Market Assessment and Forecast, By Type, 2013-2023 ($Million)

6.5.1.2.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.5.1.3.Supermarkets & Hypermarkets l

6.5.1.3.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.5.1.4.In-Store Bakeries

6.5.1.4.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

6.5.1.5.Convenience Stores

6.5.1.5.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

7.Frozen Bakery Products Market, By Technology

7.1.Introduction

7.2.Frozen Bakery Products Market Assessment and Forecast, By Technology, 2013-2023 ($Million)

7.3.Ready Baked & Frozen

7.3.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

7.4.Raw Products

7.4.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

7.5.Ready-to-Bake

7.5.1.1.Market Assessment and Forecast, By Region, 2013-2023 ($Million)

8.Frozen Bakery Products Market, By Region

8.1.Introduction

8.2.Frozen Bakery Products Market Assessment and Forecast, By Region, 2013-2023 ($Million)

8.3.North America

8.3.1. Market Assessment and Forecast, By Country, 2013-2023 ($Million)

8.3.2. Market Assessment and Forecast, By Target Audience, 2013-2023 ($Million)

8.3.3. Market Assessment and Forecast, By Product, 2013-2023 ($Million)

8.3.4. Market Assessment and Forecast, By Distribution Channel, 2013-2023 ($Million)

8.3.5. Market Assessment and Forecast, By Technology, 2013-2023 ($Million)

8.3.5.1.U.S.

8.3.5.1.1.Market Assessment and Forecast, By Target Audience, 2013-2023 ($Million)

8.3.5.1.2.Market Assessment and Forecast, By Product, 2013-2023 ($Million)

8.3.5.1.3.Market Assessment and Forecast, By Distribution Channel, 2013-2023 ($Million)

8.3.5.1.4.Market Assessment and Forecast, By Technology, 2013-2023 ($Million)

8.3.5.1.5.

8.3.5.2.Canada

8.3.5.2.1.Market Assessment and Forecast, By Target Audience, 2013-2023 ($Million)

8.3.5.2.2.Market Assessment and Forecast, By Product, 2013-2023 ($Million)

8.3.5.2.3.Market Assessment and Forecast, By Distribution Channel, 2013-2023 ($Million)

8.3.5.2.4.Market Assessment and Forecast, By Technology, 2013-2023 ($Million)

8.3.5.3.Mexico

8.3.5.3.1.Market Assessment and Forecast, By Target Audience, 2013-2023 ($Million)

8.3.5.3.2.Market Assessment and Forecast, By Product, 2013-2023 ($Million)

8.3.5.3.3.Market Assessment and Forecast, By Distribution Channel, 2013-2023 ($Million)

9.Company Profiles

9.1.CSC BRANDS, L.P

9.1.1. Business Overview

9.1.2. Product Portfolio

9.1.3. Key Financials

9.1.4. Strategic Developments

9.2.General Mills Inc.

9.2.1. Business Overview

9.2.2. Product Portfolio

9.2.3. Key Financials

9.2.4. Strategic Developments

9.3.Vaasan Ltd.

9.3.1. Business Overview

9.3.2. Product Portfolio

9.3.3. Strategic Developments

9.4.Lantmännen

9.4.1. Business Overview

9.4.2. Product Portfolio

9.4.3. Key Financials

9.4.4. Strategic Developments

9.5.Maple Leaf Foods Inc.

9.5.1. Business Overview

9.5.2. Product Portfolio

9.5.3. Key Financials

9.5.4. Strategic Developments

9.6.Flowers Foods Inc.

9.6.1. Business Overview

9.6.2. Product Portfolio

9.6.3. Key Financials

9.6.4. Strategic Developments

9.7.Barilla G. e R. Fratelli S.p.A

9.7.1. Business Overview

9.7.2. Product Portfolio

9.7.3. Key Financials

9.7.4. Strategic Developments

9.8.KELLOGG CO.

9.8.1. Business Overview

9.8.2. Product Portfolio

9.8.3. Key Financials

9.8.4. Strategic Developments

9.9.Alpha Baking Company, Inc.

9.9.1. Business Overview

9.9.2. Product Portfolio

9.9.3. Key Financials

9.9.4. Strategic Developments

9.10.Grupo Bimbo

9.10.1.Business Overview

9.10.2.Product Portfolio

9.10.3.Key Financials

9.10.4.Strategic Developments

9.11.Premier Foods Plc

9.11.1.Business Overview

9.11.2.Product Portfolio

9.11.3.Key Financials

9.11.4.Strategic Developments

9.12.Bridgford Foods Corporation

9.12.1.Business Overview

9.12.2.Product Portfolio

9.12.3.Key Financials

9.12.4.Strategic Developments

9.13.EUROPASTRY, S.A.

9.13.1.Business Overview

9.13.2.Product Portfolio

9.13.3.Key Financials

9.13.4.Strategic Developments

9.14.Aryzta AG

9.14.1.Business Overview

9.14.2.Product Portfolio

9.14.3.Strategic Developments

8.3.5.3.4.Market Assessment and Forecast, By Technology, 2013-2023 ($Million)

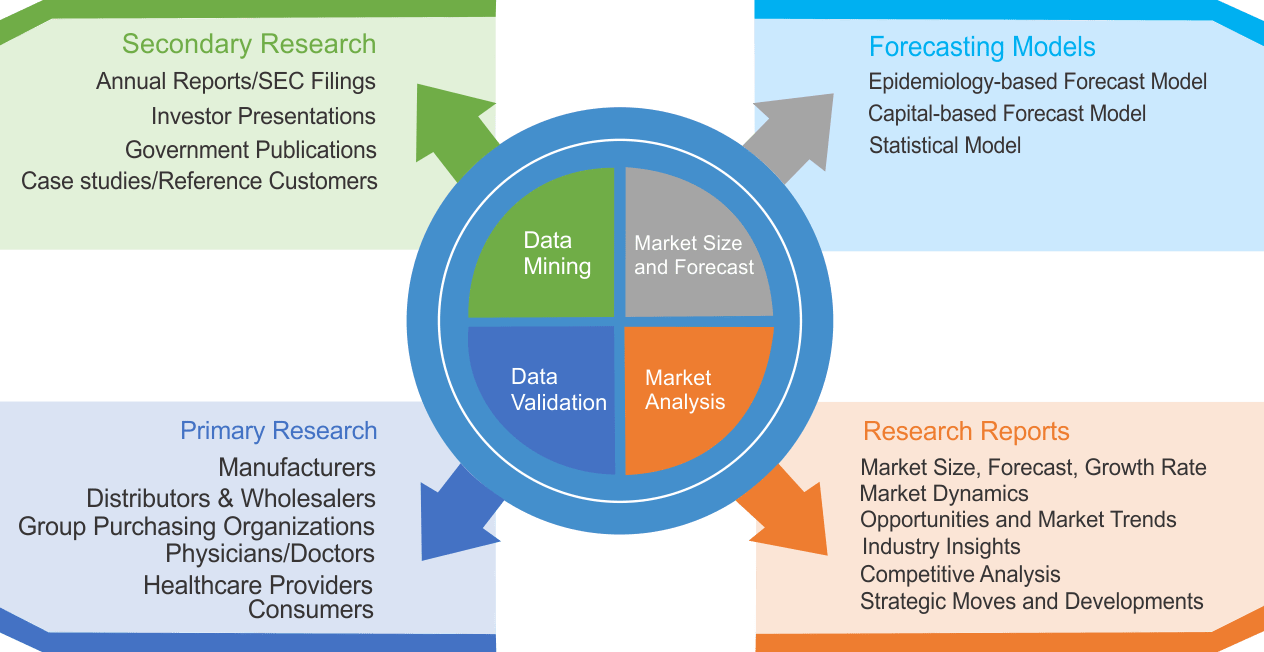

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|