.png)

Waterproofing Membranes Market by Application and End User- Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 120 Category: Packaging Report Code : CM02614

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Outlook and Trend Analysis

The Waterproofing Membranes Market was worth USD billion in the year of 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Developing industry of infrastructure, increasing requirement for management of water and wastewater, and advancements in the field of liquid membranes are foreseen to emphatically affect the market development. Waterproofing membranes are used as a part of a large group of uses including balconies, walls, basements, roofing, bridge decks, tunnels, parking areas, foundation and water tank linings. Expanding customer awareness in regards to the advantages of waterproofing and new materials, for example, geomembranes is foreseen to increase the requirement throughout the following years. The item is accessible in two structures including sheet and liquid. In 2017 the market was dominated by Liquid applied membranes by virtue of their ease and high effectiveness when compared with the sheet membranes. While EPDM, TPO, PVC, and bitumen are the significant materials used for assembling sheet products, liquid coatings are made by making the use of acrylic, polyurethane, cementitious materials, and bitumen. Rising mining exercises in different areas combined with low manufacturing cost and cost-effectiveness are probably going to increase the usage of the product in the coming years. Technological advancements focused at the improvement of new materials for waterproofing by organizations, for example, Sika AG, Eastman Chemical Company, and Pidilite Industries are foreseen to remain imperative achievement factors for market development over the gauge time frame. Inconstancy of costs and supply of raw materials used for in the manufacturing is foreseen to hamper the development. Furthermore, unstable costs of crude materials are anticipated to expand the general manufacturing cost, hence contrarily influencing the demand.

Application Outlook and Trend Analysis

Liquid applied membranes commanded the worldwide market with an income share of 62 percent in the worldwide market. Expanding interest in foundation, developing consciousness regarding the product, and cost-viability are foreseen to be the key variables driving development. Ceaseless R&D combined with related technological breakthrough in the zone of processing and production that is cost-effective is probably going to boost the usage of the product over the coming years. Steady government activities are additionally anticipated that would provide opportunities for the market. Acrylic membranes are foreseen to encounter noteworthy development over the conjecture time frame. Expanding usage of acrylic covering to shield rooftops from brutal climate and absorption of sunlight is foreseen to give positive extension to the development of the market over the estimate time frame. Also, the capacity of the product to give protection against heat, hail storms, and snow build up is probably going to drive the development of the market. Sheet membranes are foreseen to encounter significant development of in the upcoming years. Bitumen or asphalt is one of the significantly used materials for its production. These products have high-temperature protection and unrivaled extension properties, which increases its productivity in applications. Bituminous sheet membranes section is anticipated to encounter a substantial development on the basis of volume in the following years. Its properties, including high durability and tensile strength, are foreseen to increase its demand throughout the following years. EPDM portion is anticipated to encounter impressive development over the coming years. Upgraded features, for example, resistance against frigid temperatures and accommodating structural movement without membrane stress are expected to boost the demand of the product in the following years.

End User Outlook and Trend Analysis

In 2017 roofing commanded the worldwide market with on the basis of revenue with a share of 31.1 percent. Rooftops are profoundly inclined to leakages and changing climatic conditions. Expanding intricacy in designs of building combined with expanding focus on protection from leakage has prompted an appeal for the item in this application. The increasing construction of non-residential buildings including recreational centers, offices, educational institutes, and hospitals is foreseen to boost the demand over the gauge time frame. Roofing systems are produced to give an adaptable watertight covering bonded precisely to the substrate. Additionally, roofing membranes give slip protection, durability, texture, and UV protection. Building structures is anticipated to encounter significant development over the following years. Liquid coatings are exceedingly favored for building structures when compared with sheet membranes as they give excellent protection over the underlying paint coat. These are progressively utilized in wet areas, balconies, decks, and bathrooms. The polyurea-based coatings are favored for use in subterranean waterproofing, hence prompting huge demand over the gauge time frame.

Regional outlook and Trend Analysis

In 2017 Europe was the biggest market with a share of 36.5 percent. Expanding focus on management of water and waste is anticipated to influence the market in a positive manner. Moreover, developing interest in construction in Eastern European nations including Turkey, Russia, and Poland is additionally expected to fuel the market. Asia Pacific is foreseen to encounter the quickest development over the gauge time frame by virtue of fast industrialization combined with developing foundation improvement in China and India. Expanding populace and urbanization is anticipated to build the residential construction, in this manner increasing business sector development. Central & South America is probably going to encounter substantial growth in the upcoming years. Expanding government expenditure on framework and rising discretionary income of the middle-class populace in key economies including Argentina, Brazil, Venezuela, and Colombia are anticipated to emphatically influence the demand. MEA is foreseen to observe slow development when compared with different economies. Nonetheless, enhancing infrastructure and reconstruction exercises in Libya and Egypt are probably going to go about as a boost for the area. Likewise, government interest out in the open private association (PPP) extends in Africa is additionally anticipated that would fuel the growth of the market.

Competitive Insights

The leading players in the market are Pidilite Industries Limited, DuPont, BASF, Paul Bauder GmbH & Co. KG, Kemper System America Inc, Dow Chemical Company, Sika AG, CICO Technologies Limited and GAF Materials Corporation. The business is divided in nature because of the existence of various organizations. There are small-scale, regional manufacturers with a solid hold in their household or local market; a considerable lot of which are available in India and China. Extension and merger and acquisition are the key procedures selected by the organizations.

The global waterproofing membranes market is segmented as follows-

By Application:

- Sheet membranes

- PVC

- Bituminous

- EPDM

- Liquid applied membranes

- Bituminous

- Acrylic

- Cementitious

- Polyurethane

By End user:

- Walls

- Landfills & tunnels

- Roofing

- Building structures

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

· Waterproofing Membranes Market, By Application, Estimates and Forecast, 2014-2023 ($Million)

· Liquid applied membranes

o Cementitious

o Bituminous

o Polyurethane

o Acrylic

o Others

· Sheet membranes

o Bituminous

o PVC

o EPDM

o Others

· Waterproofing Membranes Market, By End User, Estimates and Forecast, 2014-2023 ($Million)

· Roofing

· Walls

· Building structures

· Landfills & tunnels

· Others

· Waterproofing Membranes Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

· North America

§ North America Waterproofing Membranes Market, By Country

§ North America Waterproofing Membranes Market, By Application

§ North America Waterproofing Membranes Market, By End User

o U.S. Waterproofing Membranes Market, By Application

o U.S. Waterproofing Membranes Market, By End User

o Canada Waterproofing Membranes Market, By Application

o Canada Waterproofing Membranes Market, By End User

o Mexico Waterproofing Membranes Market, By Application

o Mexico Waterproofing Membranes Market, By End User

· Europe

§ Europe Waterproofing Membranes Market, By Country

§ Europe Waterproofing Membranes Market, By Application

§ Europe Waterproofing Membranes Market, By End User

o Germany Waterproofing Membranes Market, By Application

o Germany Waterproofing Membranes Market, By End User

o France Waterproofing Membranes Market, By Application

o France Waterproofing Membranes Market, By End User

o UK Waterproofing Membranes Market, By Application

o UK Waterproofing Membranes Market, By End User

o Italy Waterproofing Membranes Market, By Application

o Italy Waterproofing Membranes Market, By End User

o Spain Waterproofing Membranes Market, By Application

o Spain Waterproofing Membranes Market, By End User

o Rest of Europe Waterproofing Membranes Market, By Application

o Rest of Europe Waterproofing Membranes Market, By End User

· Asia-Pacific

§ Asia-Pacific Waterproofing Membranes Market, By Country

§ Asia-Pacific Waterproofing Membranes Market, By Application

§ Asia-Pacific Waterproofing Membranes Market, By End User

o Japan Waterproofing Membranes Market, By Application

o Japan Waterproofing Membranes Market, By End User

o Australia Waterproofing Membranes Market, By Application

o Australia Waterproofing Membranes Market, By End User

o India Waterproofing Membranes Market, By Application

o India Waterproofing Membranes Market, By End User

o South Korea Waterproofing Membranes Market, By Application

o South Korea Waterproofing Membranes Market, By End User

o Rest of Asia-Pacific Waterproofing Membranes Market, By Application

o Rest of Asia-Pacific Waterproofing Membranes Market, By End User

· Rest of the World

§ Rest of the World Waterproofing Membranes Market, By Country

§ Rest of the World Waterproofing Membranes Market, By Application

§ Rest of the World Waterproofing Membranes Market, By End User

o Brazil Waterproofing Membranes Market, By Application

o Brazil Waterproofing Membranes Market, By End User

o South Africa Waterproofing Membranes Market, By Application

o South Africa Waterproofing Membranes Market, By End User

o Saudi Arabia Waterproofing Membranes Market, By Application

o Saudi Arabia Waterproofing Membranes Market, By End User

o Turkey Waterproofing Membranes Market, By Application

o Turkey Waterproofing Membranes Market, By End User

o United Arab Emirates Waterproofing Membranes Market, By Application

o United Arab Emirates Waterproofing Membranes Market, By End User

o Others Waterproofing Membranes Market, By Application

o Others Waterproofing Membranes Market, By End User

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growing Construction Industry

3.2.1.2. Growing Polyurethane Liquid Membranes Demand

3.2.1.3. Growing Water and Waste Management Industry

3.2.2. Restraints

3.2.2.1. Lack of Awareness Regarding Construction Chemicals

3.2.2.2. Bitumen Price Volatility

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Waterproofing Membranes Market, By Application

4.1. Introduction

4.2. Global Waterproofing Membranes Sales, Revenue and Market Share by Application (2017-2017)

4.2.1. Global Waterproofing Membranes Sales and Sales Share by Application (2017-2017)

4.2.2. Global Waterproofing Membranes Revenue and Revenue Share by Application (2017-2017)

4.3. Waterproofing Membranes Market Assessment and Forecast, By Application, 2017-2023

4.4. Liquid applied membranes

4.4.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.3. Cementitious

4.4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.4. Bituminous

4.4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.5. Polyurethane

4.4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.6. Acrylic

4.4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.7. Others

4.4.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Sheet membranes

4.5.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

4.5.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.3. Bituminous

4.5.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.4. PVC

4.5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.5. EPDM

4.5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5.6. Others

4.5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Waterproofing Membranes Market, By End User

5.1. Introduction

5.2. Global Waterproofing Membranes Sales, Revenue and Market Share by End User (2017-2017)

5.2.1. Global Waterproofing Membranes Sales and Sales Share by End User (2017-2017)

5.2.2. Global Waterproofing Membranes Revenue and Revenue Share by End User (2017-2017)

5.3. The Waterproofing Membranes Market Assessment and Forecast, By End User, 2017-2023

5.4. Roofing

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Walls

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Building structures

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Landfills & tunnels

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Other End Users

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Waterproofing Membranes Market, By Region

6.1. Introduction

6.2. Waterproofing Membranes Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.3. Global Waterproofing Membranes Sales, Revenue and Market Share by Regions

6.3.1. Global Waterproofing Membranes Sales by Regions (2017-2017)

6.3.2. Global Waterproofing Membranes Revenue by Regions (2017-2017)

6.4. North America

6.4.1. North America Waterproofing Membranes Sales and Growth Rate (2017-2017)

6.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.4.5. U.S.

6.4.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.4.6. Canada

6.4.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.4.7. Mexico

6.4.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.7.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5. Europe

6.5.1. Europe Waterproofing Membranes Sales and Growth Rate (2017-2017)

6.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.5. Germany

6.5.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.6. France

6.5.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.7. UK

6.5.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.8. Italy

6.5.8.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.9. Spain

6.5.9.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.5.10. Rest of Europe

6.5.10.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.10.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6. Asia-Pacific

6.6.1. Asia-Pacific Waterproofing Membranes Sales and Growth Rate (2017-2017)

6.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.5. Japan

6.6.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.6. China

6.6.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.7. Australia

6.6.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.8. India

6.6.8.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.9. South Korea

6.6.9.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.6.10. Rest of Asia-Pacific

6.6.10.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.10.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7. Rest of the World

6.7.1. Rest of the World Waterproofing Membranes Sales and Growth Rate (2017-2017)

6.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.7.3. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.4. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.5. Brazil

6.7.5.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.5.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.6. Turkey

6.7.6.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.6.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.7. Saudi Arabia

6.7.7.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.7.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.8. South Africa

6.7.8.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.8.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.9. United Arab Emirates

6.7.9.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.9.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

6.7.10. Others

6.7.10.1. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.10.2. Market Assessment and Forecast, By End User, 2017-2023 ($Million)

7. Company Profiles

7.1. Sika AG

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Strategic Developments

7.1.4. Waterproofing Membranes Sales, Revenue and Market Share

7.2. Pidilite Industries Ltd.

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Strategic Developments

7.2.4. Waterproofing Membranes Sales, Revenue and Market Share

7.3. BASF SE

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.3.4. Waterproofing Membranes Sales, Revenue and Market Share

7.4. Paul Bauder GmbH & Co. KG

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.4.4. Waterproofing Membranes Sales, Revenue and Market Share

7.5. Kemper System America, Inc.

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.5.4. Waterproofing Membranes Sales, Revenue and Market Share

7.6. Dow Chemical Company

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.6.4. Waterproofing Membranes Sales, Revenue and Market Share

7.7. DuPont

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.7.4. Waterproofing Membranes Sales, Revenue and Market Share

7.8. GAF Materials Corporation

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.8.4. Waterproofing Membranes Sales, Revenue and Market Share

7.9. Fosroc Ltd.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.9.4. Waterproofing Membranes Sales, Revenue and Market Share

7.10. CICO Technologies Limited

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.10.4. Waterproofing Membranes Sales, Revenue and Market Share

7.11. Alchimica Building Chemicals

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

7.11.4. Waterproofing Membranes Sales, Revenue and Market Share

8. Global Waterproofing Membranes Market Competition, by Manufacturer

8.1. Global Waterproofing Membranes Sales and Market Share by Manufacturer (2017-2017)

8.2. Global Waterproofing Membranes Revenue and Market Share by Manufacturer (2017-2017)

8.3. Top 5 Waterproofing Membranes Manufacturer Market Share

8.4. Market Competition Trend

List of Tables and Figures

*You can glance through the list of Tables and Figures when you view the sample copy of Waterproofing Membranes Market.

Research Methodology

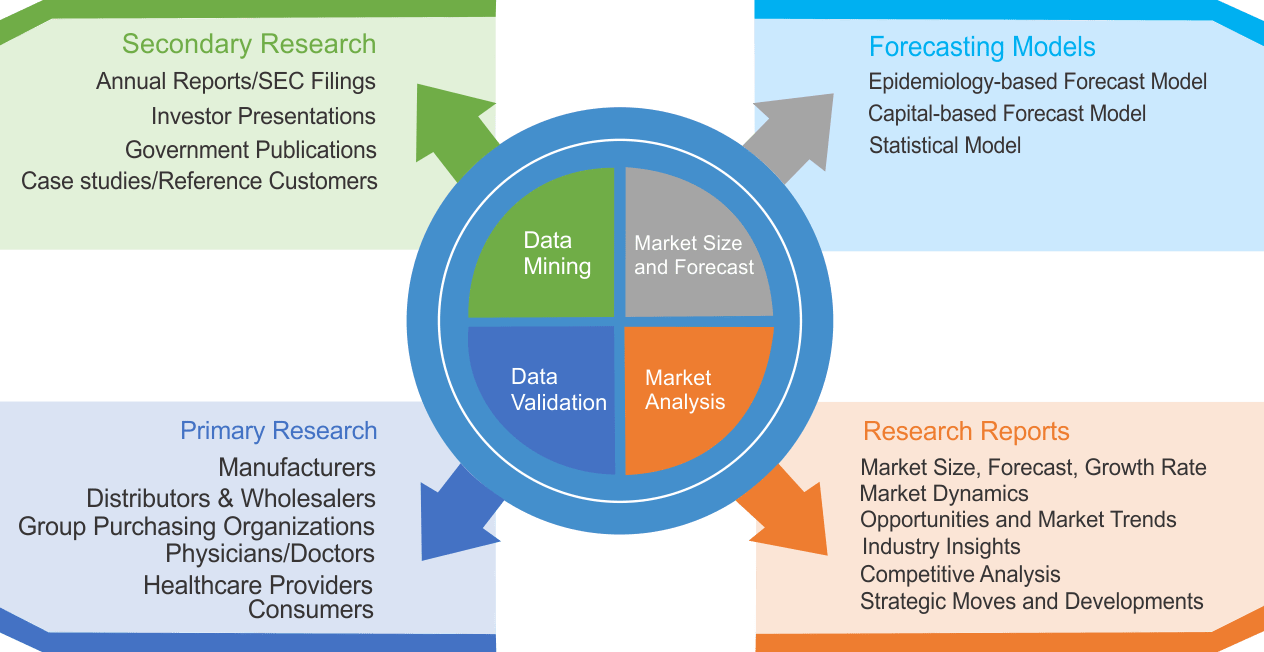

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|