Sulfuric Acid Market by Raw Material and Application- Global Industry Analysis and Forecast to 2023

Published On : November 2017 Pages : 100 Category: Organic Chemicals Report Code : CM11365

Industry Outlook and Trend Analysis

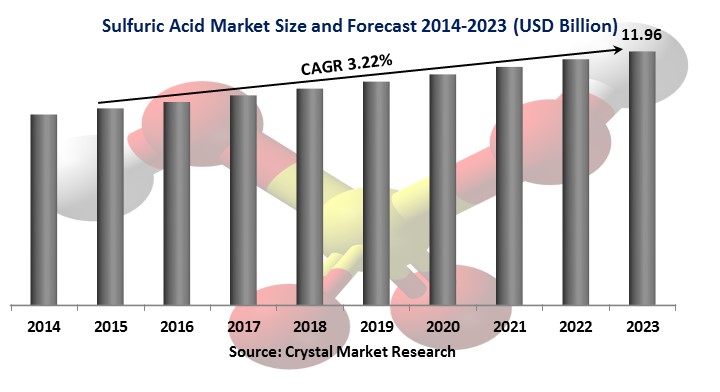

The Sulfuric Acid Market was worth USD 8.99 billion in the year 2017 and is expected to reach approximately USD 11.96 billion by 2023, while registering itself at a compound annual growth rate (CAGR) of 3.22% during the forecast period. The ascent can be ascribed to the existence of stringent natural directions to control emanations, which is foreseen to prompt the expanded usage of smelters to catch sulfur dioxide products. Expanding requirement for the product from paper & pulp, fertilizers, metal processing, chemical manufacturing, petroleum refinery, and automotive ventures for use as a reactant, catalyst, and a dehydrating agent is anticipated to help the business over the predictable period. Rising worries about high harvest yield and incredible quality of food from agricultural area are anticipated to boost the fertilizer market development, which will thusly to trigger sulfuric acid market. Factors, for example, unpredictability in the raw material costs because of the rising usage from phosphate fertilizer makers amid tight supply period and the usage of different directions for the creation of environmentally-friendly products, are anticipated to adversely affect the business development. An expansion in the usage of models, for example, New Source Performance Standards (NSPS) to manage the outflows of particulate matter, sulfur dioxide, sulfuric acid mist, and nitrogen oxides from H2SO4 generation facilities is anticipated to boost the market in the upcoming years.

Raw Material Outlook and Trend Analysis

In 2017 Elemental sulfur raw material portion got huge share of the overall industry and is anticipated to advance at the quickest rate over the conjecture time frame. The raw material makes less contamination when compared with pyrite metal or base metal smelters and is accessible in plenitude in the business. Keeping in mind the end goal to confine or check environmental contamination, an expansive number of organizations have received stringent measures to treat the discharged sulfur gas before discharging it into the air. Rising developmental exercises, for example, upgrading the generation capacities of organizations to spur the manufacturing of sulfuric acid items from basic sulfur are anticipated to trigger the market development. China is the main producer of pyrites and most of the share of this raw material is used for creating sulfuric acid. Strict measures are probably going to be attempted by the makers for digging pyrites for the generation of acid products as they are less natural inviting in contrast with elemental sulfur. These components are probably going to make a block the development of pyrite mineral raw material fragment. Canada and Mexico are the merchants of sulfuric acid, which is composed from the result of smelters. The product is imported from the United States. Expanding requirement for ecologically commanded smelter limit with regards to the generation of sulfuric acid is probably going to drive market over the estimate time frame.

Application Outlook and Trend Analysis

In 2017 Fertilizers was the noteworthy application fragment and represented around 54 percent of the general market income. Expanding interest for enhanced nature of harvest and rising populace all inclusive are probably going to boost the market over the predictable period. Fast urbanization and industrialization are bringing about the diminishment of arable land, which thus is driving the farmers to make use of fertilizers for expanding crop yield. Rising usage of H2SO4 for the generation of value manures for farming use to support creation capacities is anticipated to impel market development

Chemical and Petroleum refineries are generally engaged with the generation of tainted sulfuric acid, bringing about the recovery of unadulterated and concentrated H2SO4 products. The recovered acids radiate low discharges prompting decreased production costs, which makes it environmentally friendly and sustainable.

Regional outlook and Trend Analysis

In 2017 Asia Pacific was the biggest regional fragment and represented around 46 percent of the aggregate income. Expanding generation of sulfur from Japan and China is foreseen to boost the product offerings of sulfuric acid in this area. Rising requirement for H2SO4 from the Indonesia and Philippines is anticipated to help Asia Pacific regional market over the conjecture time frame. The costs of sulfuric acid are fortifying because of the rising interest for the product in Asia Pacific. Expanding need to extend the generation of phosphate manure because of rising compost segment and stringent environmental controls concerning the assembling of ecologically friendly product is probably going to support the market over the coming years. Rising demand from phosphoric and industrial acid divisions attributable to an expansion in the development of harvests and higher product yields is expected to trigger development in China market. The developing supply of H2SO4 products from Morocco and Saudi Arabia is anticipated to goad the market over the predictable period. An expansion in the quantity of acid plants to fulfill developing buyer demand alongside the rising supply of sulfur-consumed acids in the Middle East is anticipated to fuel the market in the upcoming years.

Competitive Insights

The market id extensively competitive with a number leading players such as PVS Chemical Solution, BASF, Chemtrade, DuPont, Akzo Nobel India Ltd and Agrium. A substantial number of organizations are essentially engaged with joint ventures, acquisitions, and mergers to improve their product portfolio and achieve a huge place in the market. For example, in June 2017, Veolia captured control over the sulfur product division of Chemour to fortify the organization's administrations in oil and gas industry for the reusing and treatment of mechanical waste in the United States. A few organizations are following investment and development procedures to reinforce their creation capacities and infiltrate into the developing markets. An expansion in the quantity of H2SO4 producers and providers is anticipated to help market development over the estimate time frame.

The Sulfuric Acid Market is segmented as follows-

By Raw Material:

- Base metal smelters

- Elemental sulfur

- Pyrite ore

- Others

By Application:

- Fertilizers

- Metal processing

- Textile industry

- Paper & pulp

- Chemical manufacturing

- Petroleum refining

- Automotive

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Sulfuric Acid Market, By Raw Material, Estimates and Forecast, 2014-2023($Million)

- Elemental sulfur

- Base metal smelters

- Pyrite ore

- Other Raw Material

- Sulfuric Acid Market, By Application, Estimates and Forecast, 2014-2023($Million)

- Fertilizers

- Chemical manufacturing

- Metal processing

- Petroleum refinery

- Textile industry

- Automotive

- Pulp & paper

- Other Applications

- Sulfuric Acid Market, By Region, Estimates and Forecast, 2014-2023($Million)

- North America

- North America Sulfuric Acid Market, By Country

- North America Sulfuric Acid Market, By Raw Material

- North America Sulfuric Acid Market, By Application

- U.S. Sulfuric Acid Market, By Raw Material

- U.S. Sulfuric Acid Market, By Application

- Canada Sulfuric Acid Market, By Raw Material

- Canada Sulfuric Acid Market, By Application

- Mexico Sulfuric Acid Market, By Raw Material

- Mexico Sulfuric Acid Market, By Application

-

- Europe

- Europe Sulfuric Acid Market, By Country

- Europe Sulfuric Acid Market, By Raw Material

- Europe Sulfuric Acid Market, By Application

- Germany Sulfuric Acid Market, By Raw Material

- Germany Sulfuric Acid Market, By Application

- France Sulfuric Acid Market, By Raw Material

- France Sulfuric Acid Market, By Application

- UK Sulfuric Acid Market, By Raw Material

- UK Sulfuric Acid Market, By Application

- Italy Sulfuric Acid Market, By Raw Material

- Italy Sulfuric Acid Market, By Application

- Spain Sulfuric Acid Market, By Raw Material

- Spain Sulfuric Acid Market, By Application

- Rest of Europe Sulfuric Acid Market, By Raw Material

- Rest of Europe Sulfuric Acid Market, By Application

-

- Asia-Pacific

- Asia-Pacific Sulfuric Acid Market, By Country

- Asia-Pacific Sulfuric Acid Market, By Raw Material

- Asia-Pacific Sulfuric Acid Market, By Application

- Japan Sulfuric Acid Market, By Raw Material

- Japan Sulfuric Acid Market, By Application

- Australia Sulfuric Acid Market, By Raw Material

- Australia Sulfuric Acid Market, By Application

- India Sulfuric Acid Market, By Raw Material

- India Sulfuric Acid Market, By Application

- South Korea Sulfuric Acid Market, By Raw Material

- South Korea Sulfuric Acid Market, By Application

- Rest of Asia-Pacific Sulfuric Acid Market, By Raw Material

- Rest of Asia-Pacific Sulfuric Acid Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Sulfuric Acid Market, By Country

- Rest of the World Sulfuric Acid Market, By Raw Material

- Rest of the World Sulfuric Acid Market, By Application

- Brazil Sulfuric Acid Market, By Raw Material

- Brazil Sulfuric Acid Market, By Application

- South Africa Sulfuric Acid Market, By Raw Material

- South Africa Sulfuric Acid Market, By Application

- Saudi Arabia Sulfuric Acid Market, By Raw Material

- Saudi Arabia Sulfuric Acid Market, By Application

- Turkey Sulfuric Acid Market, By Raw Material

- Turkey Sulfuric Acid Market, By Application

- United Arab Emirates Sulfuric Acid Market, By Raw Material

- United Arab Emirates Sulfuric Acid Market, By Application

- Others Sulfuric Acid Market, By Raw Material

- Others Sulfuric Acid Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Steady and Sustainable Demand for Sulfuric Acid Due to its Diversified Raw Materials

3.2.1.2. Increase in the Production of Nutrient-Rich Food Crops

3.2.2. Restraints

3.2.2.1. Strict Environmental Regulations Due to Toxicological Effects of Sulfuric Acid

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Sulfuric Acid Market, By Raw Material

4.1. Introduction

4.2. Sulfuric Acid Market Assessment and Forecast, By Raw Material, 2017-2023

4.3. Elemental sulfur

4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4. Base metal smelters

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Pyrite ore

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Other Raw Materials

4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Sulfuric Acid Market, By Application

5.1. Introduction

5.2. The Sulfuric Acid Market Assessment and Forecast, By Application, 2017-2023

5.3. Fertilizers

5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.4. Chemical manufacturing

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Metal processing

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Petroleum refinery

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Textile industry

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Automotive

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.9. Pulp & paper

5.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.10. Other Applications

5.10.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Sulfuric Acid Market, By Region

6.1. Introduction

6.2. Sulfuric Acid Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.3. Sulfuric Acid Market Assessment and Forecast, By Application , 2017-2023 ($Million)

6.4. North America

6.4.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.2. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.4. U.S.

6.4.4.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.5. Canada

6.4.5.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.6. Mexico

6.4.6.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5. Europe

6.5.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.2. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.4. Germany

6.5.4.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.5. France

6.5.5.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.6. UK

6.5.6.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.7. Italy

6.5.7.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.8. Spain

6.5.8.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.9. Rest of Europe

6.5.9.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6. Asia-Pacific

6.6.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.2. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.4. Japan

6.6.4.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.5. China

6.6.5.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.6. Australia

6.6.6.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.7. India

6.6.7.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.8. South Korea

6.6.8.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.9. Rest of Asia-Pacific

6.6.9.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7. Rest of the World

6.7.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.7.2. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.4. Brazil

6.7.4.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.5. Turkey

6.7.5.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.6. Saudi Arabia

6.7.6.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.7. South Africa

6.7.7.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.8. United Arab Emirates

6.7.8.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.9. Others

6.7.9.1. Market Assessment and Forecast, By Raw Material, 2017-2023 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

7. Company Profiles

7.1. The Mosaic Company

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. Chemtrade Refinery

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. DuPont

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Akzonobel N.V.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. BASF SE

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. PVS Chemical Solution

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. Solvay

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.8. Valero Energy

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9. Potash Corp (PCS Phosphate)

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.10. Agrium Inc.

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Key Financials

7.10.4. Strategic Developments

List of Tables

Table 1.Global Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 2.Elemental sulfur Market, By Region, 2017-2023 ($Million)

Table 3.Base metal smelters Market, By Region, 2017-2023 ($Million)

Table 4.Pyrite ore Market, By Region, 2017-2023 ($Million)

Table 5.Other Raw Material Market, By Region, 2017-2023 ($Million)

Table 6.Global Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 7.Fertilizers Market, By Region, 2017-2023 ($Million)

Table 8.Chemical manufacturing Market, By Region, 2017-2023 ($Million)

Table 9.Metal processing Market, By Region, 2017-2023 ($Million)

Table 10.Petroleum refinery Market, By Application, 2017-2023 ($Million)

Table 11.Textile industry Market, By Region, 2017-2023 ($Million)

Table 12.Automotive Market, By Region, 2017-2023 ($Million)

Table 13.Pulp & paper Market, By Region, 2017-2023 ($Million)

Table 14.Other Applications Market, By Region, 2017-2023 ($Million)

Table 15.North America Sulfuric Acid Market, By Country, 2017-2023 ($Million)

Table 16.North America Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 17.North America Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 18.U.S. Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 19.U.S. Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 20.Canada Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 21.Canada Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 22.Mexico Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 23.Mexico Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 24.Europe Sulfuric Acid Market, By Country, 2017-2023 ($Million)

Table 25.Europe Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 26.Europe Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 27.Germany Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 28.Germany Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 29.France Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 30.France Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 31.UK Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 32.UK Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 33.Italy Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 34.Italy Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 35.Spain Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 36.Spain Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 37.Rest of Europe Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 38.Rest of Europe Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 39.Asia-Pacific Sulfuric Acid Market, By Country, 2017-2023 ($Million)

Table 40.Asia-Pacific Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 41.Asia-Pacific Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 42.Japan Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 43.Japan Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 44.China Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 45.China Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 46.Australia Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 47.Australia Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 48.India Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 49.India Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 50.South Korea Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 51.South Korea Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 52.Rest of Asia-Pacific Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 53.Rest of Asia-Pacific Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 54.Rest of the World Sulfuric Acid Market, By Country, 2017-2023 ($Million)

Table 55.Rest of the World Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 56.Rest of the World Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 57.Brazil Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 58.Brazil Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 59.Turkey Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 60.Turkey Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 61.Saudi Arabia Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 62.Saudi Arabia Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 63.South Africa Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 64.South Africa Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 65.United Arab Emirates Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 66.United Arab Emirates Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 67.Others Sulfuric Acid Market, By Raw Material, 2017-2023 ($Million)

Table 68.Others Sulfuric Acid Market, By Application, 2017-2023 ($Million)

Table 69.The Mosaic Company: Key Strategic Developments, 2017-2017

Table 70.Chemtrade Refinery: Key Strategic Developments, 2017-2017

Table 71.DuPont: Key Strategic Developments, 2017-2017

Table 72.Akzonobel N.V.: Key Strategic Developments, 2017-2017

Table 73.BASF SE: Key Strategic Developments, 2017-2017

Table 74.PVS Chemical Solution: Key Strategic Developments, 2017-2017

Table 75.Solvay: Key Strategic Developments, 2017-2017

Table 76.Valero Energy: Key Strategic Developments, 2017-2017

Table 77.Potash Corp (PCS Phosphate): Key Strategic Developments, 2017-2017

Table 78.Agrium Inc.: Key Strategic Developments, 2017-2017.

List of Figures

Figure 1.Global Sulfuric Acid Market Share, By Raw Material, 2017 & 2023

Figure 2.Global Sulfuric Acid Market, By Application, 2017 & 2023 ($Million)

Figure 3.Global Sulfuric Acid Market, By Region, 2017 & 2023 ($Million)

Figure 4.The Mosaic Company: Net Revenues, 2017-2017 ($Million)

Figure 5.The Mosaic Company: Net Revenue Share, By Segment, 2017

Figure 6.The Mosaic Company: Net Revenue Share, By Geography, 2017

Figure 7.Chemtrade Refinery: Net Revenues, 2017-2017 ($Million)

Figure 8.Chemtrade Refinery: Net Revenue Share, By Segment, 2017

Figure 9.Chemtrade Refinery: Net Revenue Share, By Geography, 2017

Figure 10.DuPont: Net Revenues, 2017-2017 ($Million)

Figure 11.DuPont: Net Revenue Share, By Segment, 2017

Figure 12.DuPont: Net Revenue Share, By Geography, 2017

Figure 13.Akzonobel N.V.: Net Revenues, 2017-2017 ($Million)

Figure 14.Akzonobel N.V.: Net Revenue Share, By Segment, 2017

Figure 15.Akzonobel N.V.: Net Revenue Share, By Geography, 2017

Figure 16.Agrium Inc.: Net Revenues, 2017-2017 ($Million)

Figure 17.Agrium Inc.: Net Revenue Share, By Segment, 2017

Figure 18.Agrium Inc.: Net Revenue Share, By Geography, 2017.

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|