.png)

Parking Sensors Market by Technology and Installation - Global Industry Analysis and Forecast To 2023

Published On : February 2018 Pages : 85 Category: Sensors & Controls Report Code : SE02605

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

The global parking sensors market is expected registering itself at a significant compound annual growth rate (CAGR) over the forecast period. Parking sensors can be referred as proximity sensors that are utilized in vehicles in an attempt to allow the vehicle driver to park vehicle safely. These are Advanced Driver Assistance Systems (ADAS) that warn the driver to any obstructions and are demonstrating to be predominantly useful owing to decreasing parking places and rising number of automobiles. The standard car has been experiencing altering dimensions, making it gradually more complex to park without inducing physical harm to the automobile. Also, parking sensors improve safety and can avert possible injury to pedestrians. According to the Transportation Department, a significant percentage of accidents happen while the automobile is in the reverse gear. These can be alleviated to a substantial degree utilizing parking sensors, which are introduced in the rear bumper bar of the automobile. In an attempt to preserve the aesthetical value of the automobile, they can be color synchronized with the exterior. They function in association with an internal siren or buzzer, which progressively increases in occurrence when the automobile draws close towards an object. An LCD display which is optional can also be mounted. It demonstrates the space between the vehicle and the obstruction. This assists as an efficient warning to the vehicle driver and can avoid a possible accident.

Technology Outlook and Trend Analysis

Reverse and parking sensor technologies involve electromagnetic and ultrasonic technologies. The ultrasonic technology was earlier one and utilizes sound waves in an attempt to calculate the distance amid close by objects. Typically 4 to 6 sensors are installed on the vehicle bumper with the assistance of bore-holes and have to be tinted to go with the bumper’s color. A significant advantage of this technology is its capability to spot obstacles and objects even when the automobile is at a standstill. Though, these sensor systems have some drawbacks like restricted detection range. Also, ultrasonic parking sensors might confirm to be physically too deep for mounting in the bumper of the vehicle owing to the existence of the crash protection barricade. Electromagnetic technology presents a huge number of benefits, the primary of which is the lack of noticeable components. Electromagnetic parking sensors get rid of the need for bore-holes, thus continuing to preserve the look of the automobile. A transceiver adhesive band is positioned down the length of the internal side of the vehicle bumper. When the vehicle is in reverse gear, the system produces a magnetic field which is then transmitted to the adhesive strip. Consequently, these sensors also assist in noticing objects at the bumper side rather than just straight in the rear the bumper. Electromagnetic parking sensors are self-diagnostic as they have an integrated maintenance system that renders immediate feedback.

Installation Outlook and Trend Analysis

Parking sensors might be set up by the original equipment manufacturer (OEM) or during aftermarket services. The aftermarket sensors are considerably cost-effective than those which installed through OEM installation. This is mainly as genuine sensors set up by OEMs are built particularly for the model and make of the automobile being considered. Moreover, the fitment and construction of OEM parking sensors are advanced, hence it assures that they are long-lasting. Ultrasonic parking assist is comparatively cost-efficient, and cost of aftermarket systems is around USD . These ultrasonic parking sensors could also be set up by OEMs; though, costs in this situation vary from USD to around USD . Electromagnetic sensors are more costly than their equivalents, with the costing of aftermarket installation around USD .

Regional Outlook and Trend Analysis

In 2017 North American regional market reported for % of the overall market and is anticipated to preserve its lead over the forecast years. Rising need for avoiding possible damage to the automobile due to driver’s fault and guarantee the safety for pedestrians is projected to be the major driving factors for the regional market growth. In addition, approaches by regulatory authorities are projected to fuel demand for the product in the approaching years. Ensuring safety is vital in thickly populated regions, which is anticipated to ensure as growing acceptance. The European market also reported for extensive market revenue share, and increasing high-end vehicles sales equipped with better-quality sensors is projected to boost the market growth. Asia Pacific region is predicted to be the highest growing regional industry, with an anticipated compound annual growth rate of % over the forecast period.

Competitive Outlook and Trend Analysis

There are a huge number of industry participants, mainly representing sensor producers and key original equipment producers. For instance, BMW presents Park Distance Control, which is integrated with the ultrasound sensors that function in combination with an audio signal. While the automobile is 30 cm afar the nearby large blockage, an uninterrupted warning tone functions as an indication to brake. The major market players are Denso Corporation, Abbott Analog Devices Inc., Continental AG., Robert Bosch GmbH, Freescale Semiconductor Ltd., NXP Semiconductors N.V., Texas Instruments Inc., BMW, Mercedes Benz, Hyundai, Ford Motor Company, Honda, Volkswagen, and Audi.

The global parking sensors market is segmented as follows –

By Technology

- Ultrasonic

- Electromagnetic

By Installation

- OEM

- Aftermarket

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

· What was the market size in 2017 and forecast from 2017 to 2023?

· What will be the industry market growth from 2017 to 2023?

· What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

· What are the major segments leading the market growth and why?

· Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Parking Sensors Market, By Technology, Estimates and Forecast, 2014-2023 ($Million)

- Ultrasonic

- Electromagnetic

- Parking Sensors Market, By Installation, Estimates and Forecast, 2014-2023 ($Million)

- OEM

- Aftermarket

- Parking Sensors Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Parking Sensors Market, By Country

- North America Parking Sensors Market, By Technology

- North America Parking Sensors Market, By Installation

- U.S. Parking Sensors Market, By Technology

- U.S. Parking Sensors Market, By Installation

- Canada Parking Sensors Market, By Technology

- Canada Parking Sensors Market, By Installation

- Mexico Parking Sensors Market, By Technology

- Mexico Parking Sensors Market, By Installation

-

- Europe

- Europe Parking Sensors Market, By Country

- Europe Parking Sensors Market, By Technology

- Europe Parking Sensors Market, By Installation

- Germany Parking Sensors Market, By Technology

- Germany Parking Sensors Market, By Installation

- France Parking Sensors Market, By Technology

- France Parking Sensors Market, By Installation

- UK Parking Sensors Market, By Technology

- UK Parking Sensors Market, By Installation

- Italy Parking Sensors Market, By Technology

- Italy Parking Sensors Market, By Installation

- Spain Parking Sensors Market, By Technology

- Spain Parking Sensors Market, By Installation

- Rest of Europe Parking Sensors Market, By Technology

- Rest of Europe Parking Sensors Market, By Installation

-

- Asia-Pacific

- Asia-Pacific Parking Sensors Market, By Country

- Asia-Pacific Parking Sensors Market, By Technology

- Asia-Pacific Parking Sensors Market, By Installation

- Japan Parking Sensors Market, By Technology

- Japan Parking Sensors Market, By Installation

- Australia Parking Sensors Market, By Technology

- Australia Parking Sensors Market, By Installation

- India Parking Sensors Market, By Technology

- India Parking Sensors Market, By Installation

- South Korea Parking Sensors Market, By Technology

- South Korea Parking Sensors Market, By Installation

- Rest of Asia-Pacific Parking Sensors Market, By Technology

- Rest of Asia-Pacific Parking Sensors Market, By Installation

- Asia-Pacific

-

- Rest of the World

- Rest of the World Parking Sensors Market, By Country

- Rest of the World Parking Sensors Market, By Technology

- Rest of the World Parking Sensors Market, By Installation

- Brazil Parking Sensors Market, By Technology

- Brazil Parking Sensors Market, By Installation

- South Africa Parking Sensors Market, By Technology

- South Africa Parking Sensors Market, By Installation

- Saudi Arabia Parking Sensors Market, By Technology

- Saudi Arabia Parking Sensors Market, By Installation

- Turkey Parking Sensors Market, By Technology

- Turkey Parking Sensors Market, By Installation

- United Arab Emirates Parking Sensors Market, By Technology

- United Arab Emirates Parking Sensors Market, By Installation

- Others Parking Sensors Market, By Technology

- Others Parking Sensors Market, By Installation

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Strict regulations that mandate the installation and development of parking sensors system

3.2.1.2. Growing number of vehicle accidents

3.2.2. Restraints

3.2.2.1. Absence of awareness regarding the technology

3.2.3. Opportunities

3.2.3.1. Technological Advancement in Parking Sensors system

4. Parking Sensors Market, By Technology

4.1. Introduction

4.2. Global Parking Sensors Sales, Revenue and Market Share By Technology (2017-2017)

4.2.1. Global Parking Sensors Sales and Sales Share By Technology (2017-2017)

4.2.2. Global Parking Sensors Revenue and Revenue Share By Technology (2017-2017)

4.3. Parking Sensors Market Assessment and Forecast, By Technology, 2017-2023

4.4. Ultrasonic

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Electromagnetic

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Parking Sensors Market, By Installation

5.1. Introduction

5.2. Global Parking Sensors Sales, Revenue and Market Share By Installation (2017-2017)

5.2.1. Global Parking Sensors Sales and Sales Share By Installation (2017-2017)

5.2.2. Global Parking Sensors Revenue and Revenue Share By Installation 2017-2017)

5.3. The Parking Sensors Market Assessment and Forecast, By Installation, 2017-2023

5.4. OEM

5.4.1.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Aftermarket

5.5.1.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Parking Sensors Market, By Region

6.1. Introduction

6.2. Parking Sensors Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.3. Global Parking Sensors Sales, Revenue and Market Share by Regions

6.3.1. Global Parking Sensors Sales by Regions (2017-2017)

6.3.2. Global Parking Sensors Revenue by Regions (2017-2017)

6.4. North America

6.4.1. North America Parking Sensors Sales and Growth Rate (2017-2017)

6.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.4.4. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.4.5. U.S.

6.4.5.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.4.6. Canada

6.4.6.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.4.7. Mexico

6.4.7.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.4.7.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5. Europe

6.5.1. Europe Parking Sensors Sales and Growth Rate (2017-2017)

6.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.4. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5.5. Germany

6.5.5.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5.6. France

6.5.6.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.7. UK

6.5.7.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5.8. Italy

6.5.8.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5.9. Spain

6.5.9.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.5.10. Rest of Europe

6.5.10.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.5.10.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6. Asia-Pacific

6.6.1. Asia-Pacific Parking Sensors Sales and Growth Rate (2017-2017)

6.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.4. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.5. Japan

6.6.5.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.6. China

6.6.6.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.7. Australia

6.6.7.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.8. India

6.6.8.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.9. South Korea

6.6.9.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.6.10. Rest of Asia-Pacific

6.6.10.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.6.10.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7. Rest of the World

6.7.1. Rest of the World Parking Sensors Sales and Growth Rate (2017-2017)

6.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.7.3. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.4. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.5. Brazil

6.7.5.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.5.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.6. Turkey

6.7.6.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.6.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.7. Saudi Arabia

6.7.7.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.7.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.8. South Africa

6.7.8.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.8.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.9. United Arab Emirates

6.7.9.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.9.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

6.7.10. Others

6.7.10.1. Market Assessment and Forecast, By Technology, 2017-2023 ($Million)

6.7.10.2. Market Assessment and Forecast, By Installation, 2017-2023 ($Million)

7. Company Profiles

7.1. Abbott Analog Devices Inc.

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Strategic Developments

7.1.4. Parking Sensors Sales, Revenue and Market Share

7.2. Denso Corporation

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Strategic Developments

7.2.4. Parking Sensors Sales, Revenue and Market Share

7.3. Denso Corporation

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.3.4. Parking Sensors Sales, Revenue and Market Share

7.4. Texas Instruments Inc.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.4.4. Parking Sensors Sales, Revenue and Market Share

7.5. Freescale Semiconductor Ltd.

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.5.4. Parking Sensors Sales, Revenue and Market Share

7.6. NXP Semiconductors N.V.

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.6.4. Parking Sensors Sales, Revenue and Market Share

8. Global Parking Sensors Market Competition, by Manufacturer

8.1. Global Parking Sensors Sales and Market Share by Manufacturer (2017-2017)

8.2. Global Parking Sensors Revenue and Market Share by Manufacturer (2017-2017)

8.3. Top 5 Parking Sensors Manufacturer Market Share

8.4. Market Competition Trend

List of Tables

*You can glance through the list of Tables and Figures when you view the sample copy of Parking Sensors Market.

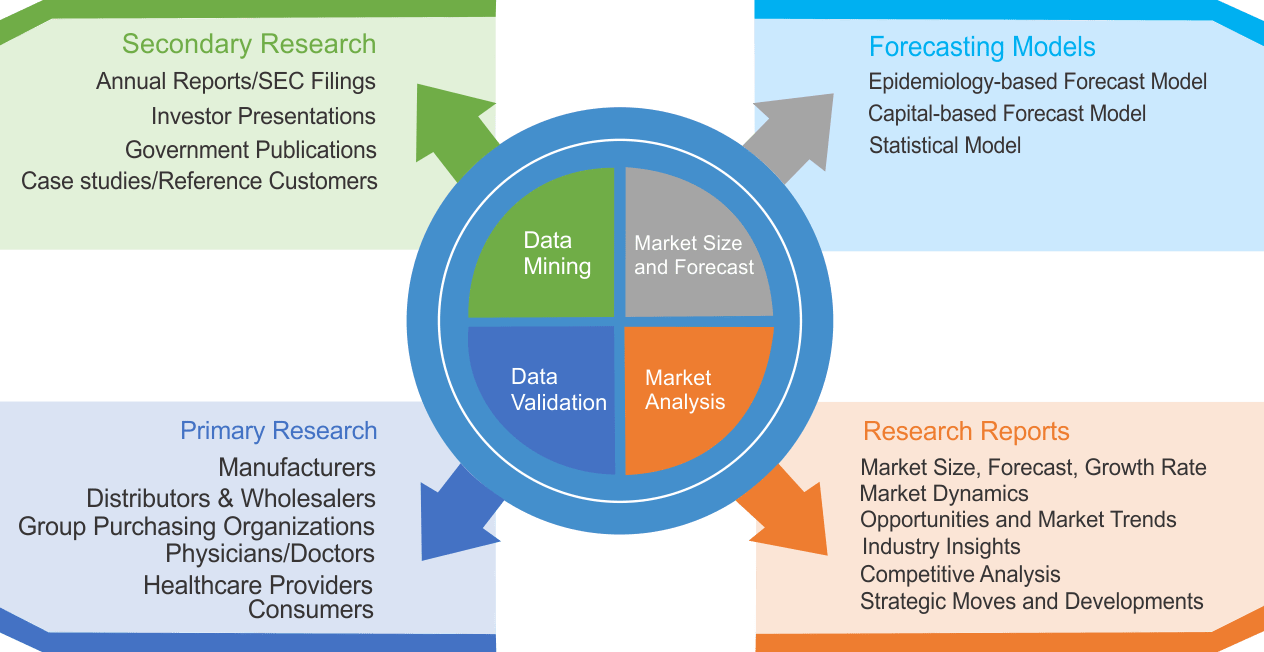

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|