.png)

Radiofrequency Ablation Devices Market by Product and Application - Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 90 Category: Medical Devices Report Code : HC02587

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

In 2017, the global radiofrequency ablation devices market was evaluated around USD billion and is expected to reach approximately USD billion by 2023 while registering itself at a compound annual growth rate (CAGR) of % over the forecast period. Lesser risk of tissue harm and post-procedure contamination, rapid recovery and cost-effectiveness linked with ablation processes are few factors anticipated to boost the global radiofrequency ablation devices industry. These devices are extensively utilized for treatments in the areas of gynecology, cosmetology, pain management, oncology, cardiac rhythm management and oncology. The growing incidence of diseases related to acute pain like arthritis and osteoporosis, particularly in the elderly population along with the advent of technological innovations like bipolar technology and thermocouple sensor is anticipated to encourage the growth of the market over the forecast years. The rising utilization of radiofrequency ablation processes in emerging countries such as Russia, Brazil, India, and China is projected to assist global market as a potential growth opportunity. Fast-improving medical infrastructure, rising patient awareness as well as disposable earnings levels in these economies are anticipated to actuate the application rates of modestly invasive surgical procedures and therefore augmented demand in the regions.

Product Outlook and Trend Analysis

Major product sections of the radiofrequency ablation devices market analyzed and estimated in this study involve reusable equipment, disposable equipment, and capital equipment. The reusable equipment comprises of RF electrodes and probes. Disposable equipment involves needles, cannulas, single-use electrodes and single-use probes. In 2017, disposable equipment was the leading product section due to rising occurrence of hospital-acquired infections along with growing the volume of modestly invasive surgical procedures. The United States FDA splits radiofrequency reusable equipment as a semi-critical device and hence, enforces the stringent rule to regulate the procedure of recycling medical devices in order to eliminate the possibility of contamination. Also, the rise in demand of reusable radiofrequency ablation devices can be assigned to its cost-effectiveness and the rising demand for laparoscopic and endoscopic interventions.

Application Outlook and Trend Analysis

Major applications for the global radiofrequency ablation devices markets involve gynecology, pain management, hypertension, surgical oncology, cardiac and cardiology rhythm management, and cosmetology. Radiofrequency ablation devices industry for surgical oncology reported for the major market share during 2017 at around %. The existence of high volumes of procedures as a result of easiness it renders to the patients concerning faster recovery is a major factor assigning to its large market share. Hypertension owing to high unfulfilled needs of the patient and inadequate availability of curative treatments is anticipated to grow at the highest compound annual growth rate over the projected years. Radiofrequency ablation provides cost-efficient treatment for the patients who are suffering from hypertension and implicates not even a single severe complications post the procedure.

Regional Outlook and Trend Analysis

In 2017, North American region was the leading regional radiofrequency ablation devices industry. The existence of high awareness levels amongst patients concerning to treatments by ablation technologies, elevated usage rates of sophisticated technologies and refined reimbursement structure is a few high impact providing driving factors of the market. European region was the second major regional market during 2017. Asia Pacific region is projected to be a high-growth regional market during the projected period.

Competitive Outlook and Trend Analysis

Key industry players in the global radiofrequency ablation devices market are Accuray, Stryker Corporation, St. Jude Medical Inc., Neurotherm Inc., Biosense Webster, Cosman Medical Inc, Halyard Health, Inc., Kimberly-Clark Corporation, Medtronic Plc, C. R. Bard, Inc., Boston Scientific Corporation, AngioDynamics, Inc., AtriCure, Inc., Hologic, Inc., Diros Technology, and Johnson & Johnson. A few major sustainability strategies implemented by these industry players are new product development, mergers and acquisitions, and entering into tactical association with distributors.

The global radiofrequency ablation devices market is segmented as follows –

By Product

- Capital equipment

- Radiofrequency ablation generator

- Reusable equipment

- Radiofrequency ablation probes

- Radiofrequency ablation electrodes

- Disposable equipment

- Radiofrequency ablation cannulas

- Radiofrequency ablation needles

- Radiofrequency ablation single use probes

- Radiofrequency ablation single use electrodes

By Application

- Surgical oncology

- Cardiology & cardiac rhythm management

- Pain management

- Gynecology

- Hypertension

- Cosmetology

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

o Others

Some of the key questions answered by the report are:

· What was the market size in 2017 and forecast from 2017 to 2023?

· What will be the industry market growth from 2017 to 2023?

· What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

· What are the major segments leading the market growth and why?

· Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Radiofrequency Ablation Devices Market, By Product, Estimates and Forecast, 2014-2023 ($Million)

- Capital equipment

- Radiofrequency ablation generator

- Reusable equipment

- Reusable equipment

- Radiofrequency ablation electrodes

- Disposable equipment

- Radiofrequency ablation cannulas

- Radiofrequency ablation needles

- Radiofrequency ablation single use probes

- Radiofrequency ablation single use electrodes

- Radiofrequency Ablation Devices Market, By Application, Estimates and Forecast, 2014-2023 ($Million)

- Surgical oncology

- Cardiology & cardiac rhythm management

- Pain management

- Gynecology

- Hypertension

- Cosmetology

- Radiofrequency Ablation Devices Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Radiofrequency Ablation Devices Market , By Country

- North America Radiofrequency Ablation Devices Market , By Product

- North America Radiofrequency Ablation Devices Market , By Application

- U.S. Radiofrequency Ablation Devices Market , By Product

- U.S. Radiofrequency Ablation Devices Market , By Application

- Canada Radiofrequency Ablation Devices Market , By Product

- Canada Radiofrequency Ablation Devices Market , By Application

- Mexico Radiofrequency Ablation Devices Market , By Product

- Mexico Radiofrequency Ablation Devices Market , By Application

-

- Europe

- Europe Radiofrequency Ablation Devices Market, By Country

- Europe Radiofrequency Ablation Devices Market , By Product

- Europe Radiofrequency Ablation Devices Market , By Application

- Germany Radiofrequency Ablation Devices Market , By Product

- Germany Radiofrequency Ablation Devices Market , By Application

- France Radiofrequency Ablation Devices Market , By Product

- France Radiofrequency Ablation Devices Market , By Application

- UK Radiofrequency Ablation Devices Market , By Product

- UK Radiofrequency Ablation Devices Market , By Application

- Italy Radiofrequency Ablation Devices Market , By Product

- Italy Radiofrequency Ablation Devices Market , By Application

- Spain Radiofrequency Ablation Devices Market , By Product

- Spain Radiofrequency Ablation Devices Market , By Application

- Rest of Europe Radiofrequency Ablation Devices Market , By Product

- Rest of Europe Radiofrequency Ablation Devices Market , By Application

-

- Asia-Pacific

- Asia-Pacific Radiofrequency Ablation Devices Market , By Country

- Asia-Pacific Radiofrequency Ablation Devices Market , By Product

- Asia-Pacific Radiofrequency Ablation Devices Market , By Application

- Japan Radiofrequency Ablation Devices Market , By Product

- Japan Radiofrequency Ablation Devices Market , By Application

- Australia Radiofrequency Ablation Devices Market , By Product

- Australia Radiofrequency Ablation Devices Market , By Application

- India Radiofrequency Ablation Devices Market , By Product

- India Radiofrequency Ablation Devices Market , By Application

- South Korea Radiofrequency Ablation Devices Market , By Product

- South Korea Radiofrequency Ablation Devices Market , By Application

- Rest of Asia-Pacific Radiofrequency Ablation Devices Market , By Product

- Rest of Asia-Pacific Radiofrequency Ablation Devices Market , By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Radiofrequency Ablation Devices Market , By Country

- Rest of the World Radiofrequency Ablation Devices Market , By Product

- Rest of the World Radiofrequency Ablation Devices Market , By Application

- Brazil Radiofrequency Ablation Devices Market , By Product

- Brazil Radiofrequency Ablation Devices Market , By Application

- South Africa Radiofrequency Ablation Devices Market , By Product

- South Africa Radiofrequency Ablation Devices Market , By Application

- Saudi Arabia Radiofrequency Ablation Devices Market , By Product

- Saudi Arabia Radiofrequency Ablation Devices Market , By Application

- Turkey Radiofrequency Ablation Devices Market , By Product

- Turkey Radiofrequency Ablation Devices Market , By Application

- United Arab Emirates Radiofrequency Ablation Devices Market , By Product

- United Arab Emirates Radiofrequency Ablation Devices Market , By Application

- Others Radiofrequency Ablation Devices Market , By Product

- Others Radiofrequency Ablation Devices Market , By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Rise in the Prevalence of Cancer and Cardiac Diseases

3.2.1.2. High Efficacy and Short Duration of the Procedure

3.2.1.3. Increase in the Number of Patients Suffering from Pain

3.2.2. Restraints

3.2.2.1. High Cost of Treatment

3.2.2.2. Availability of Other Treatments

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Radiofrequency Ablation Devices Market, By Product

4.1. Introduction

4.2. Global Radiofrequency Ablation Devices Sales, Revenue and Market Share by Product (2017-2017)

4.2.1. Global Radiofrequency Ablation Devices Sales and Sales Share by Product (2017-2017)

4.2.2. Global Radiofrequency Ablation Devices Revenue and Revenue Share by Product (2017-2017)

4.3. Radiofrequency Ablation Devices Market Assessment and Forecast, By Product, 2017-2023

4.4. Capital Equipment

4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.3. Radiofrequency Ablation Generator

4.4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Reusable Equipment

4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

4.5.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.3. Radiofrequency Ablation Probes

4.5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.4. Radiofrequency Ablation Electrodes

4.5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Disposable equipment

4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

4.6.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.3. Radiofrequency Ablation Cannulas

4.6.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.4. Radiofrequency Ablation Needles

4.6.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.5. Radiofrequency Ablation Single Use Probes

4.6.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6.6. Radiofrequency Ablation Single Use Electrodes

4.6.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Radiofrequency Ablation Devices Market, By Application

5.1. Introduction

5.2. Global Radiofrequency Ablation Devices Sales, Revenue and Market Share by Application (2017-2017)

5.2.1. Global Radiofrequency Ablation Devices Sales and Sales Share by Application (2017-2017)

5.2.2. Global Radiofrequency Ablation Devices Revenue and Revenue Share by Application (2017-2017)

5.3. The Radiofrequency Ablation Devices Market Assessment and Forecast, By Application, 2017-2023

5.4. Surgical oncology

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Cardiology & Cardiac Rhythm Management

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Pain Management

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Gynecology

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Hypertension

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.9. Cosmetology

5.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Radiofrequency Ablation Devices Market, By Region

6.1. Introduction

6.2. Radiofrequency Ablation Devices Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.3. Global Radiofrequency Ablation Devices Sales, Revenue and Market Share by Regions

6.3.1. Global Radiofrequency Ablation Devices Sales by Regions (2017-2017)

6.3.2. Global Radiofrequency Ablation Devices Revenue by Regions (2017-2017)

6.4. North America

6.4.1. North America Radiofrequency Ablation Devices Sales and Growth Rate (2017-2017)

6.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.5. U.S.

6.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.6. Canada

6.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.7. Mexico

6.4.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5. Europe

6.5.1. Europe Radiofrequency Ablation Devices Sales and Growth Rate (2017-2017)

6.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.5. Germany

6.5.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.6. France

6.5.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.7. UK

6.5.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.8. Italy

6.5.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.9. Spain

6.5.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.10. Rest of Europe

6.5.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6. Asia-Pacific

6.6.1. Asia-Pacific Radiofrequency Ablation Devices Sales and Growth Rate (2017-2017)

6.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.5. Japan

6.6.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.6. China

6.6.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.7. Australia

6.6.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.8. India

6.6.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.9. South Korea

6.6.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.10. Rest of Asia-Pacific

6.6.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7. Rest of the World

6.7.1. Rest of the World Radiofrequency Ablation Devices Sales and Growth Rate (2017-2017)

6.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.7.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.5. Brazil

6.7.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.6. Turkey

6.7.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.7. Saudi Arabia

6.7.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.8. South Africa

6.7.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.9. United Arab Emirates

6.7.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.10. Others

6.7.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

7. Company Profiles

7.1. Accuray

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Strategic Developments

7.1.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.2. Biosense Webster

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Strategic Developments

7.2.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.3. Cosman Medical Inc.

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.3.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.4. Diros Technology Inc.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.4.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.5. NeuroTherm (St. Jude Medical)

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.5.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.6. St. Jude Medical.

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.6.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.7. Stryker Corporation

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.7.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.8. Kimberly-Clark.

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.8.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.9. RF Medical Co. Ltd.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.9.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.10. AngioDynamics

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.10.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

7.11. Covidien

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

7.11.4. Radiofrequency Ablation Devices Sales, Revenue and Market Share

8. Global Radiofrequency Ablation Devices Market Competition, by Manufacturer

8.1. Global Radiofrequency Ablation Devices Sales and Market Share by Manufacturer (2017-2017)

8.2. Global Radiofrequency Ablation Devices Revenue and Market Share by Manufacturer (2017-2017)

8.3. Top 5 Radiofrequency Ablation Devices Manufacturer Market Share

8.4. Market Competition Trend

List of Tables

*You can glance through the list of Tables and Figures when you view the sample copy of Radiofrequency Ablation Devices Market.

Research Methodology

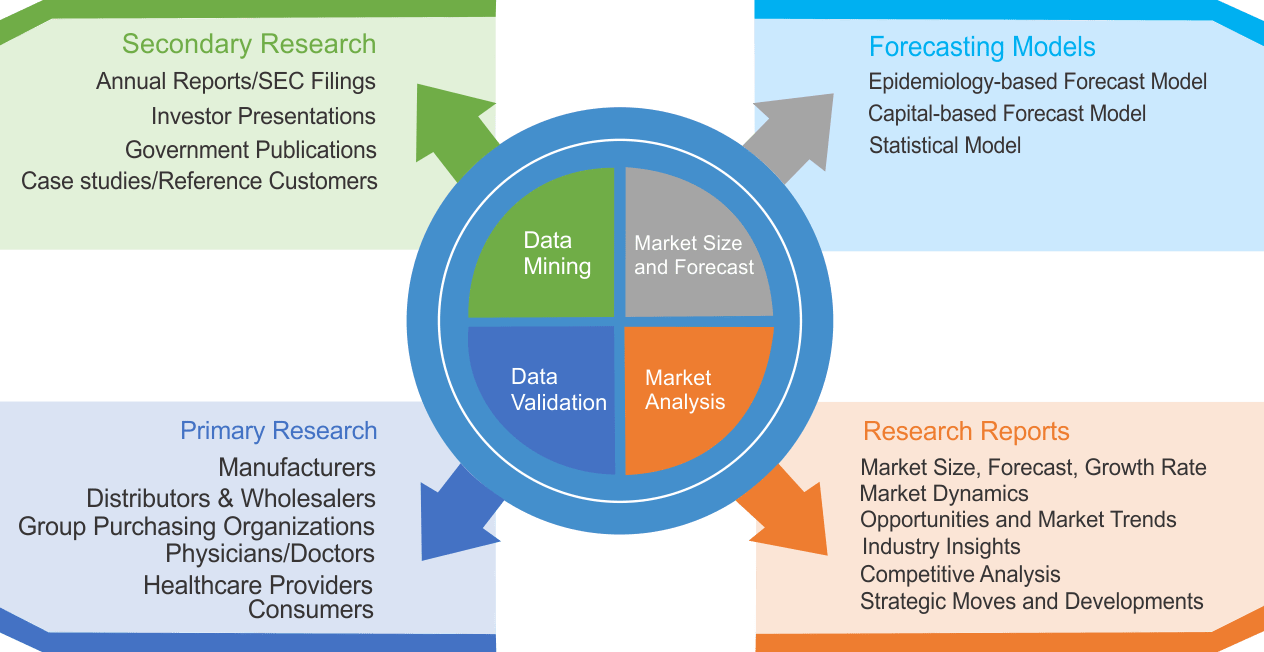

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|