.png)

Polyurethane (PU) Market by Product and Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 150 Category: Plastics, Polymers & Resins Report Code : CM11324

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

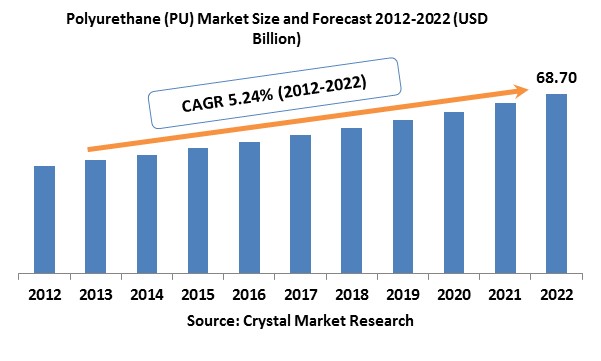

The global Polyurethane (PU) market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2022, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Popularity for lightweight and sturdy materials from end-use enterprises, for example, footwear & packaging, electronics & appliances, furniture, footwear and packaging and automotive has driven development lately. PU is generally used in interior components, cushion foams, and other lightweight automotive parts to cultivate fuel and vitality savings. Seat frames shaped from this material are around 35 percent lighter than metal stamped frames, while inventive matrix resins utilized as a part of composites, for example, the Henkel Loctite glass-fiber strengthened leaf springs add to more than 65 percent segment weight savings. Proficient and insulative foams are additionally being used in 'green' structures and other feasible framework activities to bring down vitality costs in created districts, for example, North America and Europe. Green building instruments, for example, the LEED confirmation and the NAHB Model Green Home Building Guidelines are driving item development to meet sound and ecological building principles. The business is focused and oligopolistic in nature with the best makers representing more than 60 percent of the general share. Item valuing and different systems are very subject to the best players, for example, Covestro, BASF and The Dow Chemical Company, while major multinationals are going into vital partnerships with smaller territorial players to grow their exercises in developing economies. Nonetheless, developing ecological concerns and unstable raw material costs are anticipated to challenge producers. MDI and TDI, the most generally utilized isocyanates utilized for PU creation have seen value swings because of change in their antecedent markets, in particular petrochemicals, for example, benzene.

Product Outlook and Trend Analysis

The business might be fragmented on the basis of products into elastomers, foams, adhesives & sealants, coatings, and different items. Natural properties of rigid & flexible froths, for example, auxiliary security permit the generation of thermally insulating items, prompting high infiltration. However, elastomers are anticipated to rise as the quickest developing item over the conjecture time frame. These polymers offer joined advantages of plastics and rubbers, which permits high adaptability, and effect and stun protection for elite applications. The improvement of PU elastomers with characteristic self-recuperating properties has likewise added to portion development as of late. The advancement of coatings that are environment-friendly with poly-aspartic and 2K waterborne PU innovation has likewise opened up new roads for development. Coatings are foreseen to possess more than 15 percent income share in the upcoming years as their use increases in the growing automotive and construction businesses of Asia Pacific and CSA.

Application Outlook and Trend Analysis

Construction is probably going to remain the leading end-use industry with more than 30 percent volume share in 2017. Developing commercial and residential spending in rising nations, for example, Venezuela, Indonesia, Thailand, South Africa and India is relied upon to remain a key figure driving item utilization in insulation, roofing and flooring applications. Moreover, interiors and furniture are likewise expending these items in seating, bedding, upholstery and different applications. Expanding discretionary cash flow and rising way of life are driving development in the luxury furniture portion and giving new chances to stylish items. Quickly developing customer electronics segment in rising economies are likewise giving gainful prospects to makers. Exemplification of electronic segments in scaled down and wearable electronics alongside different items, for example, sensors and circuits are driving development.

Regional Outlook and Trend Analysis

Asia Pacific was the leading regional market attributable to the huge pool of talented workforce, raw materials and government bolster. Recent activities such the advent of 'Make in India' scheme and the ideal purchasers' motivator plot in Thailand are cultivating interests in the household manufacturing and automotive of these nations separately. Producers are in this manner embracing low cost, lightweight, and innovative materials to fabricate superior construction and automobiles materials. Polyurethane maker relationship in Asian nations are likewise reassuring recycling & endorsing manageability practices to advance safe and eco-friendly applications in these ventures. Central and South America (CSA) witnessed relentless development in the course of recent years particularly by virtue of expanding utilization from Colombia's automotive OEMs. The area is anticipated to develop at a significant pace, as makers are winding up more aggressive and receiving such materials to bring down generation costs. Nations, for example, Paraguay and Peru are relied upon to rise as best entertainers as far as financial development, producing yield and present a few lucrative chances for new participants too.

Competitive Insights

The leading players in the market are Mitsui Chemicals Inc, Nippon Polyurethane Industry Corp Ltd, BASF, Covestro, Eastman Chemical Company, Woodbridge Foam Corporation, Huntsman Corporation, RAMPF Holding GmbH & Co. KG, Mitsubishi Chemical Corporation and DIC Corporation. BASF SE is a noteworthy producer and provider of polyurethane solutions for systems & specialties. The organization takes into account a few ventures, for example, footwear, construction and automotive and has presented a few creative items, for example, sandwich plate system and first TPU for the automotive exterior. Different organizations are additionally going with the same pattern, participating in broad R&D to present new items and advances. This is relied upon to support inner rivalry and contention over the estimate time frame, convincing existing organizations to team up with each other and lower working expenses.

The global Polyurethane (PU) Market is segmented as follows-

By Product

- Adhesives & Sealants

- Rigid Foam

- Coatings

- Elastomers

- Flexible Foam

- Others

By Application

- Electronics & Appliances

- Packaging

- Furniture

- Construction

- Automotive

- Footwear

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Polyurethane (PU) Market, By Product, Estimates and Forecast, 2012-2022 ($Million)

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

- Polyurethane (PU) Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Furniture

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

- Others

- Polyurethane (PU) Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Polyurethane (PU) Market, By Country

- North America Polyurethane (PU) Market, By Product

- North America Polyurethane (PU) Market, By Application

- U.S. Polyurethane (PU) Market, By Product

- U.S. Polyurethane (PU) Market, By Application

- Canada Polyurethane (PU) Market, By Product

- Canada Polyurethane (PU) Market, By Application

- Mexico Polyurethane (PU) Market, By Product

- Mexico Polyurethane (PU) Market, By Application

-

- Europe

- Europe Polyurethane (PU) Market, By Country

- Europe Polyurethane (PU) Market, By Product

- Europe Polyurethane (PU) Market, By Application

- Germany Polyurethane (PU) Market, By Product

- Germany Polyurethane (PU) Market, By Application

- France Polyurethane (PU) Market, By Product

- France Polyurethane (PU) Market, By Application

- UK Polyurethane (PU) Market, By Product

- UK Polyurethane (PU) Market, By Application

- Italy Polyurethane (PU) Market, By Product

- Italy Polyurethane (PU) Market, By Application

- Spain Polyurethane (PU) Market, By Product

- Spain Polyurethane (PU) Market, By Application

- Rest of Europe Polyurethane (PU) Market, By Product

- Rest of Europe Polyurethane (PU) Market, By Application

-

- Asia-Pacific

- Asia-Pacific Polyurethane (PU) Market, By Country

- Asia-Pacific Polyurethane (PU) Market, By Product

- Asia-Pacific Polyurethane (PU) Market, By Application

- Japan Polyurethane (PU) Market, By Product

- Japan Polyurethane (PU) Market, By Application

- Australia Polyurethane (PU) Market, By Product

- Australia Polyurethane (PU) Market, By Application

- India Polyurethane (PU) Market, By Product

- India Polyurethane (PU) Market, By Application

- South Korea Polyurethane (PU) Market, By Product

- South Korea Polyurethane (PU) Market, By Application

- Rest of Asia-Pacific Polyurethane (PU) Market, By Product

- Rest of Asia-Pacific Polyurethane (PU) Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Polyurethane (PU) Market, By Country

- Rest of the World Polyurethane (PU) Market, By Product

- Rest of the World Polyurethane (PU) Market, By Application

- Brazil Polyurethane (PU) Market, By Product

- Brazil Polyurethane (PU) Market, By Application

- South Africa Polyurethane (PU) Market, By Product

- South Africa Polyurethane (PU) Market, By Application

- Saudi Arabia Polyurethane (PU) Market, By Product

- Saudi Arabia Polyurethane (PU) Market, By Application

- Turkey Polyurethane (PU) Market, By Product

- Turkey Polyurethane (PU) Market, By Application

- United Arab Emirates Polyurethane (PU) Market, By Product

- United Arab Emirates Polyurethane (PU) Market, By Application

- Others Polyurethane (PU) Market, By Product

- Others Polyurethane (PU) Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growing Demand For Building Insulation In Light Of Sustainability Concerns

3.2.1.2. Lightweight, High Performance Composites Demand In Automotive Applications

3.2.2. Restraints

3.2.2.1. Raw Material Price Volatility

3.2.2.2. Increasing Environmental Concerns

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Polyurethane (PU) Market, By Product

4.1. Introduction

4.2. Polyurethane (PU) Market Assessment and Forecast, By Product, 2012-2022

4.3. Rigid Foam

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Flexible Foam

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Coatings

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Adhesives & Sealants

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.7. Elastomers

4.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.8. Other Products

4.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.9. Other Products

4.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Polyurethane (PU) Market, By Application

5.1. Introduction

5.2. The Polyurethane (PU) Market Assessment and Forecast, By Application, 2012-2022

5.3. Furniture

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Construction

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Electronics & Appliances

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.6. Automotive

5.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.7. Footwear

5.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.8. Packaging

5.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.9. Other Applications

5.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Polyurethane (PU) Market, By Region

6.1. Introduction

6.2. Polyurethane (PU) Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.3. Polyurethane (PU) Market Assessment and Forecast, By Application , 2012-2022 ($Million)

6.4. North America

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.4. U.S.

6.4.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.5. Canada

6.4.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.6. Mexico

6.4.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5. Europe

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.4. Germany

6.5.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.5. France

6.5.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.6. UK

6.5.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.7. Italy

6.5.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.8. Spain

6.5.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.9. Rest of Europe

6.5.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6. Asia-Pacific

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.4. Japan

6.6.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.5. China

6.6.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.6. Australia

6.6.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.7. India

6.6.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.8. South Korea

6.6.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.9. Rest of Asia-Pacific

6.6.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7. Rest of the World

6.7.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.7.2. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.4. Brazil

6.7.4.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.5. Turkey

6.7.5.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.6. Saudi Arabia

6.7.6.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.7. South Africa

6.7.7.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.8. United Arab Emirates

6.7.8.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.9. Others

6.7.9.1. Market Assessment and Forecast, By Product, 2012-2022 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7. Company Profiles

7.1. The Dow Chemical Company

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. BASF SE

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. Covestro

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.4. Huntsman Corp.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.5. Eastman Chemical Co.

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. Mitsui Chemicals, Inc.

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. Mitsubishi Chemical Corp.

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

7.8. Nippon Polyurethane Industry Corp Ltd.

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Key Financials

7.8.4. Strategic Developments

7.9. Recticel S.A.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.10. Woodbridge Foam Corp.

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.11. DIC Corp

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

List of Tables

Table 1.Global Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 2.Metallic Compounds Market, By Region, 2012-2022 ($Million)

Table 3.Halogen Compounds Market, By Region, 2012-2022 ($Million)

Table 4.Organic Acids Market, By Region, 2012-2022 ($Million)

Table 5.Organosulfures Market, By Region, 2012-2022 ($Million)

Table 6.Nitrogen Market, By Region, 2012-2022 ($Million)

Table 7.Phenolic Market, By Region, 2012-2022 ($Million)

Table 8.Other Product Market, By Region, 2012-2022 ($Million)

Table 9.Global Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 10.Food and Beverage Market, By Region, 2012-2022 ($Million)

Table 11.Water Treatment Market, By Region, 2012-2022 ($Million)

Table 12.Wood Preservation Market, By Region, 2012-2022 ($Million)

Table 13.Personal Care Market, By Region, 2012-2022 ($Million)

Table 14.HVAC Market, By Region, 2012-2022 ($Million)

Table 15.Paints and Coatings Market, By Region, 2012-2022 ($Million)

Table 16.Oil and Gas Market, By Region, 2012-2022 ($Million)

Table 17.Fuels Market, By Region, 2012-2022 ($Million)

Table 18.Boilers Market, By Region, 2012-2022 ($Million)

Table 19.Other Application Market, By Region, 2012-2022 ($Million)

Table 20.North America Polyurethane (PU) Market, By Country, 2012-2022 ($Million)

Table 21.North America Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 22.North America Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 23.U.S. Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 24.U.S. Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 25.Canada Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 26.Canada Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 27.Mexico Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 28.Mexico Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 29.Europe Polyurethane (PU) Market, By Country, 2012-2022 ($Million)

Table 30.Europe Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 31.Europe Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 32.Germany Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 33.Germany Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 34.France Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 35.France Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 36.UK Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 37.UK Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 38.Italy Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 39.Italy Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 40.Spain Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 41.Spain Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 42.Rest of Europe Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 43.Rest of Europe Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 44.Asia-Pacific Polyurethane (PU) Market, By Country, 2012-2022 ($Million)

Table 45.Asia-Pacific Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 46.Asia-Pacific Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 47.Japan Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 48.Japan Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 49.China Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 50.China Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 51.Australia Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 52.Australia Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 53.India Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 54.India Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 55.South Korea Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 56.South Korea Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 57.Rest of Asia-Pacific Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 58.Rest of Asia-Pacific Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 59.Rest of the World Polyurethane (PU) Market, By Country, 2012-2022 ($Million)

Table 60.Rest of the World Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 61.Rest of the World Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 62.Brazil Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 63.Brazil Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 64.Turkey Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 65.Turkey Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 66.Saudi Arabia Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 67.Saudi Arabia Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 68.South Africa Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 69.South Africa Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 70.United Arab Emirates Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 71.United Arab Emirates Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 72.Others Polyurethane (PU) Market, By Product, 2012-2022 ($Million)

Table 73.Others Polyurethane (PU) Market, By Application, 2012-2022 ($Million)

Table 74.AkzoNobel N.V.: Key Strategic Developments, 2017-2017

Table 75.Albemarle Corporation: Key Strategic Developments, 2017-2017

Table 76.Arch Chemicals Inc.: Key Strategic Developments, 2017-2017

Table 77.Champion Technologies: Key Strategic Developments, 2017-2017

Table 78.Lubrizol: Key Strategic Developments, 2017-2017

Table 79.Baker Hughes Incorporated.: Key Strategic Developments, 2017-2017

Table 80.Ashland Inc.: Key Strategic Developments, 2017-2017

Table 81.BASF: Key Strategic Developments, 2017-2017

Table 82.BWA Water Additives: Key Strategic Developments, 2017-2017

Table 83.GE Water and Process Technologies: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Polyurethane (PU) Market Share, By Product, 2017 & 2025

Figure 2.Global Polyurethane (PU) Market, By Application, 2017, ($Million)

Figure 3.Global Polyurethane (PU) Market, By Region, 2017, ($Million)

Figure 4.AkzoNobel N.V.: Net Revenues, 2017-2017 ($Million)

Figure 5.AkzoNobel N.V.: Net Revenue Share, By Segment, 2017

Figure 6.AkzoNobel N.V.: Net Revenue Share, By Geography, 2017

Figure 7.Albemarle Corporation: Net Revenues, 2017-2017 ($Million)

Figure 8.Albemarle Corporation: Net Revenue Share, By Segment, 2017

Figure 9.Albemarle Corporation: Net Revenue Share, By Geography, 2017

Figure 10.Ashland Inc.: Net Revenues, 2017-2017 ($Million)

Figure 11.Ashland Inc.: Net Revenue Share, By Segment, 2017

Figure 12.Ashland Inc.: Net Revenue Share, By Geography, 2017

Figure 13.BASF: Net Revenues, 2017-2017 ($Million)

Figure 14.BASF: Net Revenue Share, By Segment, 2017

Figure 15.BASF: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|