North America Heavy-Duty Starters Market By Type and Application - Industry Analysis and Forecast to 2027

Published On : March 2019 Pages : 52 Category: Automotive & Transportations Report Code : AT032915

Industry Outlook

The starter (likewise known as the starter motor, self-starter, or cranking motor) is the gadget utilized to crank (rotate) the internal-combustion engine in order to start the operation of engine under its very own capacity. The starters may be hydraulic, pneumatic, or electric. On account of vast engines, the starter may even be thought of as another internal ignition motor. Therefore, the Heavy-Duty Starters Market is anticipated to expand and has tremendous scope during the forecast period. The global Heavy-Duty Starters Market anticipated to flourish in the future by growing at a significantly higher CAGR.

Drivers & Restrains

Factors driving the market are; increasing production of various vehicles that are proving an economical mode of transportation, faster arte of industrialization, growth in various end use industries and few other factors. The factors affecting the growth can be due rising number of product returning.

Regional Insights

The Asia Pacific region is leading the global Heavy-Duty Starters Market owing to factor like; increasing production related to vehicles, number of manufacturers located in this region, rising number of electrification of vehicles, etc.

Table of Contents

1. Introduction

1.1. Report Description

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

4. Market Analysis by Regions

4.1. North America (United States, Canada and Mexico)

4.1.1. United States Market Status and Outlook (2017-2027)

4.1.2. Canada Market Status and Outlook (2017-2027)

4.1.3. Mexico Market Status and Outlook (2017-2027)

5. Heavy-Duty Starters Market, By Type

5.1. Introduction

5.2. North America Heavy-Duty Starters Revenue and Market Share by Type (2017-2027)

5.2.1. North America Heavy-Duty Starters Revenue and Revenue Share by Type (2017-2027)

5.3. DC Type Heavy-Duty Starters

5.3.1. North America DC Type Heavy-Duty Starters Revenue and Growth Rate (2017-2027)

5.4. AC Type Heavy-Duty Starters

5.4.1. North America AC Type Heavy-Duty Starters Revenue and Growth Rate (2017-2027)

6. Heavy-Duty Starters Market, By Application

6.1. Introduction

6.2. North America Heavy-Duty Starters Revenue and Market Share by Application (2017-2027)

6.2.1. North America Heavy-Duty Starters Revenue and Revenue Share by Application (2017-2027)

6.3. Commercial Vehicle

6.3.1. North America Commercial Vehicle Revenue and Growth Rate (2017-2027)

6.4. Passenger Vehicle

6.4.1. North America Passenger Vehicle Revenue and Growth Rate (2017-2027)

7. Heavy-Duty Starters Market, By Region

7.1. North America Heavy-Duty Starters by Countries

7.1.1. North America Heavy-Duty Starters Revenue and Growth Rate (2017-2027)

7.1.2. North America Heavy-Duty Starters Revenue (Million USD) by Countries (2017-2027)

7.1.3. United States

7.1.3.1. United States Heavy-Duty Starters Revenue (Millions USD) and Growth Rate (2017-2027)

7.1.4. Canada

7.1.4.1. Canada Heavy-Duty Starters Revenue (Millions USD) and Growth Rate (2017-2027)

7.1.5. Mexico

7.1.5.1. Mexico Heavy-Duty Starters Revenue (Millions USD) and Growth Rate (2017-2027)

8. Company Profiles

8.1. Siemens

8.1.1. Business Overview

8.1.2. Service Portfolio

8.1.3. Strategic Developments

8.1.4. Financial Overview

8.2. Delco Remy

8.2.1. Business Overview

8.2.2. Service Portfolio

8.2.3. Strategic Developments

8.2.4. Financial Overview

8.3. B&C Truck Electrical

8.3.1. Business Overview

8.3.2. Service Portfolio

8.3.3. Strategic Developments

8.3.4. Financial Overview

8.4. NIKKO

8.4.1. Business Overview

8.4.2. Service Portfolio

8.4.3. Strategic Developments

8.4.4. Financial Overview

8.5. Bosch

8.5.1. Business Overview

8.5.2. Service Portfolio

8.5.3. Strategic Developments

8.5.4. Financial Overview

9. North America Heavy-Duty Starters Market Competition, by Manufacturer

9.1. North America Heavy-Duty Starters Revenue and Market Share by Manufacturer (2017-2017)

9.2. Top 5 Heavy-Duty Starters Manufacturer Market Share

10. Heavy-Duty Starters Market Forecast (2017-2027)

10.1.North America Heavy-Duty Starters Market Forecast (2017-2027)

10.1.1. United States Heavy-Duty Starters Market Forecast (2017-2027)

10.1.2. Canada Heavy-Duty Starters Market Forecast (2017-2027)

10.1.3. Mexico Heavy-Duty Starters Market Forecast (2017-2027)

10.2.Heavy-Duty Starters Market Forecast by Type (2017-2027)

10.2.1. Heavy-Duty Starters Forecast by Type (2017-2027)

10.2.2. Heavy-Duty Starters Market Share Forecast by Type (2017-2027)

10.3.Heavy-Duty Starters Market Forecast by Application (2017-2027)

10.3.1. Heavy-Duty Starters Forecast by Application (2017-2027)

10.3.2. Heavy-Duty Starters Market Share Forecast by Application (2017-2027)

Research Methodology

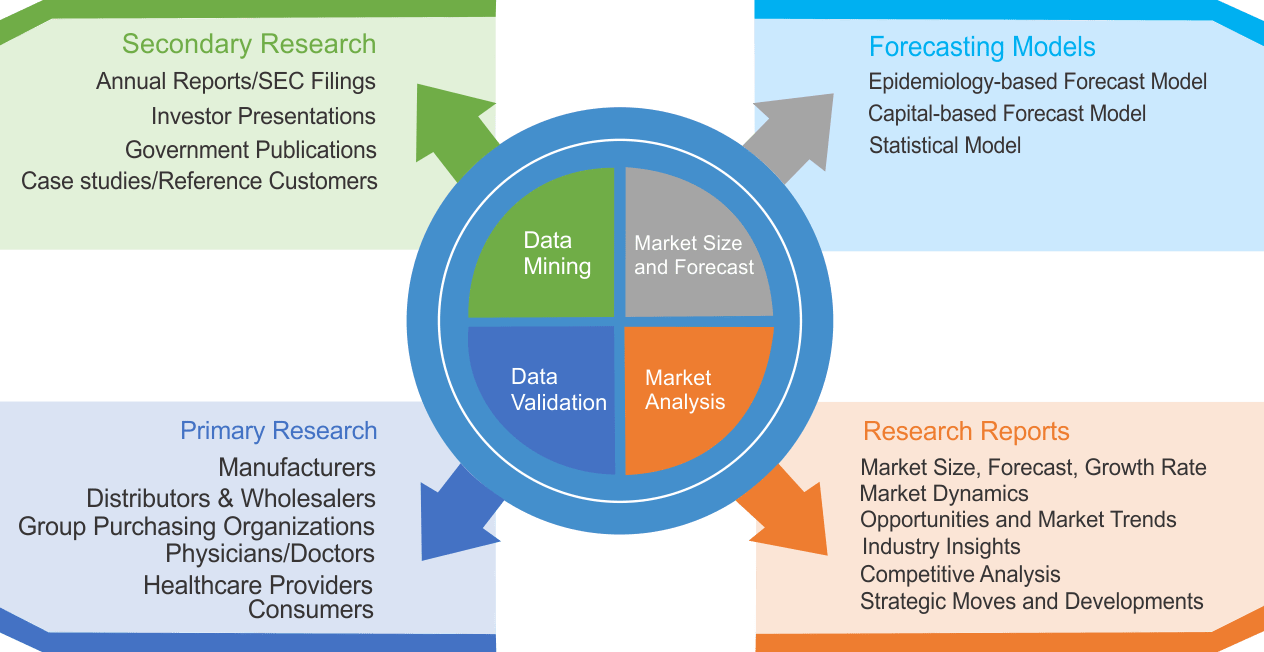

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|