.png)

Ultrasonic Sensors Market by Product and Application - Global Industry Analysis and Forecast To 2023

Published On : November 2017 Pages : 102 Category: Sensors & Controls Report Code : SE11363

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

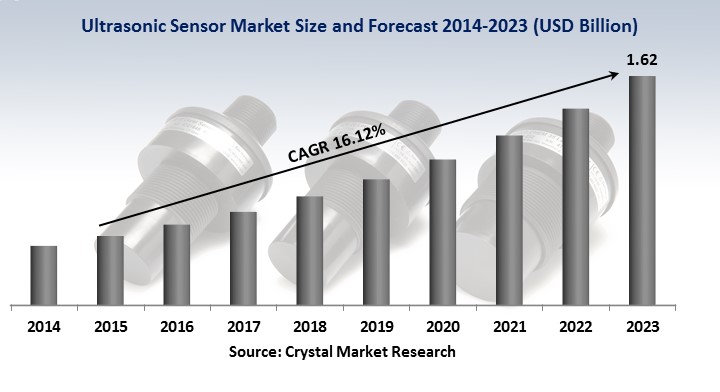

The Ultrasonic Sensors Market was worth USD billion in the year 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. The Increasing requirement for sensors technology in smart factories is distinguished as one of the essential development factors for this market. The requirement for automated factories or smart factories has expanded over the world and this pattern is anticipated to grow amid the conjecture time frame. Nations, for example, Germany and China are home to many manufacturing ventures that have embraced computerization in their current industrial facilities to remain in front of the opposition. Automation empowers enhanced correspondence and exact coordination inside processing plants. It likewise guarantees adaptability in the manufacturing procedures. In addition, the merchants have a tendency to computerize end-to-end procedures by making the use of robots, enterprise software, sensors, ultrasonic systems, and automation solutions. Various procedures and discrete manufacturing enterprises make use of these systems to distinguish and build up the best business practices and for data retrieval, documentation, and information sharing. For example, ultrasonic sensors include microprocessor and ultrasonic technology to give accuracy non-contact distance estimation for automation of factory or industrial process control. These elements are energizing the interest for smart factories alongside advancements like ultrasonic sensors.

Type Outlook and Trend Analysis

On the basis of type the market is segmented into Ultrasonic proximity sensors, Ultrasonic retro-reflective sensors and Ultrasonic through beam sensors. Amid 2017, the ultrasonic through beam sensors section represented the major share of the ultrasonic sensors market. The expanding use of Zigbee, an ultrasonic technology to make personal area networks with low-power and small digital radio will add to the development of this industry section in the coming years. ZigBee is used as a part of numerous uses of ultrasonic sensors systems administration, for example, traffic management systems, electrical meters, ultrasonic light switches, and numerous other industrial applications that include ultrasonic information transfer inside a short scope of separation.

Application Outlook and Trend Analysis

On the basis of application the market is segmented into Healthcare, Automotive, Military and defense, Industrial manufacturing, Food and beverage and Petroleum. The industrial manufacturing fragment is anticipated to be the biggest market section amid the anticipated period. The capacity of ultrasonic sensors to play out the elements of both photoelectric and proximity sensors combined with its ability to work proficiently in any condition will bring about this present section's great CAGR of roughly 15 percent amid the figure time frame.

Regional Outlook and Trend Analysis

Geographically, the market is segmented into Europe, North America, Asia Pacific, Latin America, Middle East and Africa. The Americas will be the significant income supporter of this market all through the figure time frame. The ultrasonic sensors market in the United States is the biggest on the planet and the area is probably going to keep up its market position in the upcoming years. North America is the home to various major MNCs that are making huge investments in process smart production and automation systems. This will be a main consideration driving the development of the ultrasonic sensors market.

Competitive Insights

The players in the market for the most part contend in light of components, for example, performance, innovation, support services, and quality. To survive and prevail in this aggressive market, it is imperative for the sellers to separate their item and administration offerings through a reasonable and one of a value proposition. The leading players in the market are Honeywell, Siemens, Baumer India Pvt. Ltd, Rockwell Automation, Migatron, Keyence and Precision Acoustics.

The ultrasonic sensors market is segmented as follows-

By Type:

- Ultrasonic proximity sensors

- Ultrasonic retro-reflective sensors

- Ultrasonic through beam sensors

By Applications:

- Military and defense

- Healthcare

- Petroleum

- Industrial manufacturing

- Food and beverages

- Petroleum

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Ultrasonic Sensors Market, By Product, Estimates and Forecast, 2014-2023 ($Million)

- Ultrasonic proximity sensors

- Ultrasonic retro-reflective sensors

- Ultrasonic through beam sensors

- Ultrasonic Sensors Market, By Application, Estimates and Forecast, 2014-2023 ($Million)

- Healthcare

- Automotive

- Petroleum

- Industrial manufacturing

- Military and defense

- Food and beverages

- Ultrasonic Sensors Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Ultrasonic Sensors Market, By Country

- North America Ultrasonic Sensors Market, By Product

- North America Ultrasonic Sensors Market, By Application

- U.S. Ultrasonic Sensors Market, By Product

- U.S. Ultrasonic Sensors Market, By Application

- Canada Ultrasonic Sensors Market, By Product

- Canada Ultrasonic Sensors Market, By Application

- Mexico Ultrasonic Sensors Market, By Product

- Mexico Ultrasonic Sensors Market, By Application

-

- Europe

- Europe Ultrasonic Sensors Market, By Country

- Europe Ultrasonic Sensors Market, By Product

- Europe Ultrasonic Sensors Market, By Application

- Germany Ultrasonic Sensors Market, By Product

- Germany Ultrasonic Sensors Market, By Application

- France Ultrasonic Sensors Market, By Product

- France Ultrasonic Sensors Market, By Application

- UK Ultrasonic Sensors Market, By Product

- UK Ultrasonic Sensors Market, By Application

- Italy Ultrasonic Sensors Market, By Product

- Italy Ultrasonic Sensors Market, By Application

- Spain Ultrasonic Sensors Market, By Product

- Spain Ultrasonic Sensors Market, By Application

- Rest of Europe Ultrasonic Sensors Market, By Product

- Rest of Europe Ultrasonic Sensors Market, By Application

-

- Asia-Pacific

- Asia-Pacific Ultrasonic Sensors Market, By Country

- Asia-Pacific Ultrasonic Sensors Market, By Product

- Asia-Pacific Ultrasonic Sensors Market, By Application

- Japan Ultrasonic Sensors Market, By Product

- Japan Ultrasonic Sensors Market, By Application

- Australia Ultrasonic Sensors Market, By Product

- Australia Ultrasonic Sensors Market, By Application

- India Ultrasonic Sensors Market, By Product

- India Ultrasonic Sensors Market, By Application

- South Korea Ultrasonic Sensors Market, By Product

- South Korea Ultrasonic Sensors Market, By Application

- Rest of Asia-Pacific Ultrasonic Sensors Market, By Product

- Rest of Asia-Pacific Ultrasonic Sensors Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Ultrasonic Sensors Market, By Country

- Rest of the World Ultrasonic Sensors Market, By Product

- Rest of the World Ultrasonic Sensors Market, By Application

- Brazil Ultrasonic Sensors Market, By Product

- Brazil Ultrasonic Sensors Market, By Application

- South Africa Ultrasonic Sensors Market, By Product

- South Africa Ultrasonic Sensors Market, By Application

- Saudi Arabia Ultrasonic Sensors Market, By Product

- Saudi Arabia Ultrasonic Sensors Market, By Application

- Turkey Ultrasonic Sensors Market, By Product

- Turkey Ultrasonic Sensors Market, By Application

- United Arab Emirates Ultrasonic Sensors Market, By Product

- United Arab Emirates Ultrasonic Sensors Market, By Application

- Others Ultrasonic Sensors Market, By Product

- Others Ultrasonic Sensors Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growing Demand for Ultrasonic Sensors in the Medical Industry

3.2.1.2. Delivers solutions for most diverse Industrial Applications

3.2.2. Restraints

3.2.2.1. Domination of Other Forms of Sensors

3.2.3. Opportunities

3.2.3.1. Technological Advancement in Ultrasonic Sensors

4. Ultrasonic Sensors Market, By Product

4.1. Introduction

4.2. Ultrasonic Sensors Market Assessment and Forecast, By Product, 2017-2023

4.3. Ultrasonic proximity sensors

4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4. Ultrasonic retro-reflective sensors

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Ultrasonic through beam sensors

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Ultrasonic Sensors Market, By Application

5.1. Introduction

5.2. The Ultrasonic Sensors Market Assessment and Forecast, By Application, 2017-2023

5.3. Healthcare

5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.4. Automotive

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Petroleum

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Industrial manufacturing

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Military and defense

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Food and beverages

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Ultrasonic Sensors Market, By Region

6.1. Introduction

6.2. Ultrasonic Sensors Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.3. North America

6.3.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.3.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.3.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.3.4. U.S.

6.3.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.3.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.3.5. Canada

6.3.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.3.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.3.6. Mexico

6.3.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.3.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4. Europe

6.4.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.4. Germany

6.4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.5. France

6.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.6. UK

6.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.7. Italy

6.4.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.8. Spain

6.4.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.9. Rest of Europe

6.4.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5. Asia-Pacific

6.5.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.4. Japan

6.5.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.5. China

6.5.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.6. Australia

6.5.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.7. India

6.5.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.8. South Korea

6.5.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.9. Rest of Asia-Pacific

6.5.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6. Rest of the World

6.6.1. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.2. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.4. Brazil

6.6.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.5. Turkey

6.6.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.6. Saudi Arabia

6.6.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.7. South Africa

6.6.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.8. United Arab Emirates

6.6.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.9. Others

6.6.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

7. Company Profiles

7.1. Honeywell

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. Siemens

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Strategic Developments

7.3. Baumer India Pvt. Ltd

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Rockwell Automation

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.5. Migatron

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Key Financials

7.5.4. Strategic Developments

7.6. Keyence

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. Precision Acoustics

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Key Financials

7.7.4. Strategic Developments

List of Tables

Table 1.Global Ultrasonic Sensors Market, By Product ($Million), 2017-2023

Table 2.Ultrasonic proximity sensors Market, By Region ($Million), 2017-2023

Table 3.Ultrasonic retro-reflective sensors Market, By Region ($Million), 2017-2023

Table 4.Ultrasonic through beam sensors Market, By Region ($Million), 2017-2023

Table 5.Global Ultrasonic Sensors Market, By Application ($Million), 2017-2023

Table 6.Healthcare Market, By Region ($Million), 2017-2023

Table 7.Automotive Market, By Region ($Million), 2017-2023

Table 8.Petroleum Market, By Region ($Million), 2017-2023

Table 9.Industrial manufacturing Market, By Region ($Million), 2017-2023

Table 10.Military and defense Market, By Region ($Million), 2017-2023

Table 11.Food and beverages Market, By Region ($Million), 2017-2023

Table 12.Ultrasonic Sensors Market, By Region ($Million), 2017-2023

Table 13.North America Ultrasonic Sensors Market, By Country, 2017-2023 ($Million)

Table 14.North America Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 15.North America Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 16.U.S. Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 17.U.S. Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 18.Canada Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 19.Canada Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 20.Mexico Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 21.Mexico Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 22.Europe Ultrasonic Sensors Market, By Country, 2017-2023 ($Million)

Table 23.Europe Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 24.Europe Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 25.Germany Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 26.Germany Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 27.France Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 28.France Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 29.UK Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 30.UK Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 31.Italy Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 32.Italy Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 33.Spain Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 34.Spain Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 35.Rest of Europe Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 36.Rest of Europe Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 37.Asia-Pacific Ultrasonic Sensors Market, By Country, 2017-2023 ($Million)

Table 38.Asia-Pacific Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 39.Asia-Pacific Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 40.Japan Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 41.Japan Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 42.China Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table43.China Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 44.Australia Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 45.Australia Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 46.India Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 47.India Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 48.South Korea Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 49.South Korea Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 50.Rest of Asia-Pacific Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 51.Rest of Asia-Pacific Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 52.Rest of the World Ultrasonic Sensors Market, By Country, 2017-2023 ($Million)

Table 53.Rest of the World Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 54.Rest of the World Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 55.Brazil Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 56.Brazil Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 57.Turkey Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 58.Turkey Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 59.Saudi Arabia Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 60.Saudi Arabia Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 61.South Africa Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 62.South Africa Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 63.United Arab Emirates Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 64.United Arab Emirates Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 65.Others Ultrasonic Sensors Market, By Product, 2017-2023 ($Million)

Table 66.Others Ultrasonic Sensors Market, By Application, 2017-2023 ($Million)

Table 67.Honeywell: Key Strategic Developments, 2017-2017

Table 68.Siemens: Key Strategic Developments, 2017-2017

Table 69.Baumer India Pvt. Ltd: Key Strategic Developments, 2017-2017

Table 70.Rockwell Automation: Key Strategic Developments, 2017-2017

Table 71.Migatron: Key Strategic Developments, 2017-2017

Table 72.Keyence: Key Strategic Developments, 2017-2017

Table 73 Precision Acoustics: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Ultrasonic Sensors Market Share, By Product, 2017 & 2023

Figure 2.Ultrasonic Sensors Market, By Application, 2017, ($Million)

Figure 3.Ultrasonic Sensors Market, By Region, 2017, ($Million)

Figure 4.Honeywell: Net Revenues, 2017-2017 ($Million)

Figure 5.Honeywell: Net Revenue Share, By Segment, 2017

Figure 6.Honeywell: Net Revenue Share, By Geography, 2017

Figure 7.Siemens: Net Revenues, 2017-2017 ($Million)

Figure 8.Siemens: Net Revenue Share, By Segment, 2017

Figure 9.Siemens: Net Revenue Share, By Geography, 2017

Figure 10.Rockwell Automation: Net Revenues, 2017-2017 ($Million)

Figure 11.Rockwell Automation: Net Revenue Share, By Segment, 2017

Figure 12.Rockwell Automation: Net Revenue Share, By Geography, 2017

Research Methodology

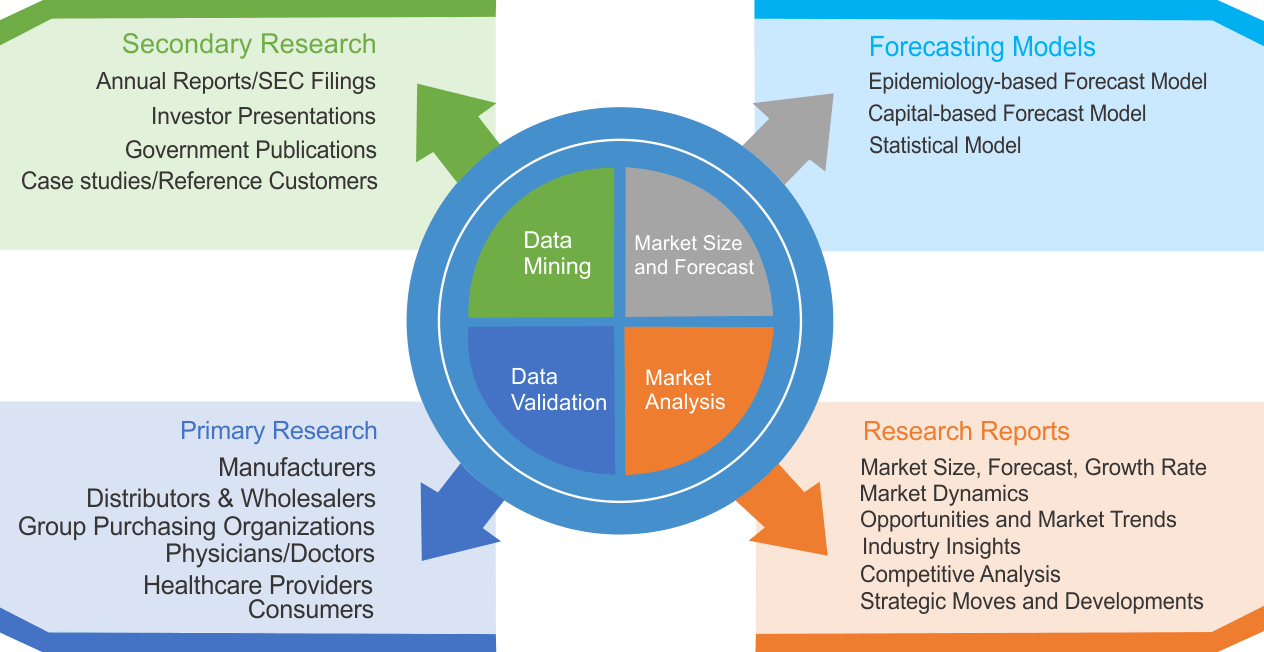

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|